-

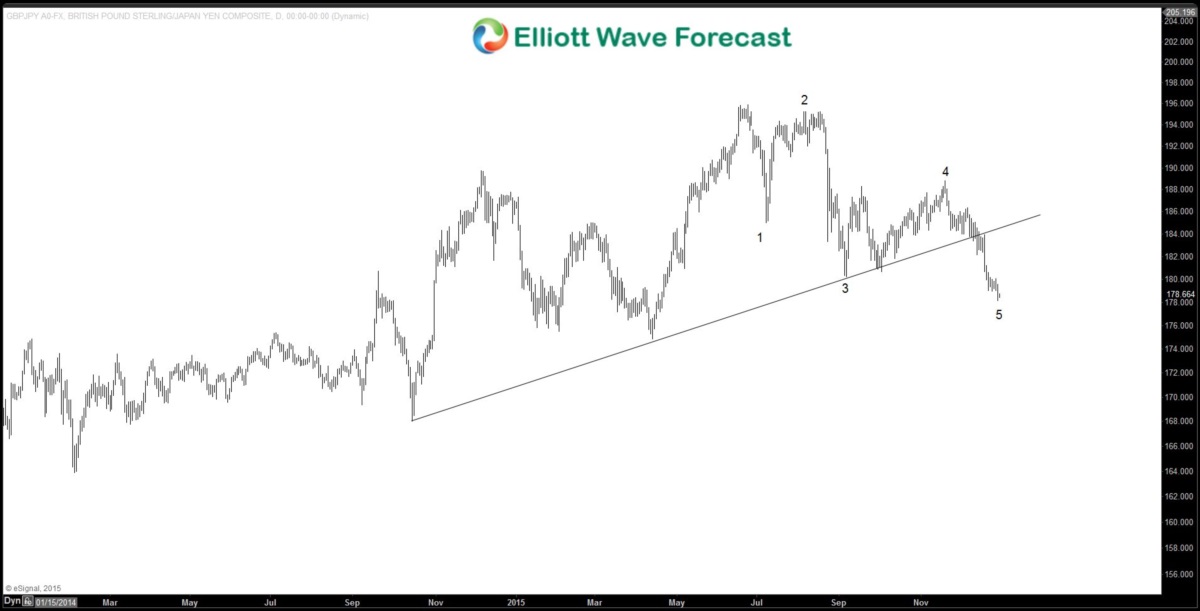

Will Euro Referendum and Brexit affect GBP?

Read MoreBackground of the Referendum When the Conservatives party under David Cameron won the general election in 2015, one of the party’s election pledges is to hold a nationwide vote over the UK membership in the European Union. The referendum will happen by the end of 2017, likely sometimes in September 2016. In this referendum, U.K seeks to renegotiate the terms […]

-

CADJPY Short Term Elliott Wave Analysis 12.30.2015

Read MoreRevised short term Elliott Wave cycle suggests decline to 86.35 ended wave 3. From this level, wave 4 bounce is unfolding as a double three where wave ((w)) ended at 87.4, wave ((x)) ended at 86.36, and wave ((y)) of 4 is in progress towards 87.43 – 87.7 area before lower again. We don’t like buying the […]

