-

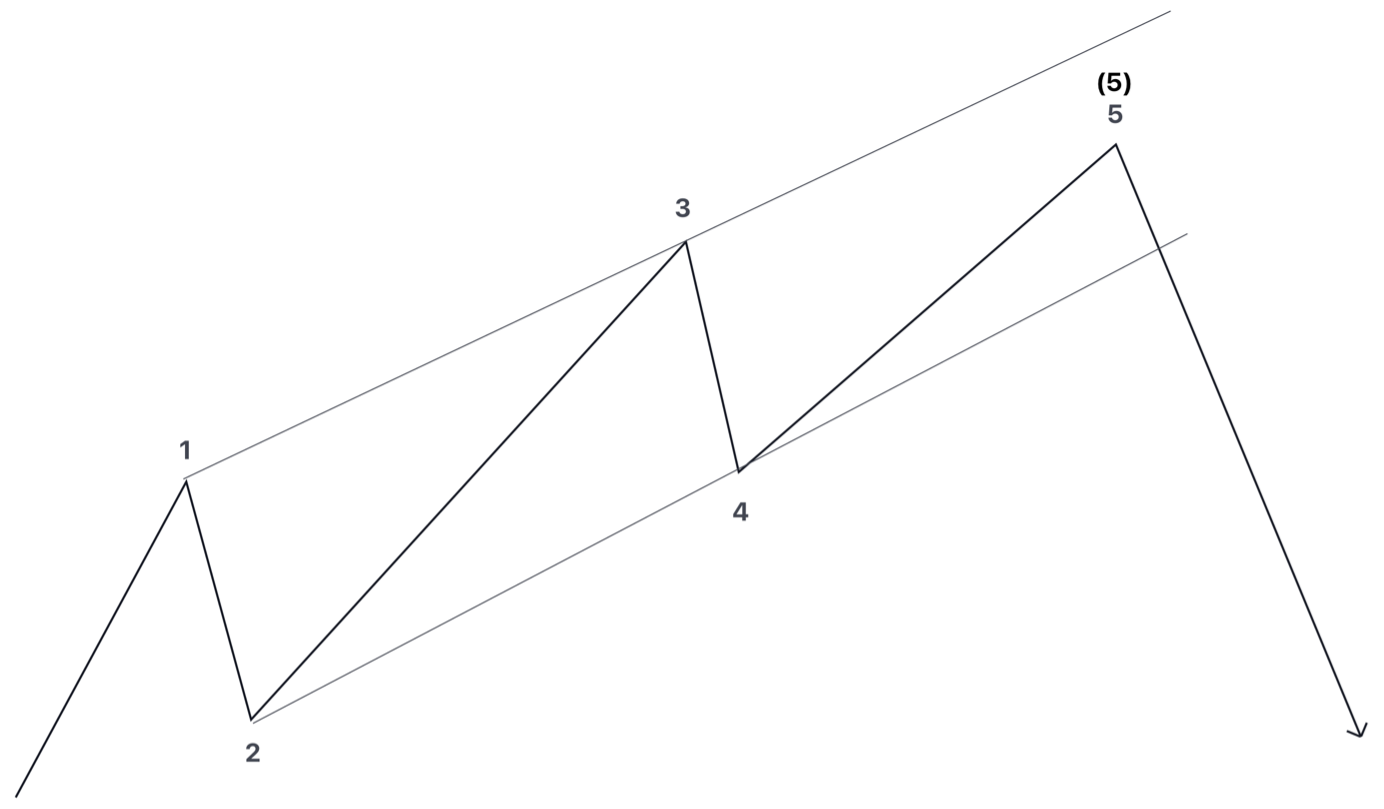

Introduction to Diagonals – Part 2

Read MoreLast time I wrote about Ending Diagonals but it does not end there with the family of diagonals. I will briefly go over Leading Diagonals. Contract Leading Diagonals As opposed to Ending Diagonals – the only difference with Leading Diagonals is that it presents itself in wave 1 instead of wave 5. This happens if […]

