-

Trade Selection Process using Elliott Wave Theory

Read MoreMany traders overlook the process of selecting the right instruments to trade. Trading is a process which requires a lot of discipline and a good technique to be consistently profitable. Selection is one of the aspects which can define the life of a trader because without the right selection process, most traders are going to […]

-

AUDCAD Strategy of Day 10.27.2016

Read MoreAUDCAD has been rallying this week and today it broke above the peak at 10.25.2016 (1.0286). Decline from 10.25.2016 peak was pretty sharp and might have shaken some buyers but we viewed the decline as a buying opportunity because there were 5 swings up from 8.19.2016 (0.9753) to 1.25.2016 (1.0286) peak which is an incomplete Elliott […]

-

Cocoa Futures: Technical Picture from 2011 low

Read MoreCocoa Futures (CC #F) has ended the cycle from all time low at 3775 (March 2011) and then it made a sharp decline into 12/12/2011 low at 1983. Since then, we have seen Cocoa futures rallying in 5 swings which is a bullish sequence. Advance from 12/12/2011 (1983) low to 12/8/2015 (3429) was an overlapping […]

-

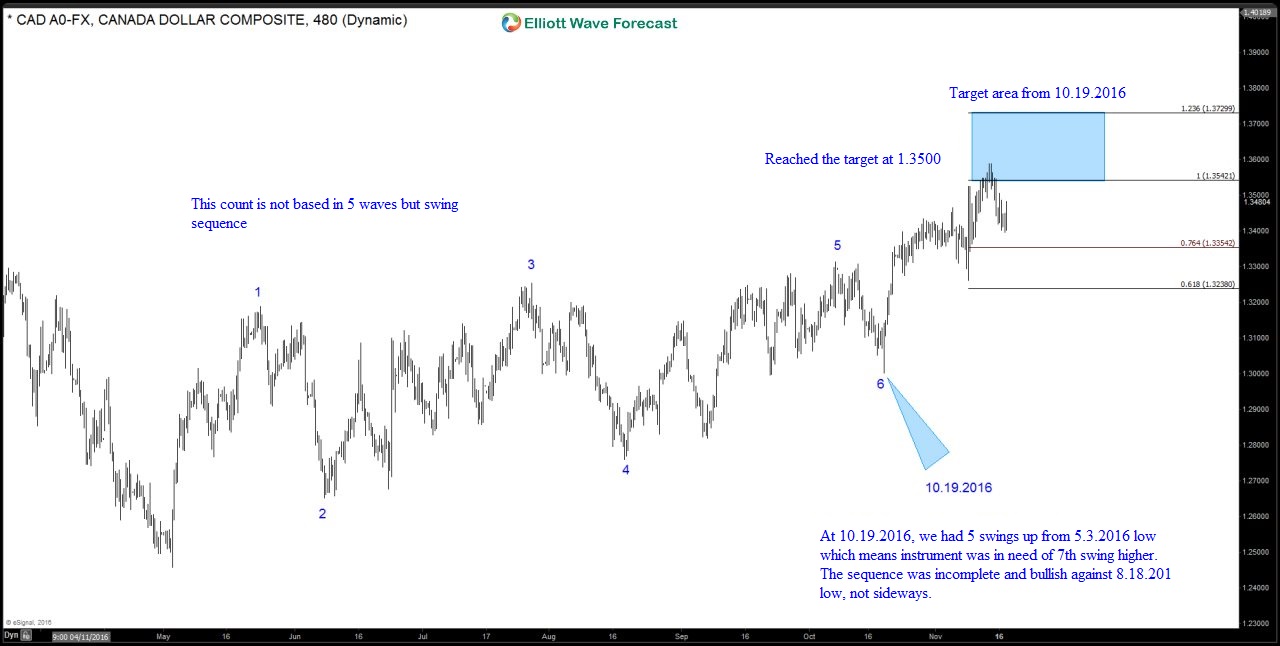

EURAUD Short-term Elliott Wave Analysis 10.19.2016

Read MoreBest reading of Elliott wave cycles suggests EURAUD is in a triple three Elliott wave structure from 10/6 (1.4779) high. Pair has got enough number of swings in place to call the cycle in wave W completed and soon a bounce would be expected to correct the cycle ideally from 9/15 (1.5096) peak and at least from 10/6 (1.4779) […]

