-

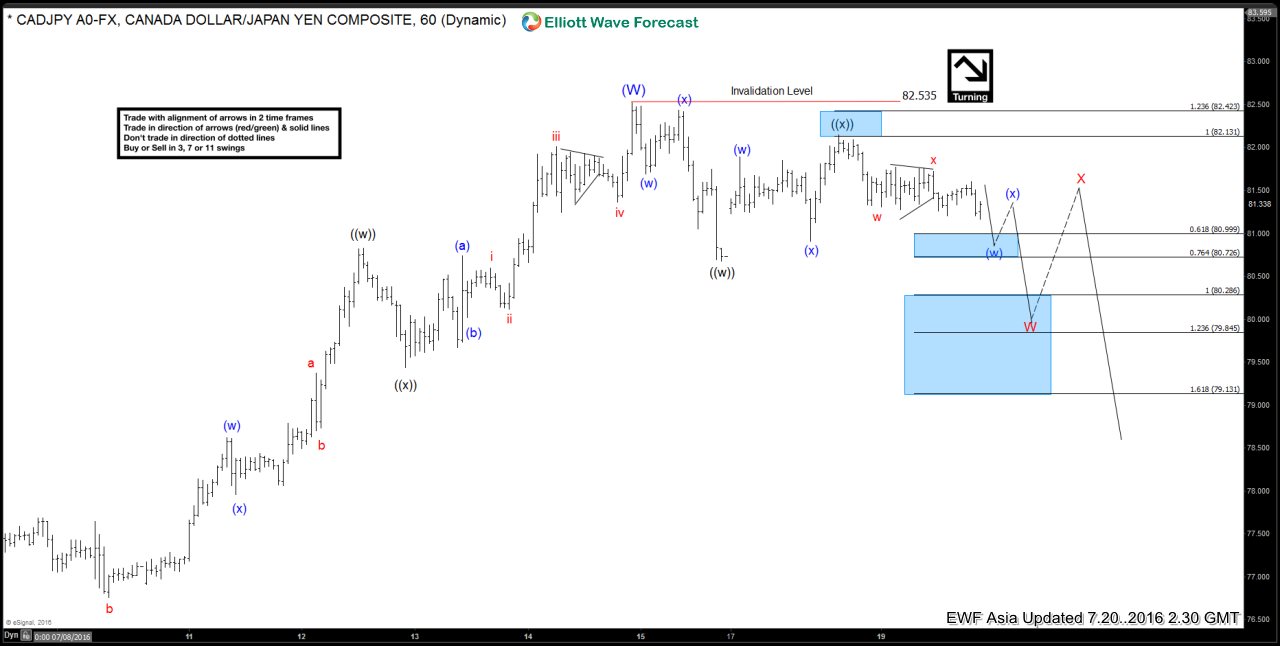

$CADJPY Short-term Elliott Wave Analysis 7.20.2016

Read MoreShort term Elliottwave structure suggests rally to 82.53 ended wave (W). Decline from there is unfolding as a double correction where wave ((w)) ended at 80.67 and wave ((x)) ended at 82.15. While pair stays below 82.15, and more importantly as far as 82.53 pivot stays intact, expect pair to resume lower. Initial target lower for wave […]

