-

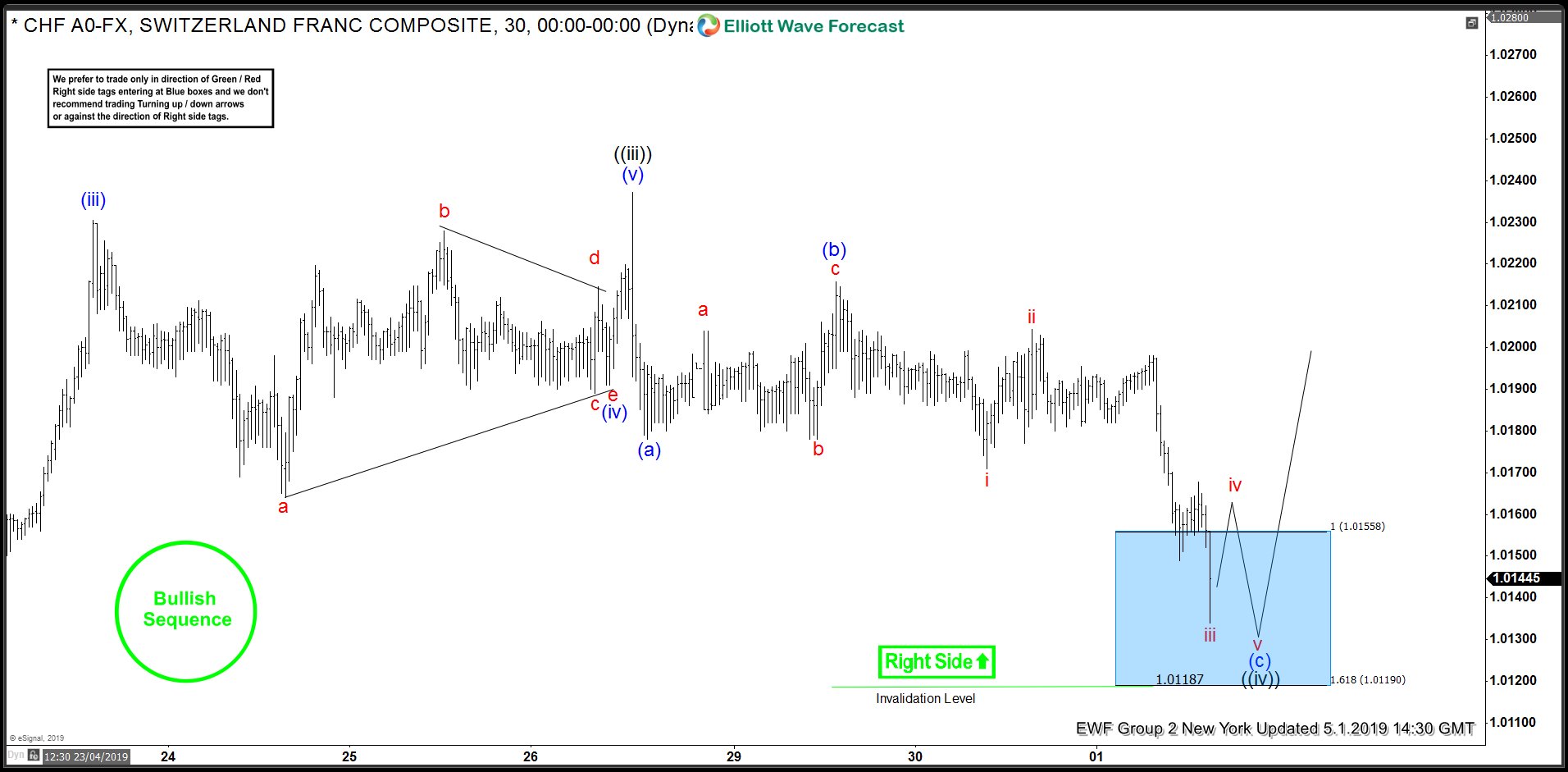

The Federal Reserve On Hold Despite Pressure to Cut

Read MoreSummary The Federal Reserve shows no bias to hike nor cut interest rate. Fed Chairman Jerome Powell believes subdued inflation is “transitory”. U.S. stocks fell and the Dollar strengthens as odds of a rate cut drops. Technical Analysis using Elliott Wave suggests U.S. Dollar should continue to strengthen. The Federal Reserve has concluded its 2 […]

