-

Elliott Wave View: SPX Is Looking To Finish A Cycle Towards A Blue Box

Read MoreShort term Elliott Wave View in SP500 (SPX) shows an incomplete bearish sequence from 1.04.2022 high favoring further downside. Short term, rally from 10.13.2022 low is unfolding as a zigzag Elliott Wave structure. Up from 10.13.2022 low, wave A ended at 3905.64 and pullback in wave B ended at 3709.83. Wave C higher is in […]

-

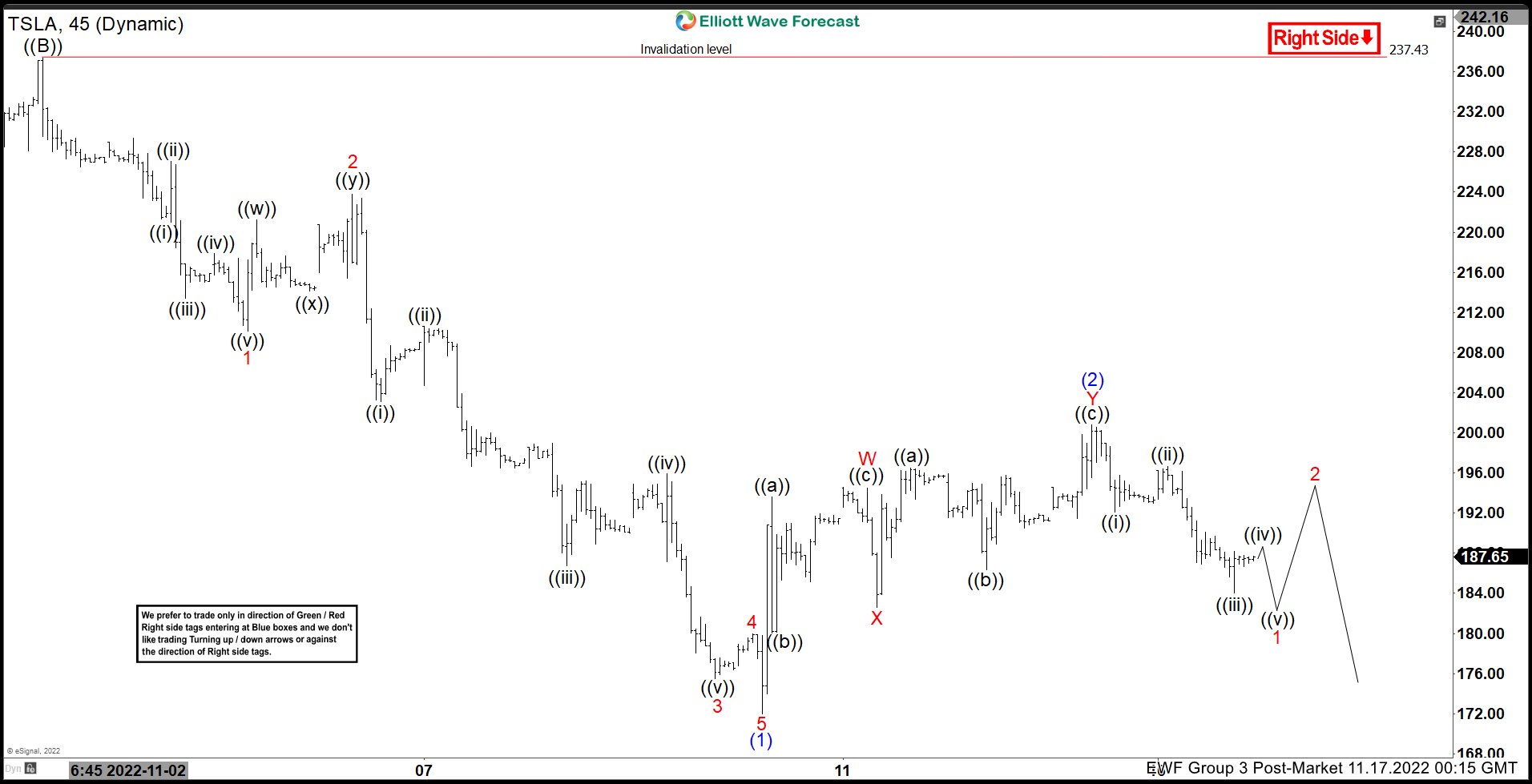

Elliott Wave View: Tesla (TSLA) Downtrend Should Start Again

Read MoreShort term Elliott Wave view in TESLA (ticker: TSLA) suggests the decline from 8.16.2022 high is unfolding as a zigzag Elliott Wave structure. Down from 8.17.2022 high, wave ((A)) ended at 198.33 and wave ((B)) rally ended at 237.43. The stock extends lower in wave ((C)) and the internal subdivision is in the form of […]

