-

Domino’s Pizza (DPZ) Is Showing a Blue Box For Selling Opportunities

Read MoreDomino’s is an American multinational pizza restaurant chain. Founded in 1960, the chain is owned by master franchisor Domino’s Pizza, Inc (DPZ). As of 2018, Domino’s had approximately 15,000 stores, with 5,649 in the United States, 1,500 in India, and 1,249 in the United Kingdom. Domino’s has stores in over 83 countries and 5,701 cities worldwide. DPZ Weekly Chart March 2020 In […]

-

SONY Is Near To Give Us New Buying Opportunities

Read MoreSony Group Corporation, commonly known as SONY, is a Japanese multinational conglomerate corporation. As a major technology company, it operates as one of the world’s largest manufacturers of consumer and professional electronic products, the largest video game console company. SONY ended an impulse that began at the end of 2012. The share price reached 133.75 […]

-

USDJPY Elliott Wave Impulsive Structure Remains In Play

Read MoreUSDJPY trades in impulsive structure from 9.1.2023 low and should see further upside. This article and video look at the Elliott Wave path.

-

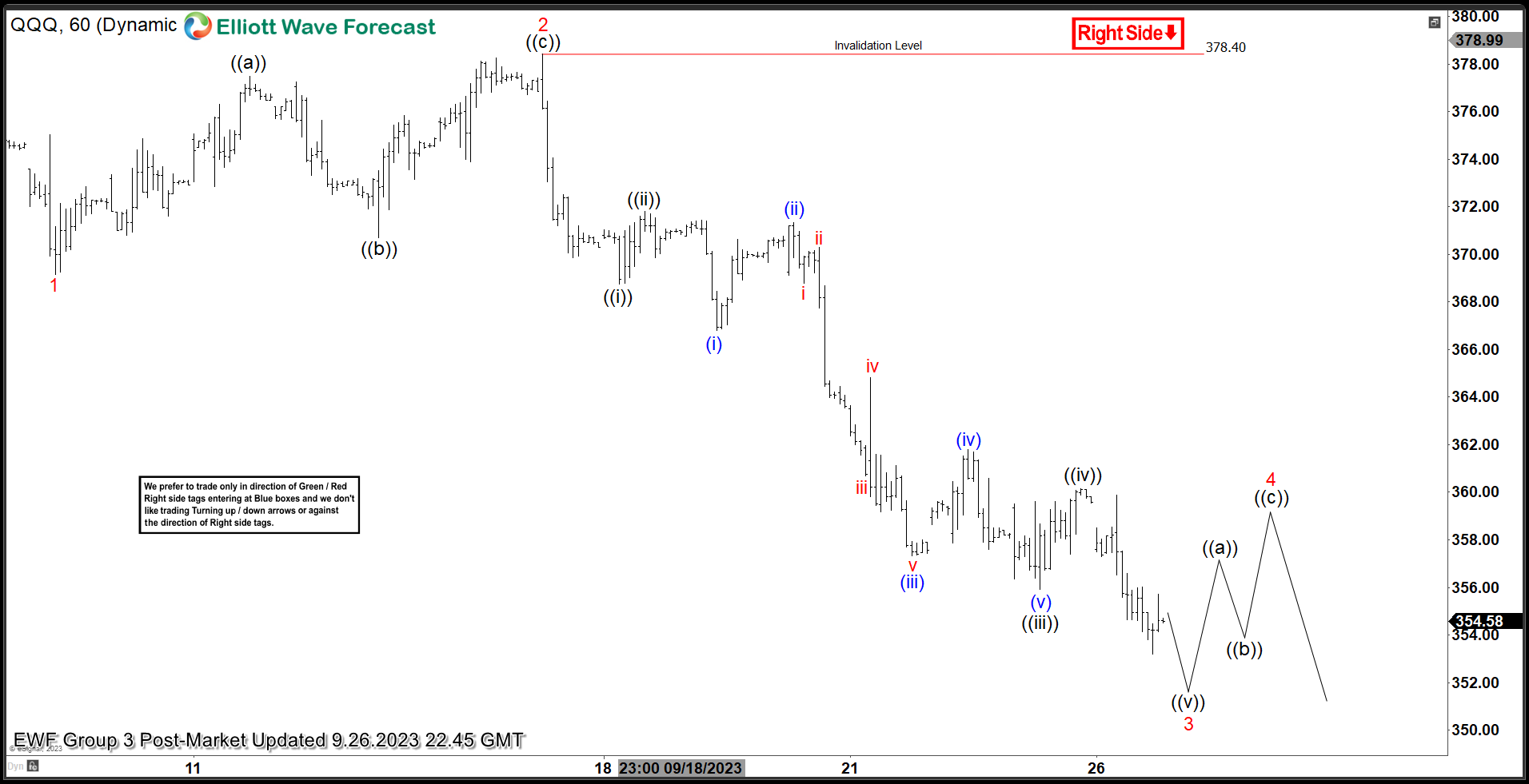

Nasdaq 100 ETF (QQQ) Continues Bearish Move Lower

Read MoreNasdaq 100 ETF (QQQ) shows incomplete bearish sequence and should see further downside. This article looks at the Elliott Wave path of the ETF.

