-

Wells Fargo WFC Remains Bullish

Read MoreWells Fargo (NYSE: WFC) is the world’s second-largest bank by market capitalization and the third largest bank in the U.S. by assets. Last week, the Bank was fined $185M by the FED for ‘widespread illegal practices’ because of the recent fake accounts scandal and it was banned from growing until it convinces authorities it’s addressing shortcomings. It’s […]

-

Prosperity Period for Airline Sector

Read MoreAir travel has become so commonplace that it would be hard to imagine life without it which made the airline industry is vital to our world. It contributes to global economy by connecting cities / countries and it enables the flow of goods / people. In the past, the airline industry was at least partly government […]

-

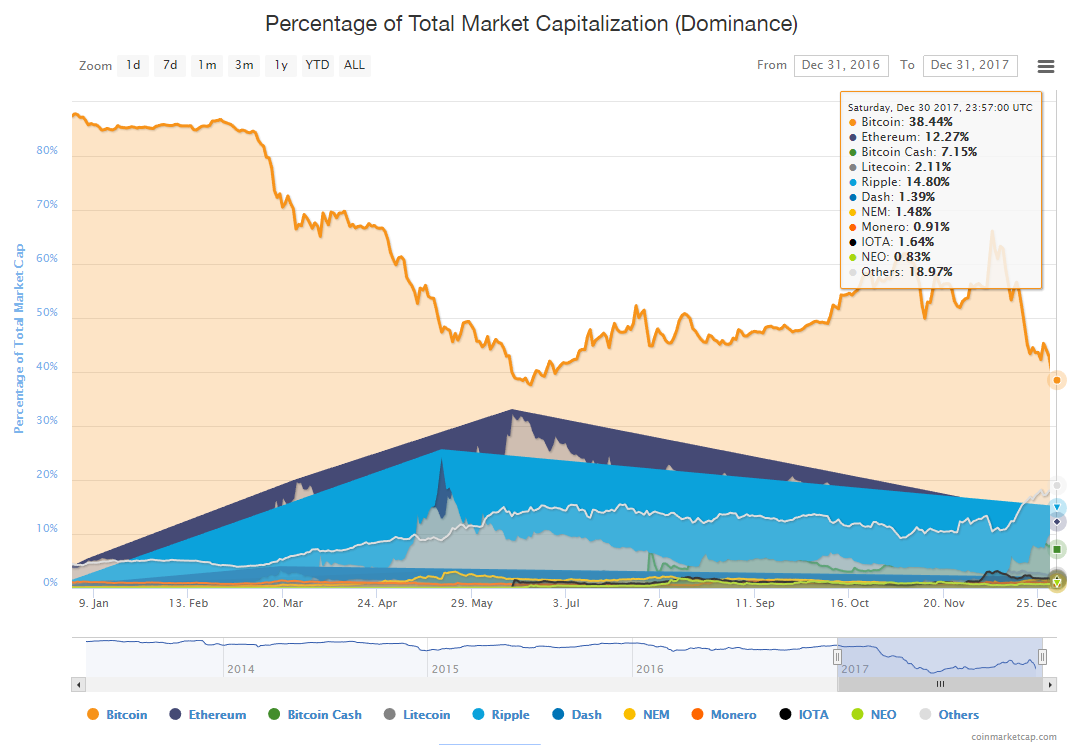

The Rise of Cryptocurrencies

Read More2017 was the mania year of cryptocurrencies without a doubt, ICOs (Initial coin offering) exploded in 2017 raising more then $3.5 billion in cryptocurrency and currently there are more then 1,400 new coin in the market compared to six years ago as bitcoin was the only cryptocurrency people talked about. The cryptocurrency market continued its growth in 2017 […]

