-

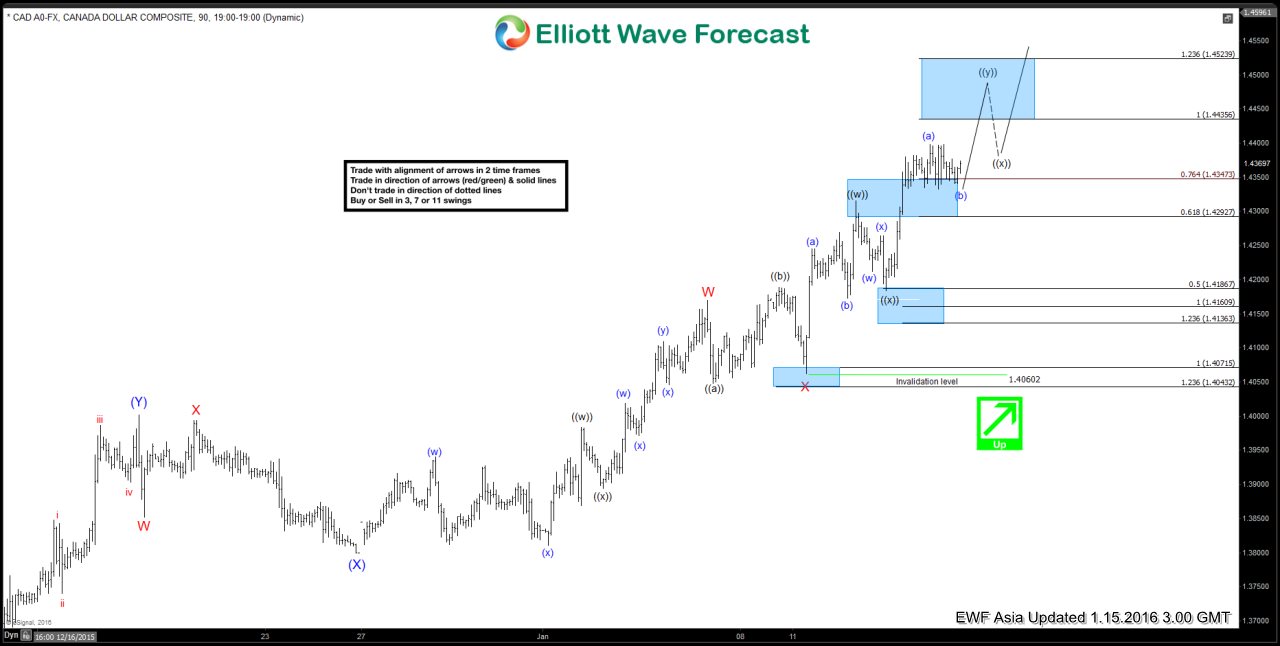

$USDCAD Short Term Elliott Wave Analysis 01.15.2016

Read MoreShort term Elliott Wave cycle suggests rally from wave (X) low at 1.38 is unfolding in a double three structure where wave W ended at 1.417, wave X ended at 1.406, and pair has resumed higher in wave Y towards 1.44 area or higher. Near term, rally to 1.431 ended wave ((w)), wave ((x)) pullback ended […]

