-

DAX Intra-Day Elliott Wave Analysis

Read MoreThe rally in DAX from 8/29 low is unfolding as a double three Elliott Wave structure where Intermediate wave (W) ended at 13089 and pullback to 12903 ended Intermediate wave (X). Up from there, the rally from 12903 low looks to be unfolding as an impulse. Minute wave ((i)) ended at 13066 and pullback to 12906.5 ended Minute […]

-

DAX Short-Term Elliott Wave Analysis 11.1.2017

Read MoreRally from 8/29 low in DAX is unfolding as a double three Elliott Wave structure where Intermediate wave (W) ended at 13089 and Intermediate wave (X) ended at 12903. Up from there, the rally from 12903 low appears to be unfolding as an impulse. Minute wave ((i)) ended at 13066, Minute wave ((ii)) ended at 12906.5, […]

-

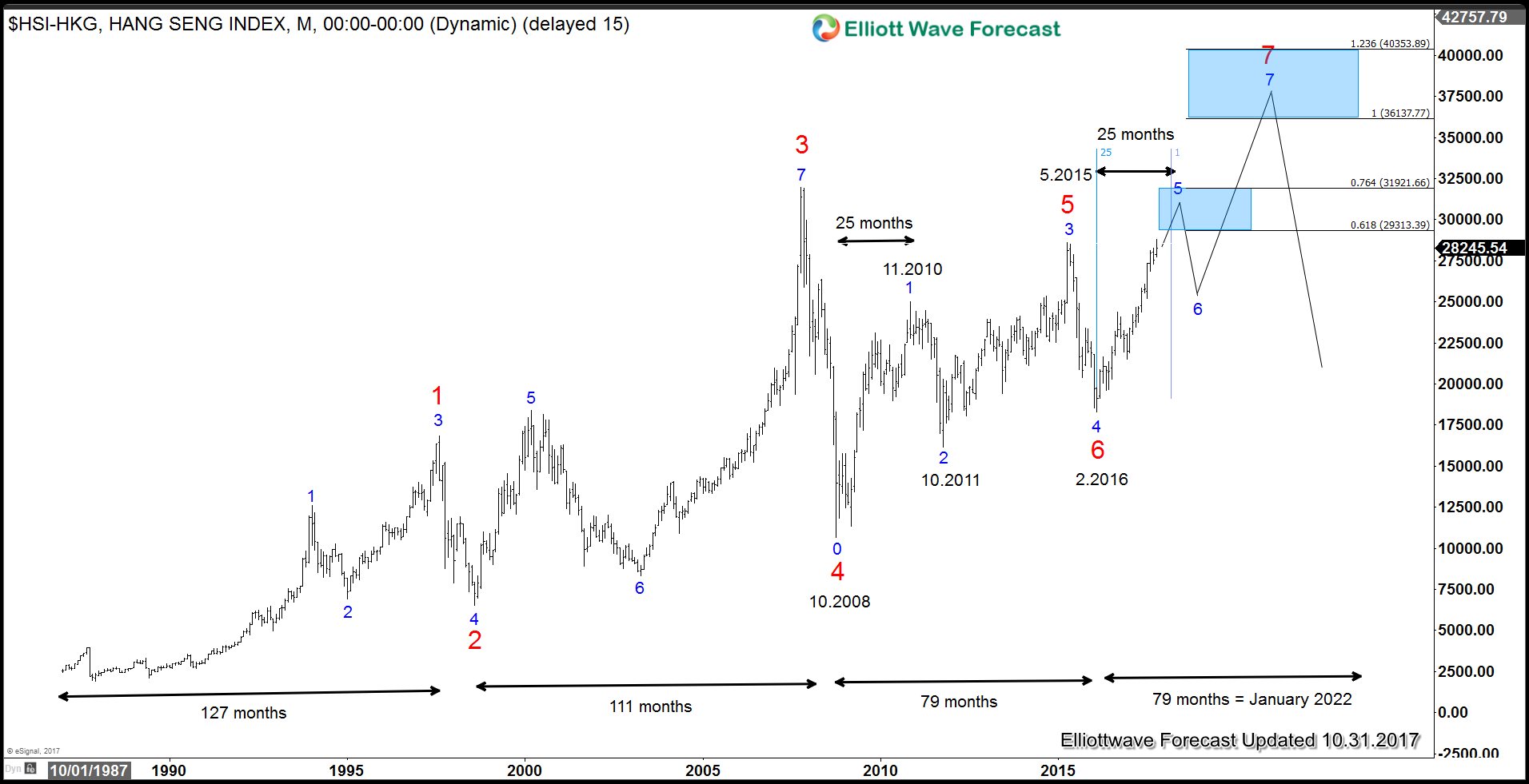

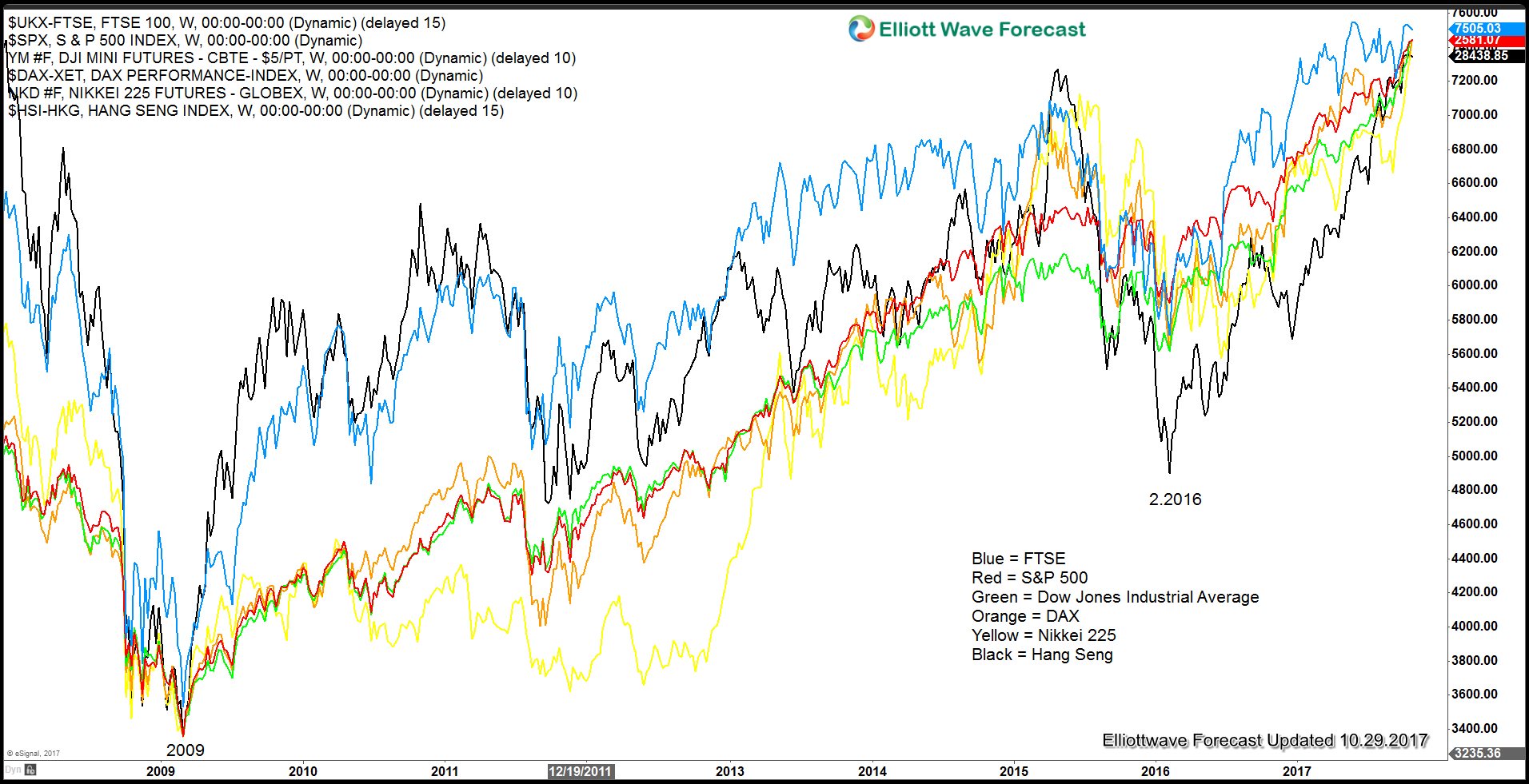

Timing the Peak in Stock Market

Read MoreIs Stock Market Valuation in Bubble Territory? Many analysts and forecasters argue that stock market is in bubble territory and about to do significant correction or even a crash. There’s a lot of reasons given, both from fundamental and technical point of view. For example, some popular reasons are: 1) The rally in S&P is the […]

-

DAX Short-Term Elliott Wave Analysis

Read MoreDAX shows a 5 swing Elliott Wave bullish sequence from 8/29 low, suggesting further upside is likely. The rally from 8/29 low is unfolding as a double three Elliott Wave structure where Intermediate wave (W) ended at 13089 and Intermediate wave (X) ended at 12903. The rally from 12903 low appears to be unfolding as an impulse […]

-

Is Trump’s Tax Reform Bullish for Equities?

