-

Grayscale Ethereum ETF $ETHE Can Reach $44 as Elliott Wave Signals a Bullish Move

Read MoreHello Traders! Today, we will look at the Weekly Elliott Wave structure of Grayscale Ethereum ETF ($ETHE) and explain why the stock is primed for more upside. Grayscale Ethereum Trust ETF solely and passively invests in Ether. Its investment objective is to reflect the value of Ether held by the Trust, less expenses and other […]

-

Microsoft Corp. $MSFT Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Microsoft Corp. ($MSFT) through the lens of Elliott Wave Theory. We’ll review how the rally from the July 23, 2025 low unfolded as a 5-wave impulse followed by a 3-swing correction (ABC) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this […]

-

Netflix Inc. $NFLX Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Netflix Inc. ($NFLX) through the lens of Elliott Wave Theory. We’ll review how the decline from the June 30, 2025, high unfolded as a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 7 Swing WXY correction […]

-

Meta Platforms Inc. $META Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Meta Platforms Inc. ($META) through the lens of Elliott Wave Theory. We’ll review how the decline from the June 30, 2025, high unfolded as a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 7 Swing WXY […]

-

Advanced Micro Devices $AMD Soars 90% from Blue Box Area, With $154 Target Still Ahead

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Advanced Micro Devices ($AMD) through the lens of Elliott Wave Theory. We’ll review how the reaction from the April 2025 blue box areas unfolded as an impulsive 5 waves and discuss what’s next. Let’s dive into the structure and expectations for this stock. ABC correction (Zig-Zag) 5 Wave […]

-

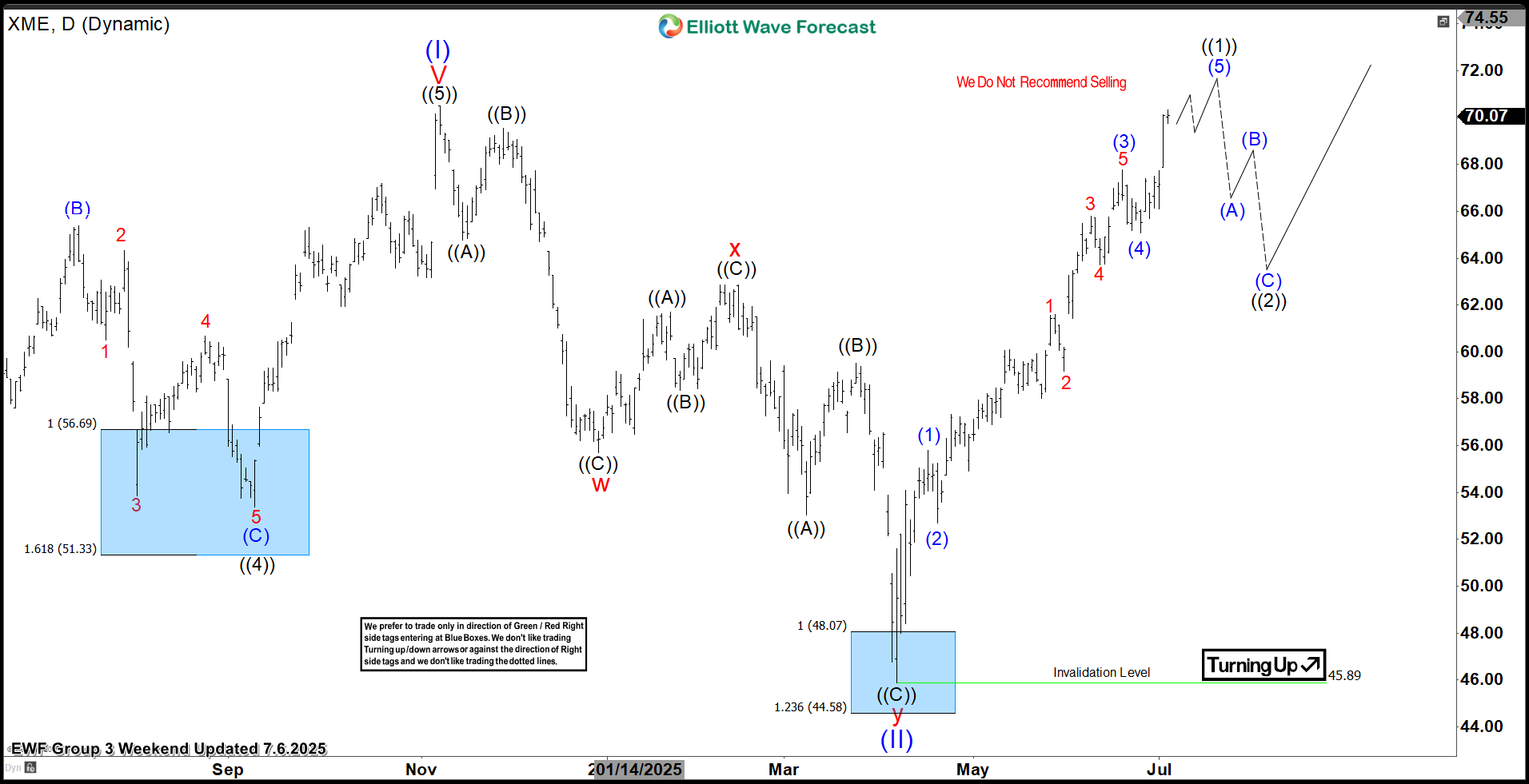

Metals & Mining ETF $XME Soars 50% from Blue Box Area, With $76 Target Still Ahead

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of SPDR Metals & Mining ETF ($XME) through the lens of Elliott Wave Theory. We’ll review how the reaction from the April 2025 blue box areas unfolded as an impulsive 5 waves and discuss what’s next. Let’s dive into the structure and expectations for this ETF. 5 Wave Impulse […]