-

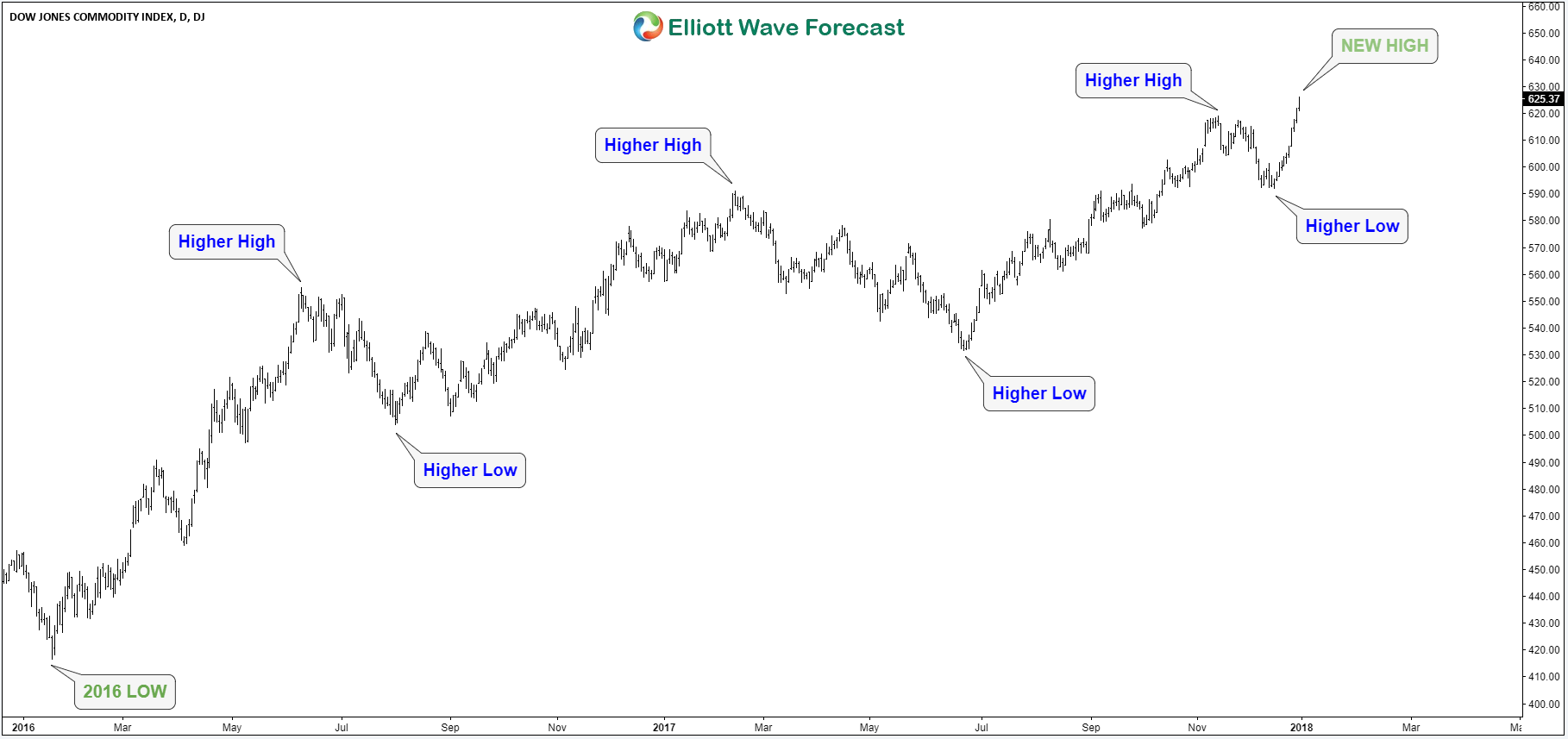

Gold is Ready for New Rally

Read MoreGold closed above $1,300 per ounce for the first time in 5 years as the U.S. dollar saw it’s worst decline over the past 14 years. Despite a strong start in 2017, XAUUSD spent most of the year in a sideways range around $1250 area before the final bounce came by year end to allow the precious metal to […]

