-

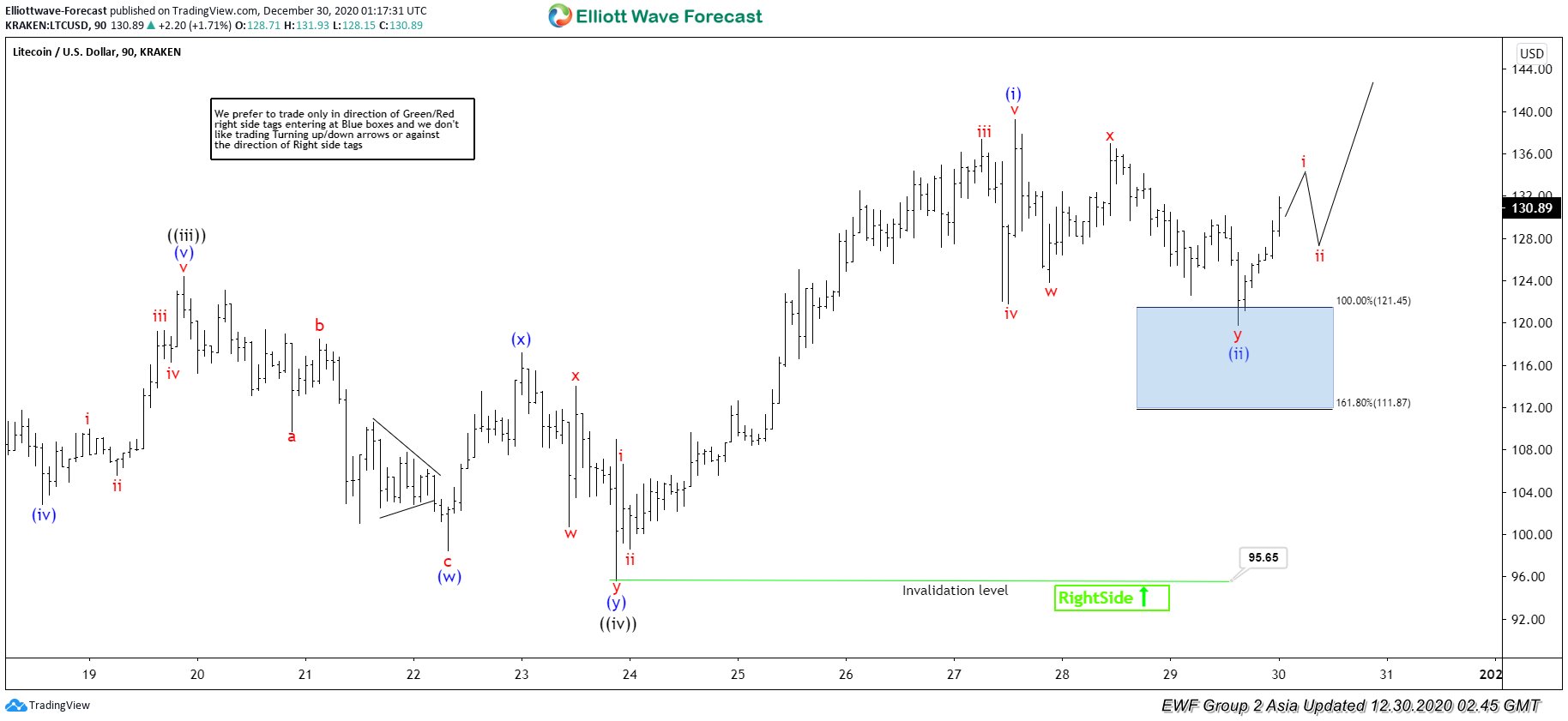

Elliott Wave View: Litecoin Ending Year 2020 on a High Note

Read MoreLitecoin and other crypto currency should end year 2020 on a high note. This article and video look at the Elliott Wave path.

