-

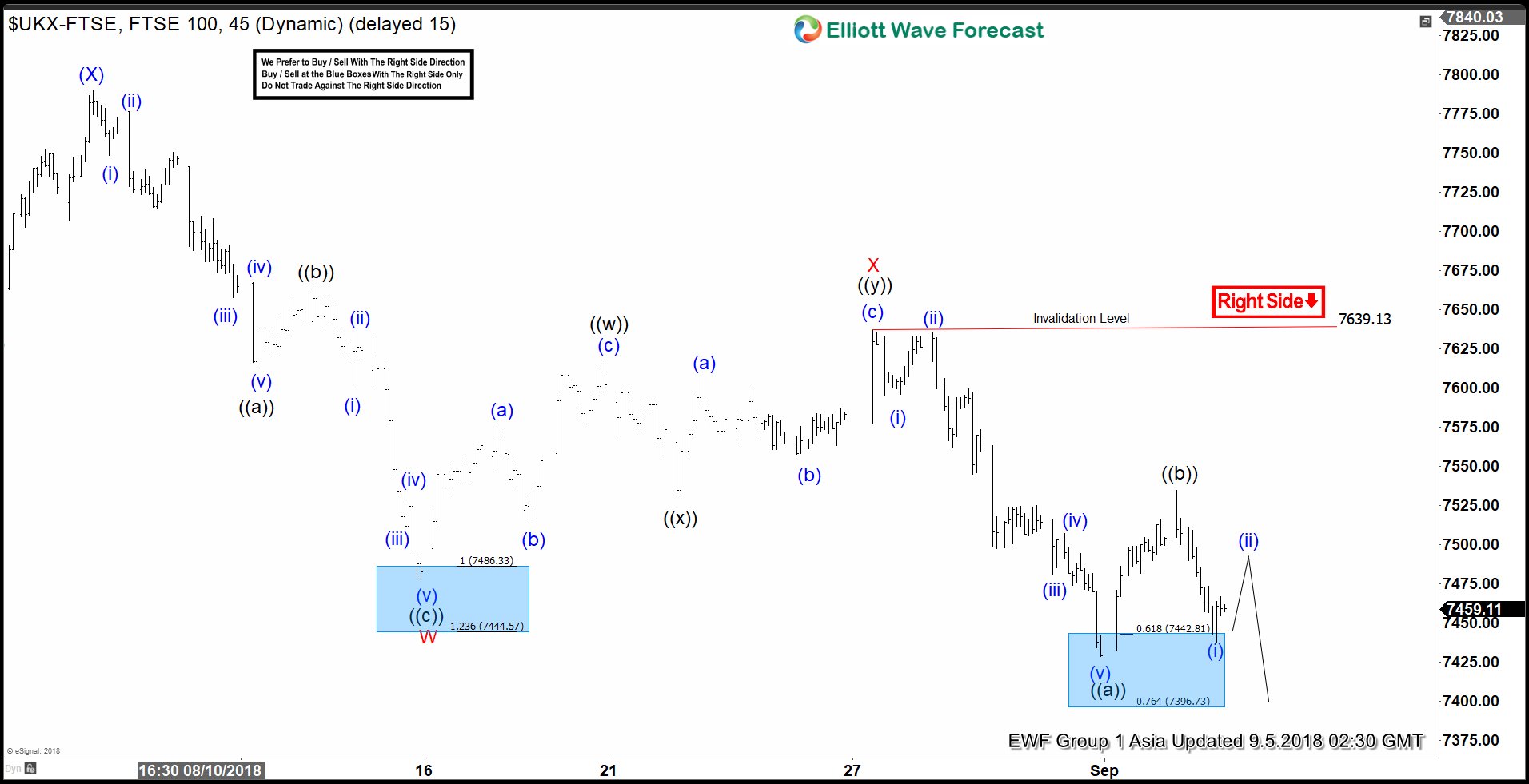

FTSE Elliott Wave Analysis: Started 7th Swing Lower

Read MoreFTSE short-term Elliott Wave view suggests that the rally to 7790.17 high ended intermediate wave (X) bounce. Down from there, intermediate wave (Y) remains in progress with instrument showing a lower low sequence. The internals of that leg lower is taking place as double correction lower due to overlapping price action happening from 7790.17 high […]

