-

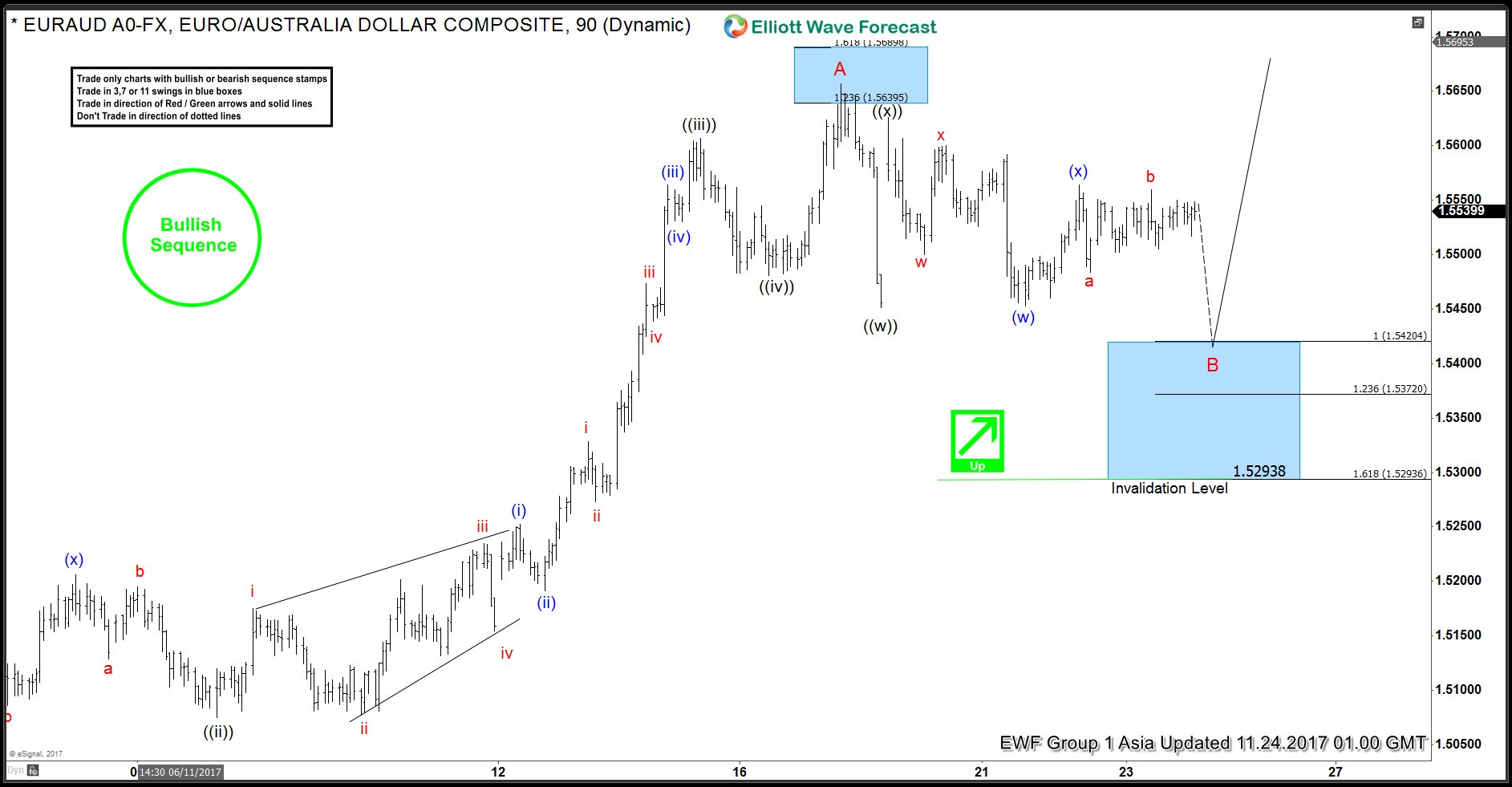

EURAUD Elliott Wave Analysis 11.24.2017

Read MoreEURAUD Elliott Wave view suggests Intermediate wave (X) ended with the decline to 1.5057. The rally from there unfolded in 5 waves impulse Elliott Wave structure, and this means that while pullbacks stay above 1.5057 low, it could see further upside. Up from 1.5057, Minute wave ((i)) ended at 1.5234, decline to 1.5075 ended Minute wave ((ii)), Minute […]

-

EURAUD Intra-Day Elliott Wave Analysis

Read MoreEURAUD Short Term Elliott Wave view suggests the decline to 1.5057 ended Intermediate wave (X). Up from there, the rally unfolded in 5 waves impulse Elliott Wave structure, suggesting that while pullbacks stay above 1.5057 low, pair could see more upside. Up from 1.5057, Minute wave ((i)) ended at 1.5234, Minute wave ((ii)) ended at 1.5075, Minute wave ((iii)) ended […]

-

Hangseng Trade from 11/17 Live Trading Room

Read MoreHangseng Trade Video Clip from 11/17 Live Trading Room On Friday last week, we told members that we like to buy the 3 wave dips in Hangseng Index and the pullback would likely happen this week. We said we are looking to buy Hangseng this week if it pullback in 3 swing pullback within wave (ii). Below […]

-

Will Germany’s Crisis Affect Euro Dollar?

