-

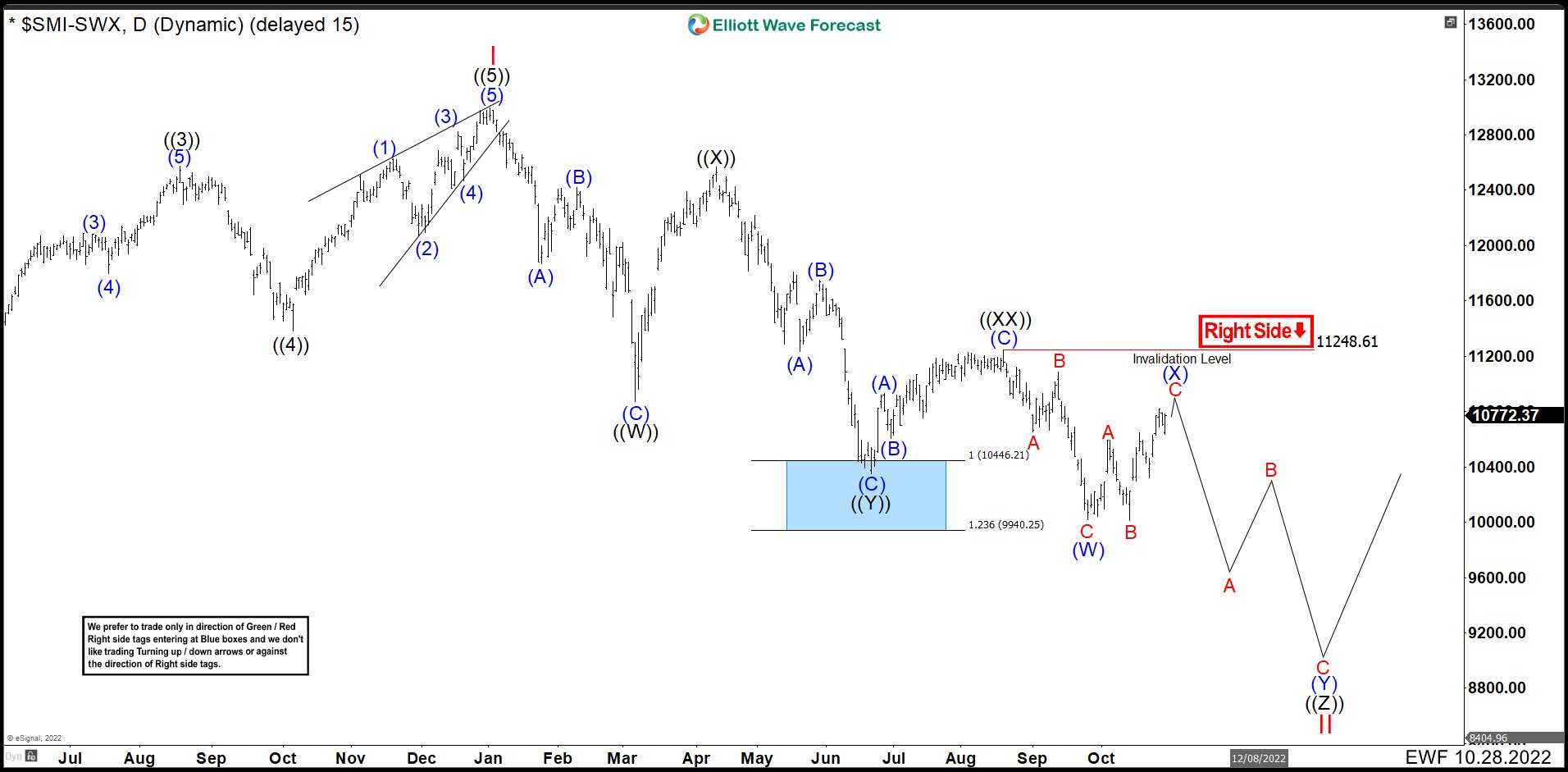

SMI (Swiss Index) Entered In A Triple Correction Structure

Read MoreThe Swiss Market Index (SMI) is Switzerland’s blue-chip stock market index, which makes it the most followed in the country. It is made up of 20 of the largest and most liquid Swiss Performance Index (SPI) stocks. The SMI is not adjusted for dividends. SMI December 04th Daily Chart This is last year’s chart, where […]

