-

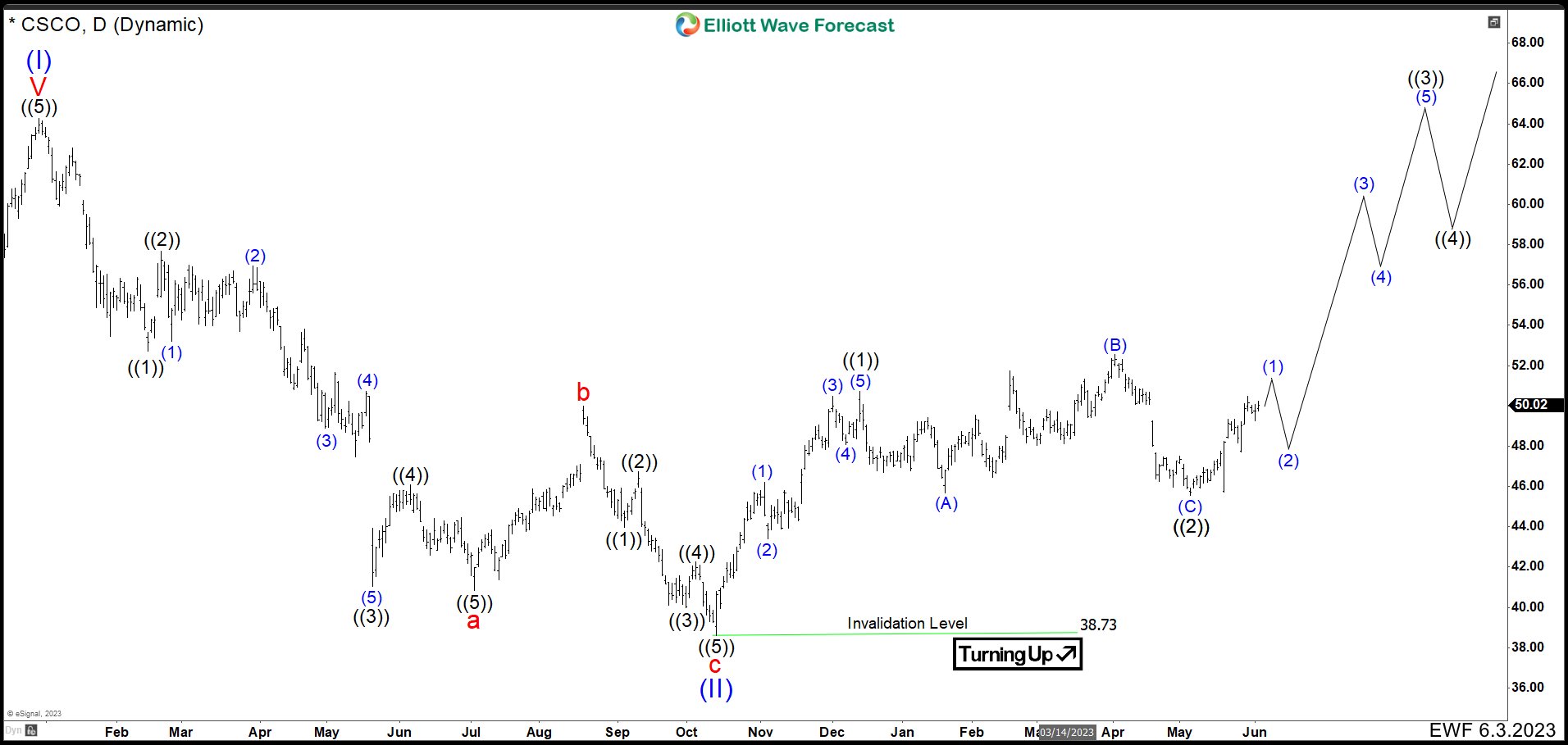

Cisco (CSCO) Ended A Correction And It Should Resume To The Upside

Read MoreCisco Systems, Inc., commonly known as Cisco (CSCO), is an American-based multinational digital communications technology conglomerate corporation headquartered in San Jose, California. Cisco develops, manufactures, and sells networking hardware, software, telecommunications equipment and other high-technology services and products. CSCO Daily Chart February 2023 At the end of 2021, Cisco finished an impulsive structure at 64.33 which we called wave (I). From this high, CSCO has been down […]

