-

CRWD’s Leading Diagonal: Grand Super Cycle Points to More Upside

Read MoreCrowdStrike Holdings, Inc. (CRWD) is an American cybersecurity technology company based in Austin, Texas. It provides cloud workload and endpoint security, threat intelligence, and cyberattack response services. Analysts have a positive outlook for CrowdStrike Holdings, Inc. (CRWD) in 2025. The stock has a consensus rating of “Moderate Buy,” with 33 analysts recommending it as a buy. The average price target for CRWD is […]

-

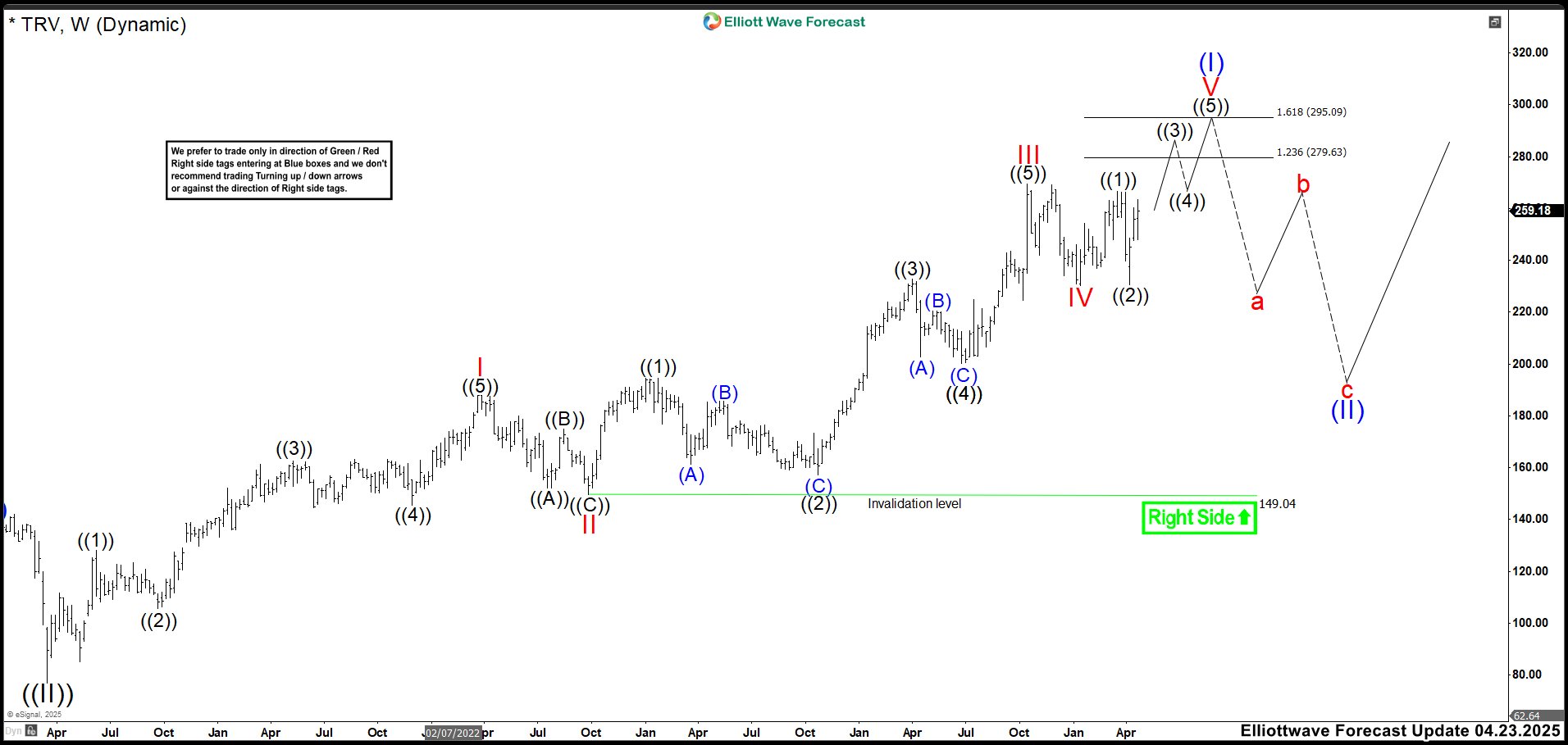

TRV Approaches Final Stage of Impulse Structure: Anticipating a Pullback

Read MoreThe Travelers Companies, Inc., TRV, is an American insurance company. It is the second-largest writer of U.S. commercial property casualty insurance, and the sixth-largest writer of U.S. personal insurance through independent agents. Experts have mixed opinions about Travelers Companies (TRV) stock for 2025. Analysts have provided a consensus price target of $263.37, with estimates ranging […]