-

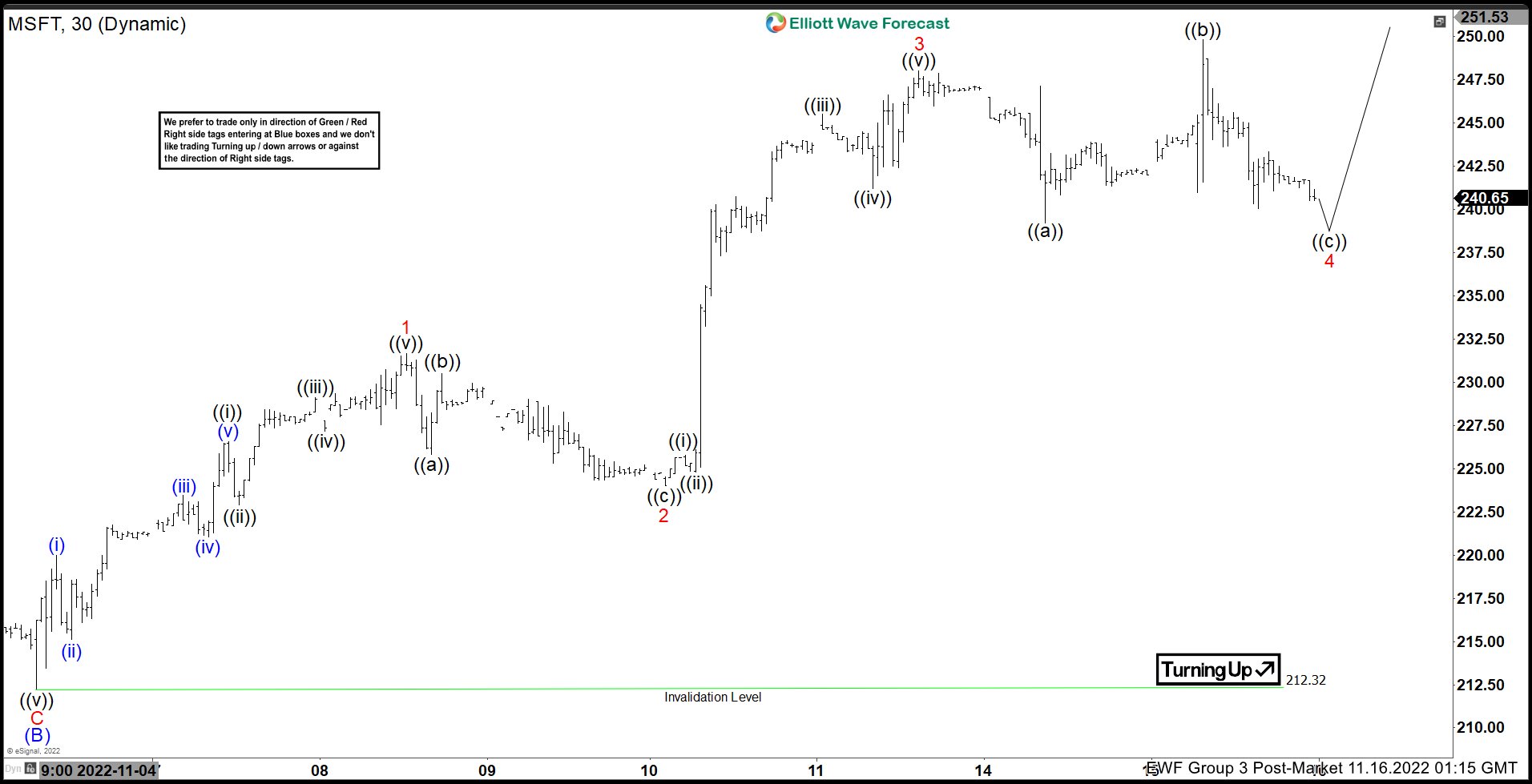

Elliott Wave View: MSFT Should Drop After A Flat Correction Is Completed

Read MoreShort term Elliott Wave View in Microsoft (MSFT) shows an incomplete bearish sequence from 11.22.2021 high favoring further downside. Short term, rally from 10.13.2022 low is unfolding as an expanded flat Elliott Wave structure. Up from 10.13.2022 low, wave (A) ended at 252.62 and pullback in wave (B) ended at 212.24. Wave (C) higher is in […]

