-

S&P 500 E-Mini (ES_F) Elliott Wave : Trading Setup Explained

Read MoreHello fellow traders, As our members know we have had many profitable trading setups in Indies recently. In this technical article, we are going to present another Elliott Wave trading setup we got in SPX E-Mini ( ES_F ) . The futures has extended pull back, giving us another buying opportunity. ES_F completed this correction […]

-

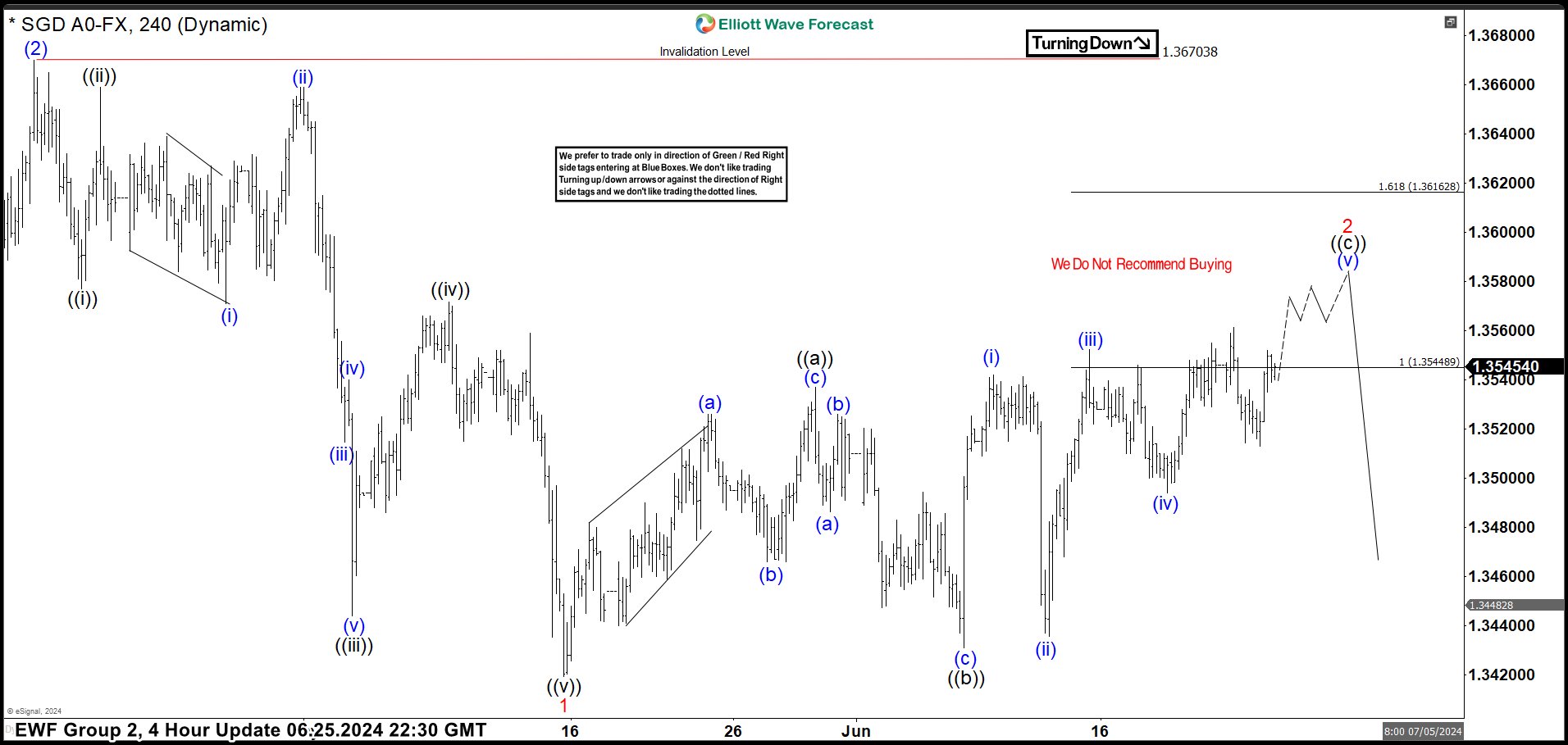

USDSGD Elliott Wave : Calling the Decline From the Extreme Zone

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of USDSGD Forex pair , published in members area of the website. As our members know, USDSGD has recently given us 3 waves recovery against the 1.36703 peak. The pair has made a bounce in a […]

