-

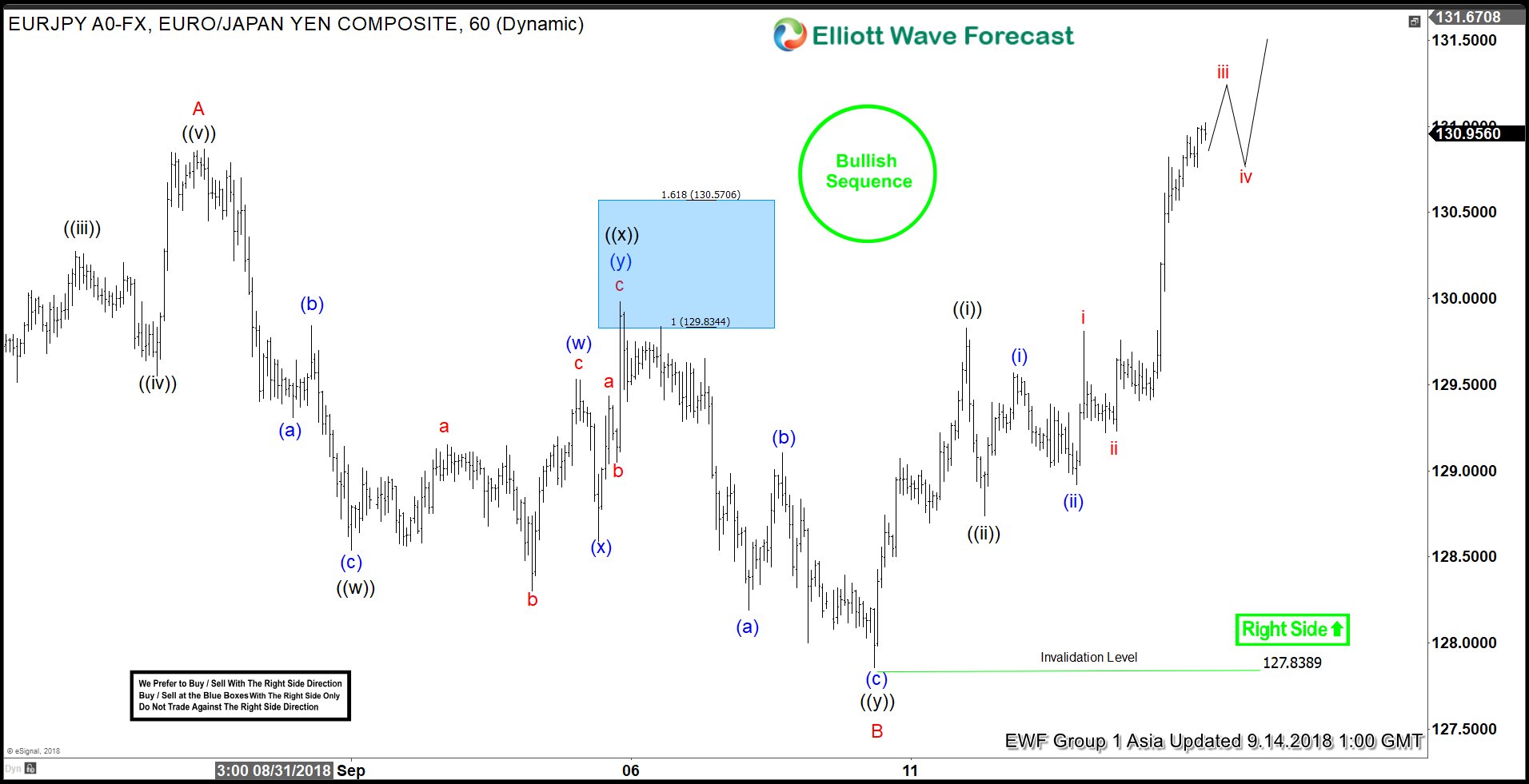

EURJPY Elliott Wave Analysis: Upside Has Started

Read MoreEURJPY short-term Elliott wave analysis suggests that the rally to 130.85 high ended Minor wave A of a Zigzag structure. The internals of that rally higher unfolded in 5 waves impulse structure with the sub-division of 5 waves structure as mentioned previously in the previous post. Down from there, the pullback to 127.83 low ended […]

-

AUDUSD Elliott Wave View: Right Side Calling Lower

Read MoreAUDUSD short-term Elliott wave view suggests that the bounce to 0.7384 high ended intermediate wave (X) bounce. Down from there, the pair has broken to new lows already confirming the intermediate wave (Y) lower. Thus suggesting that the right side in the pair is to the downside. The decline to 0.7084 low unfolded in 5 […]

-

AAPL Elliott Wave View: Ready For Wave 5 Higher?