-

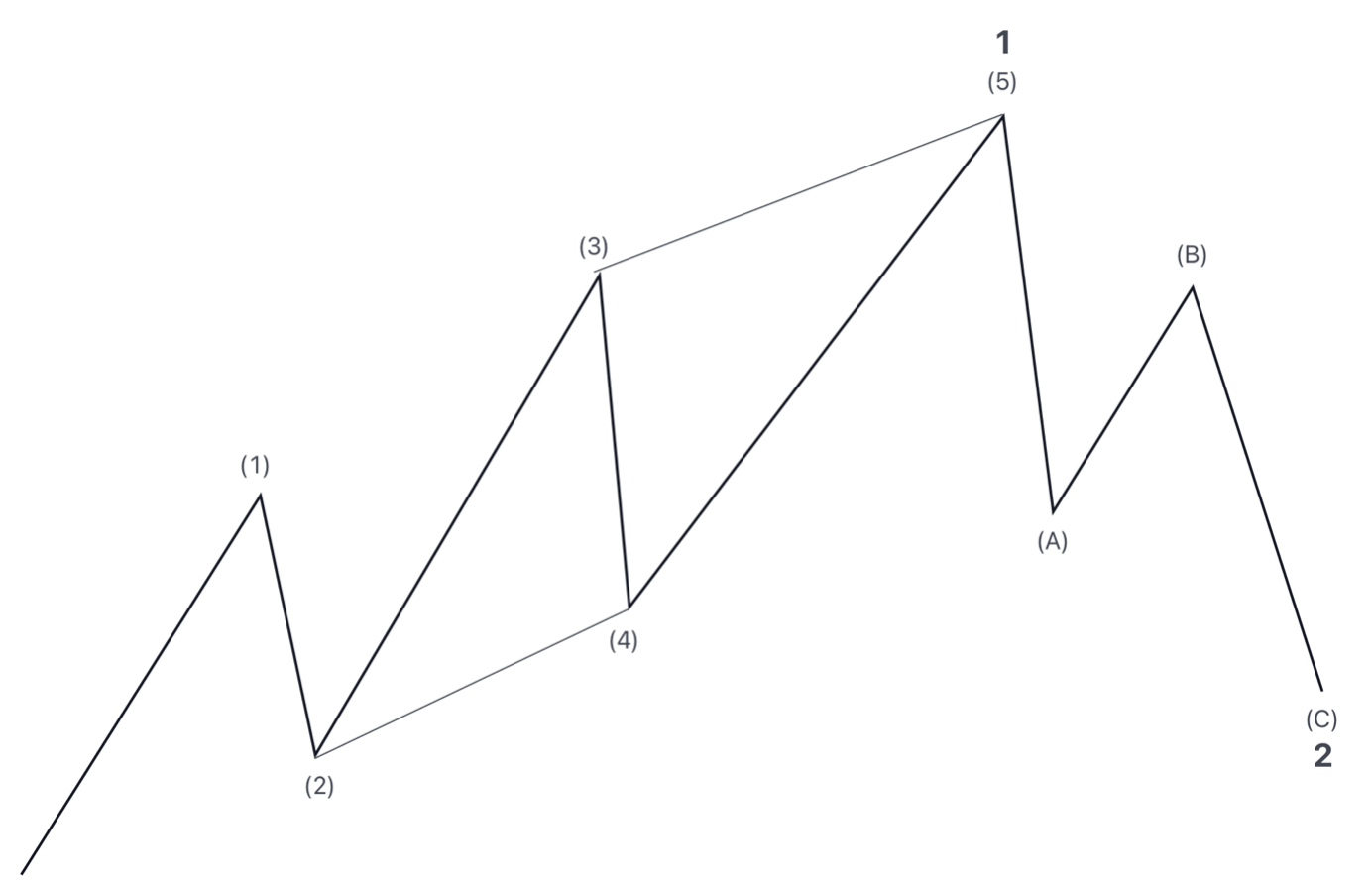

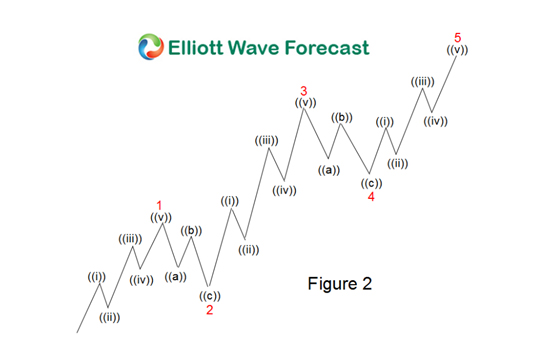

Introduction to Diagonals – Part 1

Read MoreDiagonals are part of the motive waves family alongside Impulse Waves. The difference with them is that they have slightly different characteristics and some rules do not apply. Rules such as 4 wave not going into wave 1’s territory and this is a must in order to quality as a Diagonal. There are two types: […]