Read MoreThe tax reform is perhaps the single most important agenda for Republicans. The consequence for falling short of the tax overhaul is dire. Should Republicans fail to deliver the tax reform, they could face rout in the mid-term elections next year. This means losing control of the Senate and possibly also the House of Representatives where they […]

-

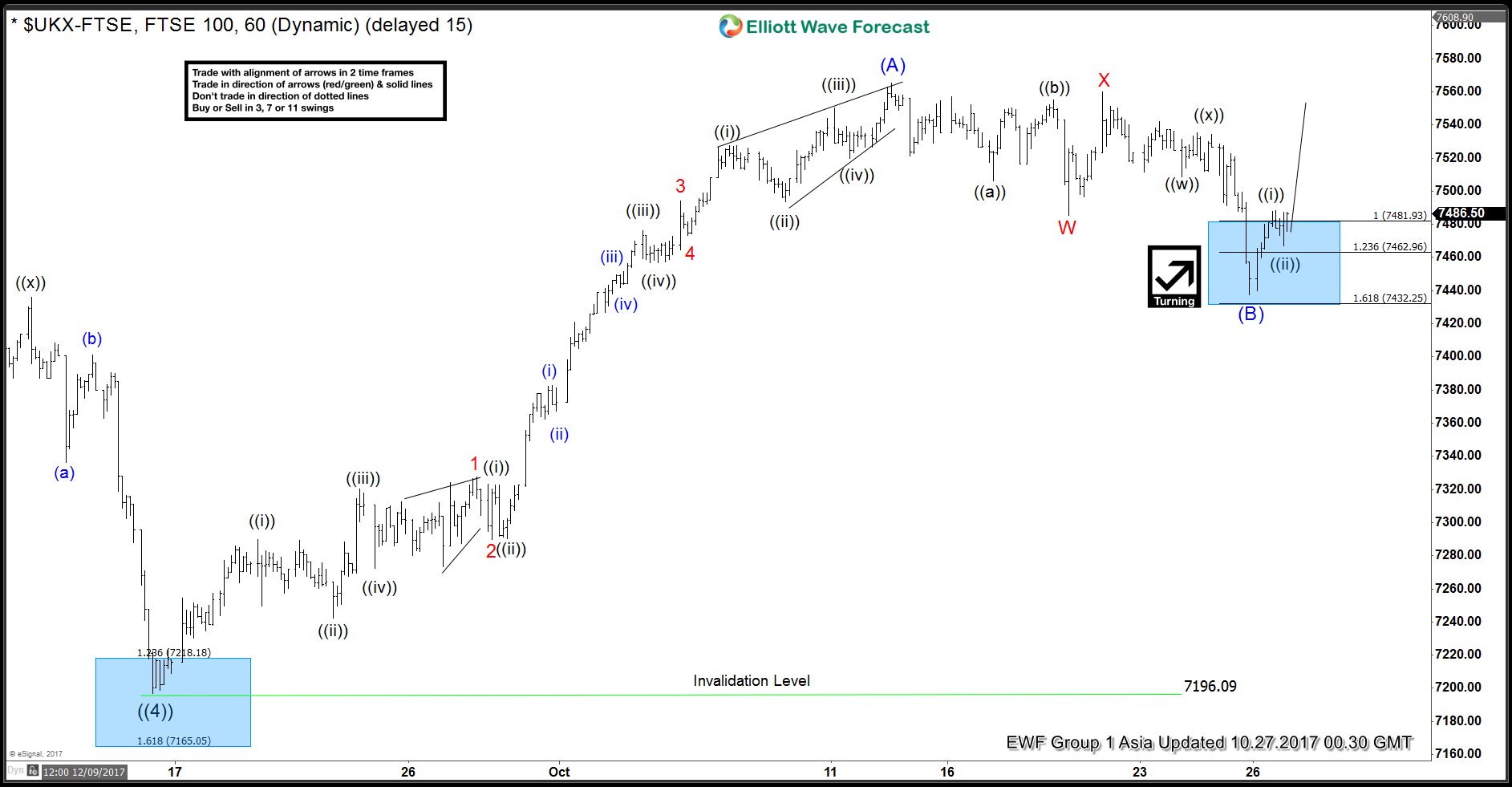

FTSE Elliott Wave Analysis: Ended Correction

Read MoreFTSE Elliott Wave view suggests that decline to 7199.5 ended Primary wave ((4)). Up from there, the rally is unfolding as an impulse Elliott Wave structure where Minor wave 1 ended at 7327.5 and pullback to 7289.75 ended Minor wave 2. Rally to 7494.34 ended Minor wave 3, and pullback to 7473.12 ended Minor wave […]