-

SHOP Completes Key Corrective Cycle: Bulls Ready to Take Control

Read MoreShopify Inc. is a Canadian multinational e-commerce company in Ottawa, Ontario. Shopify (SHOP) is the name of its proprietary e-commerce platform for online stores and retail point-of-sale systems. The Shopify platform offers online retailers a suite of services including payments, marketing, shipping and customer engagement tools. Experts hold varied perspectives on Shopify (SHOP) stock for 2025. On one hand, some analysts recommend a moderate buy rating, citing a […]

-

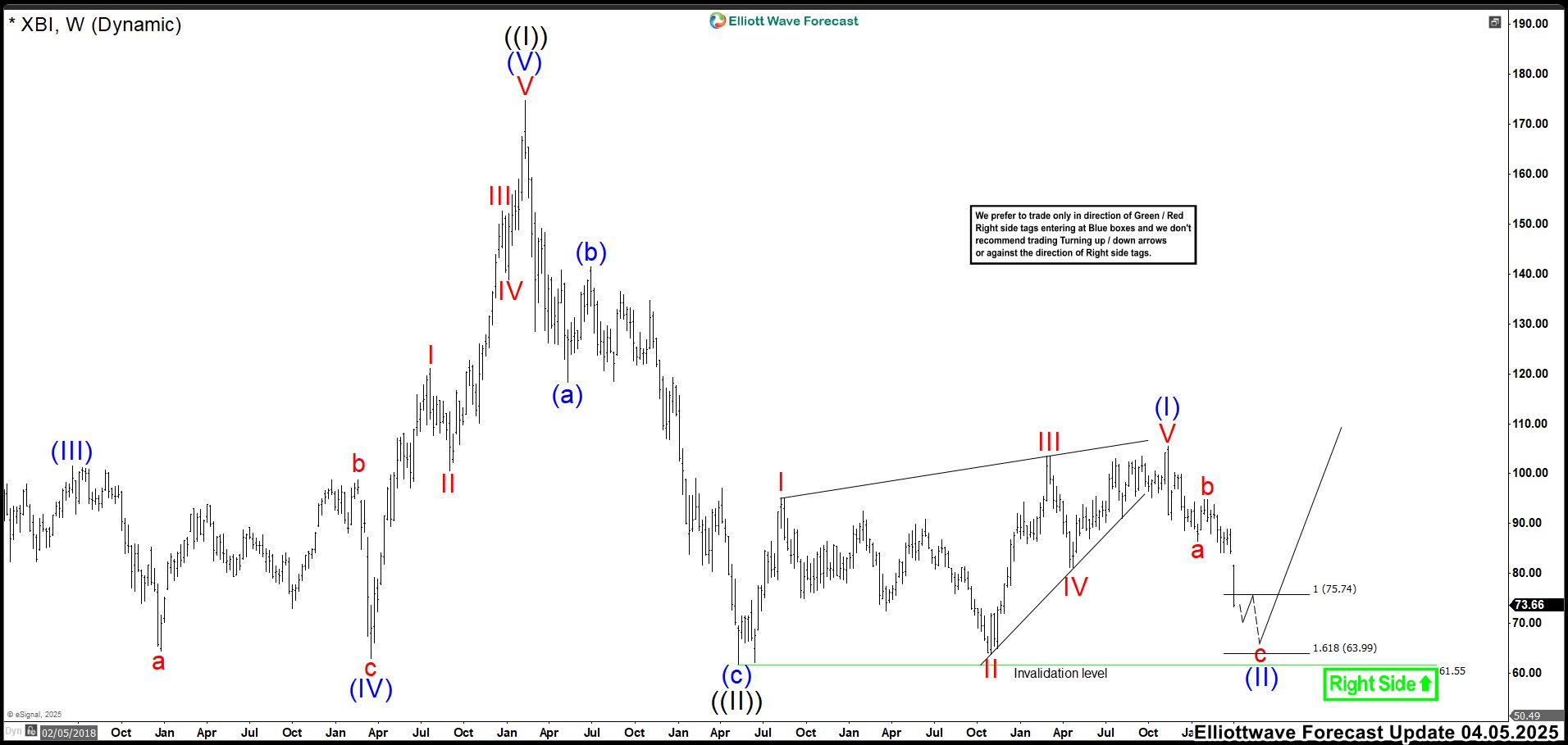

Will XBI Crash 61.78 Low? Analyzing the Biotech ETF’s Correction

Read MoreThe SPDR S&P Biotech ETF (XBI) is an exchange-traded fund that tracks the biotechnology segment of the S&P Total Market Index. This ETF allows investors to gain exposure to large, mid, and small-cap biotech stocks. If you’re interested in biotechnology, XBI could be worth exploring further. Here are some of its top holdings and their percentage weights: United Therapeutics […]