-

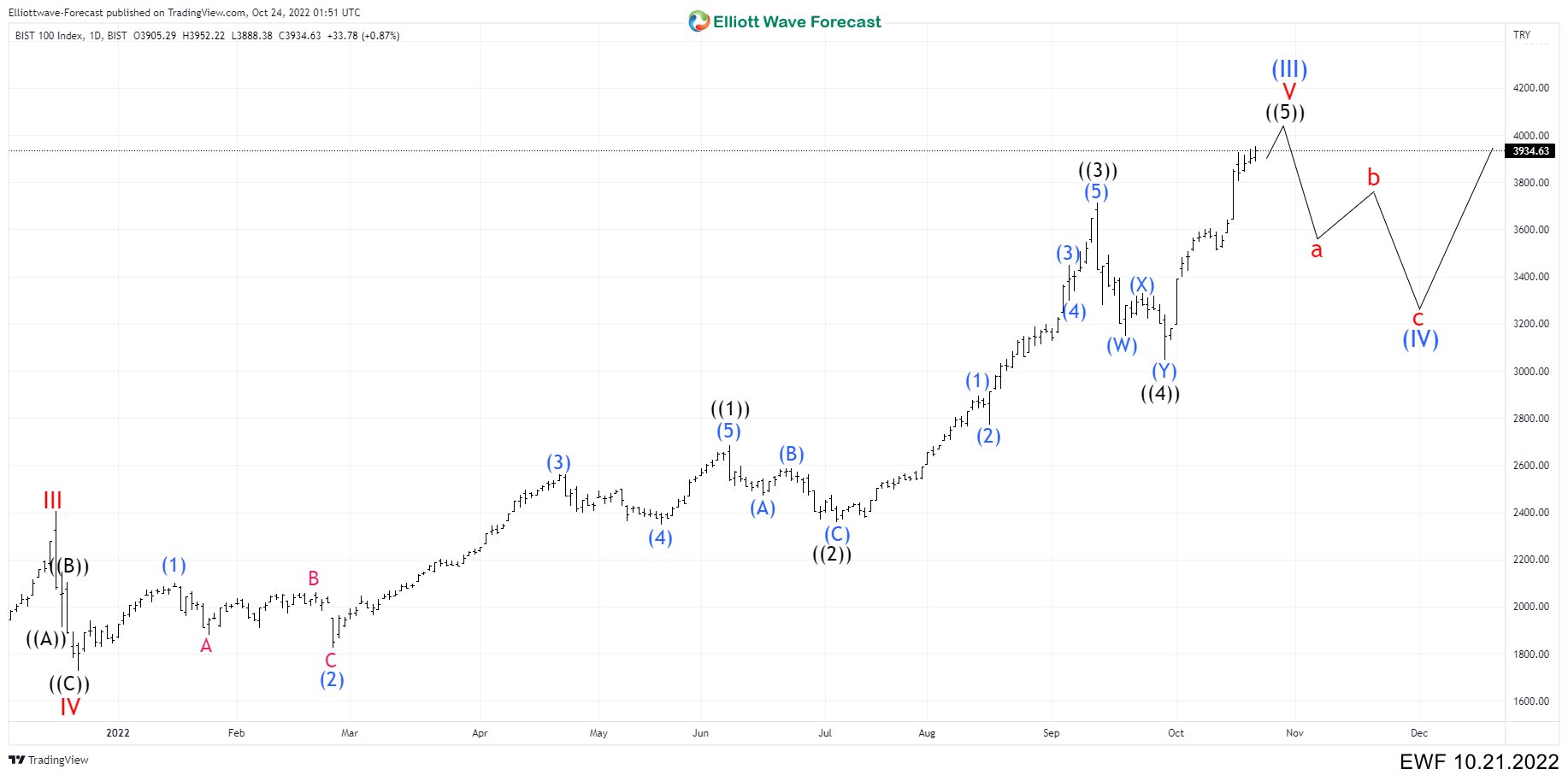

BIST (XU100) May Drop at Any Time To Test Wave ((4)) Again

Read MoreThe Borsa İstanbul (BIST or XU100) is the sole exchange entity of Turkey combining the former Istanbul Stock Exchange (ISE), the Istanbul Gold Exchange and the Derivatives Exchange of Turkey under one umbrella. It was established as an incorporated company with a founding capital of ₺423,234,000 (approx. US$240 million) on 2013 and began to operate […]

-

Elliott Wave View: Gold Could Shine A Bit In Coming Days

Read MoreShort term Elliott Wave view on Gold (XAUUSD) continued with bearish momentum from 10.04.2022 high calling for further downside. Decline from 10.04.2022 high is unfolding in 3 waves to complete a double correction. Down from 10.04.2022 high, wave (i) ended at 1700.00 and rally in wave (ii) ended at 1725.78. Then XAUUSD resumes the drop […]

-

Elliott Wave View: Silver Needs More Downside Before a Pullback

Read MoreShort term Elliott Wave view on Silver (XAGUSD) continued with bearish momentum from 10.04.2022 high calling for further downside. Decline from 10.04.2022 high is unfolding as a 5 waves impulse. Down from 10.04.2022 high, wave ((i)) ended at 19.92 and rally in wave ((ii)) ended at 20.87. Then silver resumes the drop as wave ((iii)). Internal […]

-

Elliott Wave View: EURUSD Should Be Near To Pullback

Read MoreShort term Elliott Wave view on EURUSD suggests the cycle from 10.04.2022 high is over at 0.9630 low as a double correction structure. The market bounced and a new double correction is in progress to end the cycle from 9.28.2022. Up from 10.13.2022 low, wave (a) ended at 0.9808 and dips in wave (b) ended […]

-

COIN And Cryptos Should Continue Lower as Market Pressure

Read MoreCoinbase Global, Inc., branded Coinbase (COIN), is an American company that operates a cryptocurrency exchange platform. Coinbase is a distributed company; all employees operate via remote work and the company lacks a physical headquarters. It is the largest cryptocurrency exchange in the United States by trading volume. The company was founded in 2012 by Brian Armstrong and Fred Ehrsam. COIN Daily Chart May 2022 In […]