-

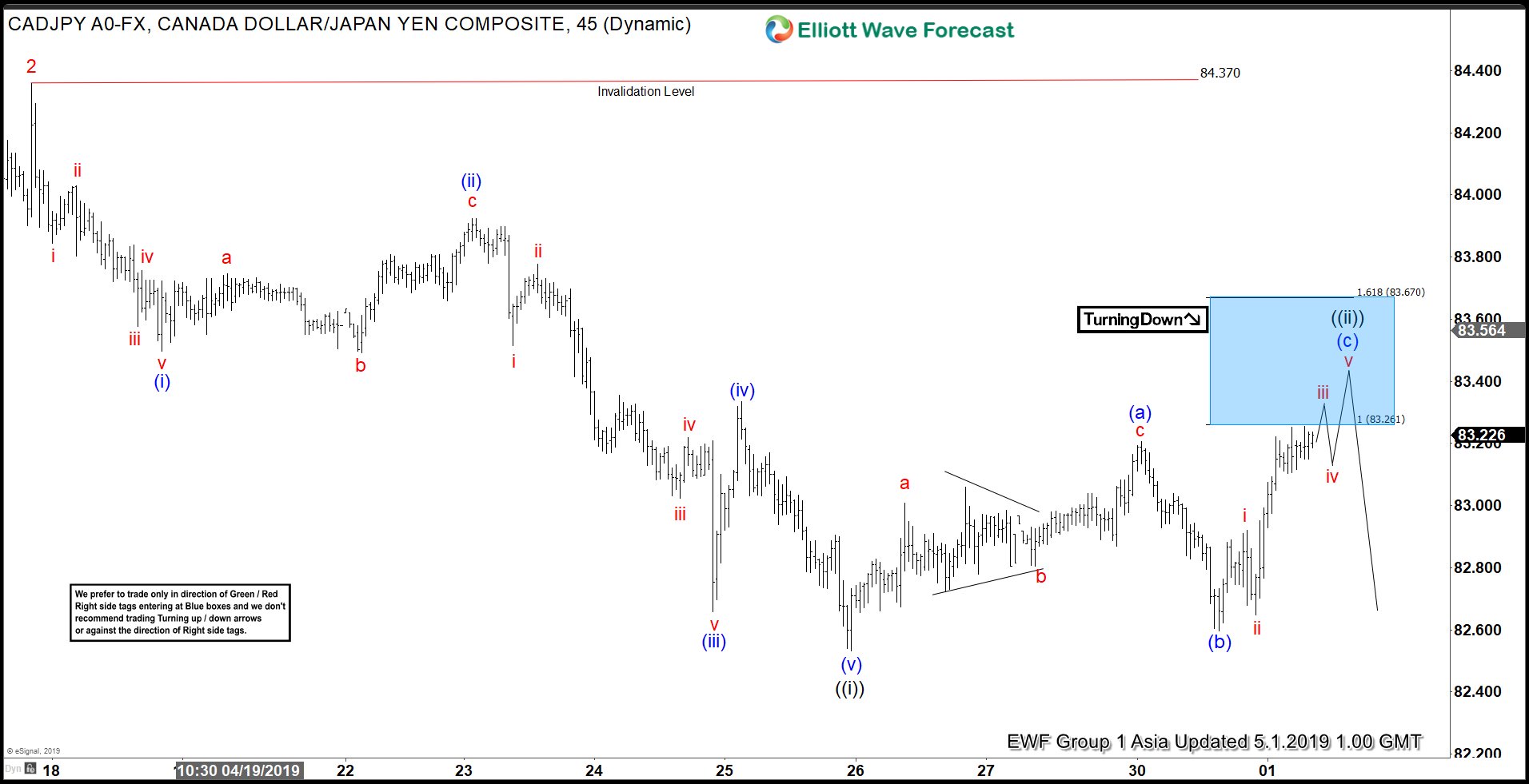

Elliot Wave View: Impulsive Decline in CADJPY

Read MoreCADJPY shows an impulsive decline from April 17. This article and video explains the short term Elliott Wave path for the pair.