Read MoreAPPLE ticker symbol: AAPL short-term Elliott wave view suggests that the rally to $229.67 high ended intermediate wave 3 higher. The internals of that rally higher unfolded as impulse structure with the sub-division of 5 waves structure in it’s each leg higher. Down from $229.67 high, the instrument did a 7 swing pullback & completed […]

-

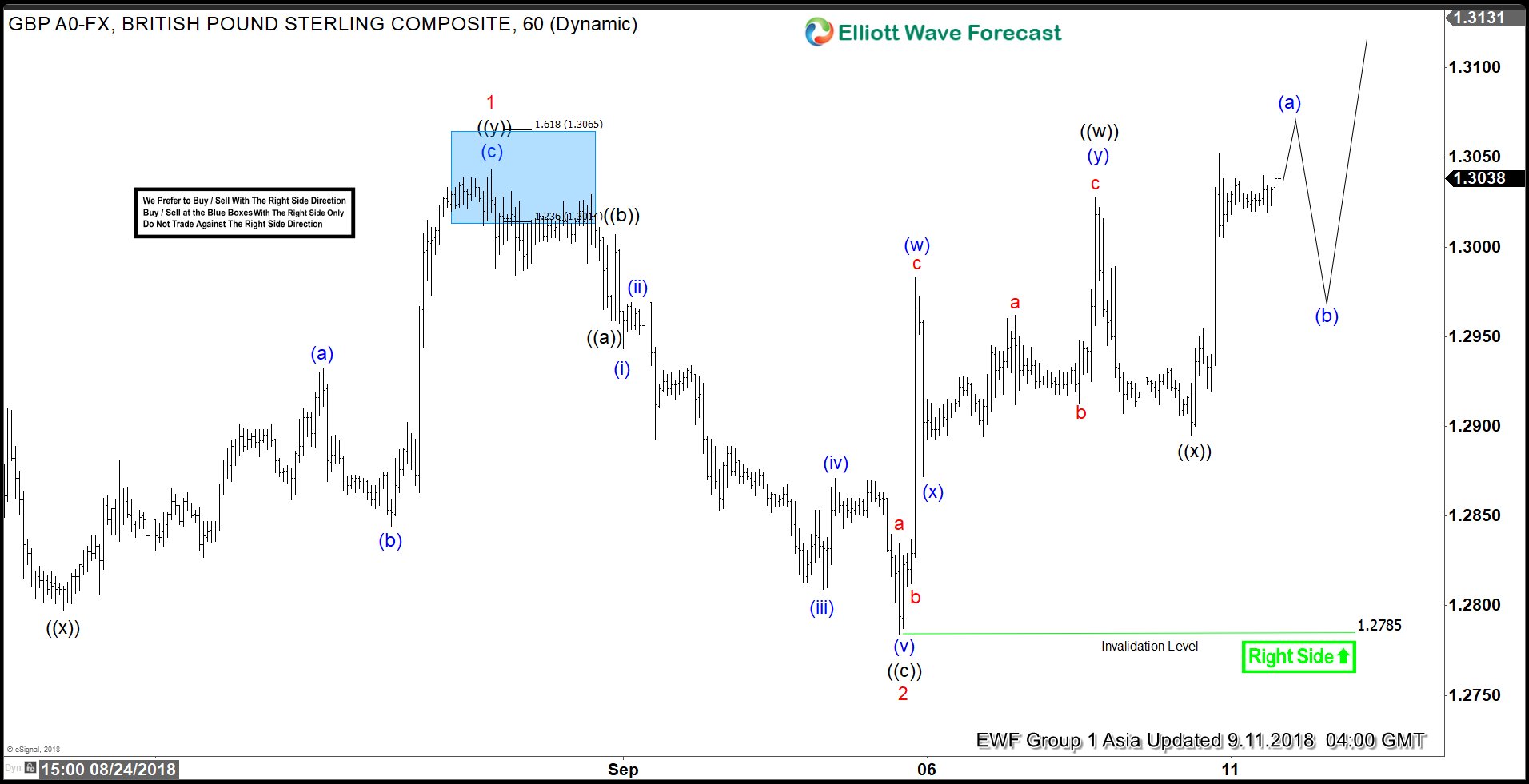

GBPUSD Elliott Wave Analysis: Calling Further Upside

Read MoreGBPUSD short-term Elliott Wave analysis suggests that the rally from 8/15/2018 low at 1.2660 to 1.3042 high ended Minor wave 1. The internals of that rally higher took place in 3 wave corrective sequence i.e double three thus suggesting that the pair can be doing a Leading diagonal structure. Up from 1.2660 low, the initial […]

