-

CVR Energy (CVI) Daily Bullish Sequence

Read MoreOn November 2016, CVR Energy (NYSE: CVI) made an important low to end a daily correction from 2013 peak, up from there the stock either started a new bullish cycle to take it toward new all time highs or it’s just doing a 3 waves bounce. We can notice that since last year low, CVI has outperformed the energy sector […]

-

Cryptocurrencies Short Term Update 09.21.2017

Read MoreCryptocurrencies: Bitcoin & Ethereum Short Term Analysis The leading cryptocurrencies BTCUSD & ETHUSD rallied up from 09/15 low in a 3 waves Zigzag structure which ended wave (1) as part of an expected 5 waves diagonal to the upside. Both instruments is now doing a short term pullback in wave (2) as a double three toward equal legs area ($3740 […]

-

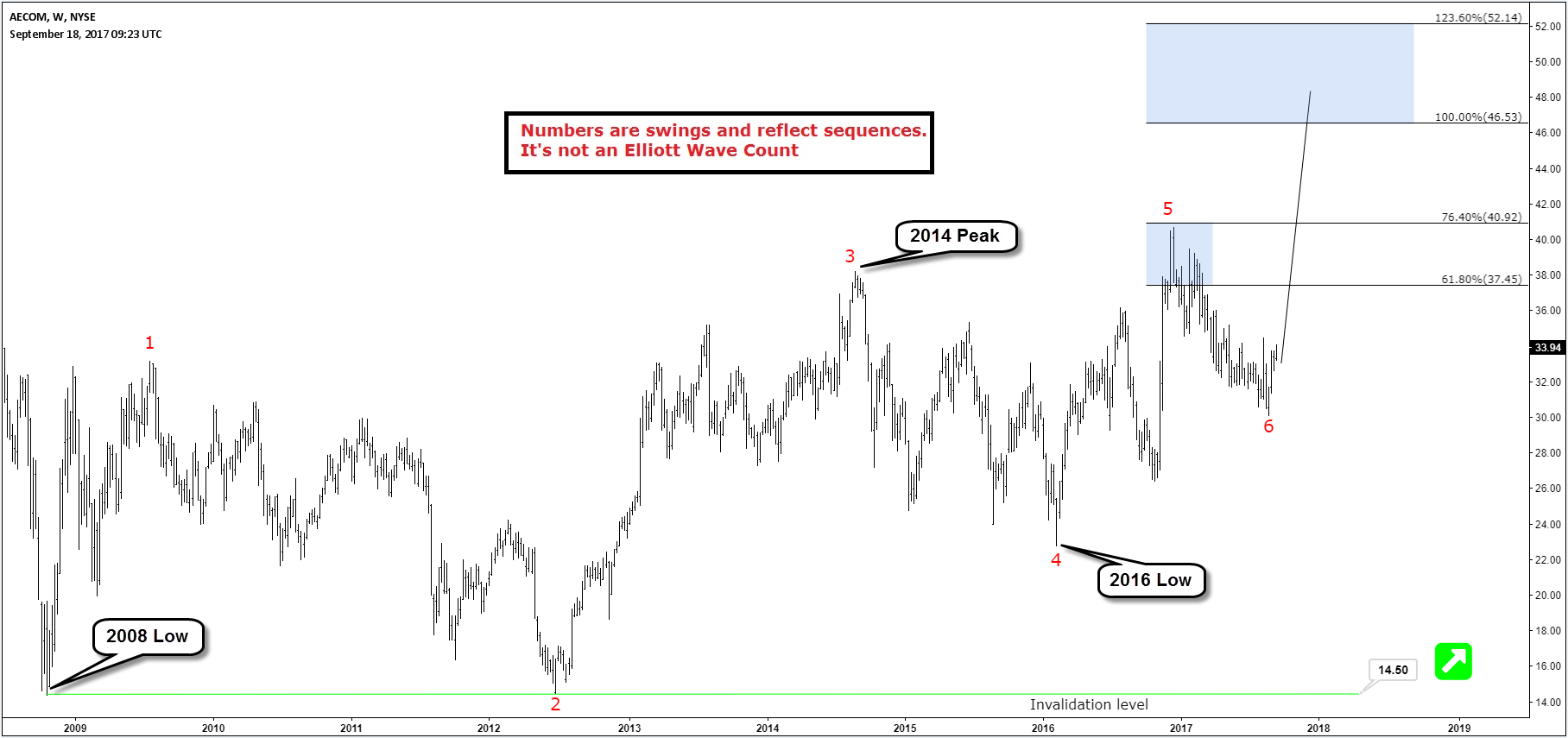

AECOM Resuming the Rally Toward $50

Read MoreAECOM (NYSE:ACM) provides planning, consulting, architectural and engineering design and program and construction management services for a range of projects including highways, airports, bridges, mass transit systems, to government and commercial clients. The company had US$17.4 billion of revenue during fiscal year 2016, it’s been ranked number one in Engineering News Record‘s “Top 500 Design Firms” […]

-

What’s Next Investing Opportunity in Stock Market?

Read MoreRecap of our free seminar “What’s Next Investing Opportunity in Stock Market?” Our public seminar was conducted on 9/6/2017, in which we discussed the coming opportunities in the stock market and why we favor investing in stocks related to commodities for the next move to the upside. We explained how metals like Gold , Silver and Copper are […]

-

Under Armour UAA Weekly Elliott Wave Outlook

Read MoreUnder Armour (NYSE: UAA) is one of the leading sporstwear companies around the world. However it’s stock has been struggling in the recent 2 years as it lost %68 since September 2015. In our previous article, we pointed out to the current correction taking place which could turn out to be 3 waves flat structure. […]

-

Cleveland Cliffs (NYSE:CLF) Daily Elliott Wave Outlook

Read MoreCleveland-Cliffs (NYSE: CLF) formerly known as Cliffs Natural Resources is a mining and natural resources company with a focus on iron ore. Let’s jump directly to the daily chart presented below showing the cycle from 01/12/2016 low which was a significant bottom for the stock. Up from there, CLF rallied in 7 swings structure forming a double three structure that ended […]