-

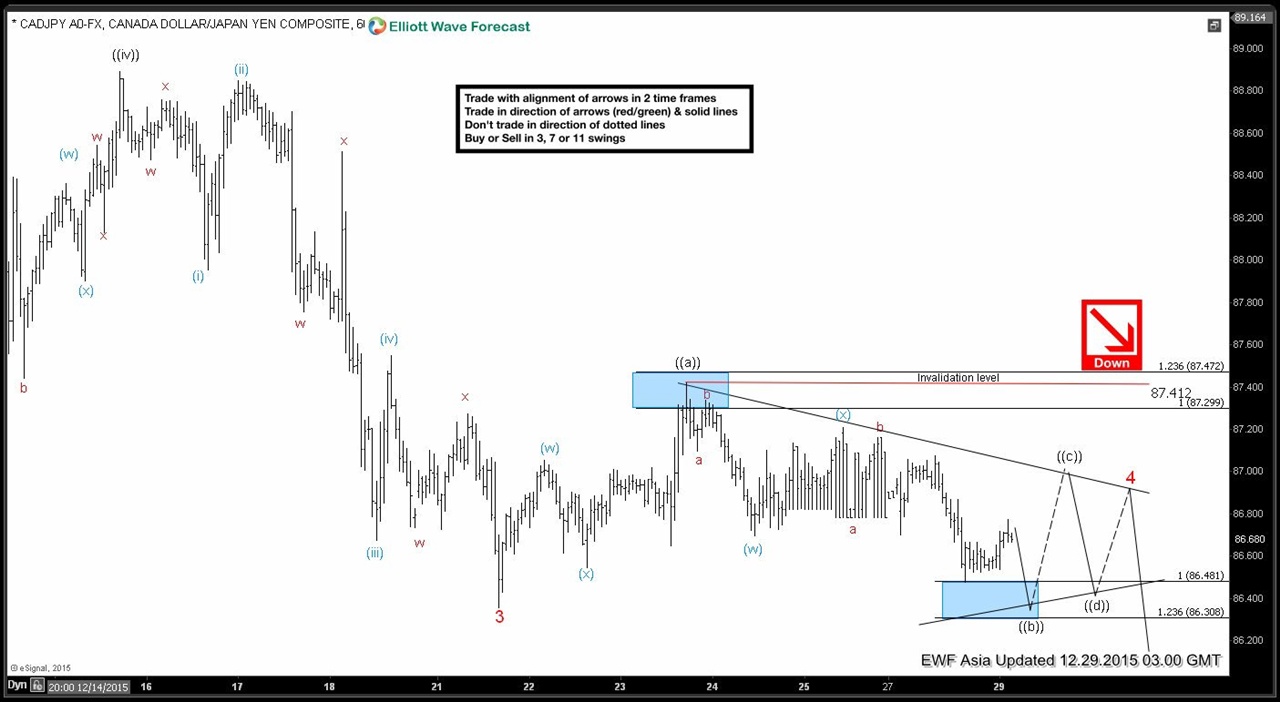

CADJPY Short Term Elliott Wave Analysis 12.29.2015

Read MoreShort term Elliott Wave cycle suggests decline to 86.35 ended wave 3. From this level, wave 4 bounce is unfolding as a running triangle where wave ((a)) ended at 87.4, and wave ((b)) can still extend to as low as 86.3 before turning higher in further consolidation in wave ((c)). Any bounce is now expected to fail below wave ((a)) […]