-

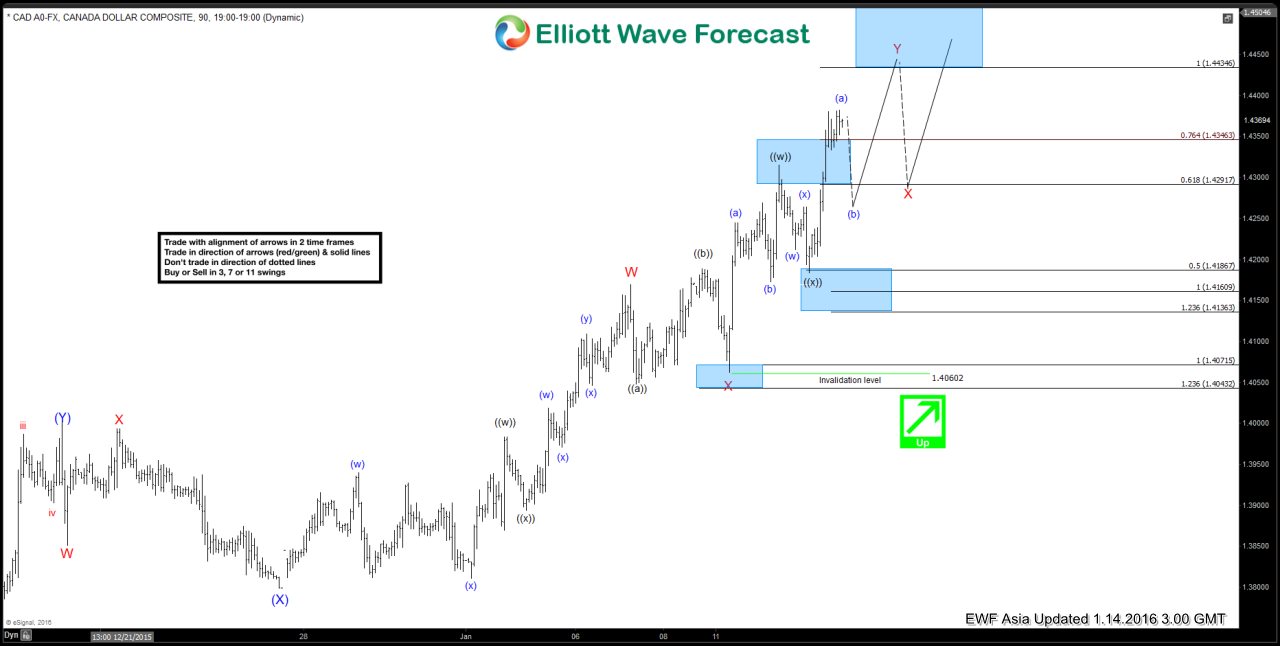

$USDCAD Short Term Elliott Wave Analysis 01.14.2016

Read MoreShort term Elliott Wave cycle suggests rally from wave (X) low at 1.38 is unfolding in a double three structure where wave W ended at 1.417, wave X ended at 1.406, and pair has resumed higher in wave Y towards 1.44 area. Near term, rally to 1.431 ended wave ((w)), wave ((x)) pullback is proposed complete […]

