-

Elliott Wave Analysis: Dow Future in Correction

Read MoreDow Future Short Term Elliott Wave view suggests that the rally to 26690 ended Intermediate wave (3). Down from there, Intermediate wave (4) pullback is unfolding as a double three Elliott Wave structure where Minor wave W ended at 26121 and Minor wave X ended at 26314. Minor wave Y is in progress and while near term bounces […]

-

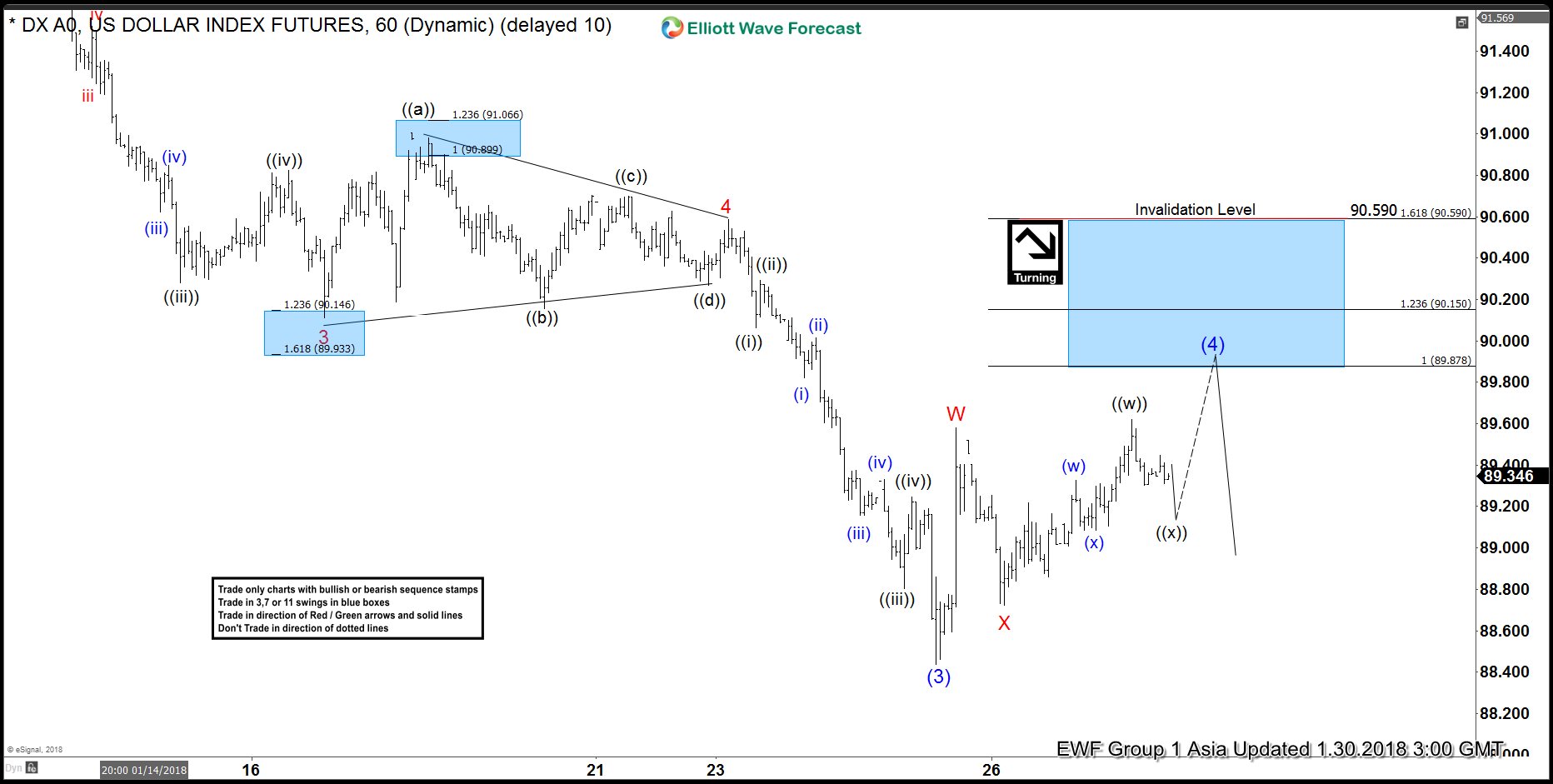

Elliott Wave Analysis: DXY in Double Correction

Read MoreDXY Dollar Index Short Term Elliott Wave view suggests that decline to 88.44 ended Intermediate wave (3). Up from there, Intermediate wave (4) bounce is unfolding as a double three Elliott Wave structure where Minor wave W ended at 89.58 and Minor wave X ended at 88.723. Minor wave Y is in progress with Minute wave ((w)) ended […]

-

EURCAD Trade from 9 Jan 2018 Live Trading Room

Read MoreEURCAD Trade Video Clip from 9 Jan 2018 Live Trading Room EURCAD shows a bullish sequence in 4 hour chart, thus we were looking for opportunities to buy in 3-7-11 swing for at least a 3 waves bounce. On 9 Jan, we got our chance to buy dips in 7 swing at the green […]

