-

The Case for Silver, Alexco, Hecla

Read MoreSilver rose to a new high of 2016 in the second quarter as a result of strong investor and speculative demand amid an environment macro support for precious metals. Overall this year silver has been a star performer. White metal ingots outshone well, marking an increase of 37 % compared to 22% increase in Gold. […]

-

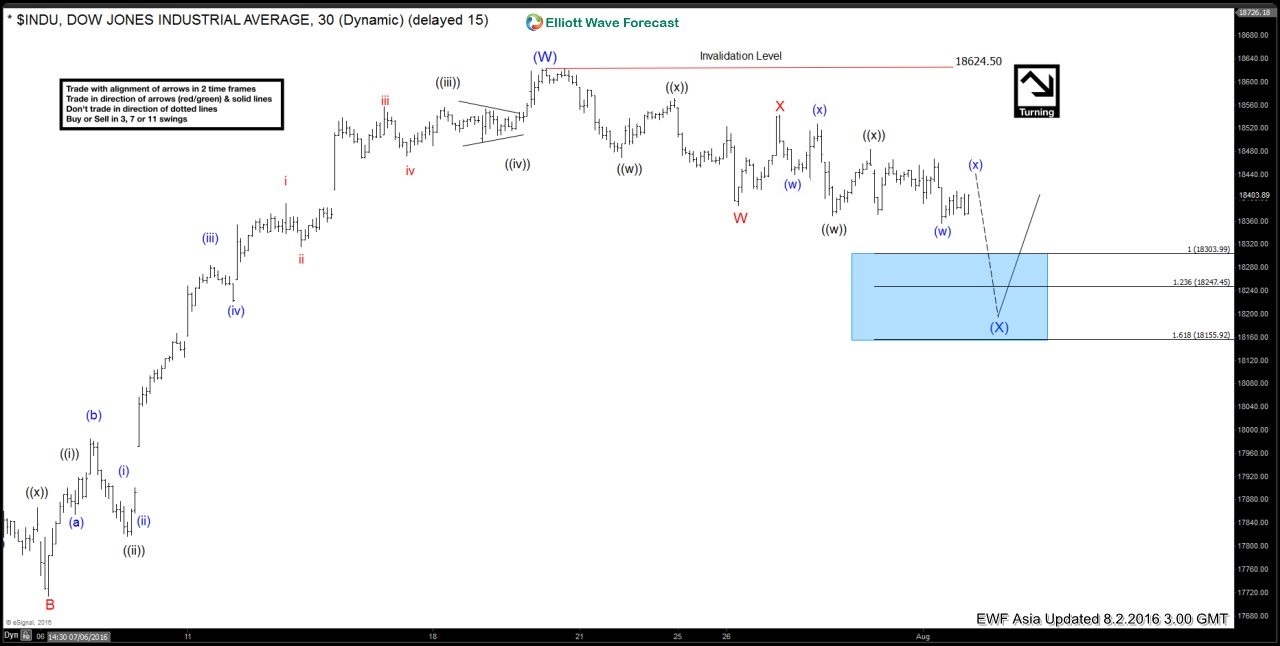

$INDU-DOW Double three Elliott Wave Structure

Read MoreGlobal Indices have seen an impressive start of Q3 as the major US indices are not tired of hitting new highs occasionally. With applause July dissemination among equity investors, capital bulls are flexing their muscles in August as well. At the beginning of last week, the indices hits fresh highs as US retail sales and […]

-

$OIL Expanded flat correction

Read MoreExpanded Elliottwave Flat is a 3 wave corrective pattern which could often be seen in the market. Inner subdivisions are 3, 3, 5 and labelled as A, B, C. Waves A and B have forms of corrective structures like zigzag, flat, double three or triple three. Whereas , wave C is always a 5 waves structure, […]

-

AUDCAD Elliottwave Strategy of the Day 8.2.2016

Read MoreOn 2nd August 2016, Our Strategy of the Day video presented to clients viewed the pull back in AUDCAD as a buying opportunity. Long AUDCAD 8/02/2016 AUDCAD is showing incomplete bullish sequence from May 2016 lows & another incomplete sequence from July 21 lows which means the sequence is bullish against 0.9823 (7/27) low and […]

-

Bank of Japan : Double Three Elliott Wave Structure

Read MoreThe Bank of Japan on Last Friday disappointed investors by offering a round much lower than expected extra while announcing a review of its current policy measures stimulus, leading some observers to wonder whether politicians fear that they are running out of tools to revive the Japanese economy. The Bank of Japan under the governor, […]

-

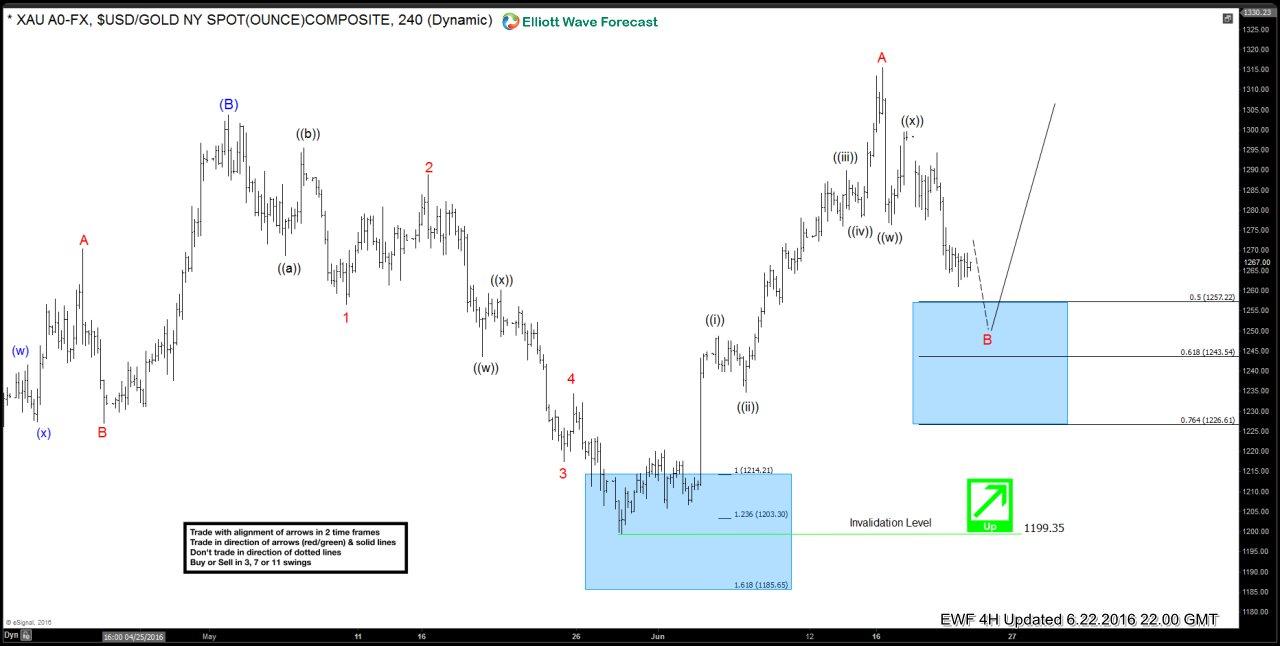

Is uncertainty Gold’s best friend?

Read MoreGold is enjoying a strong run in recent times due to the recent decision market shake Britain to leave the European Union. Healthy boost the yellow metal is exhibited by an increase roughly 24 % of its value since the beginning of this year. Gold prices rebounded as much as about 8 % to its […]