-

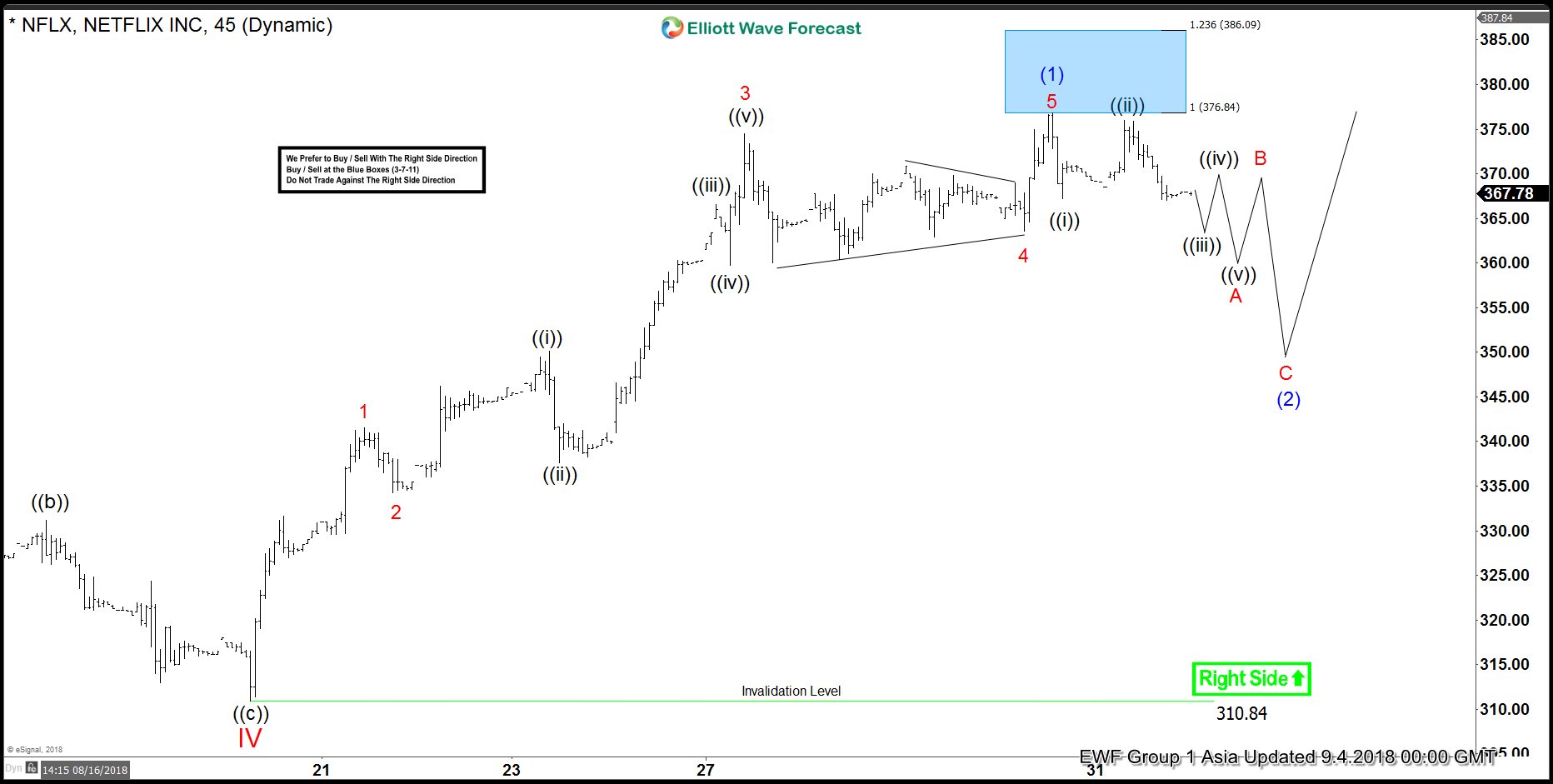

Netflix Elliott Wave View: Pullbacks Should Remain Supported

Read MoreNetflix ticker symbol: $NFLX short-term Elliott wave view suggests that the decline to $310.84 low ended cycle degree wave “IV” pullback. Up from there, cycle degree wave “V” can have started but a break above $423.21 6/21/2018 high remains to be seen for final confirmation. Above from $310.84 low, the rally higher $376.81 high ended […]

-

Nike Providing Buying Opportunity Soon?