-

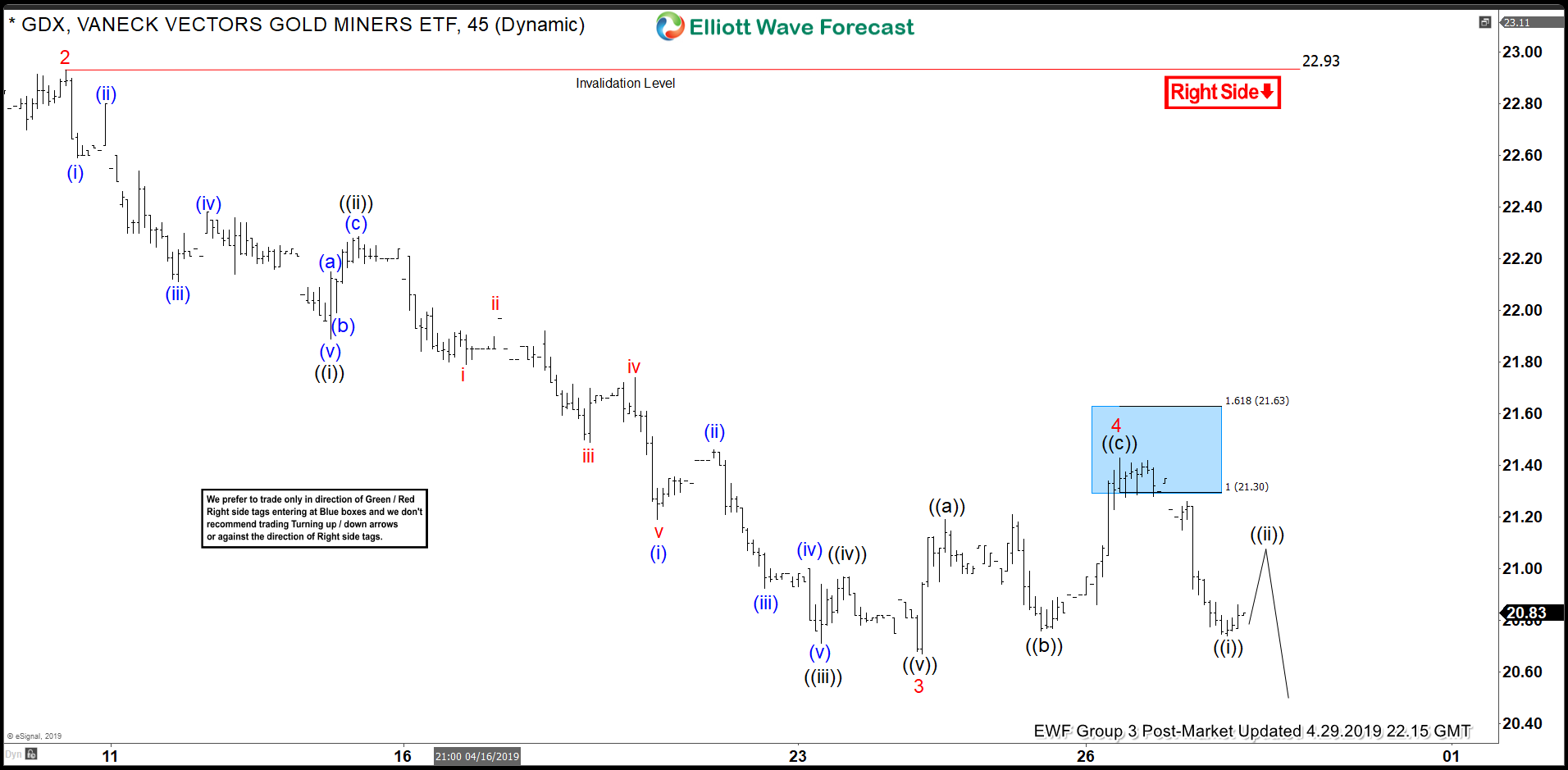

Elliott Wave View: More Weakness in GDX

Read MoreDecline from Feb 21, 2019 high in GDX appears missing at least 1 more leg lower. This article & video explains the Elliott Wave path for the Gold Miners.