-

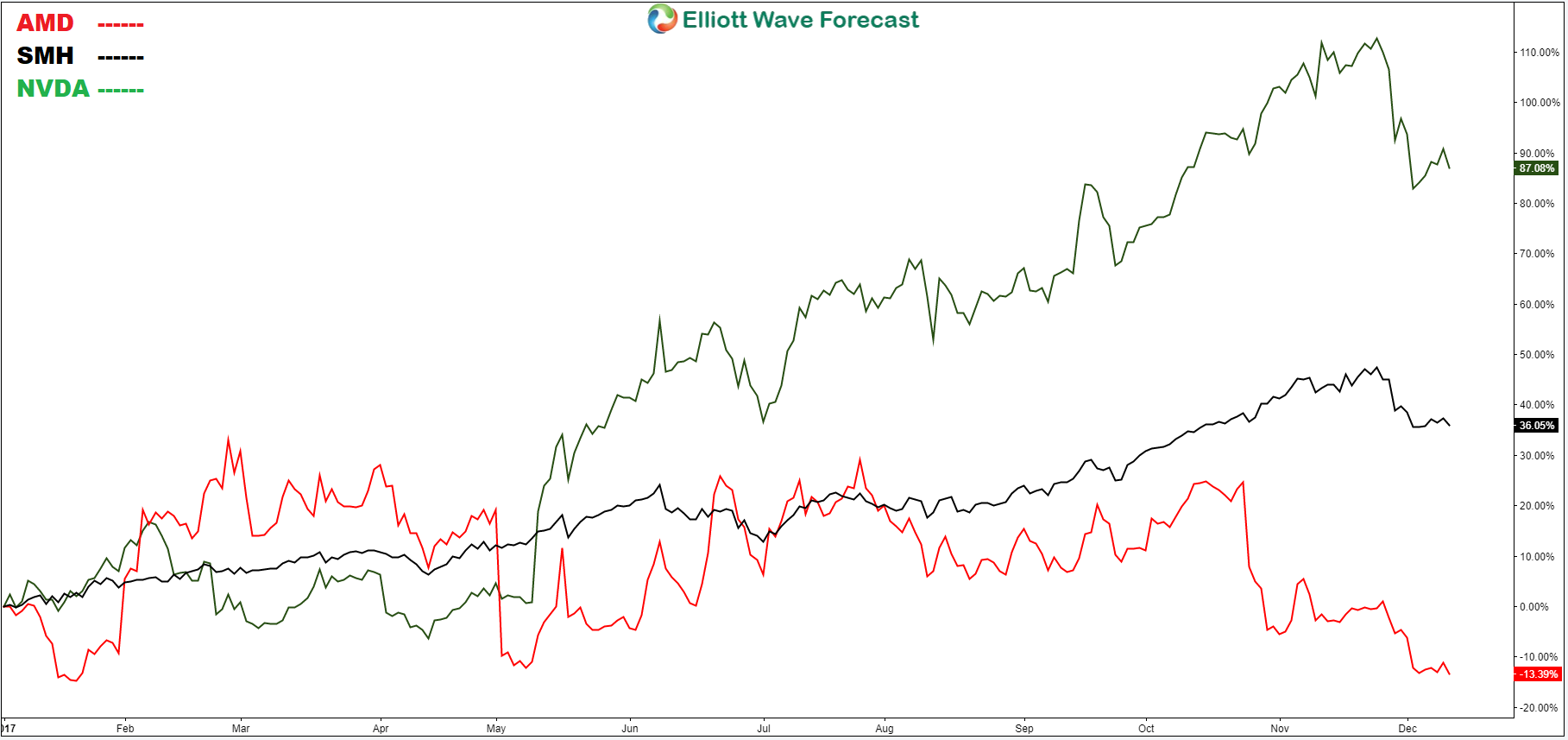

AMD Looking for Lower Levels

Read MoreAdvanced Micro Devices, Inc. (AMD: NASDAQ) is a Global semiconductor company based in California and it was founded 48 years ago. The company’s main products include microprocessors, motherboard chipsets, embedded processors and graphics processors for servers, workstations and personal computers, and embedded systems applications. The semiconductors industry saw it’s biggest growth since 2014 as global revenue surpassed […]