-

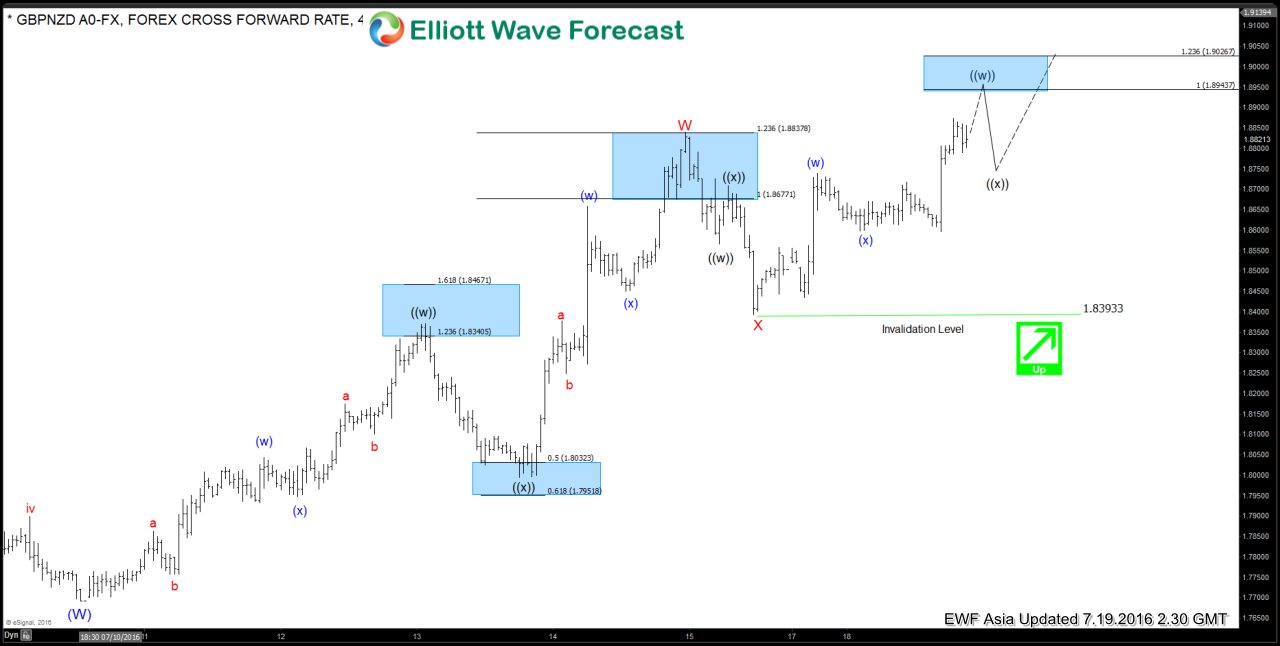

$GBPNZD Short-term Elliott Wave Analysis 7.19.2016

Read MoreShort term Elliottwave structure suggests cycle from 7/9 low is unfolding as a double three where wave W ended at 1.884 and wave X ended at 1.839. Rally from 1.839 is in progress as a double three where wave ((w)) is expected to complete at 1.894 – 1.9026 area, then it should pullback in wave ((x)) […]