-

Riding the Trend: USDCNH Shows Dollar Strength Set to Persist

Read MoreIn recent years, the renminbi paused its attempt to strengthen against the USD. In February 2014, the renminbi found support at 6.0153 as wave ((III)). From there, it formed a perfect zig-zag corrective structure, reaching equal legs at the 7.1964 high in September 2019. Following these three swings, USDCNH was expected to continue its downtrend. […]

-

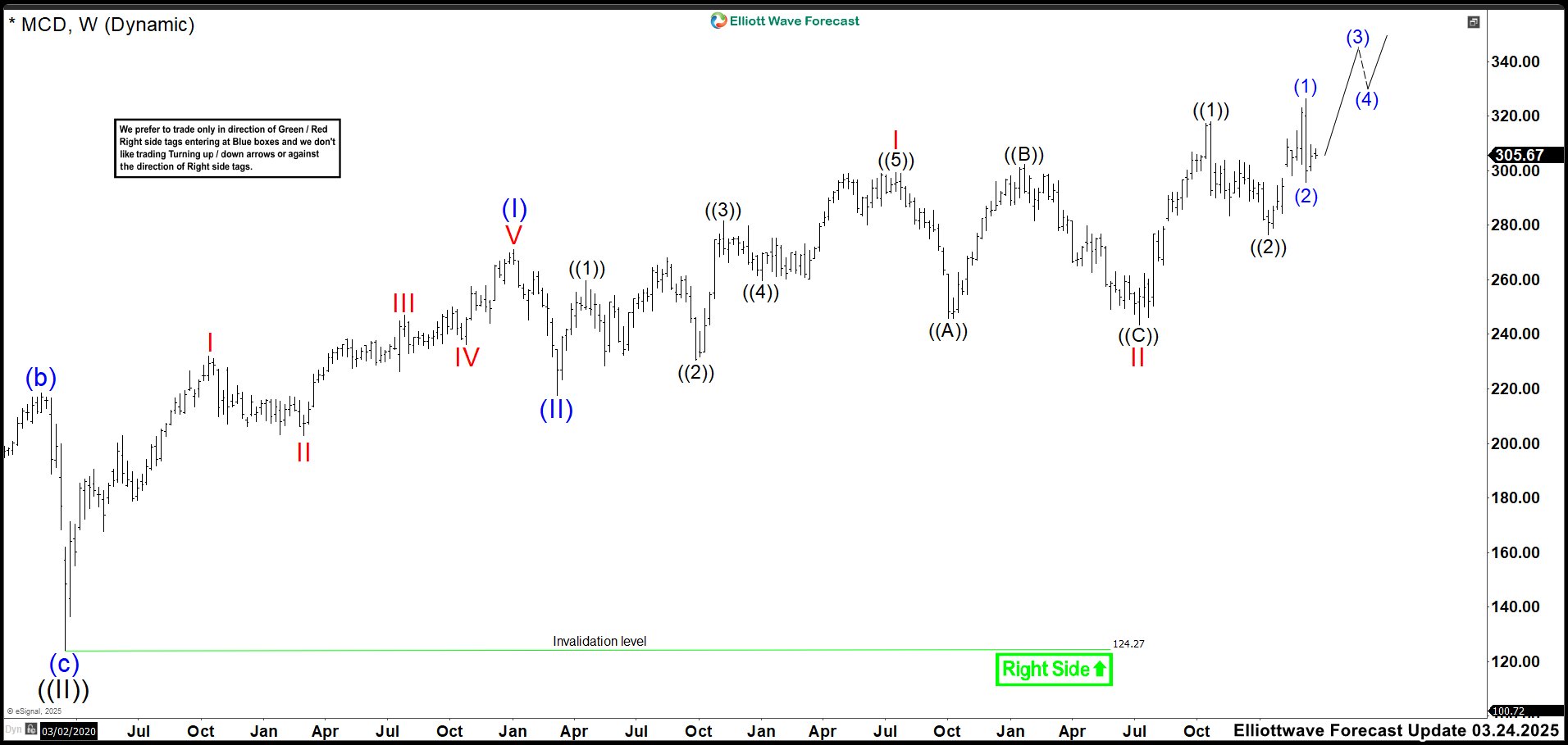

McDonald’s (MCD): Continuing the Bullish Trend with Wave ((3))

Read MoreMcDonald’s (MCD) stock is on track to deliver moderate growth throughout 2025. Analysts expect an average price target of $323.39, offering a potential upside of 5.79% from its current level. Furthermore, monthly forecasts highlight price fluctuations between $282 and $370, influenced by market conditions. Menu innovation, digital initiatives, and geographic diversification strengthen its position and […]