-

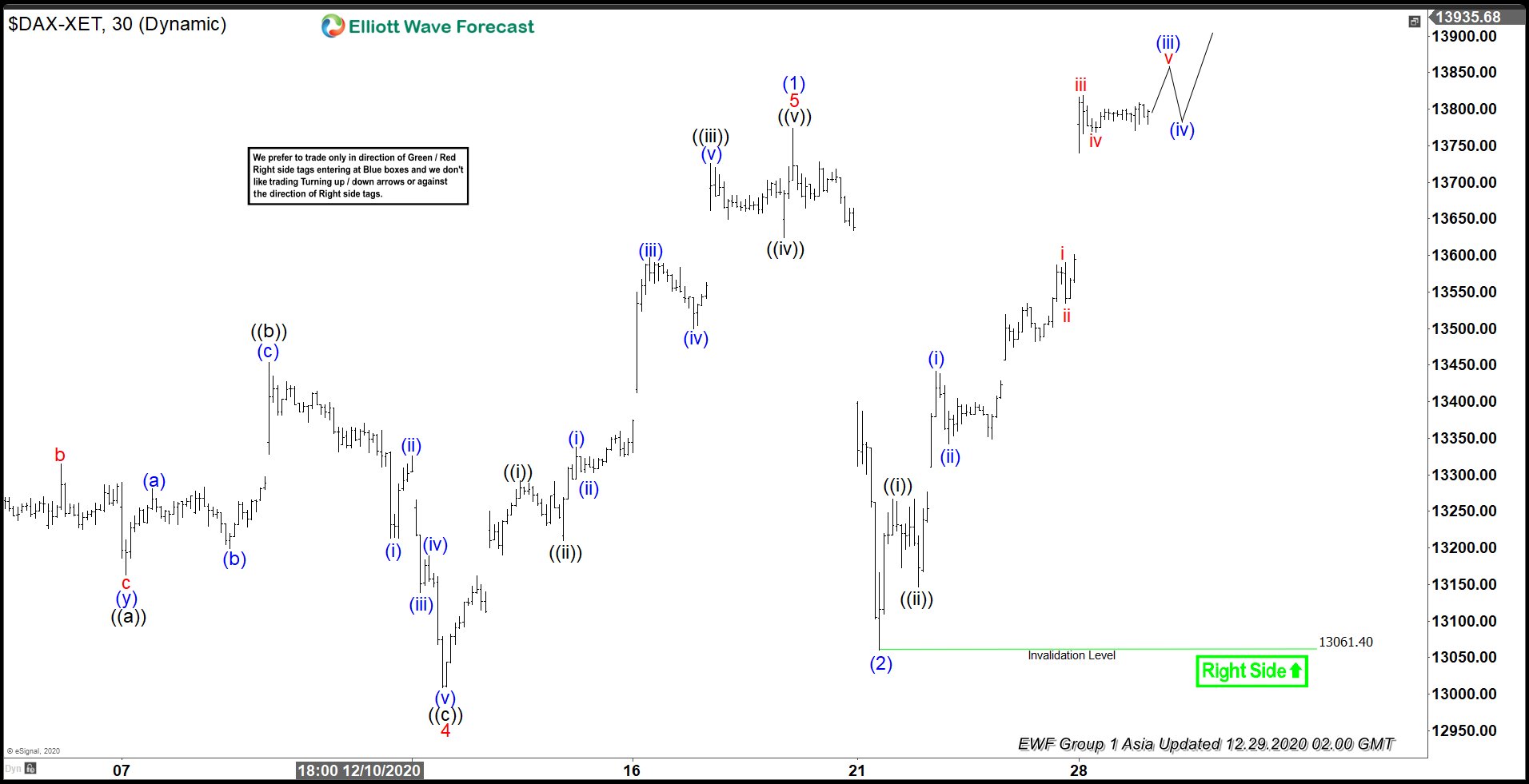

Elliott Wave View: DAX Starts a New Bullish Cycle

Read MoreDAX has started a new bullish cycle and dips should find support in 3, 7, or 11 swing. This article and video look at the Elliott Wave path.