-

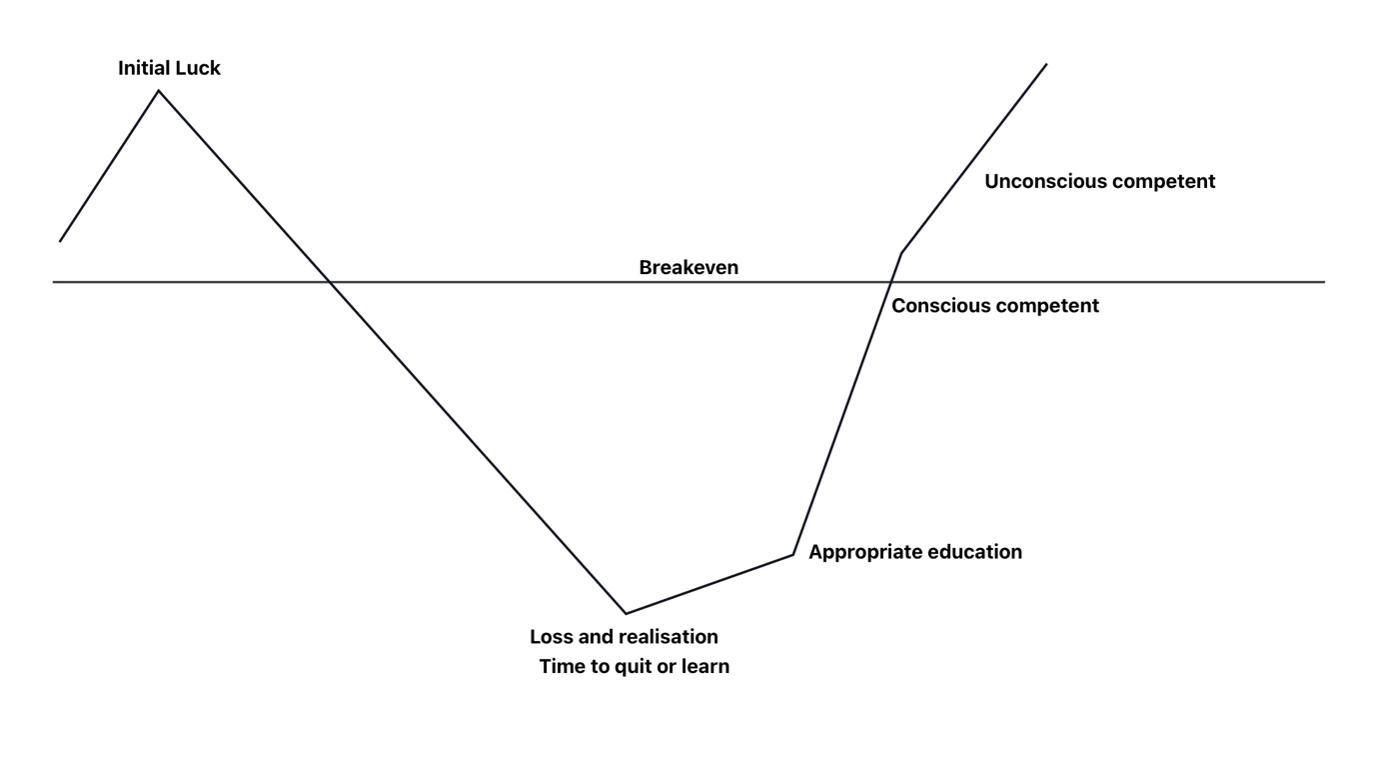

Typical journey of a trader

Read MoreA trader’s journey is typically a long and painful route. Usually, to survive through this process a trader must be very patient with their studying of the market and strategy but simultaneously understand the process and most importantly survive through the journal i.e. not get burnt out, emotionally and monetary. Here is a visual representation […]