-

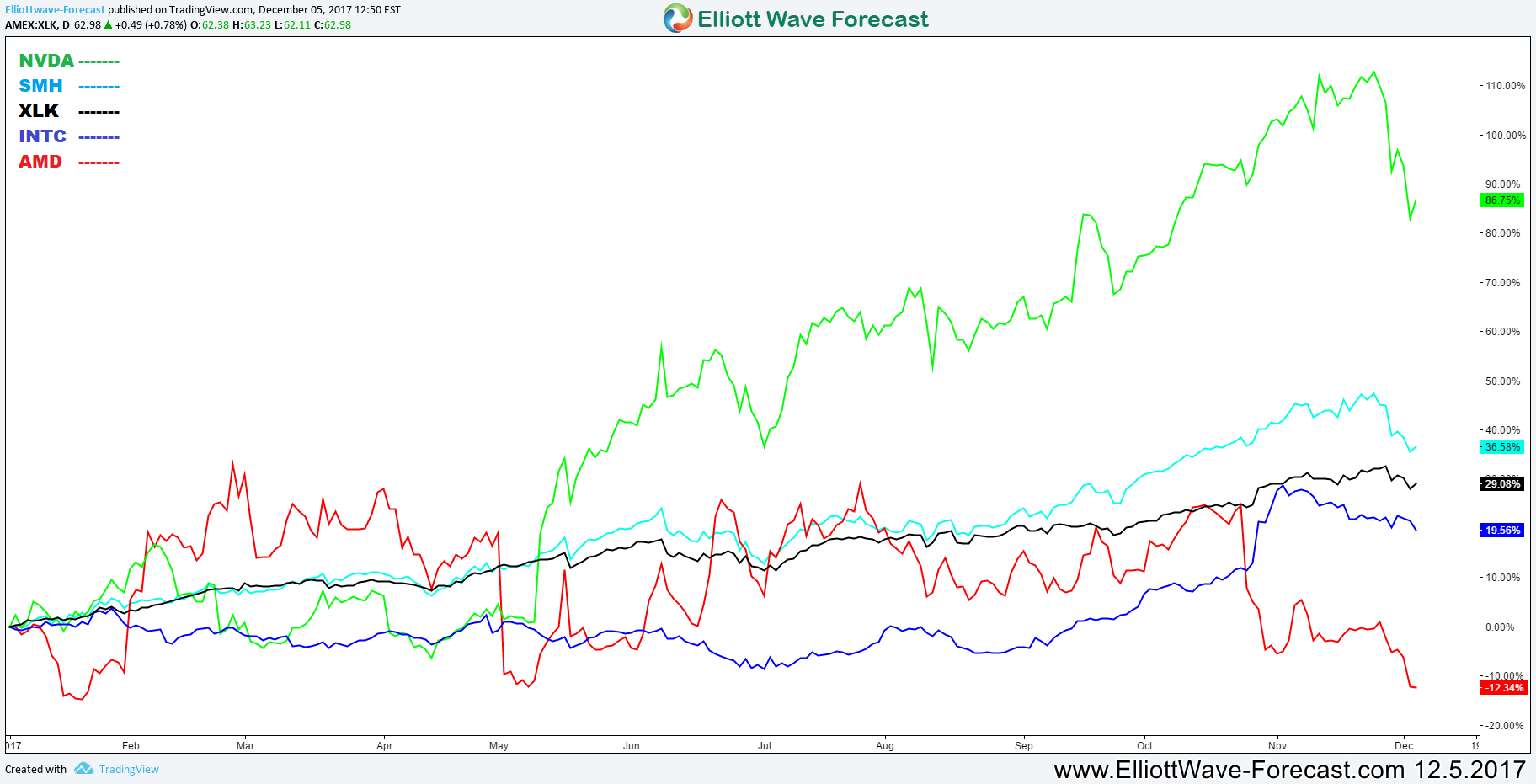

Nvidia NVDA Correction is Around the Corner

Read MoreThe American semiconductors company Nvidia (NASDAQ: NVDA) is specialized is designing graphics processing units (GPUs) for the gaming, cryptocurrency, and professional markets, as well as system on a chip units (SoCs) for the mobile computing and automotive market. Nvidia is considered as one of the strongest technology companies this year and its stock NVDA enjoyed a great rally this […]