Read MoreNike ticker symbol: $NKE short-term Elliott wave view suggests that the decline to $75.06 low ended intermediate wave (2). Above from there, the stock has rallied to new all-time highs confirming the next extension higher in intermediate wave (3) higher. The internals of intermediate wave (3) is unfolding as Elliott wave impulse structure with the […]

-

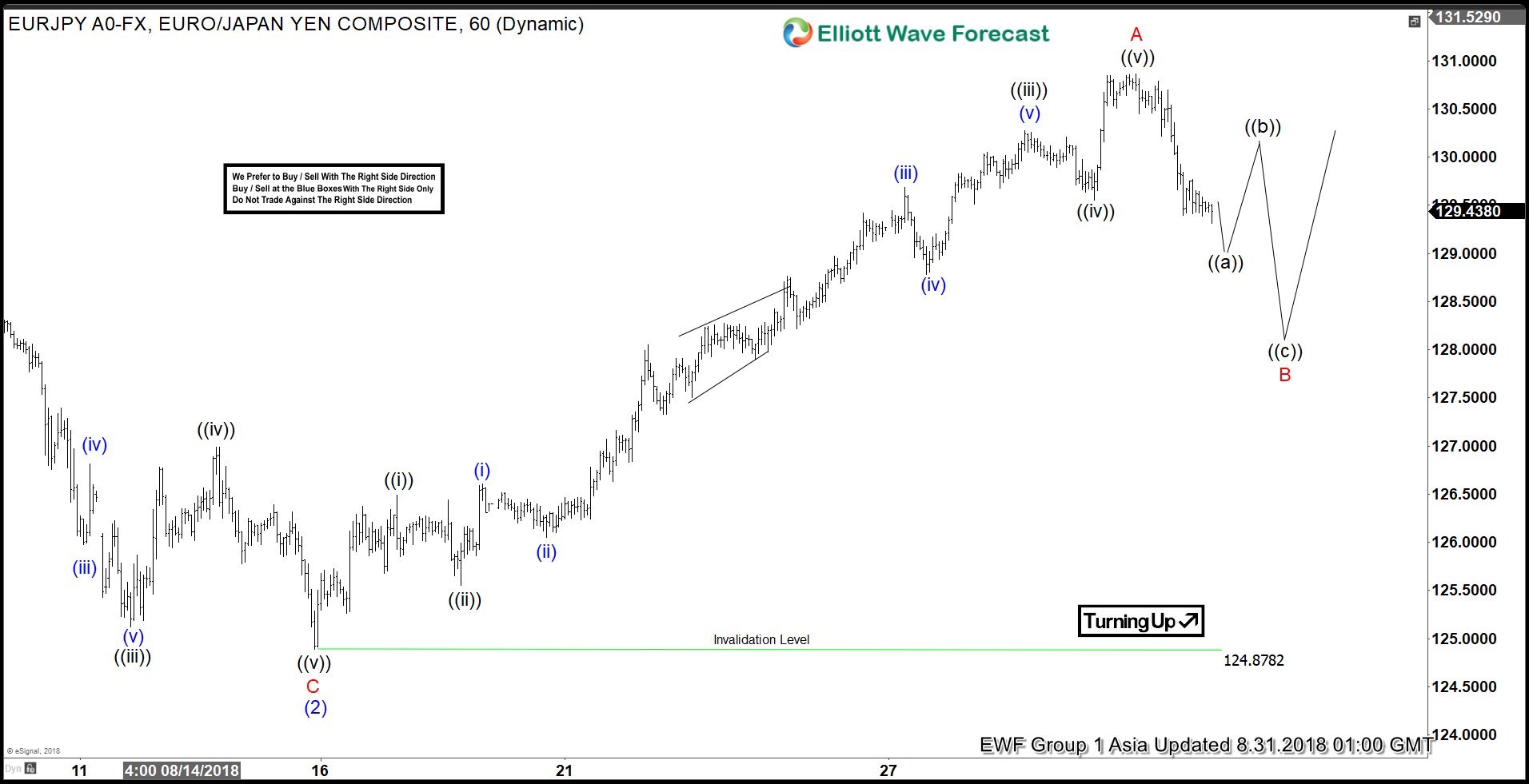

EURJPY Elliott Wave View: Ended 5 Waves Advance

Read MoreEURJPY short-term Elliott wave view suggests that the decline to 124.87 low ended intermediate wave (2) pullback of a leading diagonal structure from 5/29/2018 cycle. Above from there, the rally higher is taking place as Elliott wave zigzag structure within intermediate wave (3) of a diagonal. In a zigzag ABC structure, lesser degree cycles should […]