-

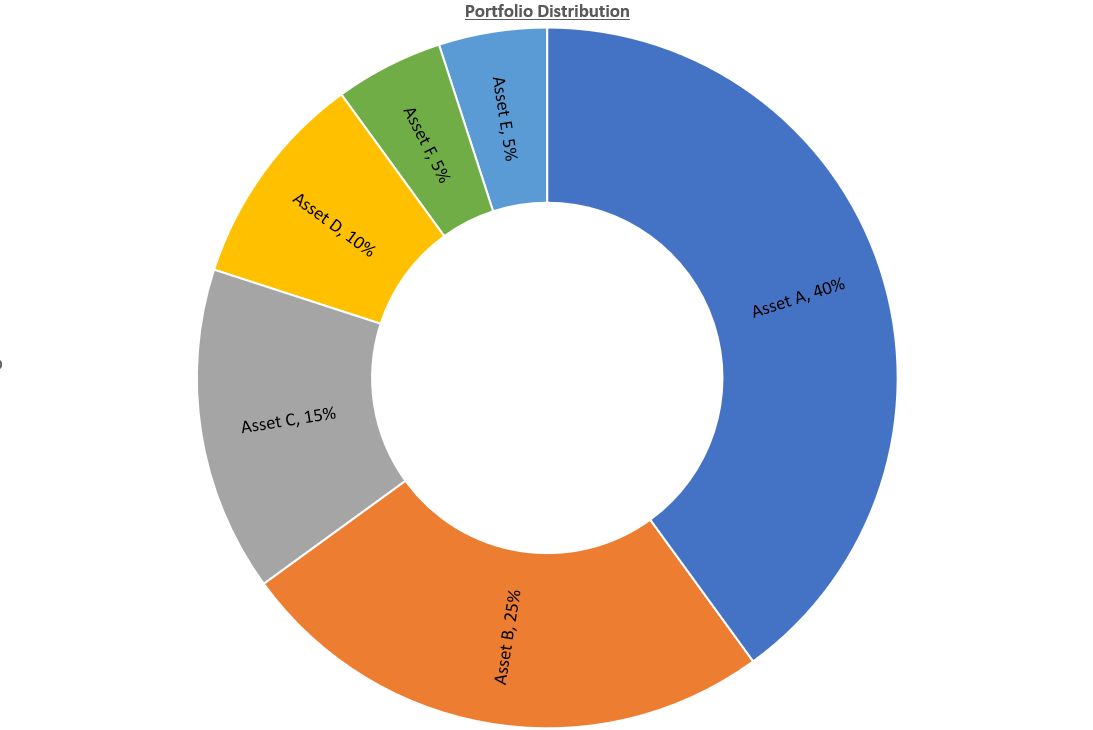

6 Steps To Create A Solid Investment Portfolio

Read MoreWhen it comes to create a financial portfolio, investors may have varying views and strategies based on their unique perspectives and goals. To choose financial instruments for a portfolio involves a combination of careful planning, diversification, and risk management. Therefore, here are some steps to help you create a solid financial portfolio: 6 Steps To Create […]

-

Roblox (RBLX) Needs To Complete A Correction Structure Before Rally Again

Read MoreRoblox (RBLX) is an online game platform and game creation system developed by Roblox Corporation that allows users to program games and play games created by other users. Created by David Baszucki and Erik Cassel in 2004 and released in 2006, the platform hosts user-created games of multiple genres coded in the programming language Lua. Roblox (RBLX) finished a bullish movement in December 2021. We called that peak wave […]