-

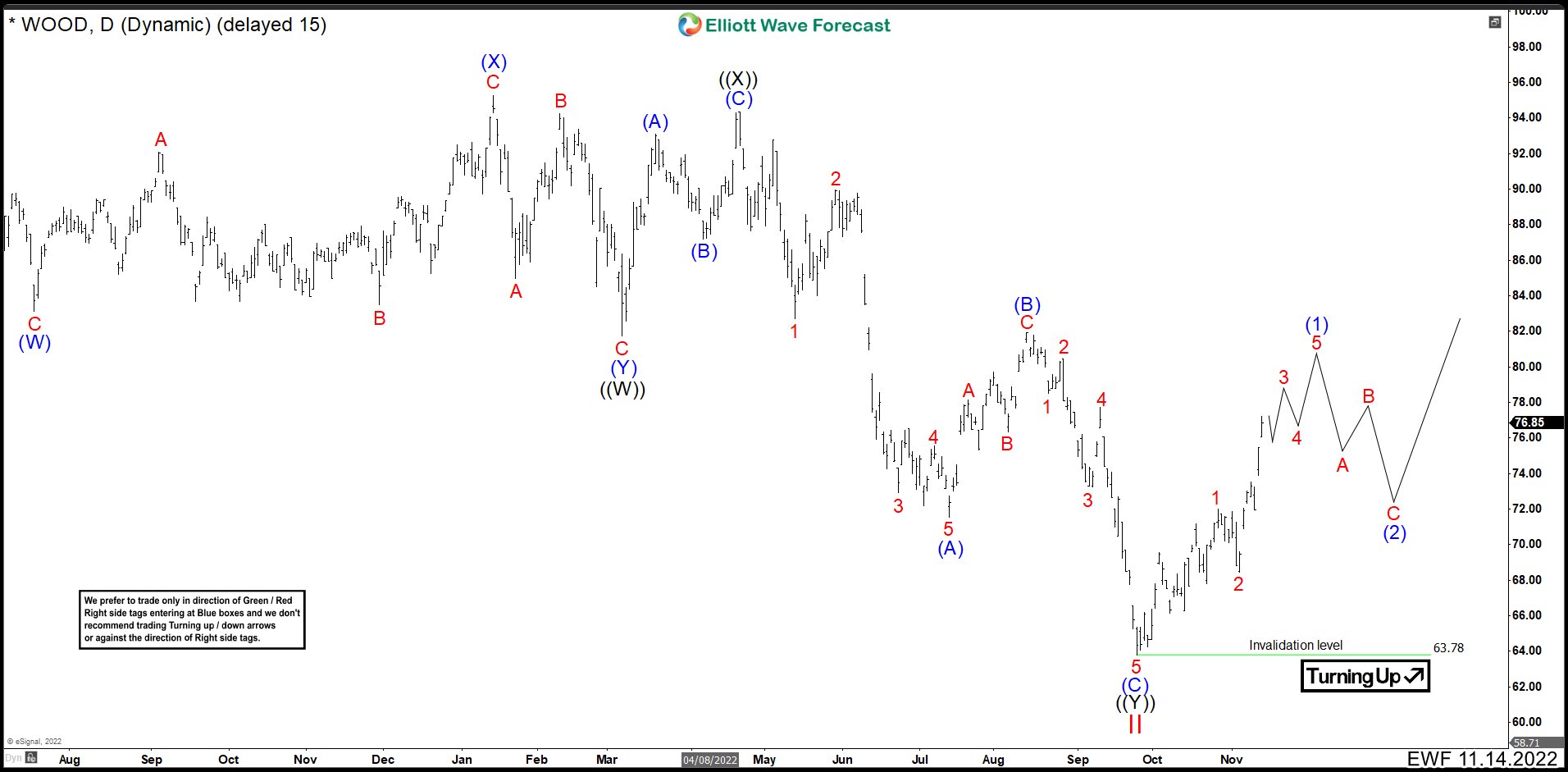

The Price Of Wood Could Already Have Started To Rise

Read MoreWOOD tracks the S&P Global Timber & Forestry Index, a cap-weighted index of the 25 largest forestry firms around the world. The fund starts with all the eligible securities from the S&P Global BMI that are classified under agriculture, forestry, homebuilding, and paper industry. ETF WOOD Daily Chart ETF WOOD ended an uptrend cycle in […]

-

Is A New Bullish Cycle Starting in DOGEUSD From June Low?

