-

CL_F: Crude Oil Futures Found Support From Equal Legs Area

Read MoreHello Traders in this blog we will see how CL_F Crude Oil Futures found support from equal legs area and reacted higher within wave 2. Many traders are wondering whether Crude Oil will still trade lower or higher after it’s larger degree peak it made from March 7th, 2022. In this article we will only […]

-

BTC/USD: Forecasting Elliott Wave ((iv)) Correction In Bitcoin

Read MoreHello Traders, in this article we will have a look on BTC/USD. You will see how we were able to forecast in advance the upcoming wave ((iv)) correction. Bitcoin is trading within a larger degree cycle that started from 11.21.2022. Current cycle appears to be within extended wave 3. Inside our members area we cover […]

-

NQ_F: Forecasting Elliott Wave ((iii)) Higher In NASDAQ Futures

Read MoreHello Traders, in this blog we will see how we were able to forecast in advance the wave ((iii)) higher in NQ_F. Nasdaq has been one of the weakest Indices within 2022 and has been seeing a relief bounce rally as of recent. We will see below how here at Elliott Wave Forecast were able […]

-

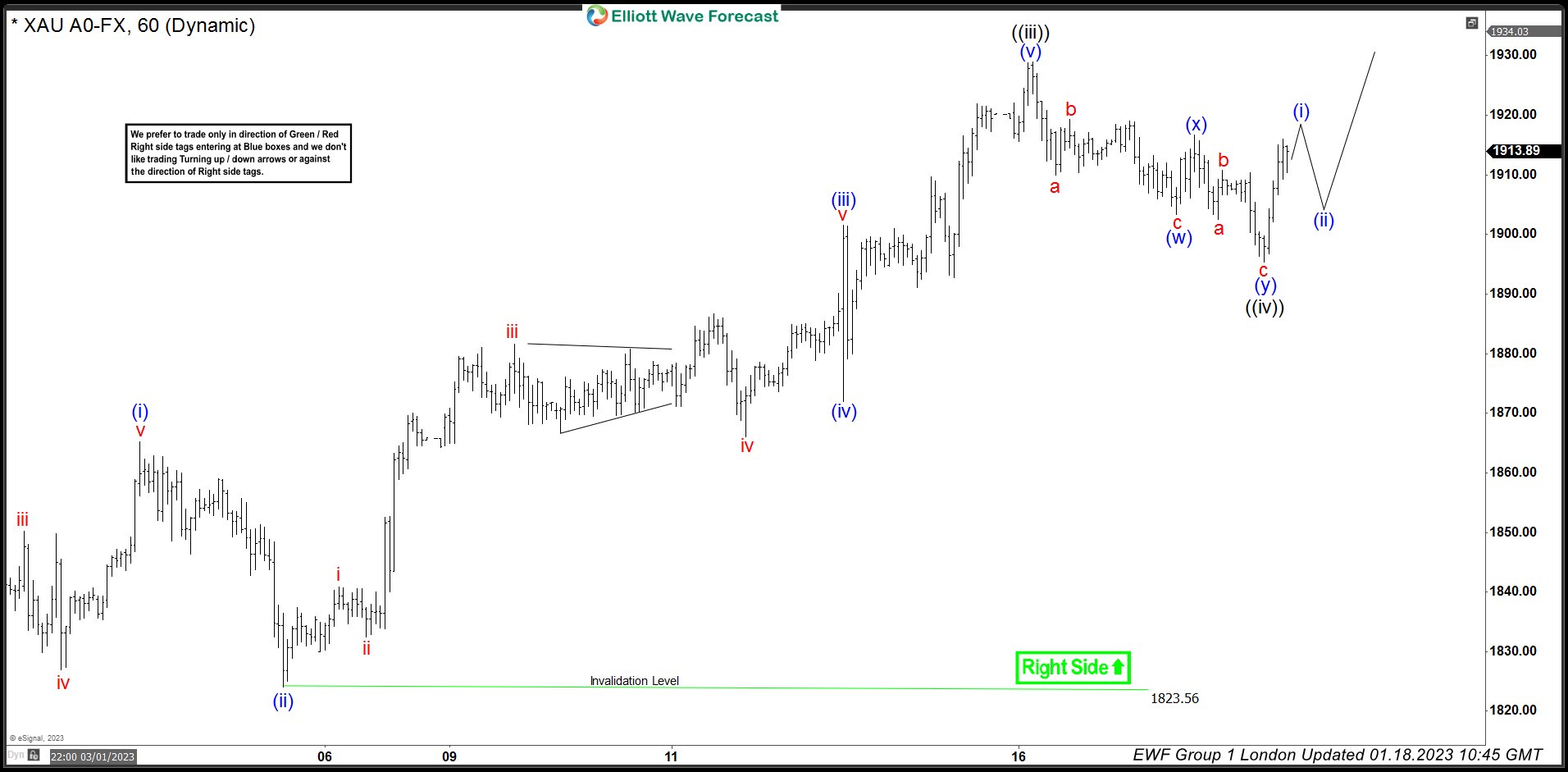

XAU/USD Forecasting the wave ((v)) higher

Read MoreHello Traders in this article we will see how we were forecasting XAU/USD to make the next leg higher within wave ((v)). Gold since it found support back from 09.28.2022 it has been in a bullish cycle. Since then it has been creating incomplete bullish sequences. Here at Elliott Wave Forecast we use incomplete sequences […]

-

LTCUSD – Forecasting the wave (5) within second dimension correlation

Read MoreOne of the well known facts of the market are correlations between instruments. However that rule does not apply every time in every instrument. Here at Elliott Wave Forecast we call a first degree correlation when 2 instruments move together according to how they are related. For example everyone knows that if the USDX is […]

-

APPLE Inc: Forecasting the reaction lower after wave (2) bounce

Read MoreApple Inc. yet another stock that many people and traders are looking at these days after it’s peak from January 2022. In total the drop so far is about 32%. Almost everyone is aware of them as a big chunk of people worldwide are using an Iphone or a Macbook device. However we must never […]