-

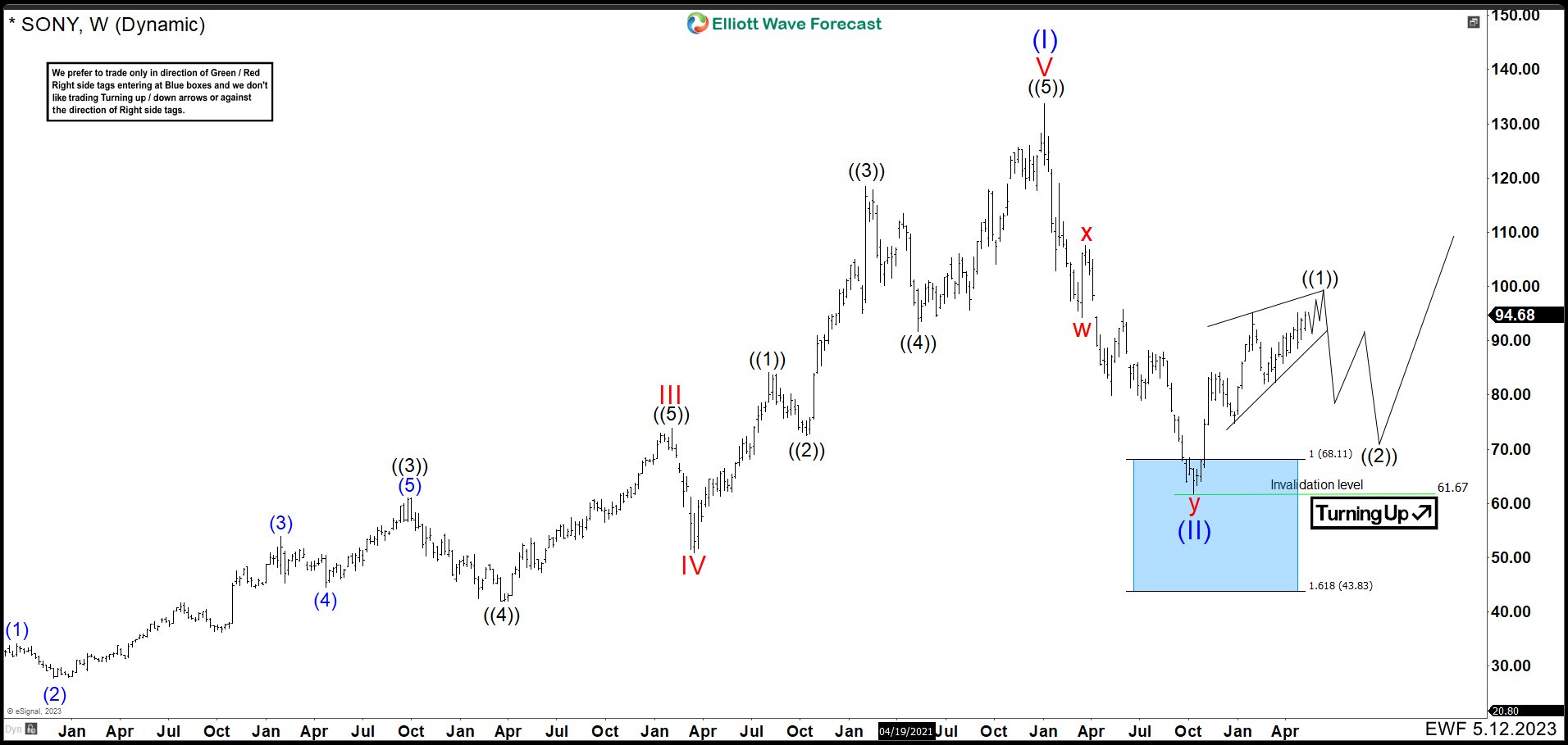

SONY Is Near To End A Leading Diagonal And It Could Start a Pullback

Read MoreSony Group Corporation, commonly known as SONY, is a Japanese multinational conglomerate corporation. As a major technology company, it operates as one of the world’s largest manufacturers of consumer and professional electronic products, the largest video game console company. SONY ended an impulse that began at the end of 2012. The share price reached 133.75 […]

