-

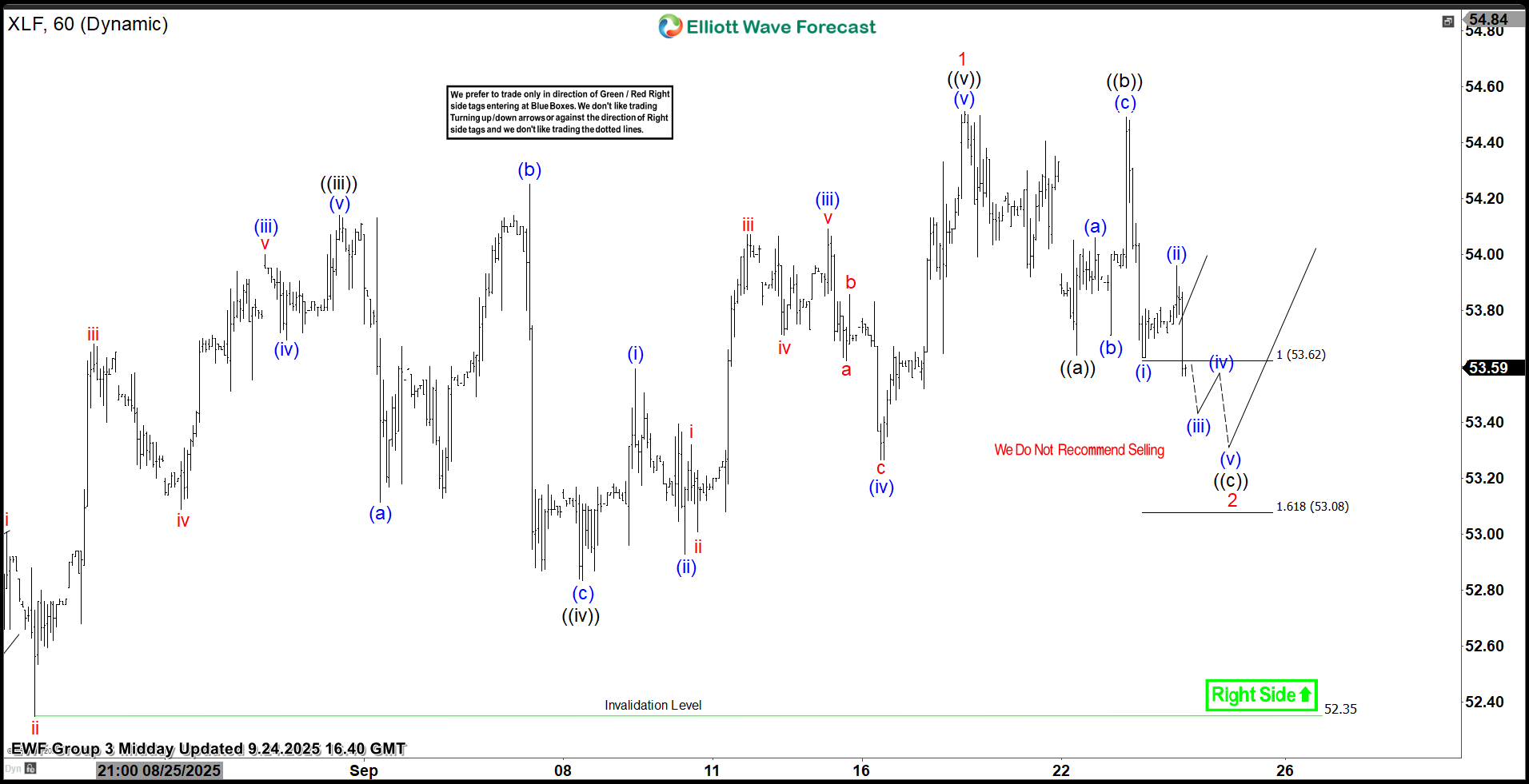

Financial Select Sector $XLF Extreme Areas Offering Buying Opportunities

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Financial Select Sector ($XLF) through the lens of Elliott Wave Theory. We’ll review how the rally from the August 01, 2025 low unfolded as a 5-wave impulse followed by a 3-swing correction (ABC) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this ETF. […]

-

Microsoft Corp. $MSFT Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Microsoft Corp. ($MSFT) through the lens of Elliott Wave Theory. We’ll review how the rally from the April 07, 2025 low unfolded as a 5-wave impulse followed by a 3-swing correction (ABC) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. […]