-

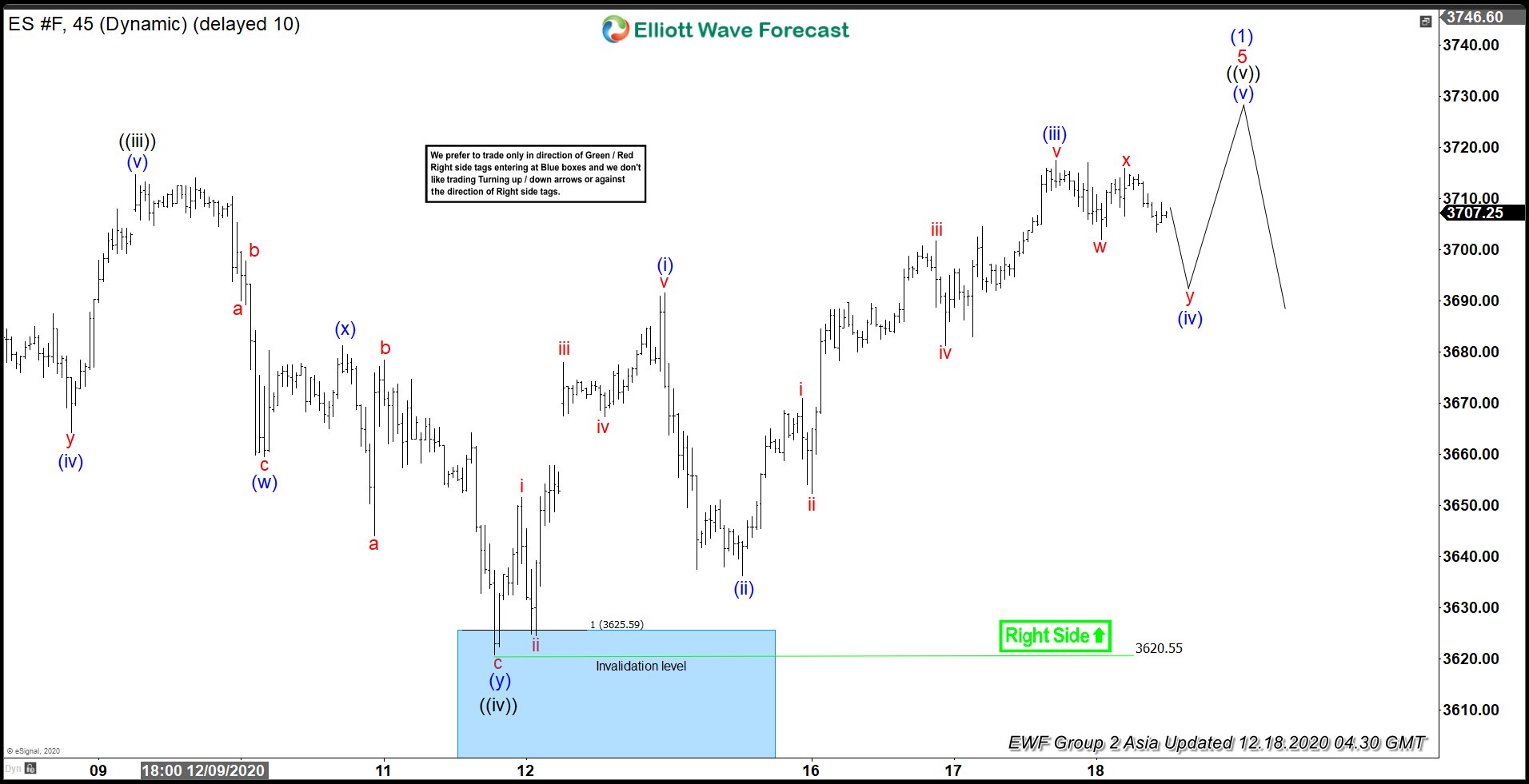

Elliott Wave View: S&P E Mini Futures (ES) Near Completing 5 Waves

Read MoreS&P E-Mini Futures (ES) is near ending a 5 waves diagonal from Nov 11 low. This article and video looks at the Elliott Wave path.

-

Elliott Wave View: Oil (CL) Impulsive Rally In Progress

Read MoreOil (CL) shows an impulsive rally from November 2 low & can continue to see further upside. This article and video look at the Elliott Wave path.

