-

Cryptocurrencies: Trading Opportunities Through USD Incomplete Sequence

Read MoreIn this video blog, we take a look at trading opportunities in Cryptocurrencies such as Bitcoin (BTCUSD) and Ethereum (ETHUSD) through the incomplete bearish sequence in USDPLN. USDPLN has an incomplete bearish sequence from the September 2022 peak against the October 2022 high. Pair has already broken below July 14, 2023 low which creates the […]

-

Bank of America (BAC) Bearish Sequence Provides Floor for Indices

Read MoreIn this video blog, we will look at the bearish sequence in BAC (Bank of America) and present two views that are slightly different in terms of the extent of the bounce but both are calling for an extension lower. We will also look at the area that can act as a floor for BAC […]

-

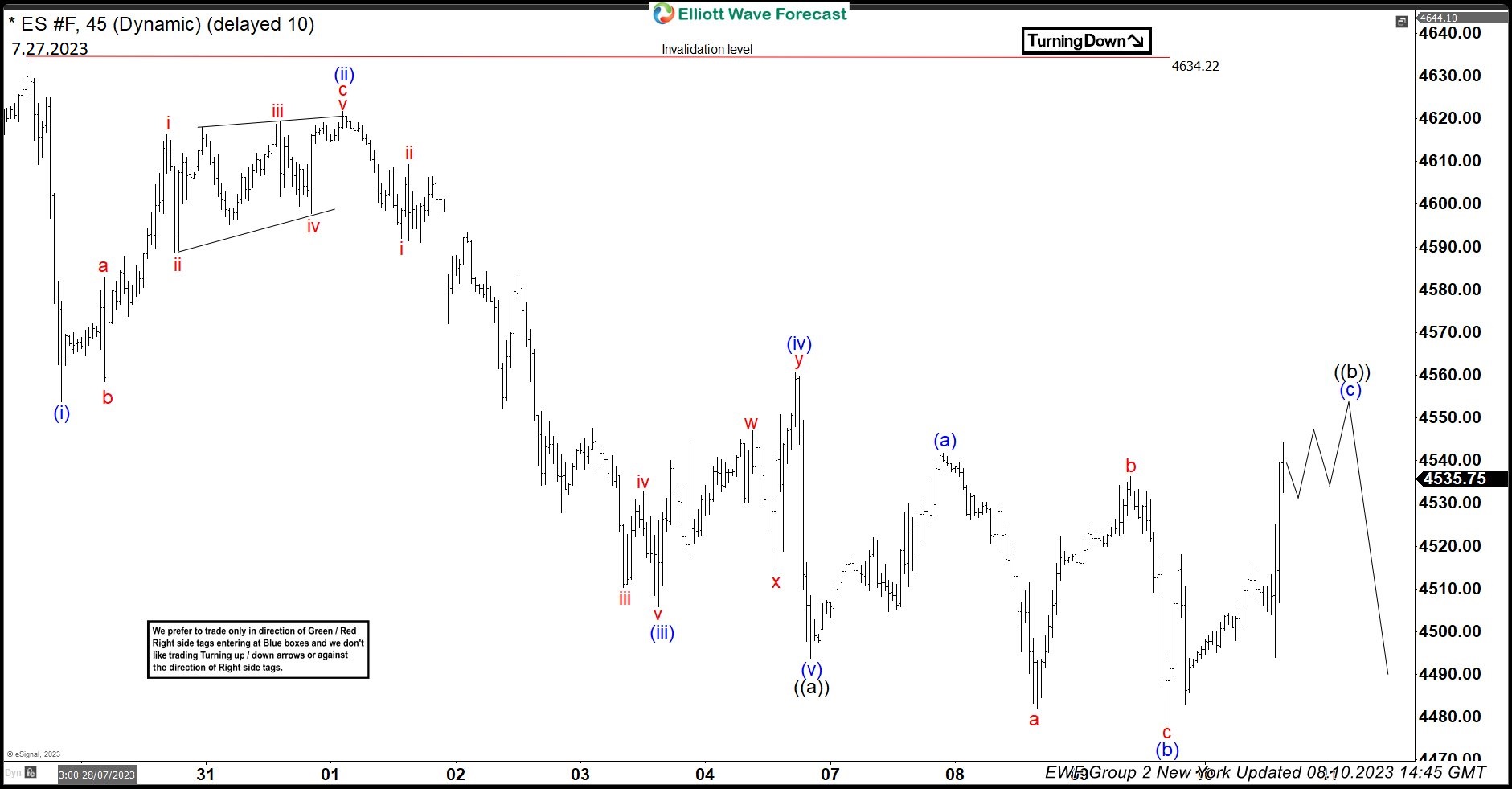

ES_F (E-mini S&P) Reaction from Equal Legs Area

Read MoreIn this article, we’re going to take a quick look at the Elliott Wave charts of ES_F (E-mini S&P 500) published in the members area of the website. As our members know, E-mini S&P500 is trading within the cycle from the October 13, 2022 low (3502). The rally so far is in 3 waves but has scope […]

-

![[Webinar Recording] Future Path of World Indices](https://elliottwave-forecast.com/wp-content/uploads/2023/09/Future-Path-of-World-Indices.png)

[Webinar Recording] Future Path of World Indices

Read MoreWe conducted a free webinar on the Future path of World Indices on Friday, 22nd September 2023. In this webinar, we looked at the future path of the World Indices. We did this using various Stocks and Indices like $CAT $BAC $NVDA $FTSE $NQ_F and $ES_F. We also talked about the US Dollar cycle correlation […]

-

FTSE and Hangseng Should Act As a Floor for the Indices

Read MoreIndices sold off last week, while some Indices reached extreme Fibonacci extension areas from the highs in 3 or 7 swings, it remains to be seen whether correction in the Indices is over or will extend. Today, we will take a look at Elliott wave sequences in two Stock Markets like FTSE from UK and […]

-

ES_F: Forecasting The Decline In A ZigZag Elliott Wave Structure

Read MoreES_F (E-mini S&P 500) dropped from 4634.50 to 4350 from 7.27.2023 to 8.18.2023. This decline took the form of a zigzag Elliott wave structure. Today, we will take a look at the structure of the decline from 7.27.2023 peak and how we spotted this zigzag structure and forecasted another leg lower in ES_F. Elliott Wave […]