-

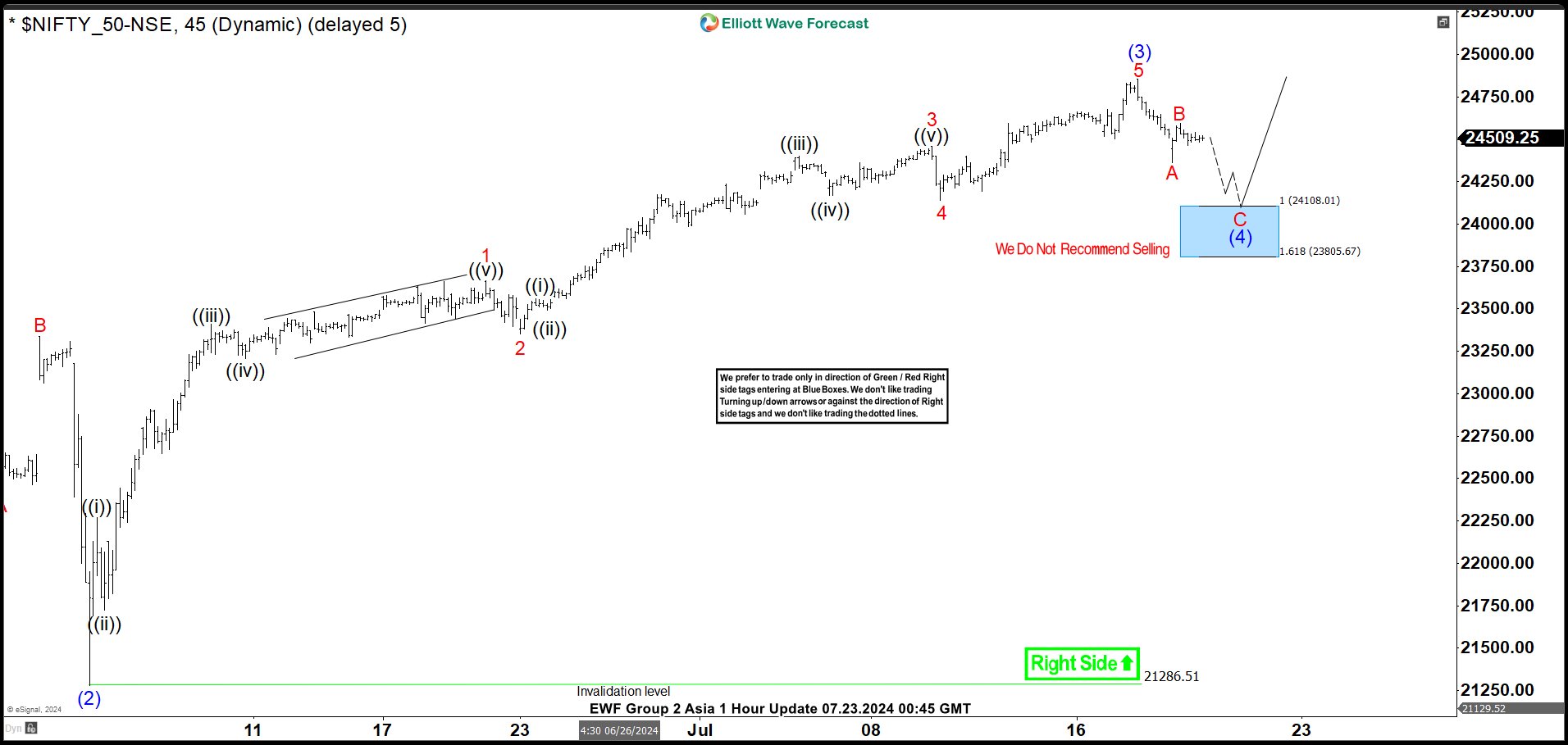

NIFTY Buying the Dips at the Blue Box Area

Read MoreHello fellow traders. In this article we’re going to take a quick look at the Elliott Wave charts of NIFTY published in members area of the website. As our members know, NIFTY is showing impulsive bullish sequences, suggesting further extension to the upside . Recently we got a 3 waves pull back that has ended […]

-

Dollar Index ( DXY ) Elliott Wave Calling the Decline After 3 Waves Bounce

Read MoreIn this technical article we’re going to take a quick look at the Elliott Wave charts of Dollar Index DXY , published in members area of the website. As our members know, Dollar has given us recovery against the 105.21 peak. It found sellers after 3 waves pattern and made the decline toward new lows […]