Read MoreGermany suddenly found itself in a political turmoil on Monday after the month-long talk to form a three-coalition party between Angela Merkel’s conservative bloc (CDU/CSU), the pro-business Free Democractic Party (FDP) and environmentalists Greens has failed. The crisis definitely challenges the idea that Germany is the anchor of democratic stability in Europe. FDP walked out of the negotiations on […]

-

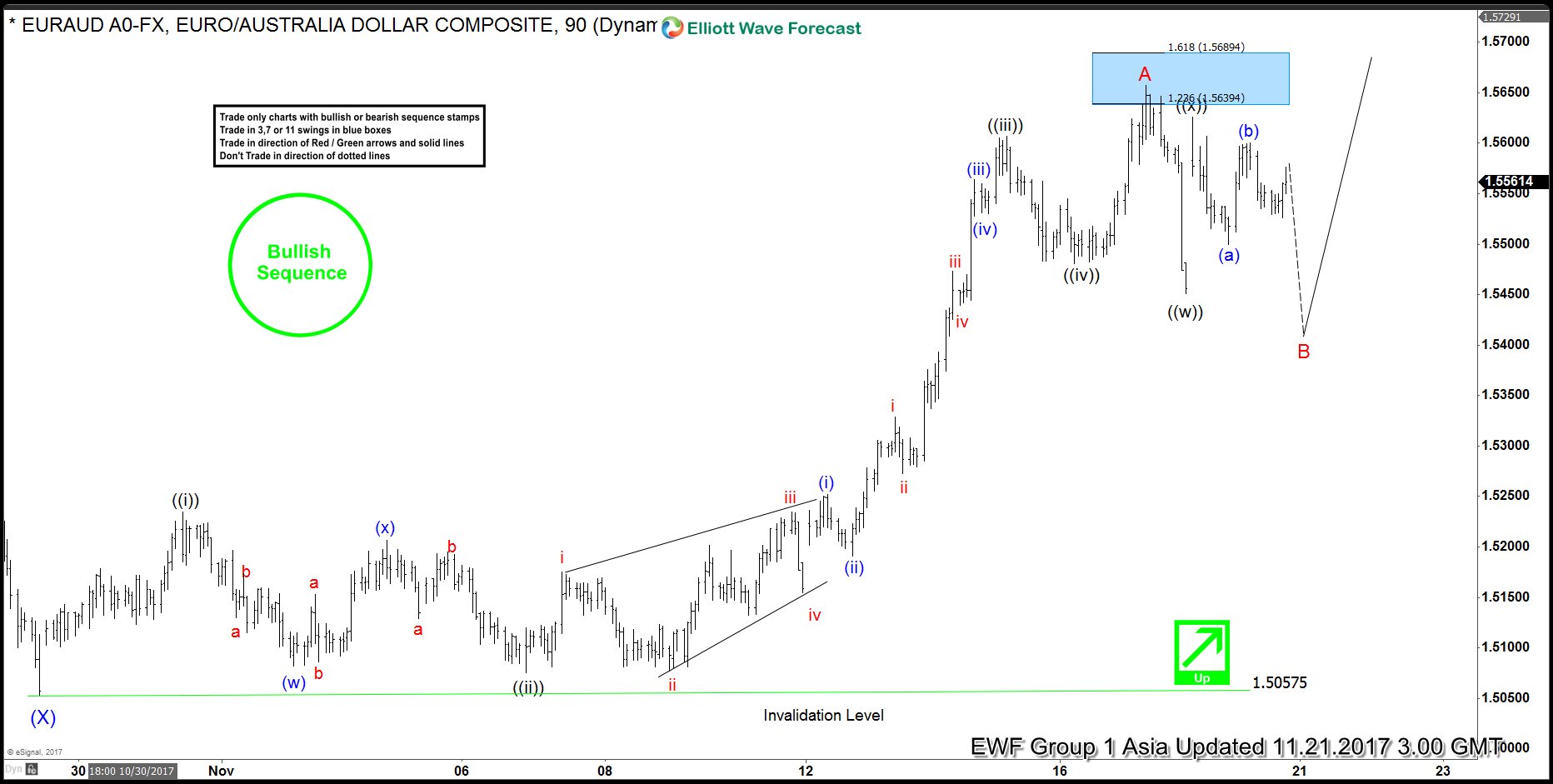

EURAUD Elliott Wave Analysis 11/22/2017

Read MoreThe decline to 1.5057 in EURAUD ended Intermediate wave (X). Rally from there unfolded as a 5 waves impulse Elliott Wave structure, this as long as the pullbacks stay above 1.5057 low, pair could see further upside. Up from 1.5057, Minute wave ((i)) ended at 1.5234, pullback to 1.5075 ended Minute wave ((ii)), Minute wave ((iii)) ended at […]

-

EURAUD Short Term Elliott Wave Analysis

Read MoreEURAUD Short-Term Elliott Wave view suggests that the decline to 1.5057 ended Intermediate wave (X). The rally from there appears to be unfolding as a 5 waves impulse Elliott Wave structure, suggesting that as long as the pullbacks stay above 1.5057, it could see further upside. Up from 1.5057, Minute wave ((i)) ended at 1.5234, Minute wave ((ii)) ended […]