Read MoreDOGEUSD promotes the currency as the “fun and friendly Internet currency”. Software engineers Billy Markus and Jackson Palmer launched the satirical cryptocurrency to make fun of Bitcoin and the many other cryptocurrencies boasting grand plans to take over the world. Dogecoin had established a dedicated blog and forum, and its market value has reached US$8 million, once jumping […]

-

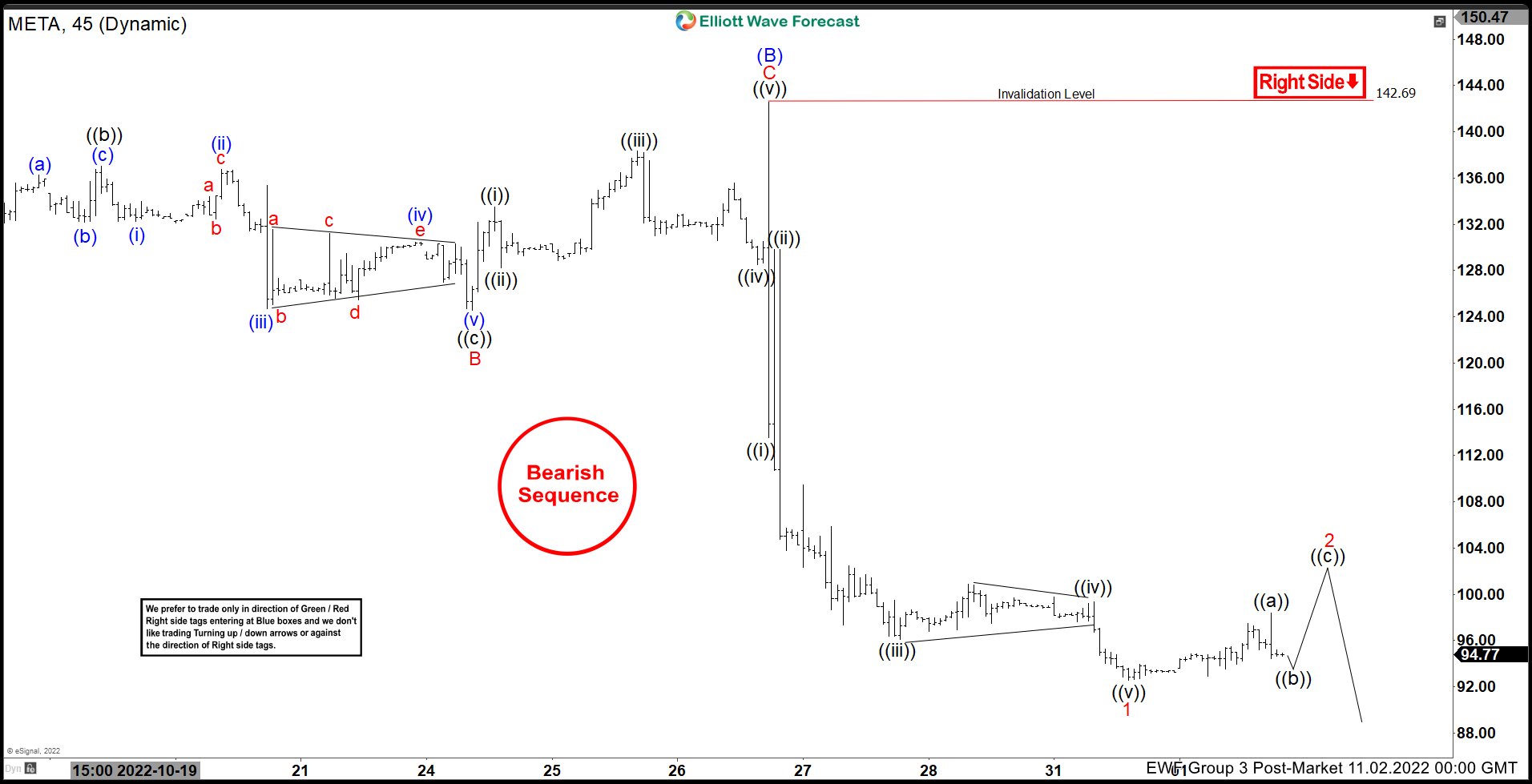

Elliott Wave View: META Should Continue Further Downside

Read MoreMETA shows a bearish sequence from 7.21.2022 high favoring more downside. This article adn video look at the Elliott Wave path.