-

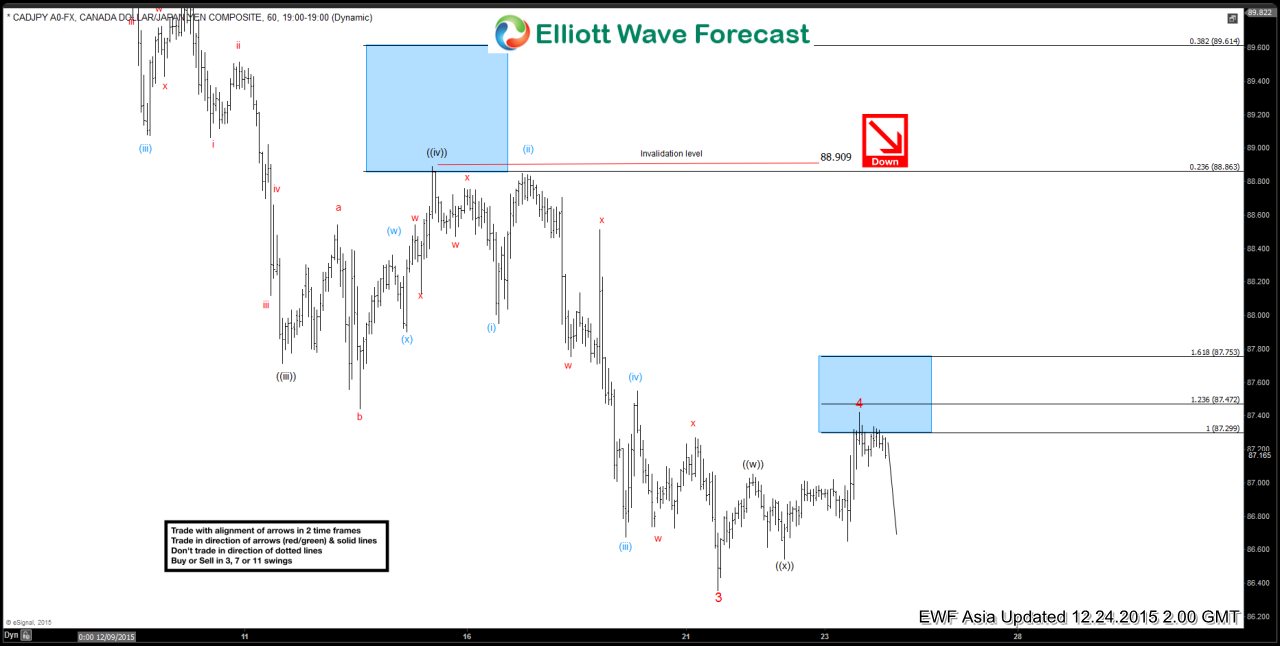

CADJPY Short Term Elliott Wave Analysis 12.24.2015

Read MoreShort term Elliott Wave cycle suggests decline to 86.35 ended wave 3. From this level, wave 4 bounce unfolded as a double three structure where wave ((w)) ended at 87.05, wave ((x)) ended at 86.5, and wave ((y)) of 4 is proposed to be complete at 87.4. Pair should now try to at least correct the rally from […]