-

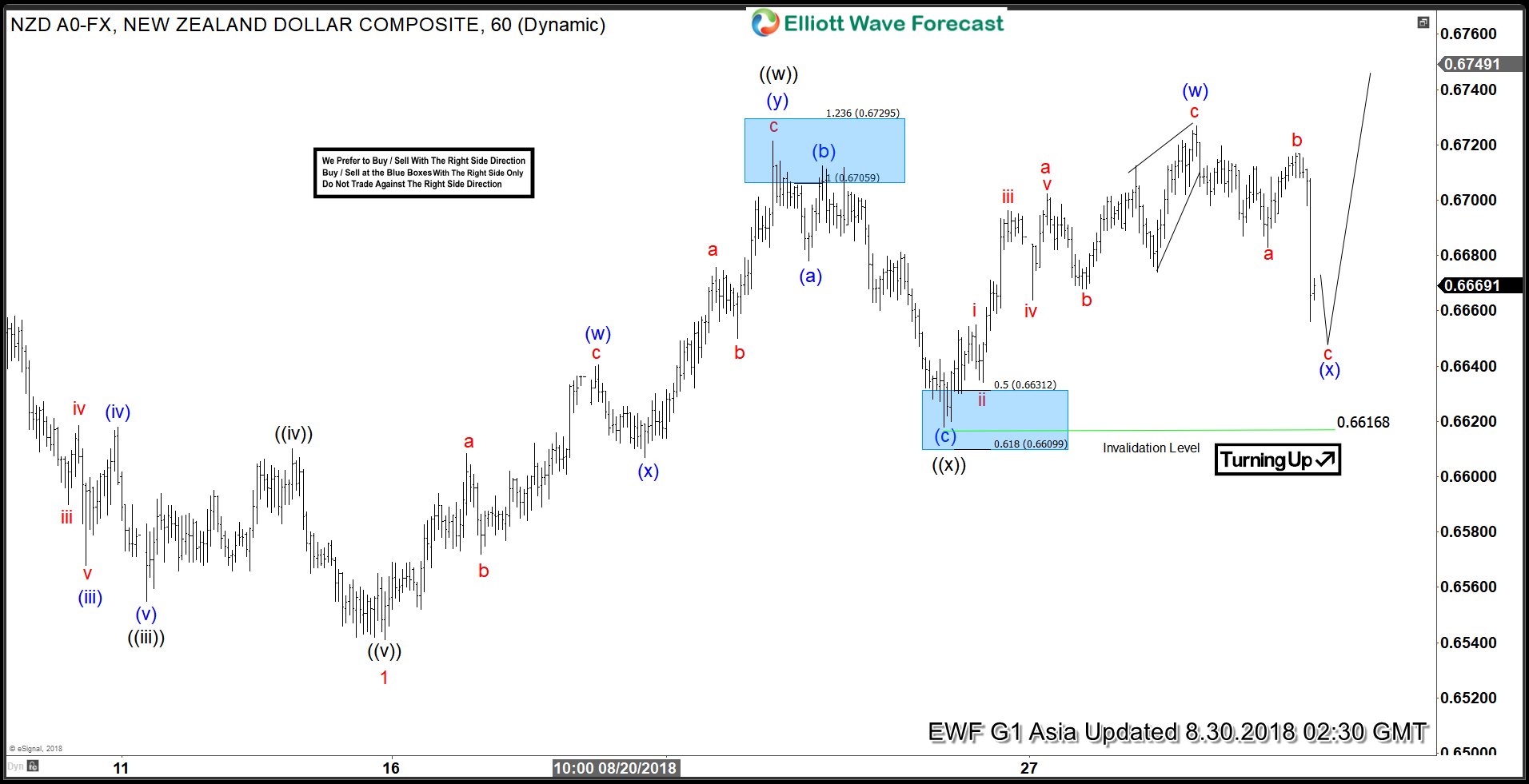

NZDUSD Elliott Wave Analysis: Double Correction Taking Place

Read MoreNZDUSD short-term elliott wave analysis suggests that the decline to 0.6543 low ended Minor wave 1. The internals of that decline unfolded as impulse structure with lesser degree Minute wave ((i)), ((iii)) & ((v)) unfolded in 5 waves structure. Above from there, Minor wave 2 bounce is taking place as double correction higher with lesser […]

