-

Oil $CL_F Short-term Elliott Wave Analysis 7.1.2016

Read MoreShort term Elliottwave structure suggests cycle from 6/9 peak remains alive as a double three where wave W ended at 45.83 and bounce to 50.54 ended wave X. Wave Y lower is in progress with the internal as a double three where wave ((w)) ended at 45.83 and wave ((x)) bounce ended at 50. Near term focus […]

-

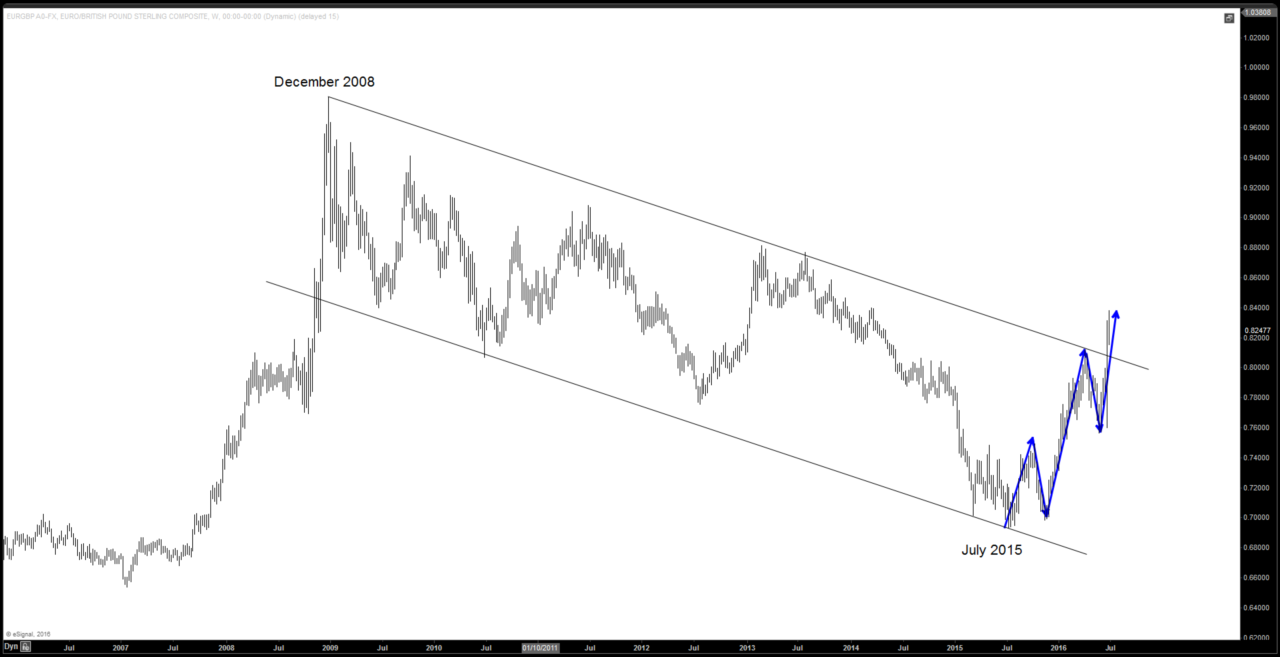

Potential Impacts of Brexit

Read MoreMarket Impacts The market got off guard with the outcome of the UK referendum to leave European Union. One of the biggest casualties is Poundsterling which tumbled 8% on Friday last week, the biggest single day drop on record. The currency hit 31 year low and momentum and also technicals suggest more weakness is likely. Global equities, […]

-

NZDCAD Elliottwave Analysis 6.30.2016

Read MoreRally from 4/28 low is proposed complete at 0.9305 as wave (X). Short term, while pair stays below here, and more importantly below 0.9567, it has scope to continue the weekly decline lower to 0.79 area, or at minimum pair can start a larger 3 waves pullback to correct rally from 4/28 low. For more […]

-

Oil $CL_F Short-term Elliott Wave Analysis 6.30.2016

Read MoreShort term Elliottwave structure suggests cycle from 6/9 peak remains alive as a double three where wave W ended at 45.83 and bounce to 50.54 ended wave X. Wave Y lower is in progress with the internal as a double three where wave ((w)) ended at 45.83 and wave ((x)) bounce is proposed complete at 50. […]

-

Oil $CL_F Short-term Elliott Wave Analysis 6.29.2016

Read MoreShort term Elliottwave structure suggests cycle from 6/9 peak remains alive as a double three where wave W ended at 45.83 and bounce to 50.54 ended wave X. Wave Y lower is in progress with the internal as a double three where wave ((w)) ended at 45.83 and wave ((x)) bounce remains in progress as a […]

-

Oil $CL_F Short-term Elliott Wave Analysis 6.28.2016

Read MoreShort term Elliottwave structure suggests cycle from 6/9 peak remains alive as a double three where wave W ended at 45.83 and bounce to 50.54 ended wave X. Wave Y lower is in progress with the internal as a double three where wave ((w)) ended at 46.7 and wave ((x)) bounce ended at 48.45. Near term, […]