-

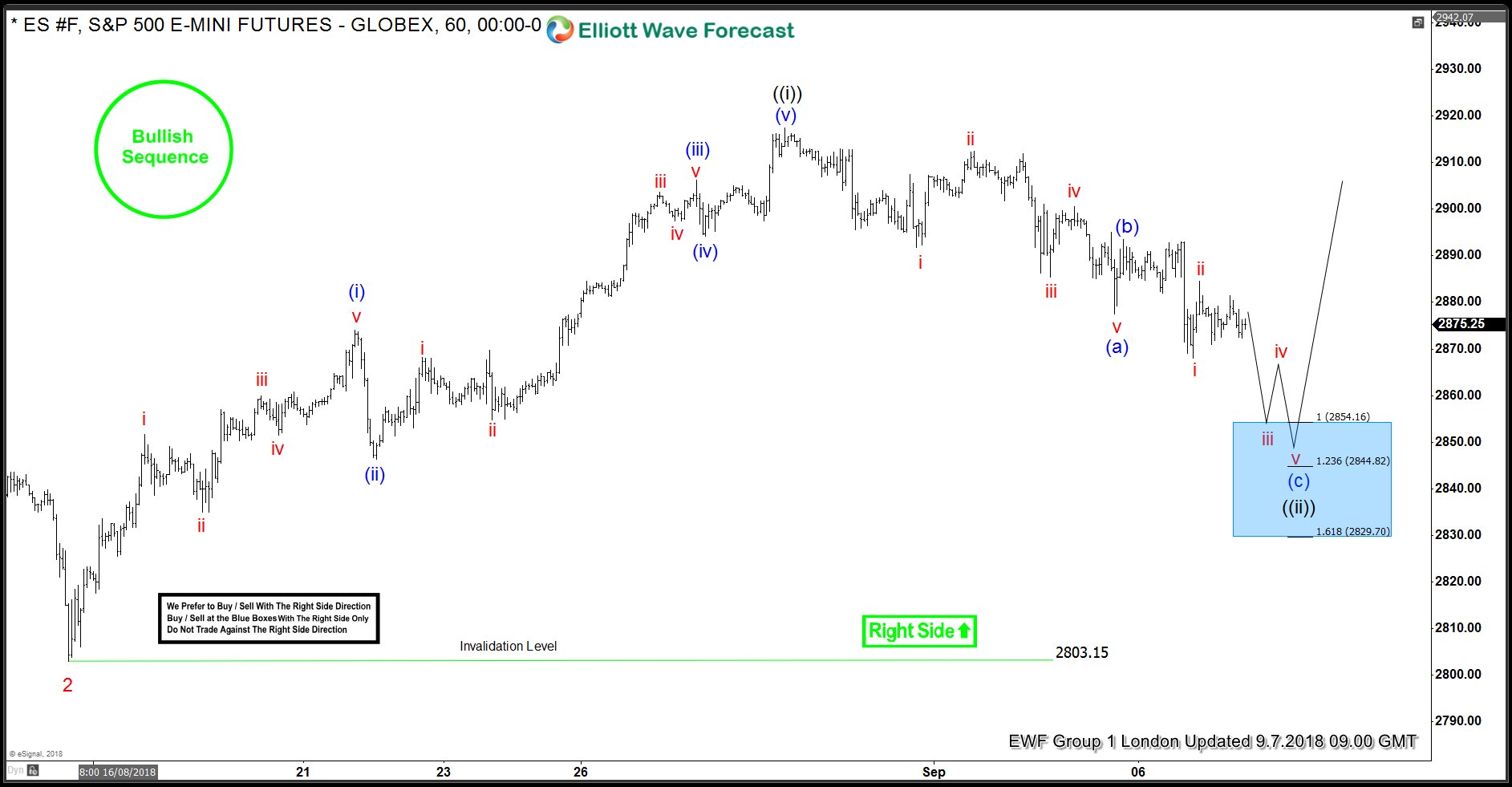

ES_F Elliott Wave Analysis: Correction Taking Place

Read MoreES_F Short-term Elliott wave analysis suggests that the pullback to $2803.15 ended Minor wave 2 pullback. Up from there, the index has rallied higher into new highs confirming that Minor wave 3 has started. The internals of that rally higher is unfolding as impulse structure with the sub-division of 5 waves structure in the lesser […]