-

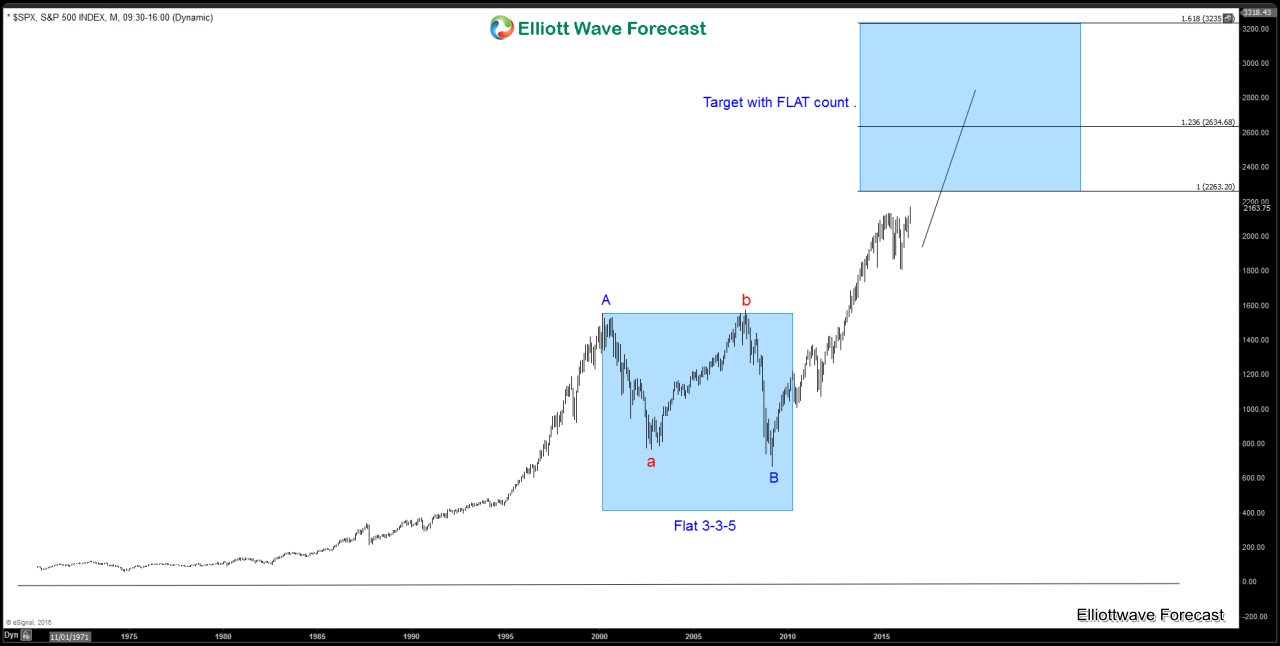

Reality vs Illusions: The case for $SPX short bias

Read MoreAs Humans, we tend to form a worldview about everything. For generations, many great individuals have fought wars and lost lives because they have a firm belief in a particular worldview. The same thing can be applied in trading. In the world of trading, we too tend to have particular view about the direction of the market. However, as […]

-

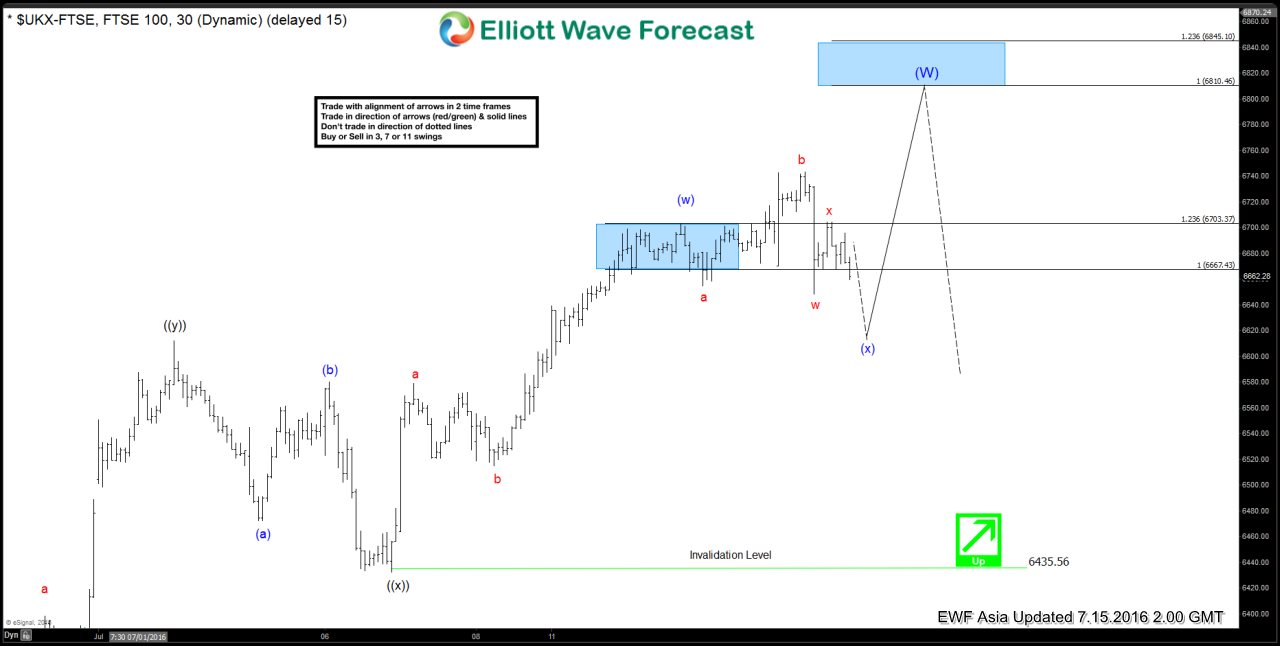

$FTSE Short-term Elliott Wave Analysis 7.15.2016

Read MoreShort term Elliottwave structure suggests rally from 7/6 low is unfolding as a double three where wave (w) ended at 6703.09 and wave (x) pullback is in progress towards 6587.2 – 6609.45 area before turning higher one more leg towards 6810.46 – 6845.1 area to complete wave (W) and end cycle from 2/11 low. Index has reached […]

