-

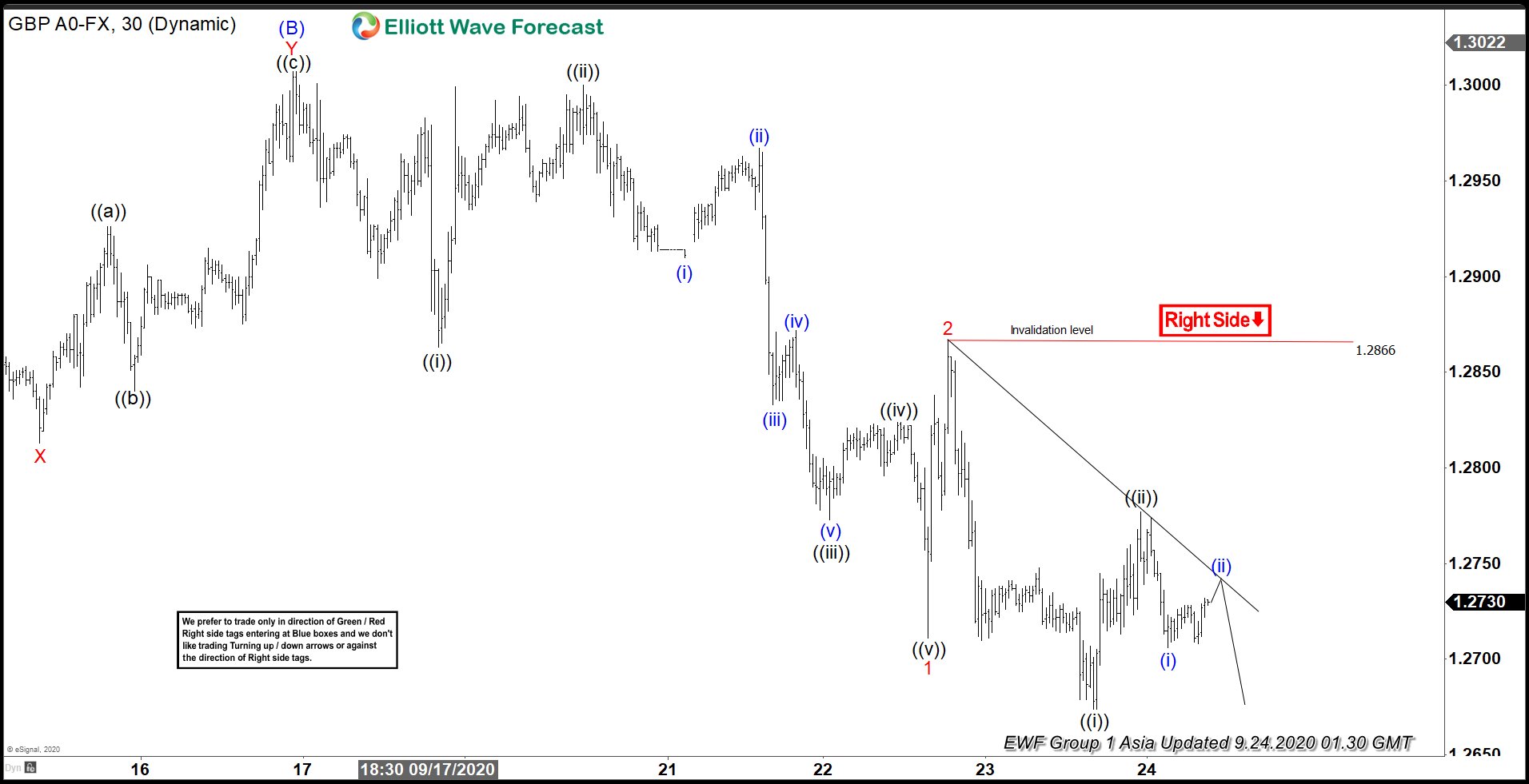

Elliott Wave View: Further Downside in Pound Sterling

Read MoreCycle from Sept 1 in Pound Sterling looks incomplete and pair can see further downside. This article looks at the Elliott Wave path.

-

Shanghai Composite Index in Multi Year Consolidation

Read MoreAs of 22 September, Shanghai Composite Index (SSE) is up 6.9% despite the geopolitical tension with the US and coronavirus pandemic. Contrast this with S&P 500 which has YTD performance of 2.1%. Part of the reasons for the resilience is due to Chinese economy relatively speedy recovery from the pandemic. After the initial breakout in […]

-

Generational Buying Opportunity in Gold and Silver?

Read MoreOn Saturday, September 12, 2020 we at Elliott Wave Forecast hosted a Free Seminar. The topic of the seminar was ” Generational Buying Opportunity in Gold and Silver?”. We analyze and talk about the outlook of Gold, Silver, and Miners. In the seminar, we explain why the break to all time high in precious metal against […]

-

Elliott Wave View: Nike (NKE) Breaks to All Time High

Read MoreNike has made an all-time high and pullback can continue to find support in 3, 7, or 11 swing for more upside. This article looks at the Elliott Wave path.

-

What Nasdaq (NQ) is saying about the Right Side of Market

Read MoreTechnology is the strongest sector in the current bullish trend in World Indices. Nasdaq (NQ) which has a lot of technology stocks naturally is one of the best performing Indices. We had some pullback in the Indices last week. As always, with every pullback, many traders and analysts start to speculate if major top is […]

-

Silver Miners ($SIL) Looking to Rally

Read MoreOne of the best performing assets this year is Silver. After bottoming on March 18 at $11.6 in the Covid-19 selloff, the metal has rallied to $30. Silver miners should benefit from the higher price of silver. As long as the price of Silver can stabilize at this upper twenty range or extend higher, we […]