-

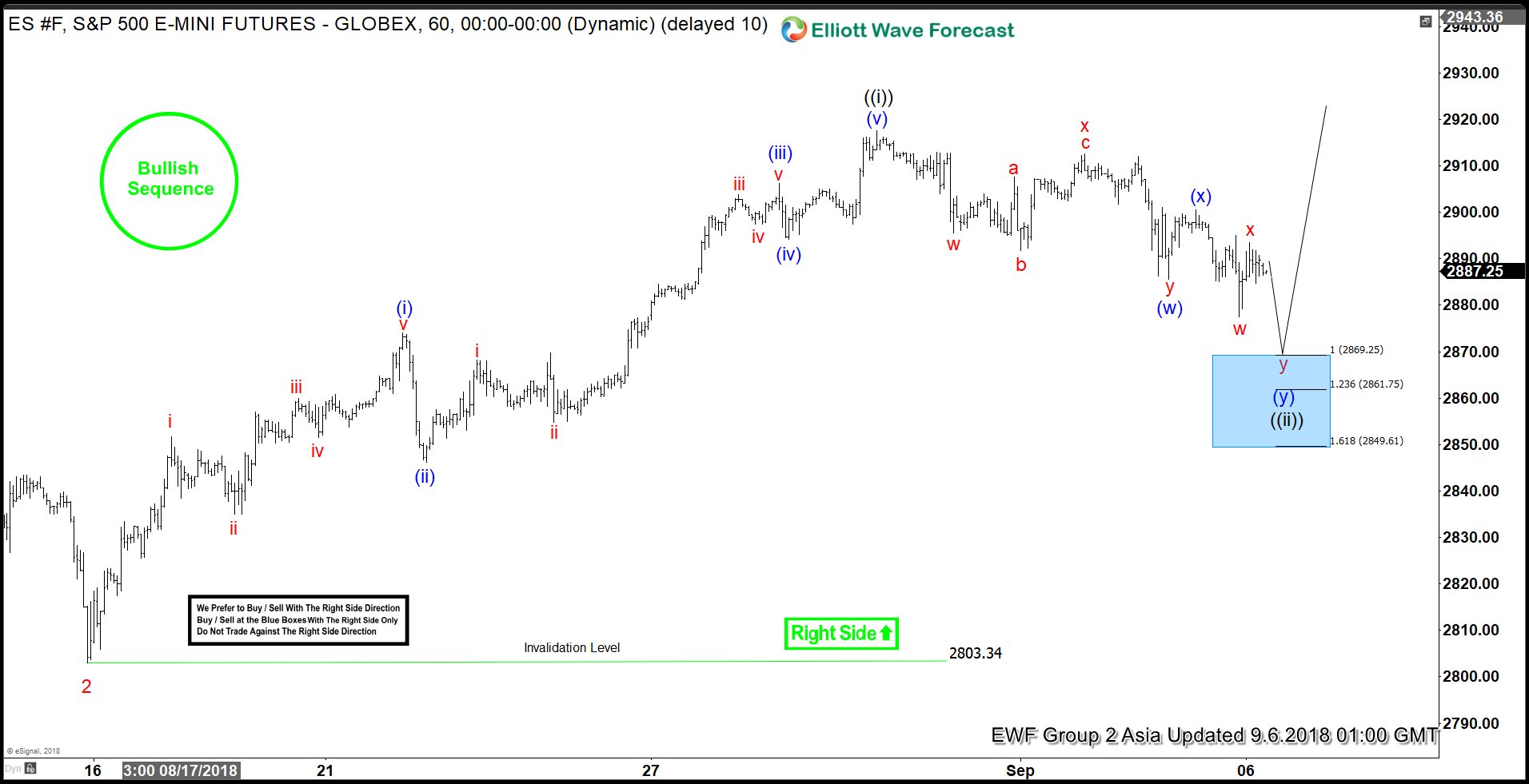

S&P500 E-Mini Futures Entering Buying Areas Soon?

Read MoreS&P500 E-Mini Futures ticker symbol: $ES_F Elliott wave view suggests that the pullback to $2803.34 low ended Minor wave 2. Up from there, the rally higher to $2917.50 high ended Minute wave ((i)). The internals of that rally higher unfolded as impulse structure with the sub-division of 5 waves structure in it’s each leg higher […]