-

PulteGroup (PHM) Riding the Wave of a Booming Real Estate Market

Read MorePulteGroup, Inc. (NYSE: PHM), a leading homebuilder in the United States, has been at the forefront of the booming real estate market. With a strong track record and a solid reputation, PulteGroup has positioned itself as a key player in the industry. In this article, we will delve into the bullish case for PHM, exploring […]

-

Bullish Sequence will Fuel Novo Nordisk (NVO) to More Upside

Read MoreNovo Nordisk (NYSE: NVO), a leading global pharmaceutical company, is revolutionizing the field of diabetes care and making a significant impact on patients’ lives. With its innovative treatments and commitment to improving health outcomes, Novo Nordisk has solidified its position as a key player in the healthcare industry. In this article, we delve into the […]

-

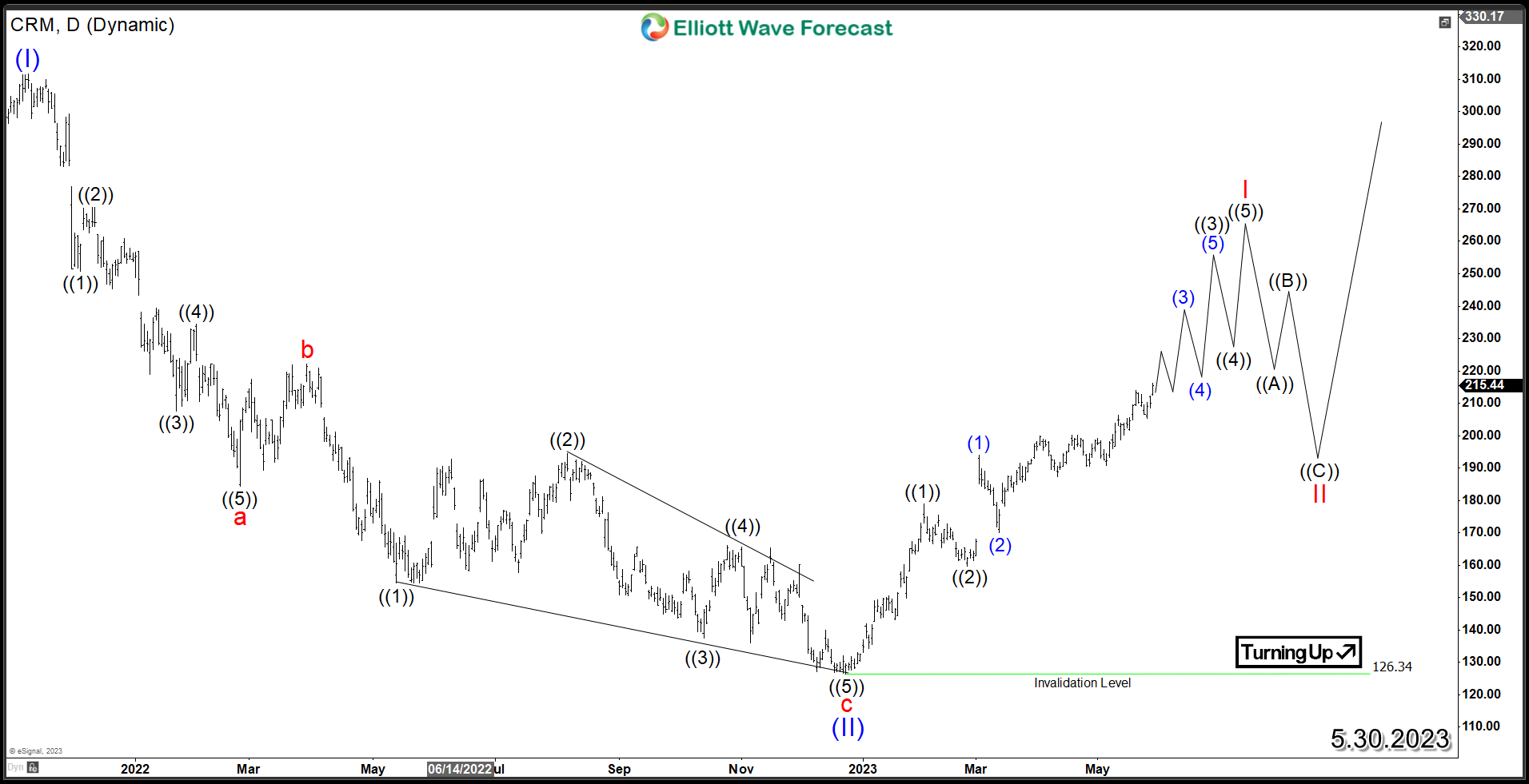

Salesforce CRM Primed for Growth as Cloud Computing Demand Soars

Read MoreSalesforce Inc (NYSE: CRM) is a leading player in the cloud computing industry, well-positioned for continued growth and success. This article explores the potential bullish technical structure of CRM using the Elliott Wave Theory. Between November 2021 and December 2022, CRM encountered a one-year decline. This downward movement resulted in a substantial drawdown of 59.5% from […]