-

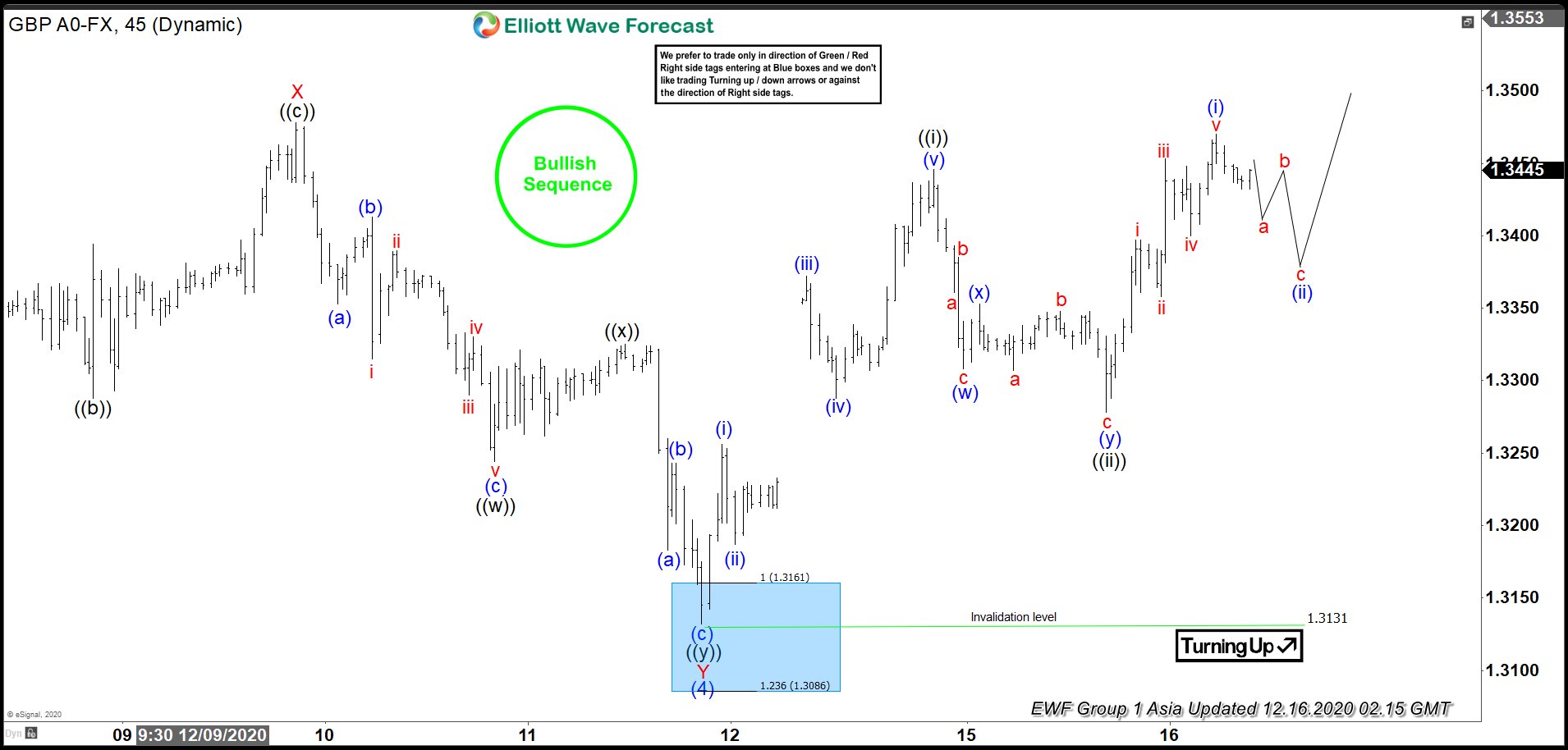

Elliott Wave View: GBPUSD Bullish Sequence Favors More Upside

Read MoreGBPUSD shows incomplete bullish sequence from March 20 low favoring more upside. This article and video look at the Elliott Wave path.

-

Silver Miners (SIL) Close to Ending Correction

Read MoreOne of the best ways to play the silver rally, if one believes in the bullish thesis, is through the Silver Miner ETF (SIL). The share price of these publicly traded mining companies usually climb faster than the precious metals that they produce during the bull market phase of the underlying metal. Since forming a […]