-

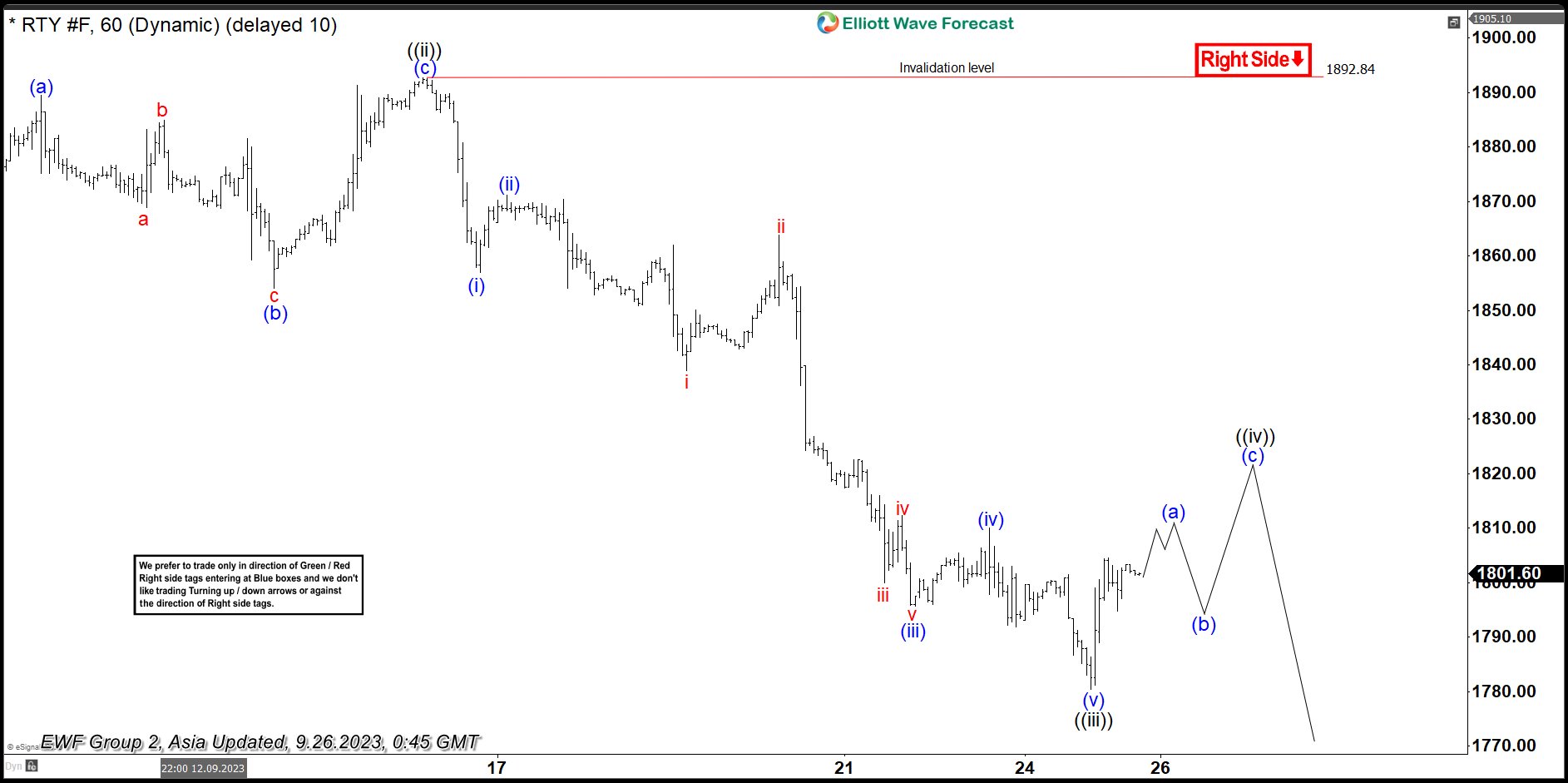

Russell 2000 (RTY) Bearish Sequence Favors Downside

Read MoreRussell 200 (RTY) shows bearish sequence from 8.1.2023 high favoring more downside. This article and video look at the Elliott Wave path.

-

McDonald’s (MCD) Is Going To Give Us Buying Opportunities

Read MoreMcDonald’s (MCD) is the world’s largest fast food restaurant chain, serving over 69 million customers daily in over 100 countries in more than 40,000 outlets as of 2021. It is best known for its hamburgers, cheeseburgers and french fries, although their menu also includes other items like chicken, fish, fruit, and salads. McDonald’s MCD Weekly […]