-

USDSGD Trade from 17 Jan 2018 Live Trading Room

Read MoreUSDSGD Trade Video Clip from 11 Jan 2018 Live Trading Room USDSGD shows a bearish sequence in the 4 hour chart and we would like to sell bounces in the pair in 3-7-11 swing. We waited for a 3 swing correction up to sell and told members to sell it at 1.327 (the 50% […]

-

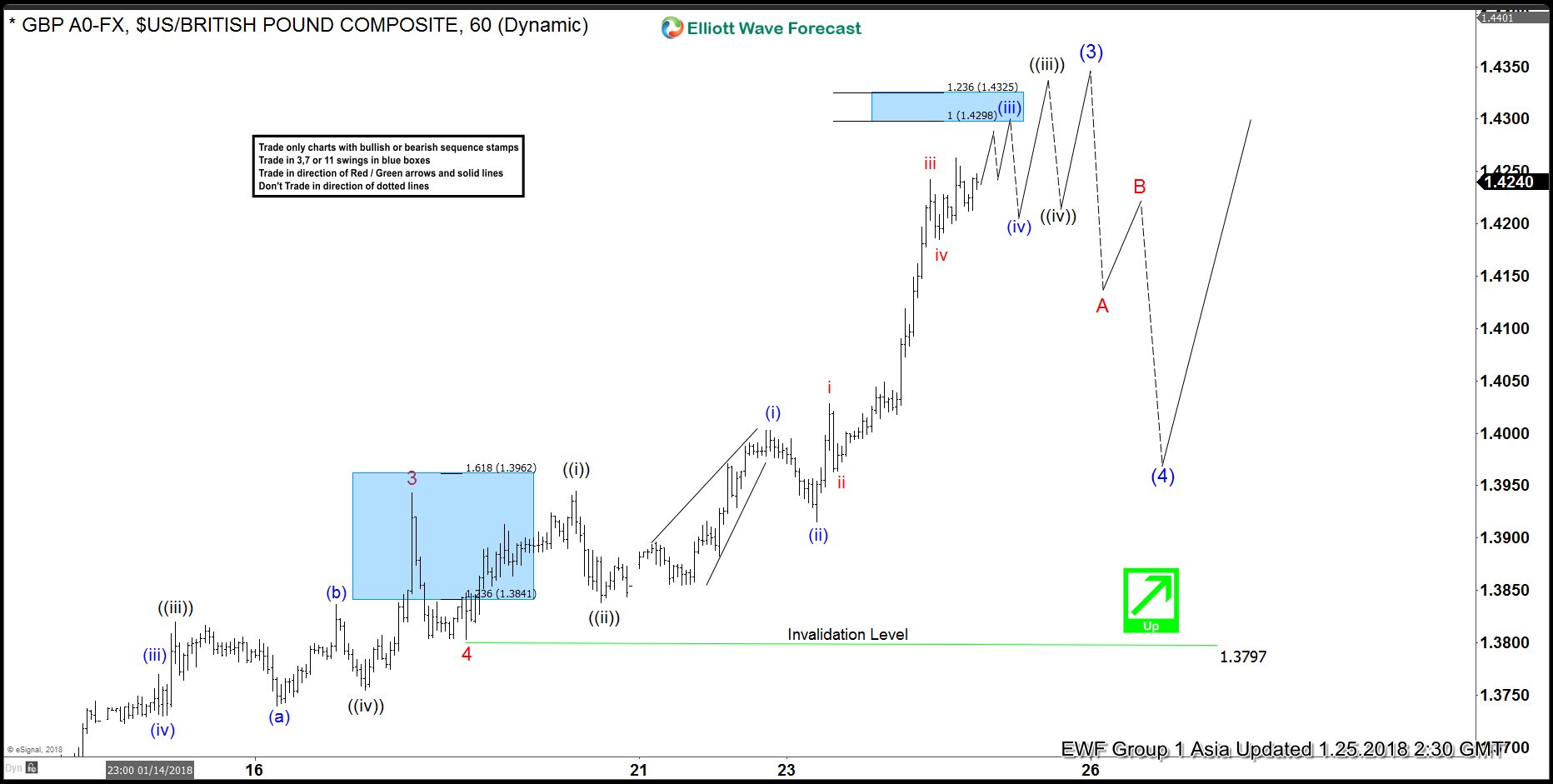

Elliott Wave Analysis: GBPUSD ended wave (4) correction

Read MoreGBPUSD Short Term Elliott Wave view suggests that pair ended Intermediate wave (2) at 1.33 on 16 December 2017. Up from there, Intermediate wave (3) rally is unfolding as 5 waves impulse Elliott Wave structure where Minor wave 1 ended at 1.3613, Minor wave 2 ended at 1.3456, Minor wave 3 ended at 1.3943, Minor wave 4 […]

-

Elliott Wave Analysis: GBPUSD still within wave (3)

Read MoreGBPUSD Short Term Elliott Wave view suggests that the rally from 16 December 2017 low is unfolding as 5 waves impulse Elliott Wave structure. Up from 16 December 2017 low (1.33), Minor wave 1 ended at 1.3613, Minor wave 2 ended at 1.3456, Minor wave 3 ended at 1.3943, and Minor wave 4 ended at 1.3797. Minor […]