-

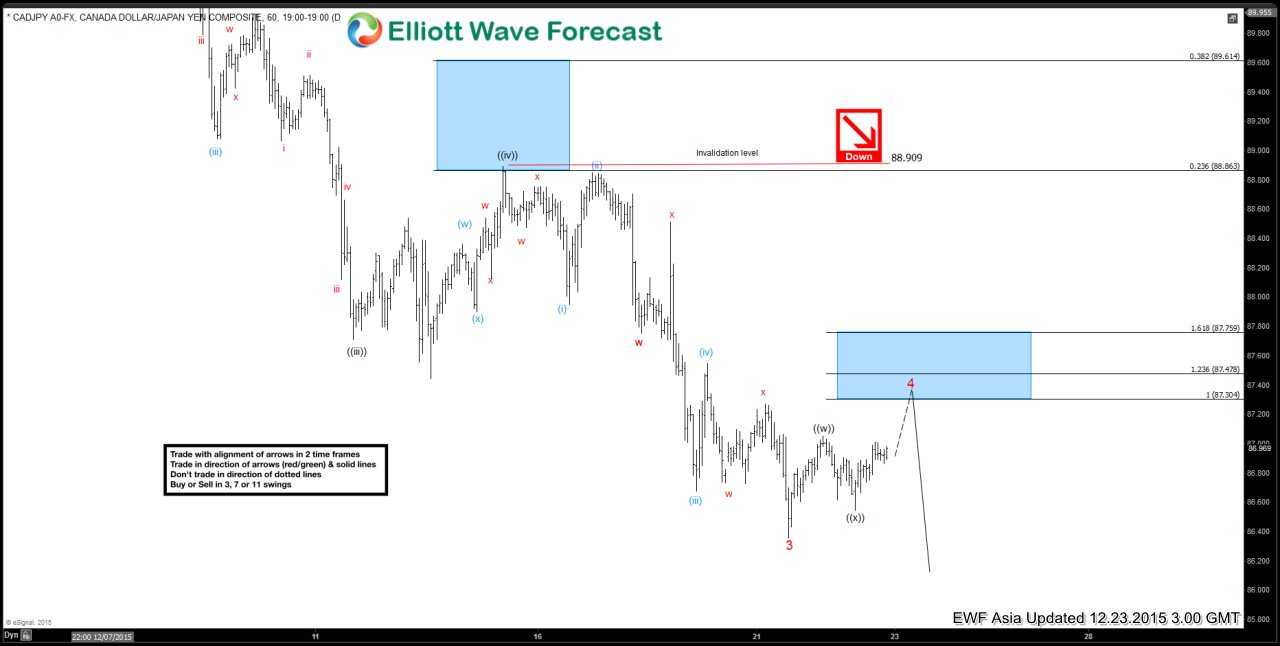

CADJPY Short Term Elliott Wave Analysis 12.23.2015

Read MoreShort term Elliott Wave cycle suggests decline to 86.35 ended wave 3. From this level, pair has started wave 4 bounce in 3 swing towards 87.3 – 87.75 before the decline resumes. As far as wave ((iv)) pivot at 88.9 stays intact, expect sellers to appear from the above area and pair to resume lower once wave 4 […]

-

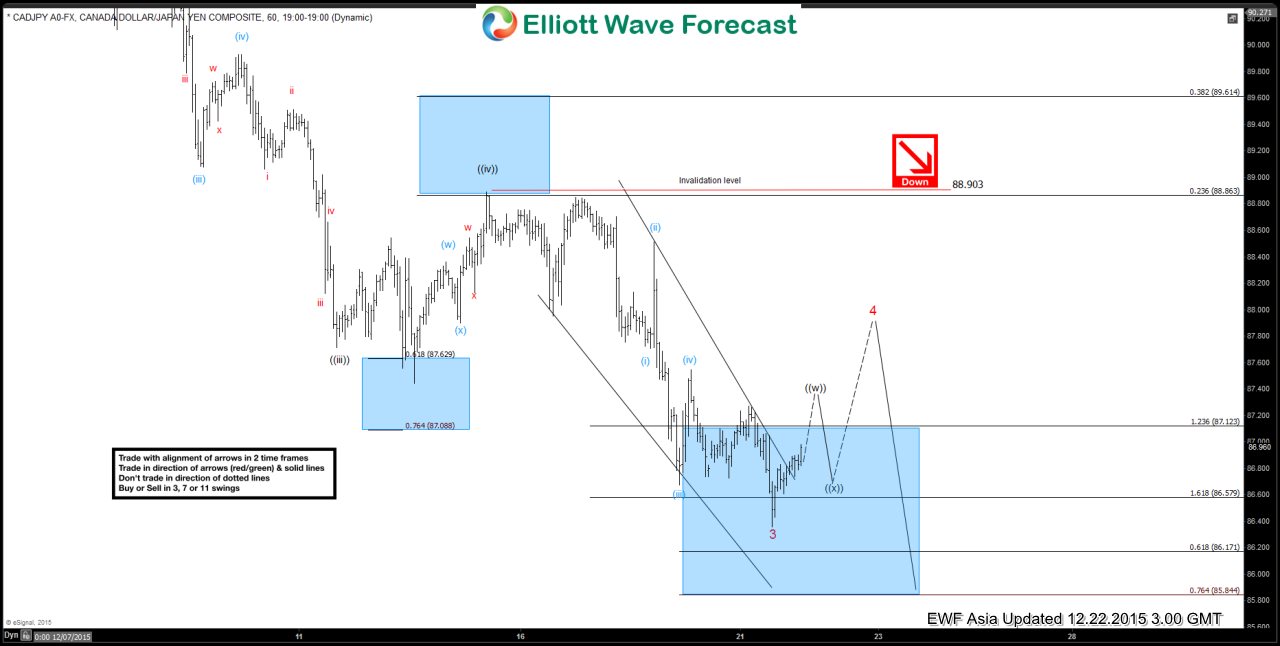

CADJPY Short Term Elliott Wave Analysis 12.22.2015

Read MoreShort term Elliott Wave cycle suggests decline to 86.35 ended wave 3. From this level, pair has started wave 4 bounce in 3 swing and ideally reach 87.6 – 88 area before the decline resumes. As far as wave ((iv)) pivot at 88.9 stays intact, pair is expected to resume lower once wave 4 bounce is complete. […]