-

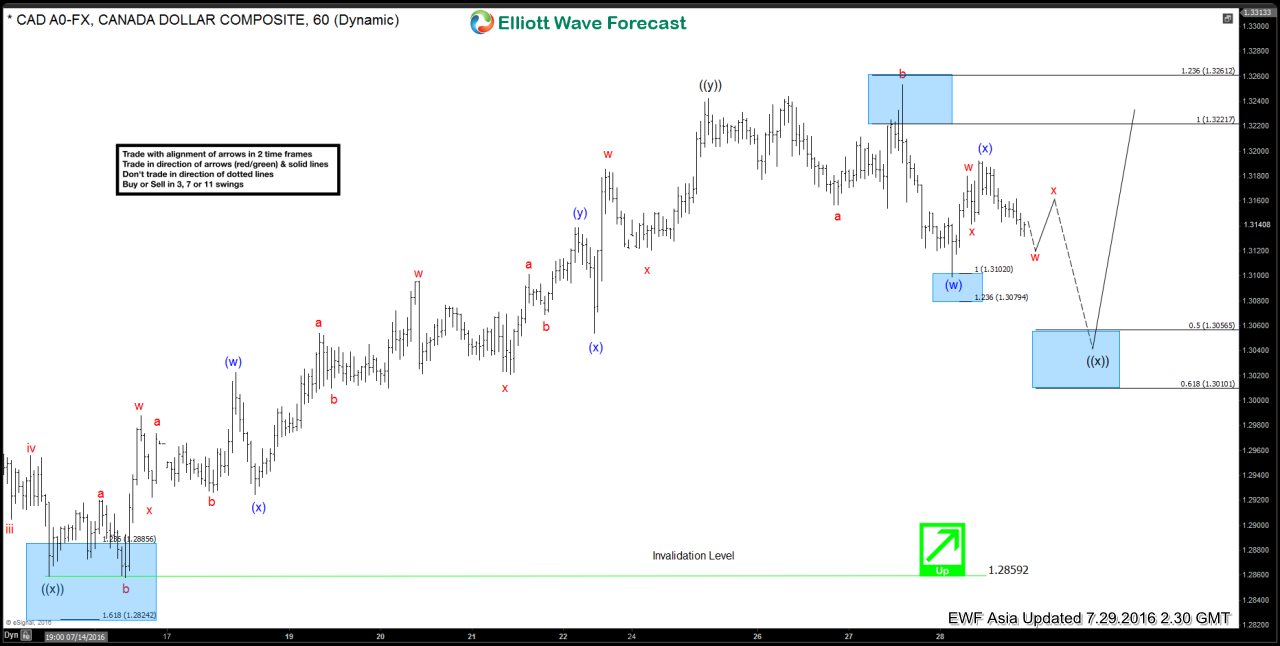

USDCAD Short-term Elliott Wave Analysis 7.29.2016

Read MorePreferred Elliott wave count suggests that move up from 1.2828 low is proposed to be unfolding as a triple three structure where wave ((w)) ended at 1.3139, wave ((x)) ended at 1.2859 and wave ((y)) ended at 1.3253. Second wave ((x)) pullback is in progress to correct the cycle from 7/15 (1.2859) low towards 1.301 – 1.3056 area before turning […]

-

$USDJPY Live Trading Room Setup from 7/22

Read MoreHere is a short clip from our Live Trading Room on July 22. Take a look at how we manage the trade and risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 7:00 AM EST , join us there for more insight into these proven methods of trading. We sold […]

-

$GBPAUD Short-term Elliott Wave Analysis 7.22.2016

Read MoreShort term Elliottwave structure suggests rally from 7/11 low is unfolding as a double correction where wave W ended at 1.763 and wave X pullback ended at 1.731. From there, pair resumes rally where wave ((w)) ended at 1.777 and while pair stays below there in the near term, pair has scope to do another leg lower in (y) […]

-

$GBPAUD Short-term Elliott Wave Analysis 7.21.2016

Read MoreShort term Elliottwave structure suggests rally from 7/11 low is unfolding as a double correction where wave W ended at 1.763 and wave X pullback ended at 1.731. From there, pair resumes rally where wave ((w)) ended at 1.777 and wave ((x)) pullback is currently in progress in 3, 7, or 11 swing to correct the rally from 1.731 before […]

-

Yen weakness may be temporary

Read MoreDefying many market participants that anticipate a fallout after the unexpected Brexit vote, many risk assets including stock markets and Yen pairs continue to show strength after a few days of pullback. U.S. Indices prove to be resilient and continue to make new all-time highs. The turning point in the sentiment seems to be right after Japanese Prime Minister Shinzo Abe won […]

-

$HG_F (Copper) Live Trading Room – Trade Recap

Read MoreHere is a short clip from our Live Trading Room at July 14. Take a look at how we manage the trade and risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 7:00 AM EST , join us there for more insight into these proven methods of trading. With […]