-

$FTSE Short-term Elliott Wave Analysis 7.14.2016

Read MoreShort term Elliottwave structure suggests rally from 7/8 low is unfolding as a triple three where wave (w) ended at 6579.25, wave (x) ended at 6515.24, wave (y) ended at 6698.54, and 2nd wave (x) ended at 6654.26. While pullback stays above 6654.26, Index is expected to extend 1 more leg higher towards 6810.46 – 6845.10 area before […]

-

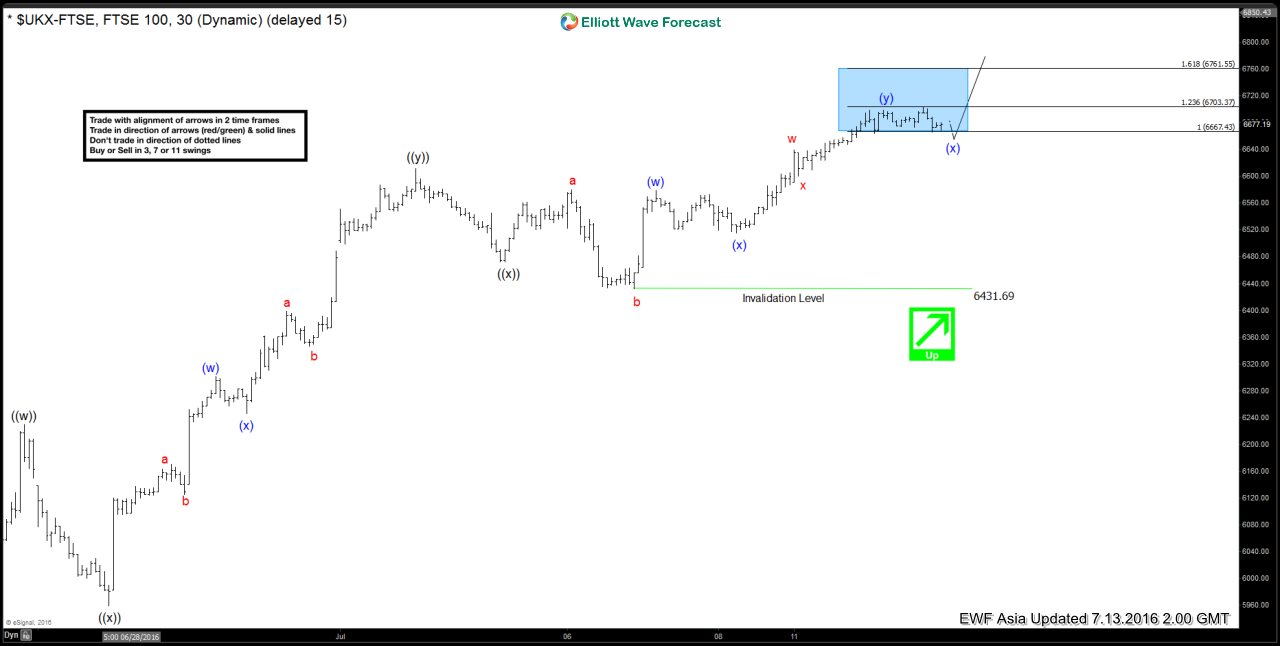

$FTSE Short-term Elliott Wave Analysis 7.13.2016

Read MoreShort term Elliottwave structure suggests Index ended wave X at 5788.7. Rally from there is unfolding as a triple three where wave ((w)) ended at 6229.18, wave ((x)) ended at 5958.66, wave ((y)) ended at 6612.13, and 2nd wave ((x)) ended at 6472.25. Near term, while 2nd wave (x) pullback stays above 6431.69, Index has scope to extend higher […]