-

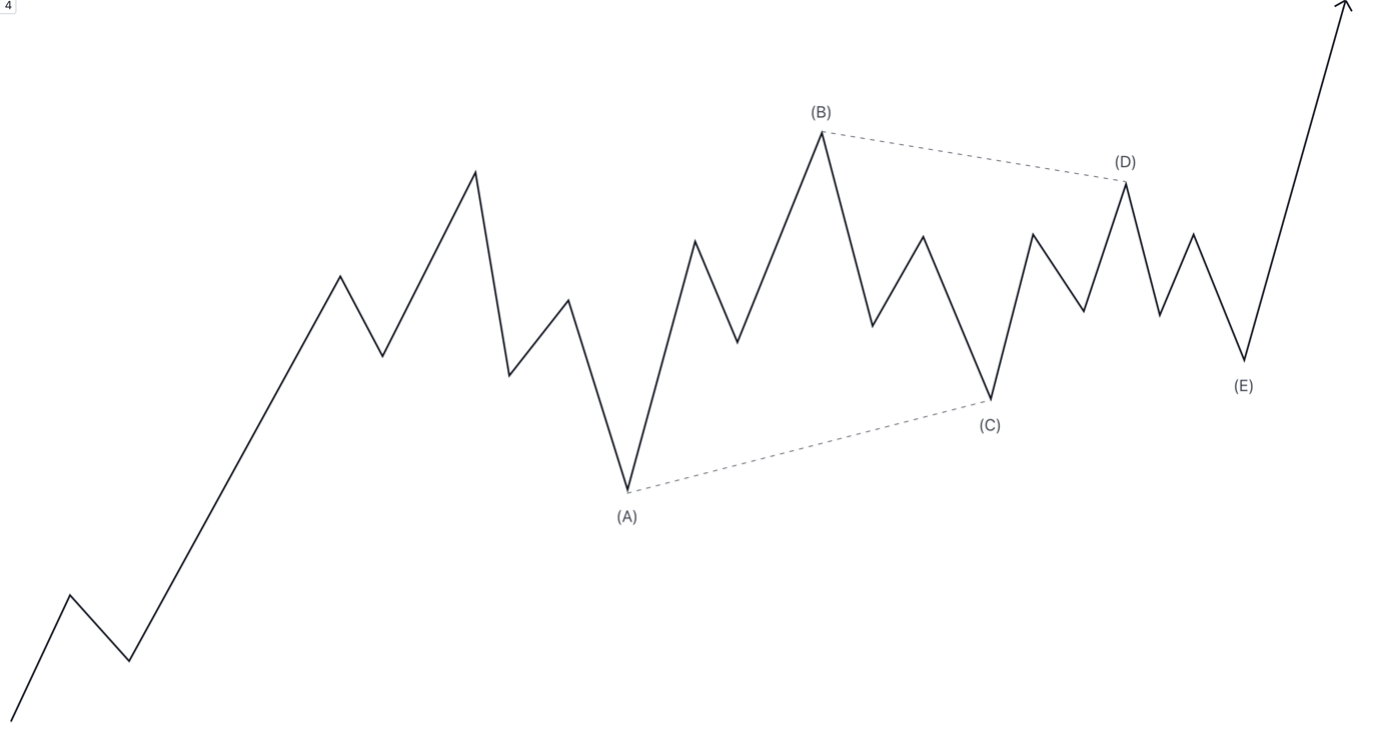

Running Triangle and how they are different to regular Triangles

Read MoreWithin the list Elliott Wave corrective patterns, alongside Zigzags, Flats and Complex Corrections we have triangles. Triangles are a sideways correction that occurs only prior to the final wave in the current trend. Therefore, can only present themselves in wave 4, B or X. The only exception they present themselves in wave 2 is if […]

-

What Is Relative Strength Index (RSI) and Why Traders Use It?

Read MoreThe Relative Strength Index (RSI) is a very popular momentum based indicator that is specifically used within technical analysis by market technicians. It measures the speed and magnitude of an instruments most recent price changes to evaluate overbought or oversold conditions in the price. Developed by J.Welles Wilder Jr in the late 70s as a […]

-

Fundamental Analysis vs Technical Analysis

Read MoreThere are two main types of analysis. Fundamental or technical analysis. Fundamental analysis studies factors that consist of macroeconomic and global events, individual country’s economy. Use data such as inflation numbers, interest rates, CPI reports, employment and unemployment rate and political conditions of the individual country. Technical analysis purely looks at the charts. Historical price […]