-

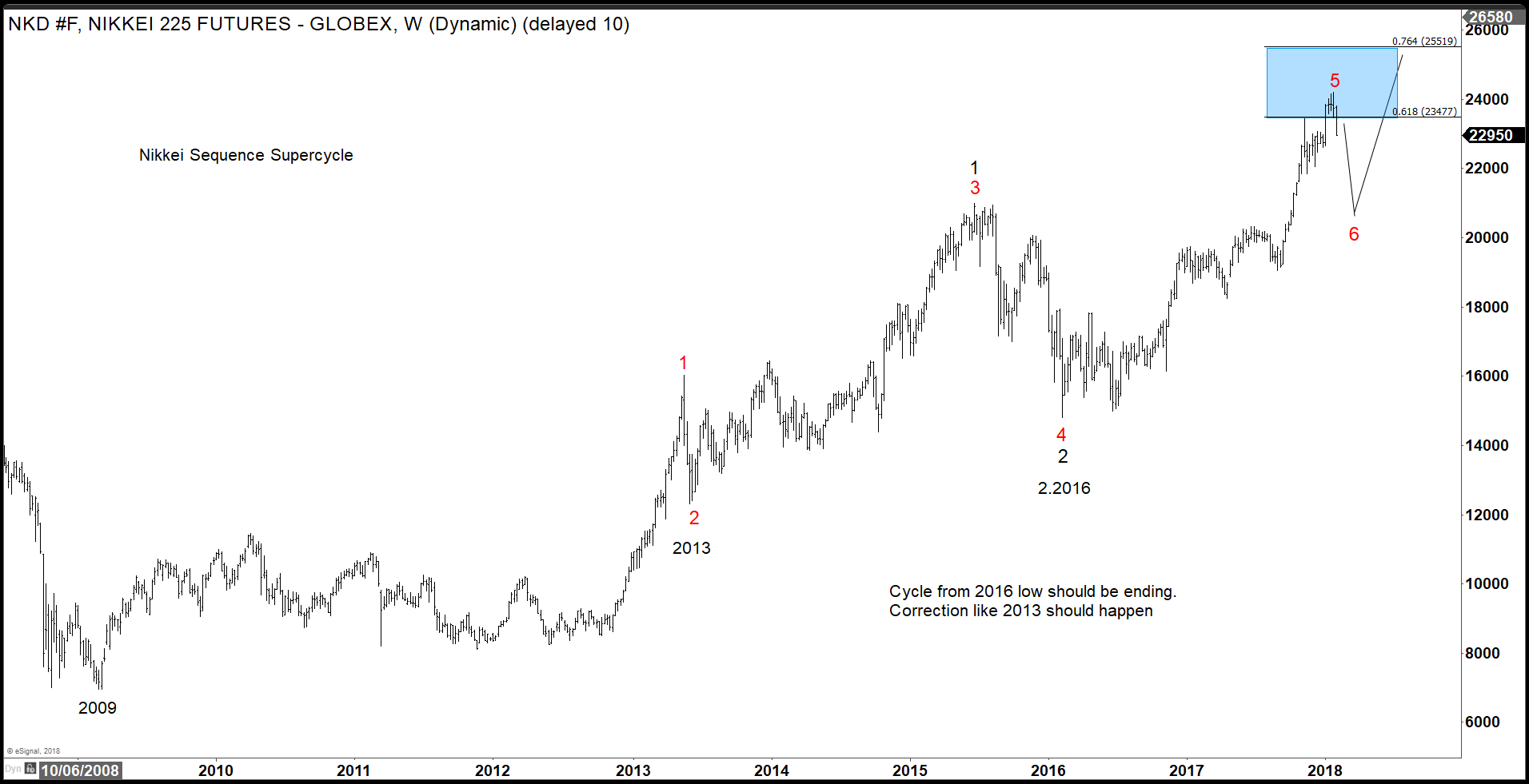

Why the NIKKEI Index still has more upside

Read MoreIn this blog, I want to discuss with you why NIKKEI Index has still more upside. In the chart below you can see our NIKKEI Indexweekly chart. You can see that the NIKKEI is in the area of 61.8-76.4% Extension from 2009 lows. Showing an incomplete bullish sequence against that low. We do understand that […]

-

High Frequency Box Provided 12% Profit in Russell

Read MoreIn this blog post, I want to discuss with you one of our recent High-Frequency box in the Russell Index which provided us with 12% in profit. We have been calling the Russell Index higher from the daily chart for a very long time. We are still bullish American indices, therefore, we have no other […]

-

Small Caps Providing Floor For The DAX Index

Read MoreHello fellow traders, in this blog post, we will discuss the related indices to the DAX from Germany in a more bigger picture. Those mid/small caps could give us a floor for the DAX Index. We will discuss the MDAX, SDAX, and the TECHDAX Let’s start with the MDAX. The MDAX is a German stock index […]

-

Why Oil Should Be Supported in Weekly Chart

Read MoreHello fellow traders, in this blog post, we will discuss oil in a more bigger picture. In the chart below, you can see crude oil futures on the weekly chart. From the 02/08/2016 low, we can clearly see that the market has a potential 5 swing incomplete bullish sequence. It seems like that it is still […]

-

Bitcoin: Technical and Psychological Perspective

Read MoreHello fellow traders, in this blog post, we will discuss the most hyped cryptocurrency Bitcoin in a technical as well as psychological perspective. From the zero line, we are calling bitcoin completed in the super cycle blue wave (a) at 17/12/17 top. From that high, the market completed the first leg of 3 of a double correction. […]

-

Gold To Silver Ratio Showing Next Move for Silver

Read MoreHello fellow traders, in this article I want to discuss with you the Gold to Silver Ratio. Before we get into that let me explain it shortly. Well, the gold to silver says how many silver ounces it takes to buy one ounce of gold. Which basically tells us how many ounces of silver we […]