-

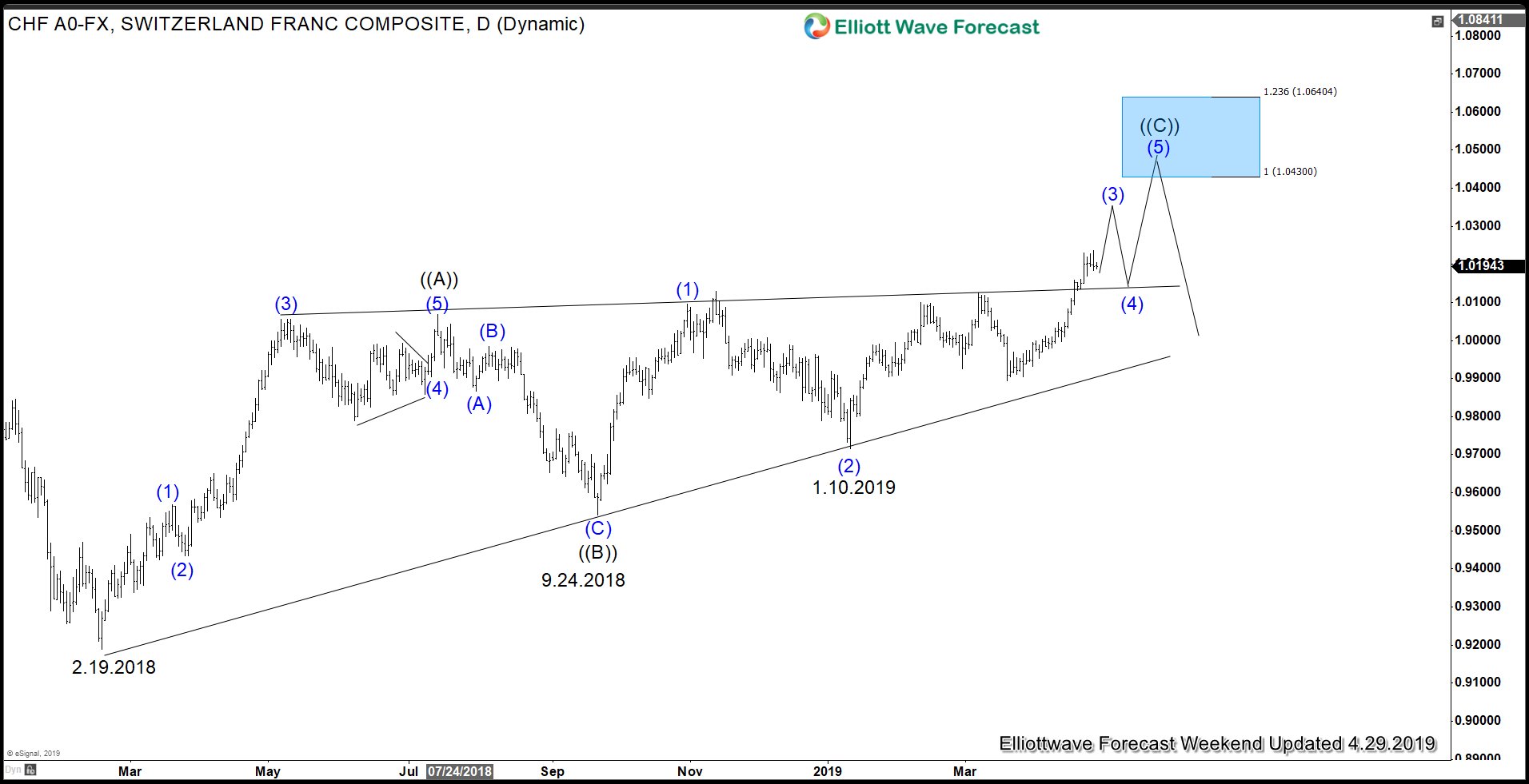

Strong GDP supports the US Dollar

Read MoreSummary A strong 3.2% U.S first quarter GDP indicates robust economy. Temporary drivers of the growth however may not be sustainable for the remainder of the year. Strong U.S. economic data can continue to boost global stock market and U.S. Dollar in the short term. The U.S Commerce Department reported a strong first quarter GDP […]