-

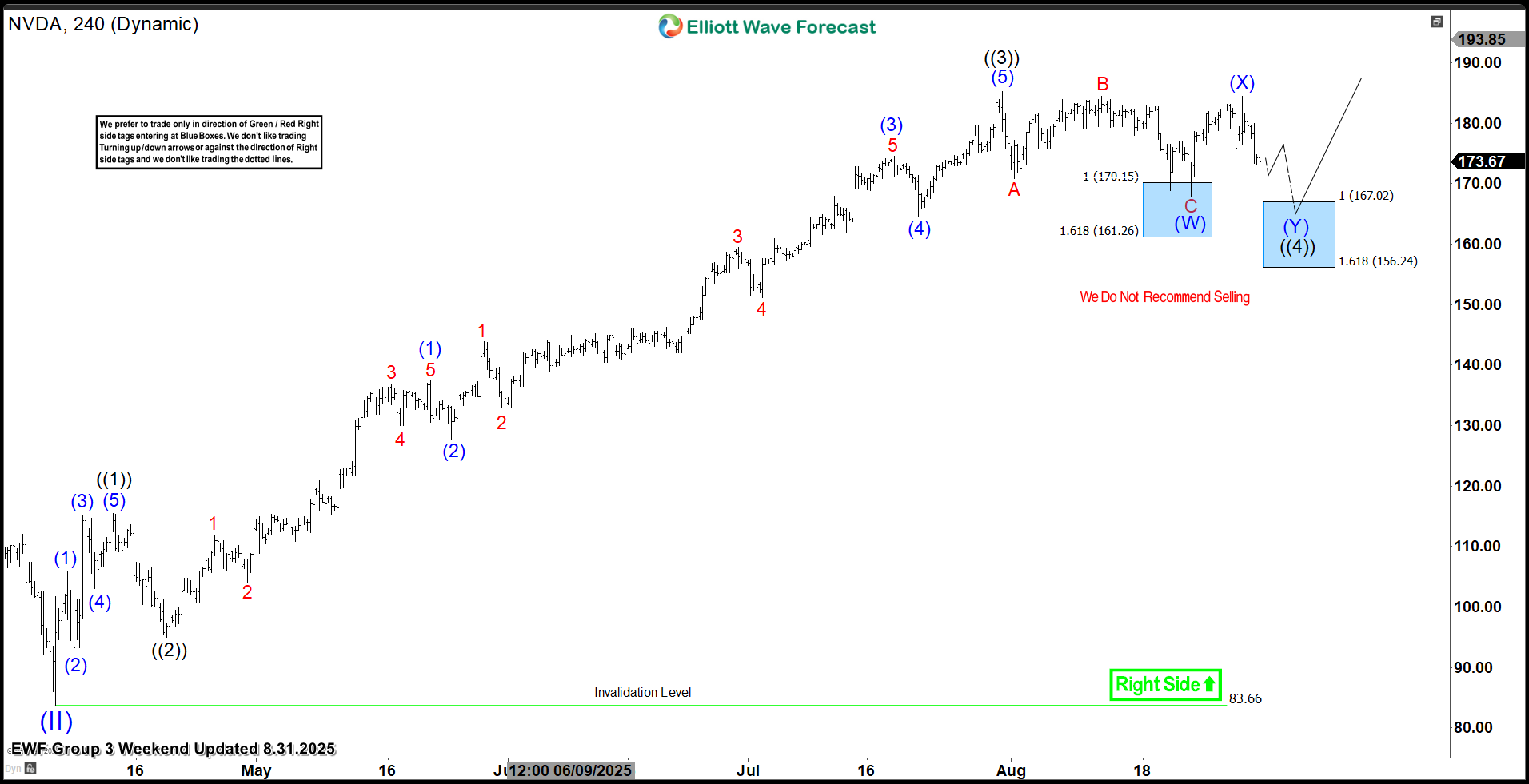

NVIDIA Corp. $NVDA Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of NVIDIA Corp. ($NVDA) through the lens of Elliott Wave Theory. We’ll review how the rally from the April 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 5 Wave […]

-

Tesla Inc. $TSLA Extreme Areas Offering Buying Opportunities Targeting $425

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Tesla Inc. ($TSLA) through the lens of Elliott Wave Theory. We’ll review how the rally from the August 01, 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 5 […]

-

Apple Inc. $AAPL Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Apple Inc. ($AAPL) through the lens of Elliott Wave Theory. We’ll review how the rally from the August 01, 2025 low unfolded as a 5-wave impulse followed by a 3-swing correction (ABC) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. […]

-

Bitfarms Ltd. $BITF Can Reach $4.20 as Elliott Wave Signals a Bullish Move

Read MoreHello Traders! Today, we will look at the Daily Elliott Wave structure of Bitfarms Ltd ($BITF) and explain why the stock is primed for more upside. Bitfarms, a global and publicly traded Bitcoin mining company, develops, owns, and operates vertically integrated mining farms. Their operations, which have in-house management and company-owned electrical engineering and repair […]