-

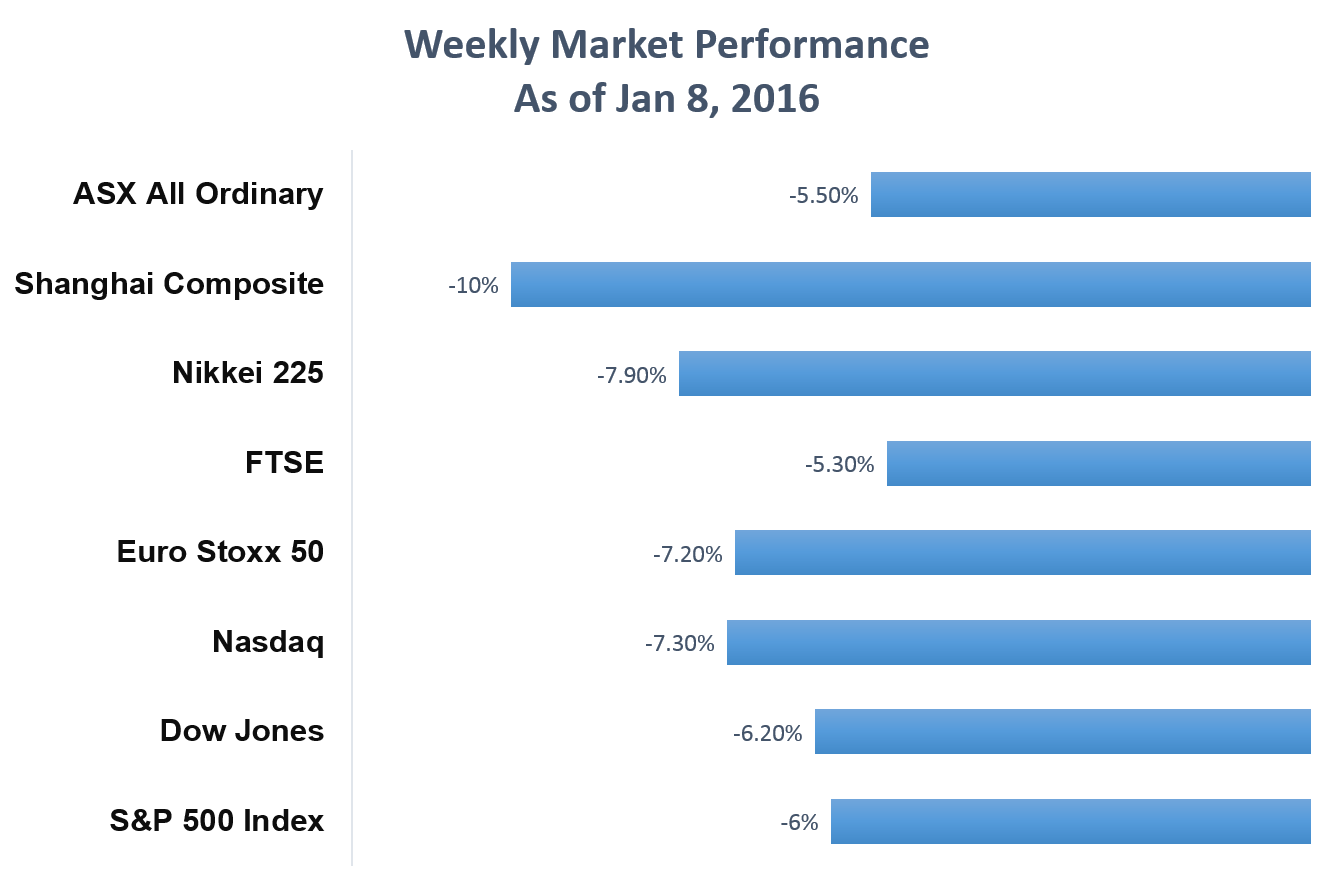

Is it time to buy Indices yet? China may provide an answer

Read MoreGlobal Market Selloff Global Indices sold off strongly to start 2016 in a risk off sentiment. Shanghai Composite Index led the global index selloff with the catalyst being the PBOC (People’s Bank of China) setting a much weaker than expected Yuan fixing from 6.49 to 6.56 through Thursday in the first week of 2016. Below is the weekly market performance […]

-

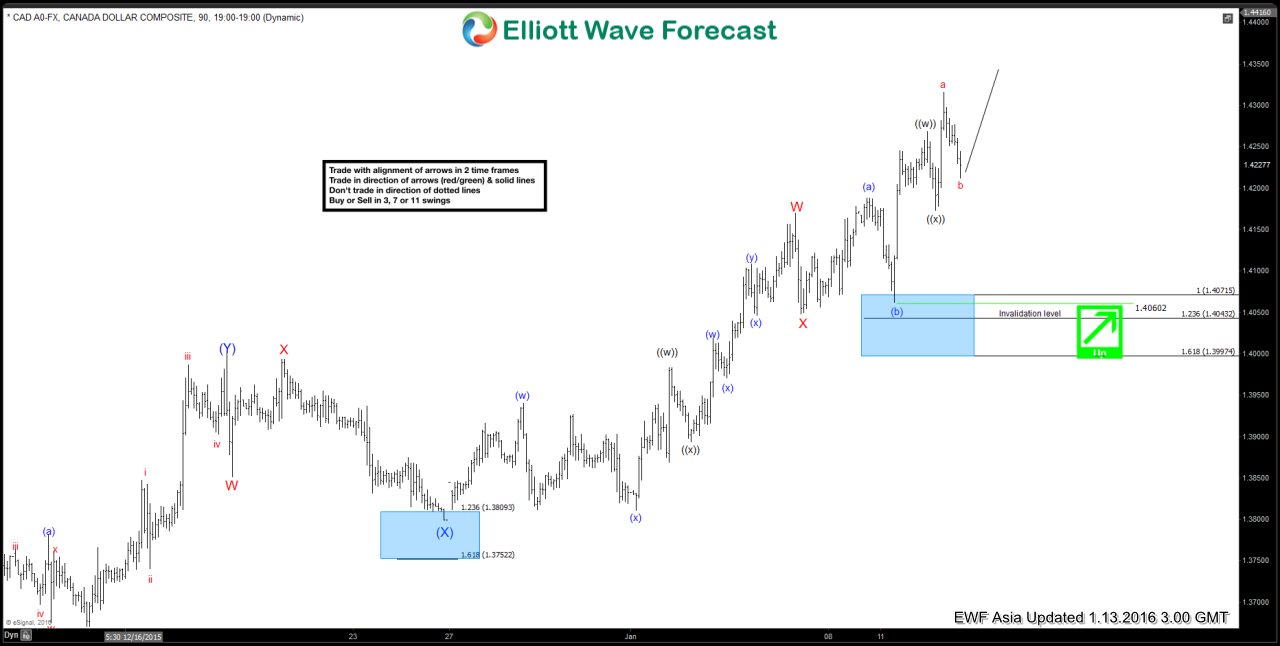

$USDCAD Short Term Elliott Wave Analysis 01.13.2016

Read MoreShort term Elliott Wave cycle suggests rally from wave (X) low at 1.38 is unfolding in a double three structure where wave W ended at 1.417, wave X ended at 1.406, and pair has resumed higher in wave Y towards 1.44 area. Near term, rally to 1.431 ended wave ((w)), wave ((x)) pullback is proposed complete […]

-

USDCAD Trade Setup Jan 10, 2016

Read MoreHere is a quick look at the areas that we highlighted for buying USDCAD in Daily Elliott wave setups video from 1/10. USDCAD found buyers in 1.4112 – 1.4096 area and turned higher. Plus members should be long and have a risk free trade with the pair. To find out precise targets and to get access to our […]

-

$USDCAD Short Term Elliott Wave Analysis 01.12.2016

Read MoreShort term Elliott Wave cycle suggests rally from wave (X) low at 1.38 is unfolding in a double three structure where wave W ended at 1.417, wave X FLAT ended at 1.406, and pair has resumed higher in wave Y towards 1.44 area. Near term, rally to 1.423 ended wave (a), and pair is in wave […]