-

Consumer Staples Select Sector ($XLP) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of Consumer Staples Select Sector ($XLP). The rally from 2.14.2024 low at $72.36 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the […]

-

AbbVie Inc. ($ABBV) Bullish Structure Calling for More Upside Since July 2023.

Read MoreHello Traders. In today’s article, we are going to follow up on AbbVie Inc. ($ABBV) forecast that was posted back in July 2023 and take a look at the latest count. You can find the article here. $ABBV Daily Elliott Wave View July 2023: Our remarks from July 2023 were as follows: “The Daily chart above shows the […]

-

Health Care Select Sector ($XLV) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of Health Care Select Sector ($XLV). The rally from 1.25.2024 low at $137.21 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the […]

-

Netflix Inc. ($NFLX) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of Netflix Inc. ($NFLX). The rally from 1.17.2024 low at $476.01 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the structure & […]

-

Invesco Nasdaq ETF ($QQQ) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of Invesco Nasdaq ETF ($QQQ). The rally from 1.17.2024 low at $402.87 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the structure […]

-

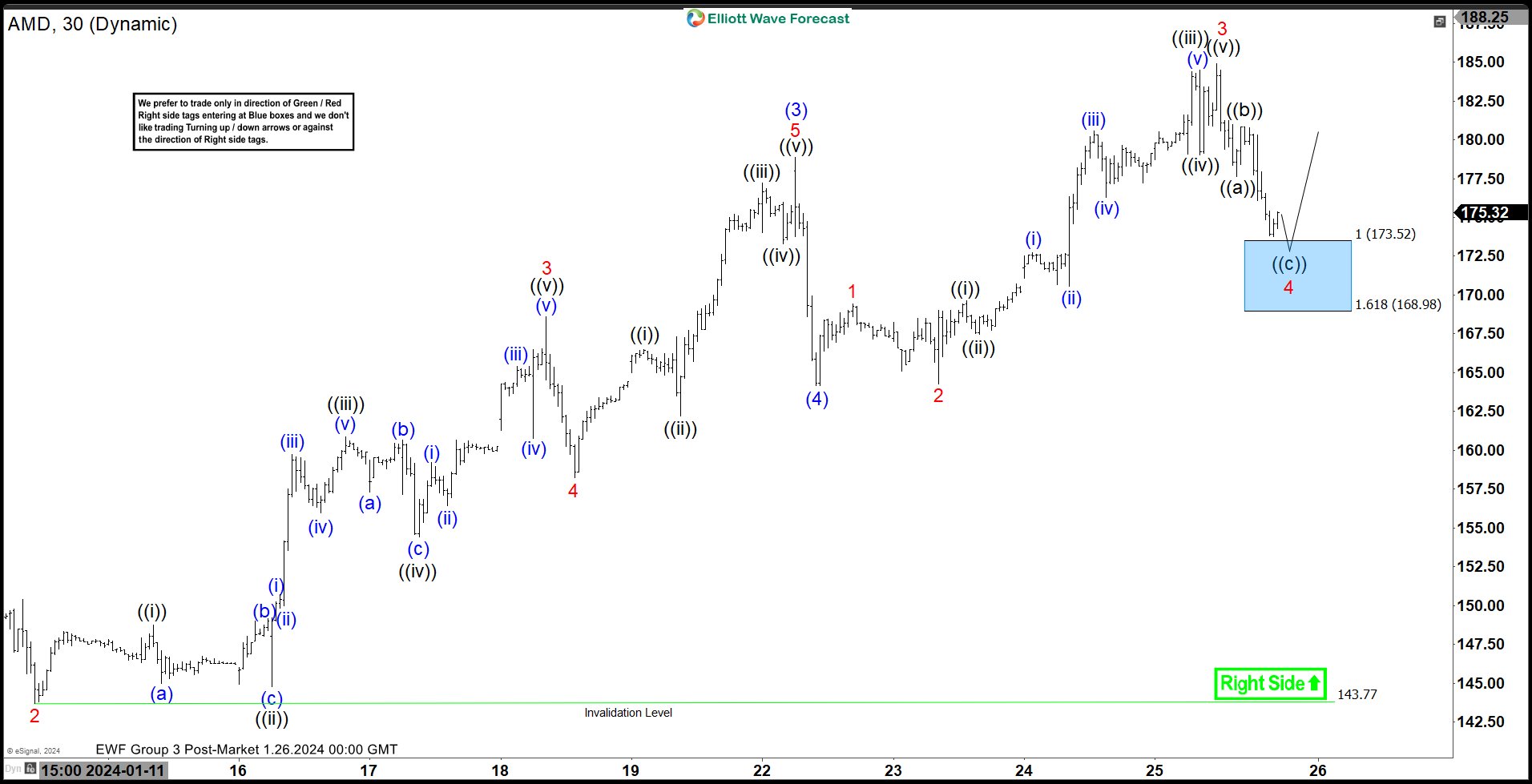

Advanced Micro Devices, Inc. ($AMD) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of Advanced Micro Devices, Inc. ($AMD). The rally from 1.11.2024 low at $143.77 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the […]