-

Microsoft $MSFT Soars 45% from Blue Box Area, Reaching Initial $500 Target

Read MoreHello everyone! In today’s article, we’ll examine the recent stellar performance of Microsoft Corp. ($MSFT) through the insightful lens of Elliott Wave Theory. We’ll review how the powerful rally from the October 2022 low unfolded as a textbook 5-wave impulse, followed by a strategic 3-swing (ABC) correction, and discuss our evolving forecast for the next […]

-

S&P 500 ETF $SPY Extreme Areas Offering Buying Opportunities

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of S&P 500 ETF ($SPY) through the lens of Elliott Wave Theory. We’ll review how the rally from the April 21, 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this ETF. […]

-

American Airlines Group Inc. $AAL Looking For A Bounce From Extreme Areas

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of American Airlines Group Inc. ($AAL) through the lens of Elliott Wave Theory. We’ll review how the decline from the May 14, 2025 high unfolded as a 3-swing correction (ABC) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. ABC correction […]

-

Alphabet Inc. $GOOGL Pullbacks Finding Buyers at Extreme Areas

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Alphabet Inc. ($GOOGL) through the lens of Elliott Wave Theory. We’ll review how the rally from the May 07, 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. […]

-

Invesco NASDAQ ETF $QQQ Pullbacks Offering Bullish Entry Points

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Invesco NASDAQ ETF ($QQQ) through the lens of Elliott Wave Theory. We’ll review how the rally from the April 21, 2025 low unfolded as a 5-wave impulse followed by a 3-swing correction (ABC) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this […]

-

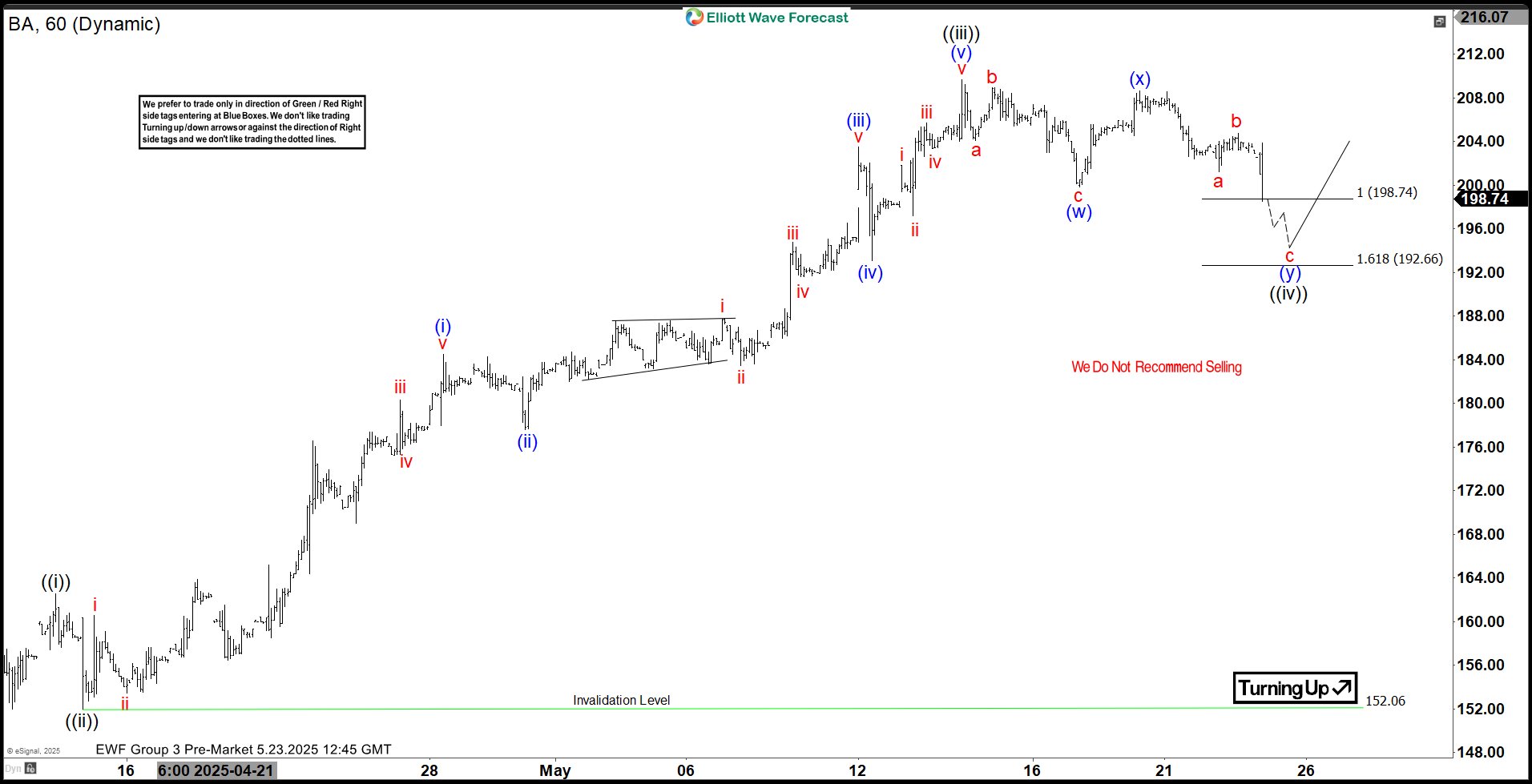

Boeing Co. $BA Extreme Areas Offering Buying Opportunities

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Boeing Co. ($BA) through the lens of Elliott Wave Theory. We’ll review how the rally from the April 15, 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 5 […]