-

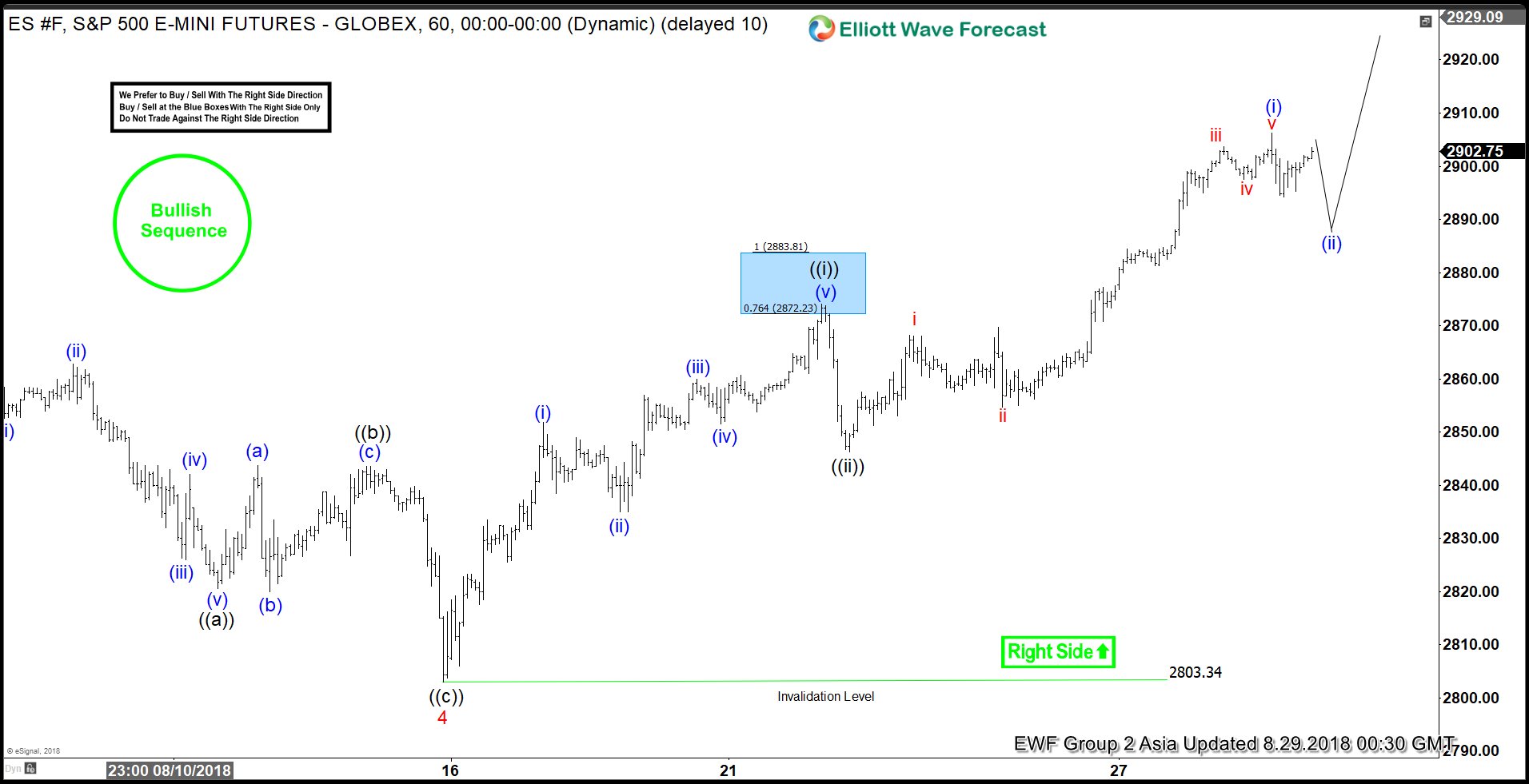

S&P500 Mini Futures: Extending Higher As Impulse

Read MoreS&P500 Mini Futures ticker symbol: $ES_F short-term Elliott wave view suggests that the decline to $2803.34 low ended Minor wave 4 pullback. The internals of that pullback unfolded as Elliott wave zigzag correction. The lesser degree Minute wave ((a)) ended in 5 waves at $2820.5 low. Then the bounce to $2843.50 high ended Minute wave […]