-

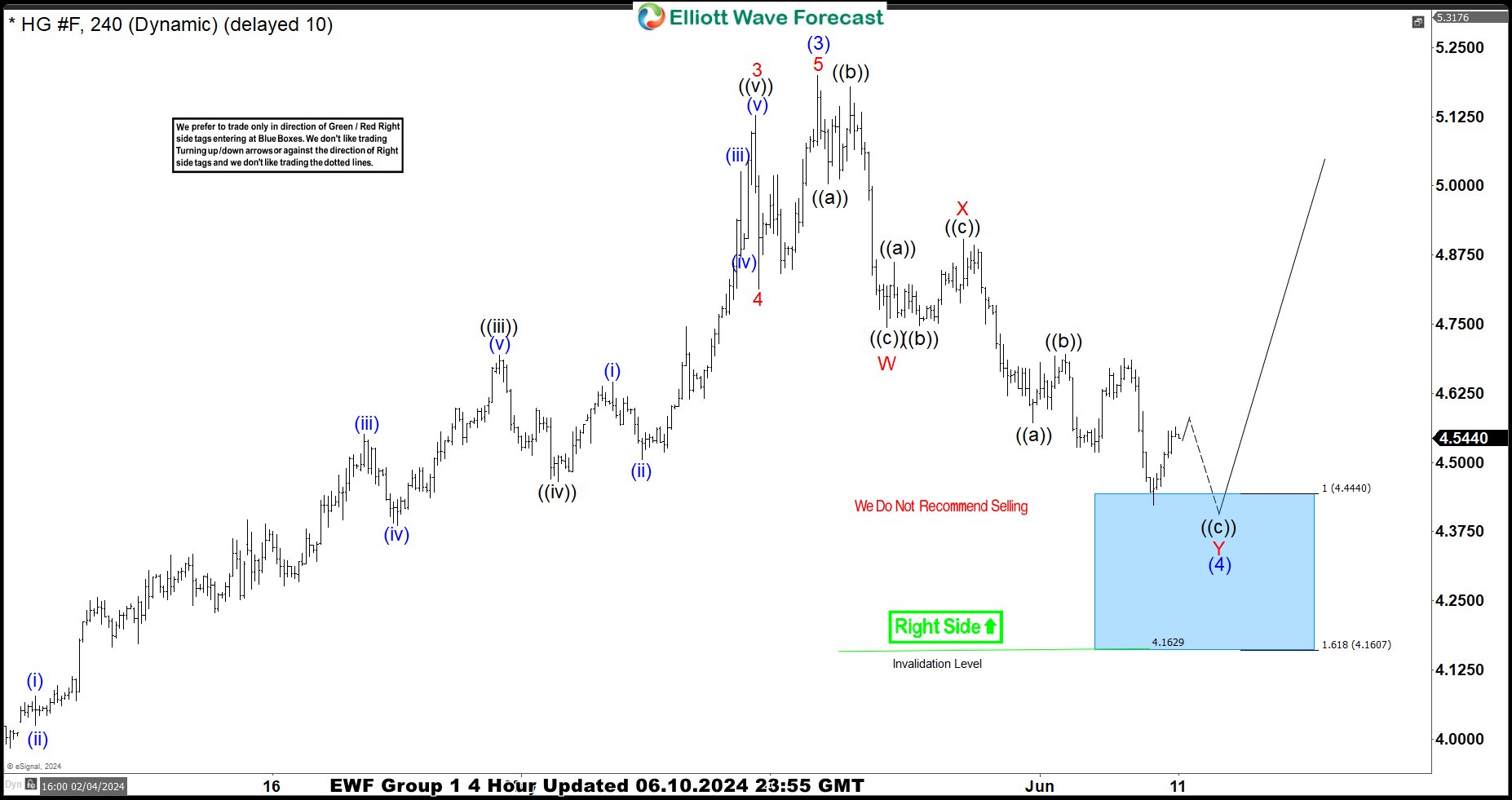

Copper (HG_F) Elliott Wave : Buying the Dips at the Equal Legs Zone

Read MoreIn this technical article we’re going to take a quick look at the Elliott Wave charts of Copper (HG_F) commodity , published in members area of the website. As our members know, Copper has recently given us correction against the October 2023 low. The commodity reached our target zone and completed correction right at the […]

-

DAX Elliott Wave: Buying the Dips at the Blue Box Area

Read MoreHello fellow traders. In this article we’re going to take a quick look at the Elliott Wave charts of DAX published in members area of the website. As our members know DAX is showing impulsive bullish sequences and we are keep favoring the long side. Recently we got a 3 waves pull back that has […]