-

Lithium ETF (LIT) is Under Pressure By Market Downtrend

Read MoreThe Global X Lithium & Battery Tech ETF (LIT) invests in the full lithium cycle, from mining and refining the metal, through battery production. The Global X Lithium & Battery Tech ETF (LIT) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global […]

-

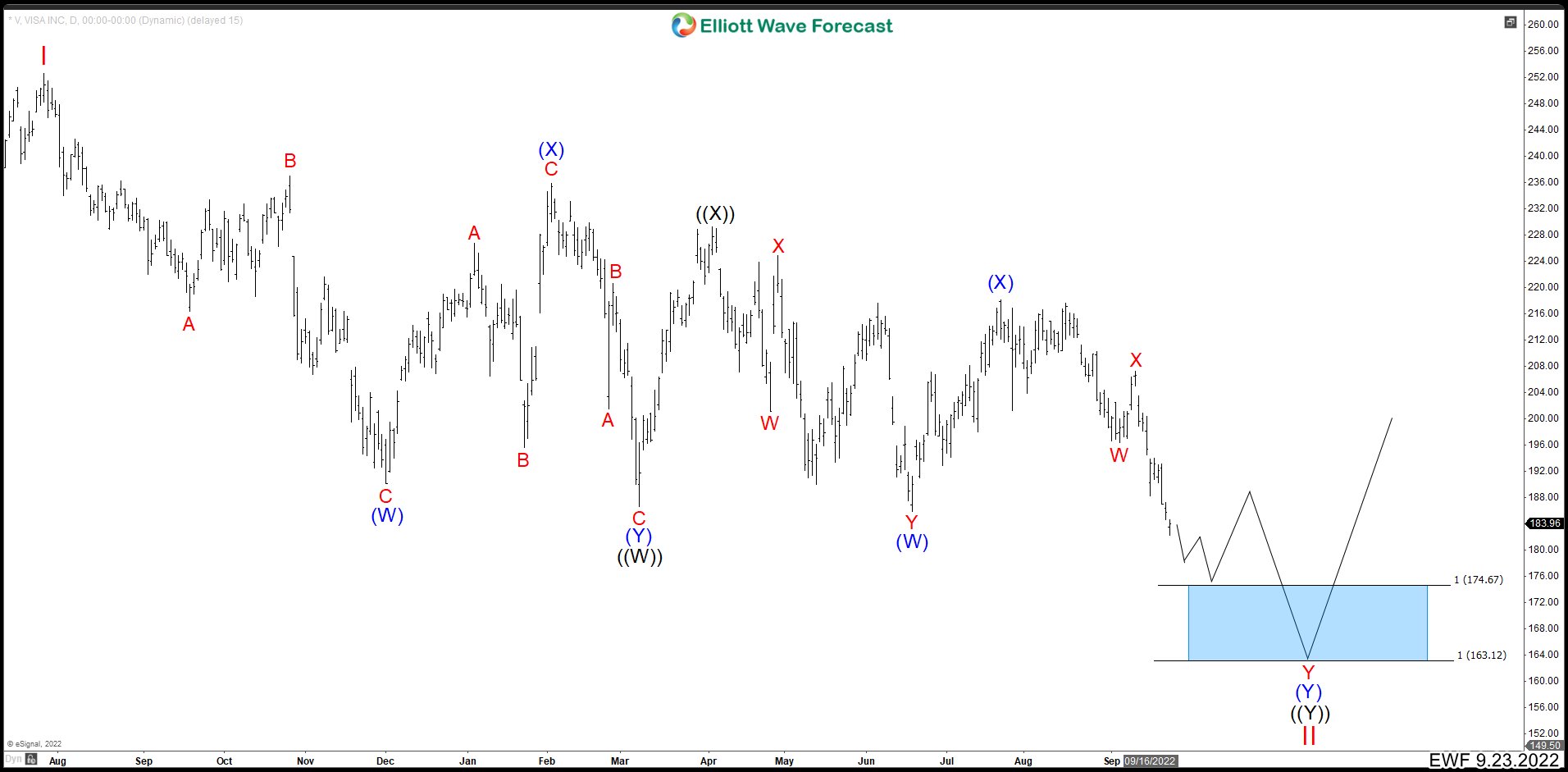

Visa (V) Shows An Incomplete Double Correction Structure

Read MoreVisa Inc. (V) is an American multinational financial services corporation headquartered in San Francisco, California. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards. Visa is one of the world’s most valuable companies. VISA (V) Daily Chart From September 2022 Visa (V) ended an important market cycle in July 2021 that started in aVrch 2020. The rally reached […]