-

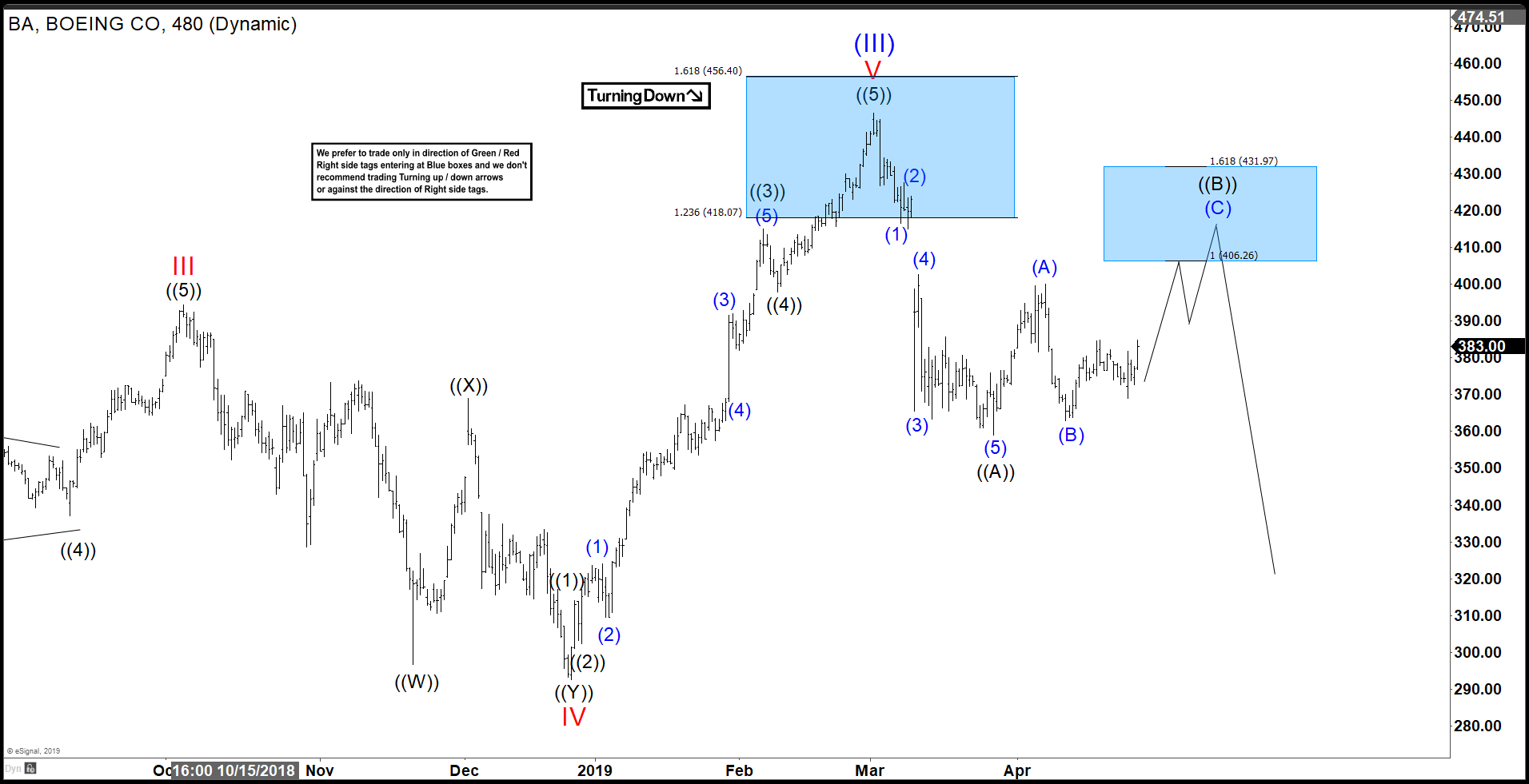

Elliott Wave View: Rally in Boeing (BA) Should Fail

Read MoreElliott Wave view in Boeing suggests that the rally to $446.49 ended wave (III) in super cycle degree. The stock is now doing the biggest pullback since 2003 low within wave (4). The decline from $446.49 to $359.01 ended wave ((A)) as an impulse Elliott Wave structure. Wave (1) ended at $416.44, wave (2) ended at […]

