-

Immutable X (IMX) Price Action Signals Further Upside

Read MoreImmutable X (IMX) is the native token of a layer-two scalingi solution for Non-Fungible Tokens (NFTs) on the Ethereum blockchain. In today’s article, we’ll explore the Elliott Wave path taking place within the daily cycle. Since December 2022, IMX rallied higher within a regular impulsive 5 waves structure. This move established the wave ((1)) after +900% to the upside […]

-

Vulcan Forged $PYR Turning Bullish From Blue Box Area

Read MoreVulcan Forged $PYR is a utility token used to buy NFTs and virtual assets within Vulcan Forged games marketplace. In today’s article, we’ll dive into the daily structure setting up a bullish reversal based on the Elliott Wave Theory. $PYR started its rally from November 2022 low similar to Bitcoin, the token moved +315% to the upside until […]

-

Alephium $ALPH Enters Extreme Daily Buying Area

Read MoreAlephium is a Layer 1 blockchain network designed to address the limitations of existing solutions and initiate a new era of decentralized applications (dApps) and decentralized finance (DeFi). In today’s article, we’ll explore the daily Elliott Wave structure of the coin $ALPH and scout the potential path based on the Theory. $ALPH rallied from $0.0.046 low ( January […]

-

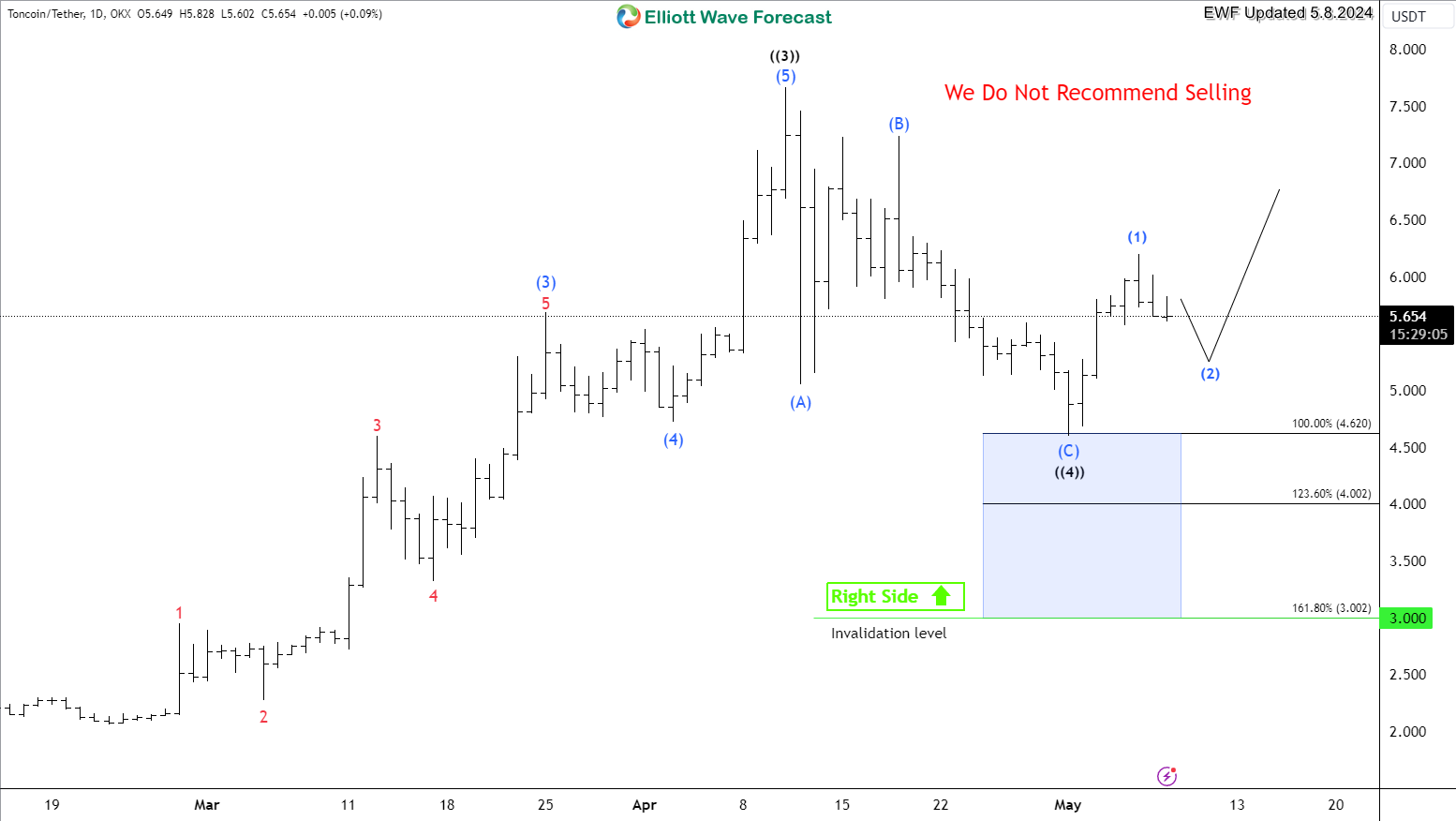

Toncoin $TON Daily Cycle Favors More Upside Toward $10

Read MoreToncoin $TON is the native cryptocurrency of The Open Network blockchain (previously Telegram Open Network). It is used for network operations, transactions, games or collectibles. In today’s article, we’ll dive into the daily Elliott Wave structure taking place and explore the potential path based on the Theory. $TON started a new bullish trend in June 2022. […]

-

Injective Protocol Coin $INJ Aiming For Daily Target at $100

Read More$INJ is the native token of Injective Protocol, a blockchain protocol optimized for trading assets across different blockchains and it offer auto-executing smart contracts which empower faster, more innovative and groundbreaking applications. In today’s article, we’ll explore the Elliott Wave path taking place within the daily cycle. Following the 4300% rally in the recent 2 years, $INJ […]

-

Optimism $OP Bulls Are Getting Ready to Take Over

Read MoreOptimism is a Layer 2 Optimistic Rollup network designed to utilize the strong security guarantees of Ethereum while reducing its cost and latency. In today’s article, we’ll take a look at the technical chart for its token $OP and explore the potential bullish path based on the Elliott Wave Theory. $OP saw an impressive 445% rally from […]