-

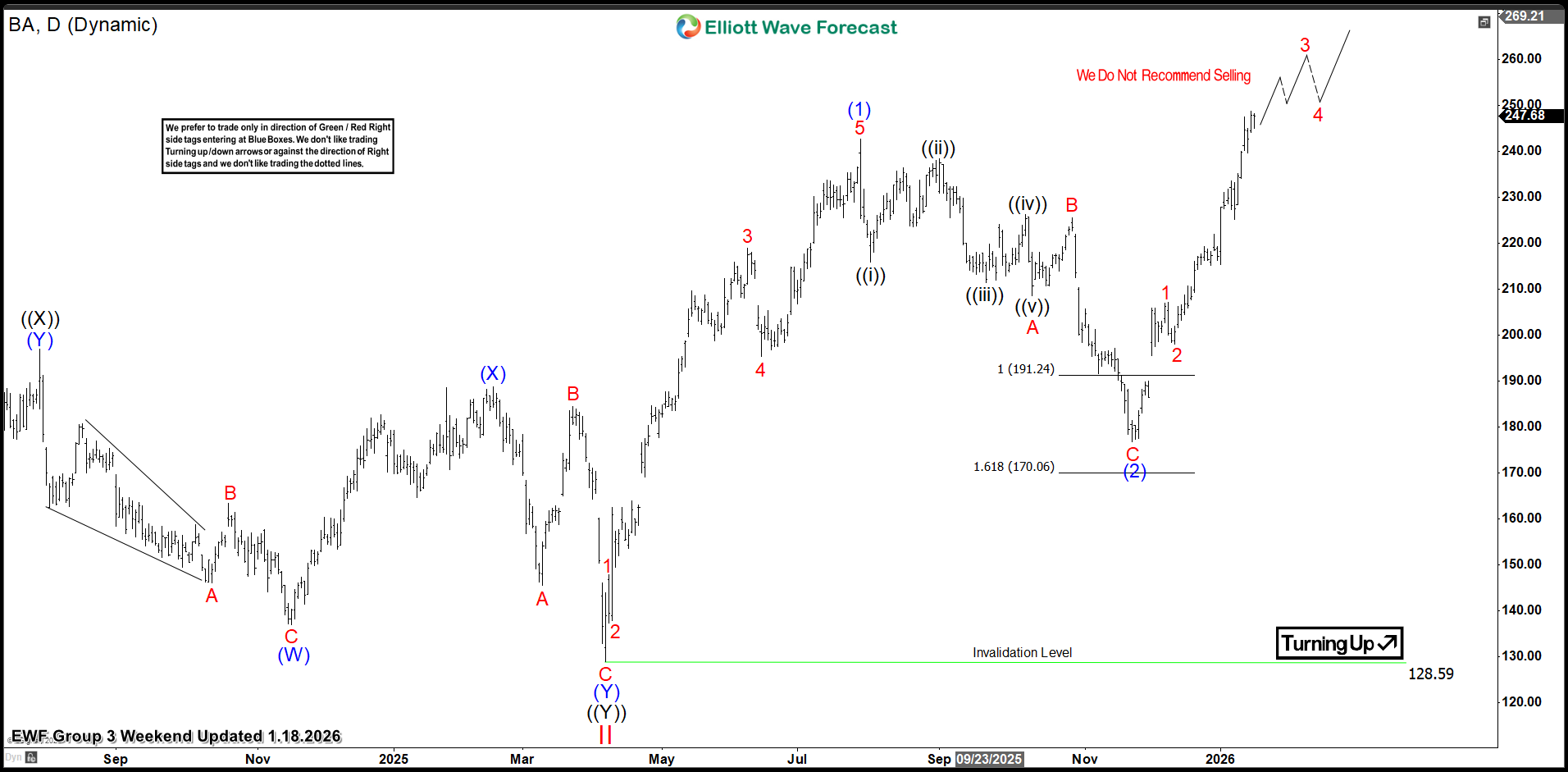

Boeing Co. $BA Extreme Area Offering a Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll review the recent performance of Boeing Co ($BA) through the lens of Elliott Wave Theory. We’ll look at how the pullback from recent 52 week highs unfolded as a textbook 3-swing correction and discuss what could come next. Let’s explore the structure and the expectations for this stock. 5 Wave Impulse Structure + ABC […]

-

SPDR Financial Sector $XLF Blue Box Area Offering a Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll review the recent performance of SPDR Financial Sector ($XLF) through the lens of Elliott Wave Theory. We’ll look at how the pullback from all-time highs unfolded as a textbook 3-swing correction and discuss what could come next. Let’s explore the structure and the expectations for this ETF. 5 Wave […]

-

Alphabet Inc. $GOOGL Blue Box Area Offering a Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Alphabet Inc. ($GOOGL) through the lens of Elliott Wave Theory. We’ll review how the pullback from All time highs unfolded as a textbook 7-swing correction and discuss our evolving forecast for the next move. Let’s dive into the fascinating structure and expectations for this tech giant. 5 […]

-

VanEck Gold Miners ETF $GDX Extreme Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of VanEck Gold Miners ETF ($GDX) through the lens of Elliott Wave Theory. We’ll review how the rally from the Nov 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this ETF. […]

-

Russell 2000 ETF $IWM Soars 11% from Blue Box Area, With $258 Target Still Ahead

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Russell 2000 ETF ($IWM) through the lens of Elliott Wave Theory. We’ll review how the powerful rally from the November 2025 low unfolded as a textbook 5-wave impulse and discuss our evolving forecast for the next move. Let’s dive into the structure and expectations for this tech […]

-

Apple Inc. $AAPL Soars 30% from Blue Box Area, With $290 Target Still Ahead

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Apple Inc. ($AAPL) through the lens of Elliott Wave Theory. We’ll review how the powerful rally from the August 2025 low unfolded as a textbook 5-wave impulse and discuss our evolving forecast for the next move. Let’s dive into the structure and expectations for this tech […]