-

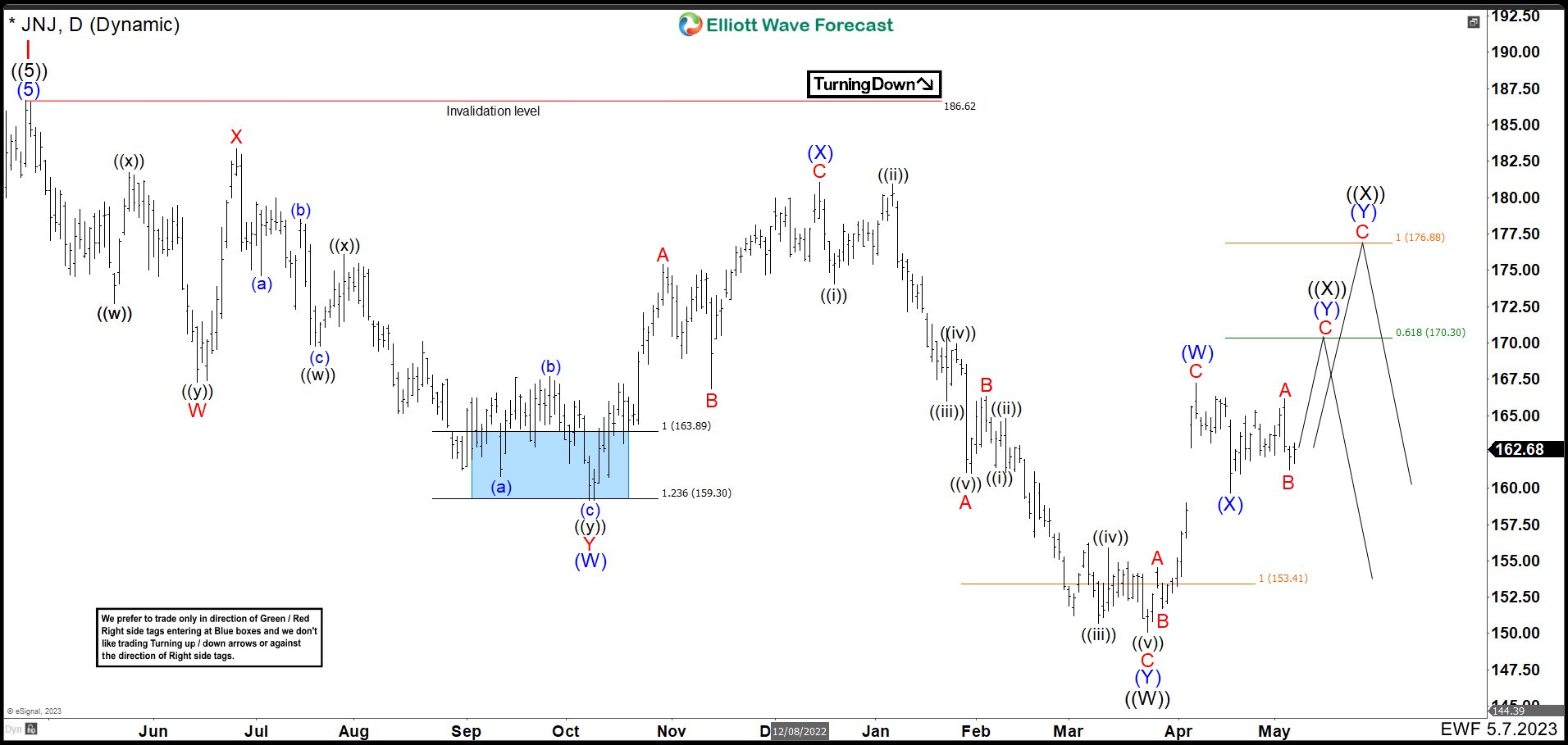

Johnson & Johnson (JNJ) Shares Are Entering In A Bull Trap

Read MoreJohnson & Johnson (JNJ) is an American multinational corporation founded in 1886 that develops medical devices, pharmaceuticals, and consumer packaged goods. Its common stock is a component of the Dow Jones Industrial Average, and the company is ranked No. 36 on the 2021 Fortune 500 list of the largest United States corporations by total revenue. […]

-

Is The Elliott Wave Principle Objective or Subjective?

Read MoreThe Elliott Wave Principle is generally considered to be a subjective tool for technical analysis. This is because the interpretation of the wave patterns and counts relies on the experience and analysis of the price movements. The Principle involves identifying repetitive patterns in price movements and using those patterns to make predictions about future price […]