-

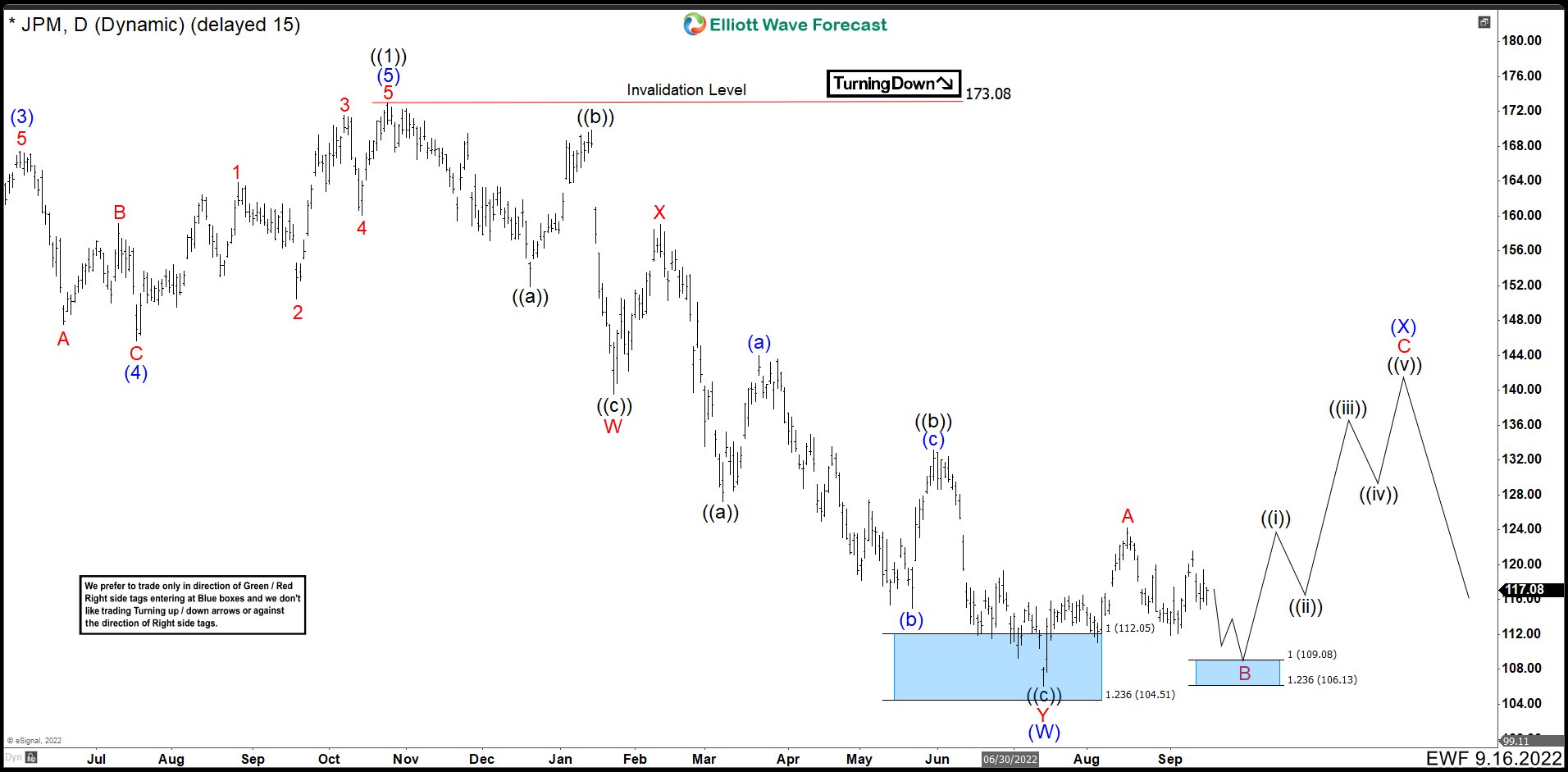

JPMorgan (JPM) Could Be Ready For A Rally In Next Quarter

Read MoreJPMorgan Chase & Co. (JPM) is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. As of December 31, 2021, JPMorgan Chase is the largest bank in the United States, the world’s largest bank by market capitalization, and the fifth-largest bank in the world in […]

-

HDFC BANK Bounce From The Blue Box. Will The Rally Continue?

Read MoreHDFC Bank Limited is an Indian banking and financial services company headquartered in Mumbai. It is India’s largest private sector bank by assets and world’s 10th largest bank by market capitalization as of April 2021, the third largest company by market capitalization of $122.50 billion on the Indian stock exchanges. It is also the fifteenth […]

-

Elliott Wave View: GBPCAD Rally Should Fail for Further Downside

Read MoreShort Term Elliott Wave View in GBPCAD suggests rally to 1.5367 ended wave ((iv)). Wave ((v)) lower is in progress to complete a cycle from August 2, 2022 high. Internal subdivision of wave ((iv)) unfolded as a zig zag Elliott Wave structure. Up from wave ((iii)), wave (a) ended at 1.5314 and pullback in wave […]

-

TSX Bounced From The Blue Box. What Is Next?

Read MoreS&P/TSX is a major stock market index which tracks the performance of largest companies by market capitalization on the Toronto Stock Exchange in Canada. It is a free float market capitalization weighted index. The index covers approximately 95 percent of the Canadian equities market. The S&P/Toronto Stock Exchange Composite Index has a base value of […]