-

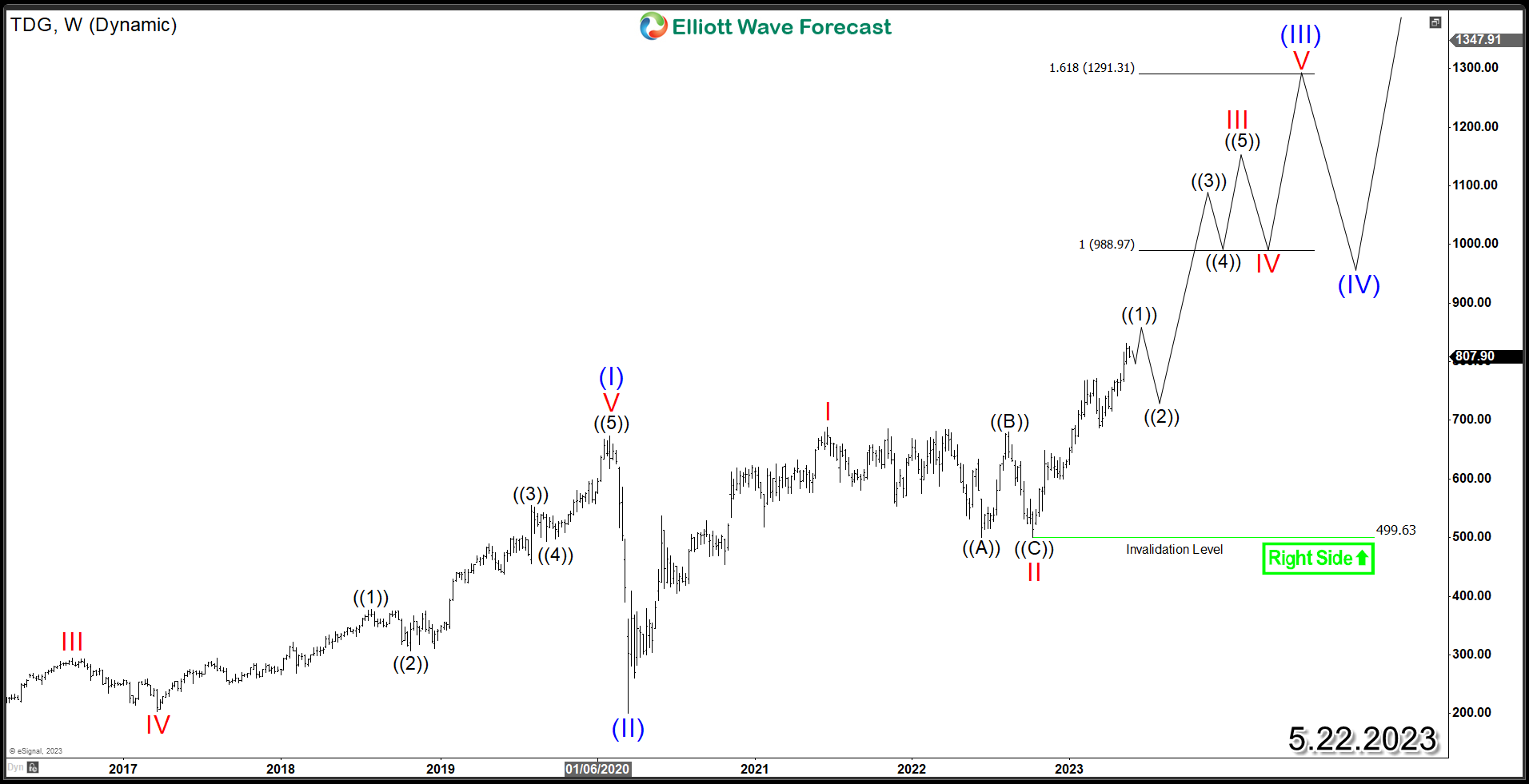

TransDigm Group Inc (NYSE: TDG) Continues to Soar

Read MoreTransDigm Group Inc (NYSE: TDG), a leading player in the aerospace industry, has been making significant strides in recent times. Despite facing challenges in the market, the company has managed to maintain a strong upward trajectory. This article aims to dive into the Elliott Wave technical analysis of TransDigm Group’s stock, exploring the bullish patterns and potential […]

-

Fortinet FTNT Continues to Dominate the Cybersecurity Market

Read MoreFortinet Inc (NASDAQ: FTNT) is a global leader in cybersecurity solutions. The company has a strong track record of growth and innovation, and it is well-positioned to continue to dominate the cybersecurity market in the years to come. FTNT’s products and services are used by businesses of all sizes to protect their data and systems […]

-

Procter & Gamble (NYSE: PG) Poised for Growth as Demand Soars!

Read MoreProcter & Gamble Co (NYSE: PG), a household name in consumer goods, has been a staple in many homes for generations. From Crest toothpaste to Tide laundry detergent, P&G’s products are ubiquitous and trusted by millions. But as the company faces increasing competition and changing consumer preferences, can it continue to deliver for its investors? […]