-

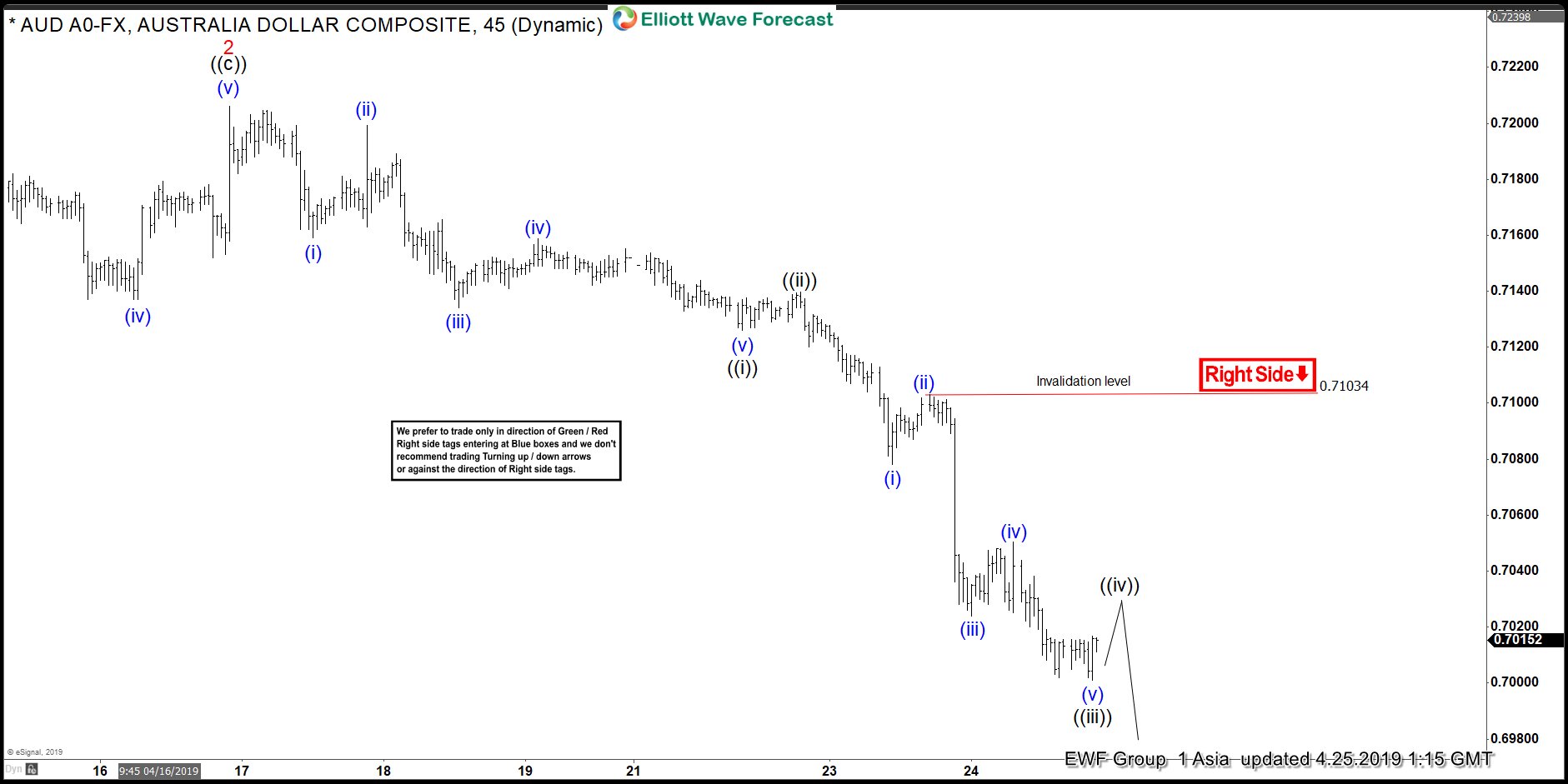

Elliott Wave View: AUDUSD Impulsive Decline

Read MoreAUDUSD shows an impulsive move from April 17 high favoring more downside. This video looks at the short term Elliott Wave path for the pair.