-

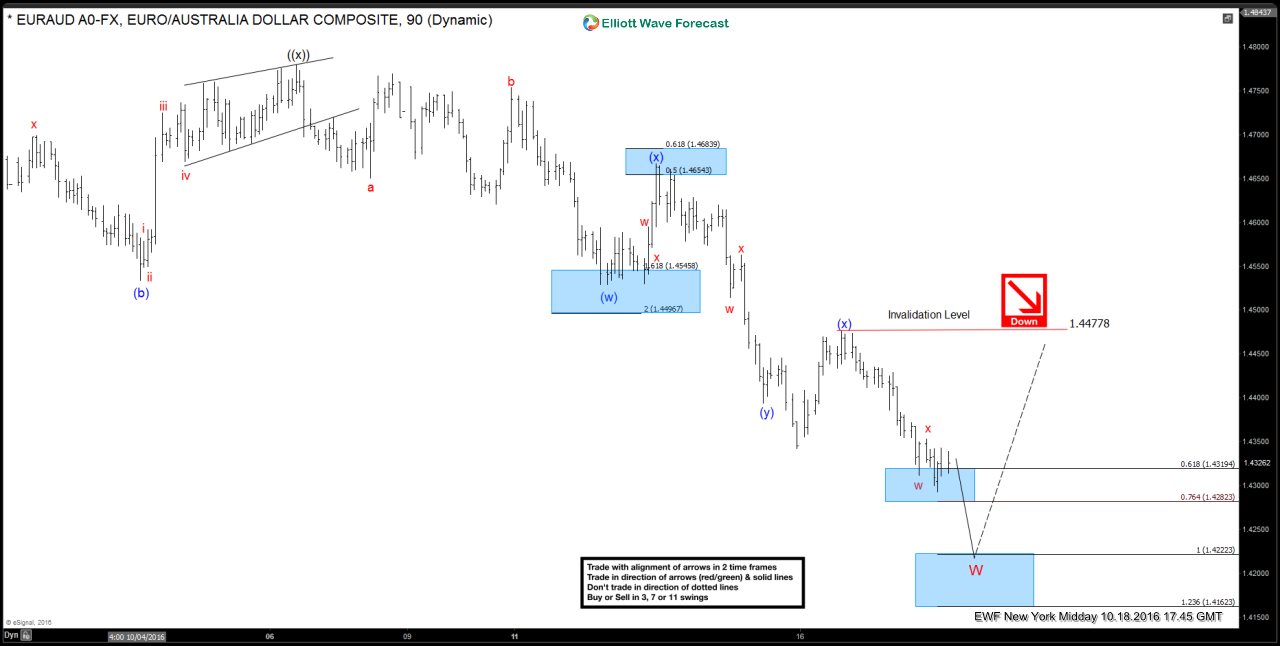

EURAUD Short-term Elliott Wave Analysis 10.18.2016

Read MoreBest reading of Elliott wave cycles suggests EURAUD is in a triple three Elliott wave structure from 10/6 (1.4779) high. While below 1.4353 and more importantly below 1.4477 high, pair has scope to make another push lower towards 1.4222 – 1.4162 area and then bounce in minimum 3 waves to correct the cycle from 10/6 (1.4779) peak […]

-

$TNX (10 Year Yields) Short-term Elliott Wave Analysis 10.17.2016

Read MoreShort term Elliott wave count suggests that pullback to 1.542 at 9/28 ended wave X. The rally from there looks to be unfolding as a 5 wave move and wave ((a)) is proposed complete at 1.801 . Wave ((b)) pull back is currently in progress to correct the cycle from 9/28 low (1.542) before the yields resume higher. We […]