-

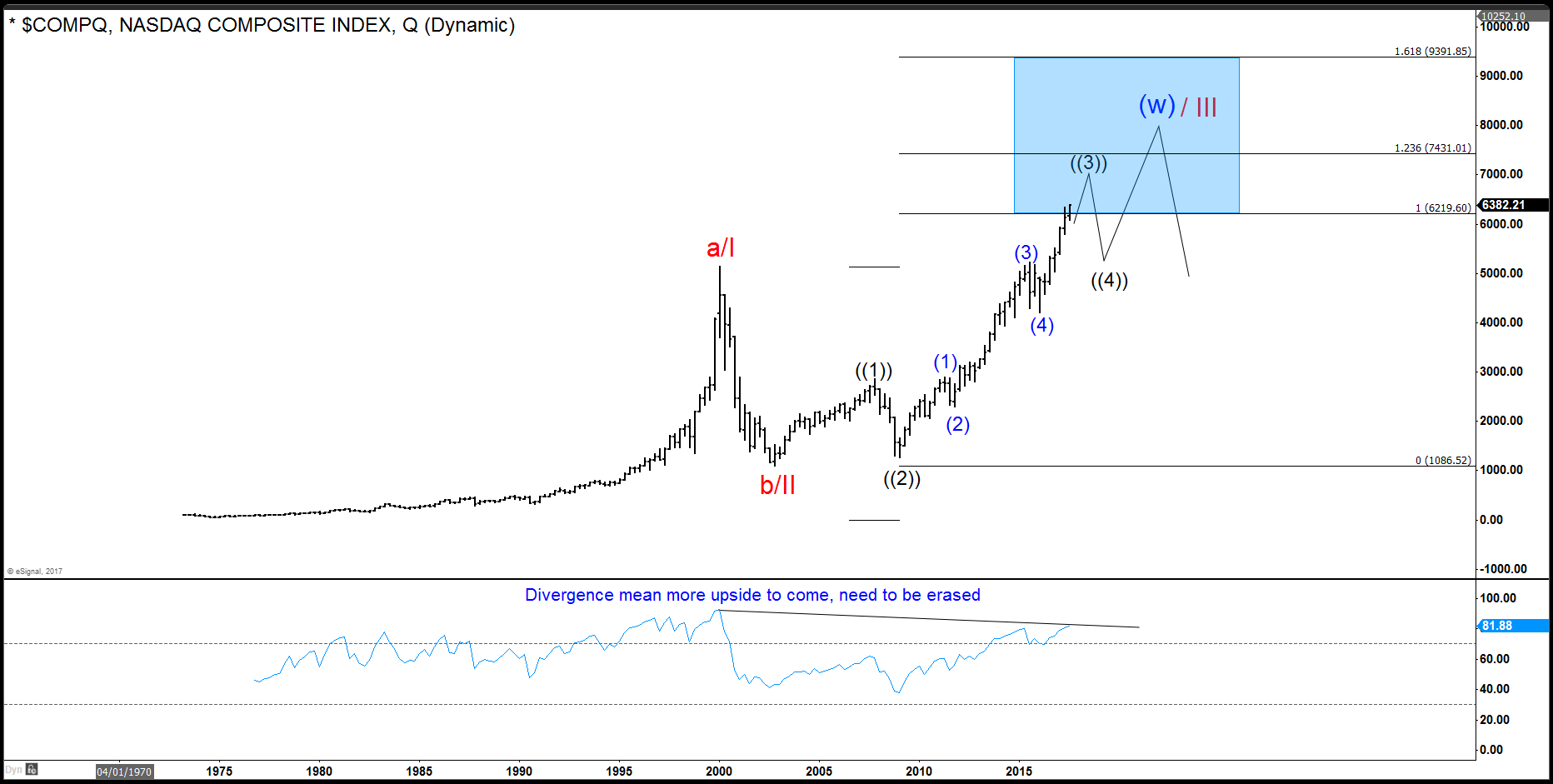

NASDAQ Composite Index should pullback soon

Read MoreThe following video/chart shows NASDAQ composite index. The index has a tremendous rally since the lows around 1975 which is pretty close to the zero level. The index has reached the bottom of the blue box at 6219 area. The question then is whether the index will extend higher or start correcting lower as the minimal […]

-

High Frequency Trading and Elliott wave Theory

Read MoreThe development of computer technology and the Internet is perhaps the most important progress that shape and characterize the 21st century. The proliferation of computer-based and algorithmic trading breed a new category of traders who trade purely based on technicals, probabilities, and statistics without the human emotional aspect. In addition, these machines trade ultra fast […]

-

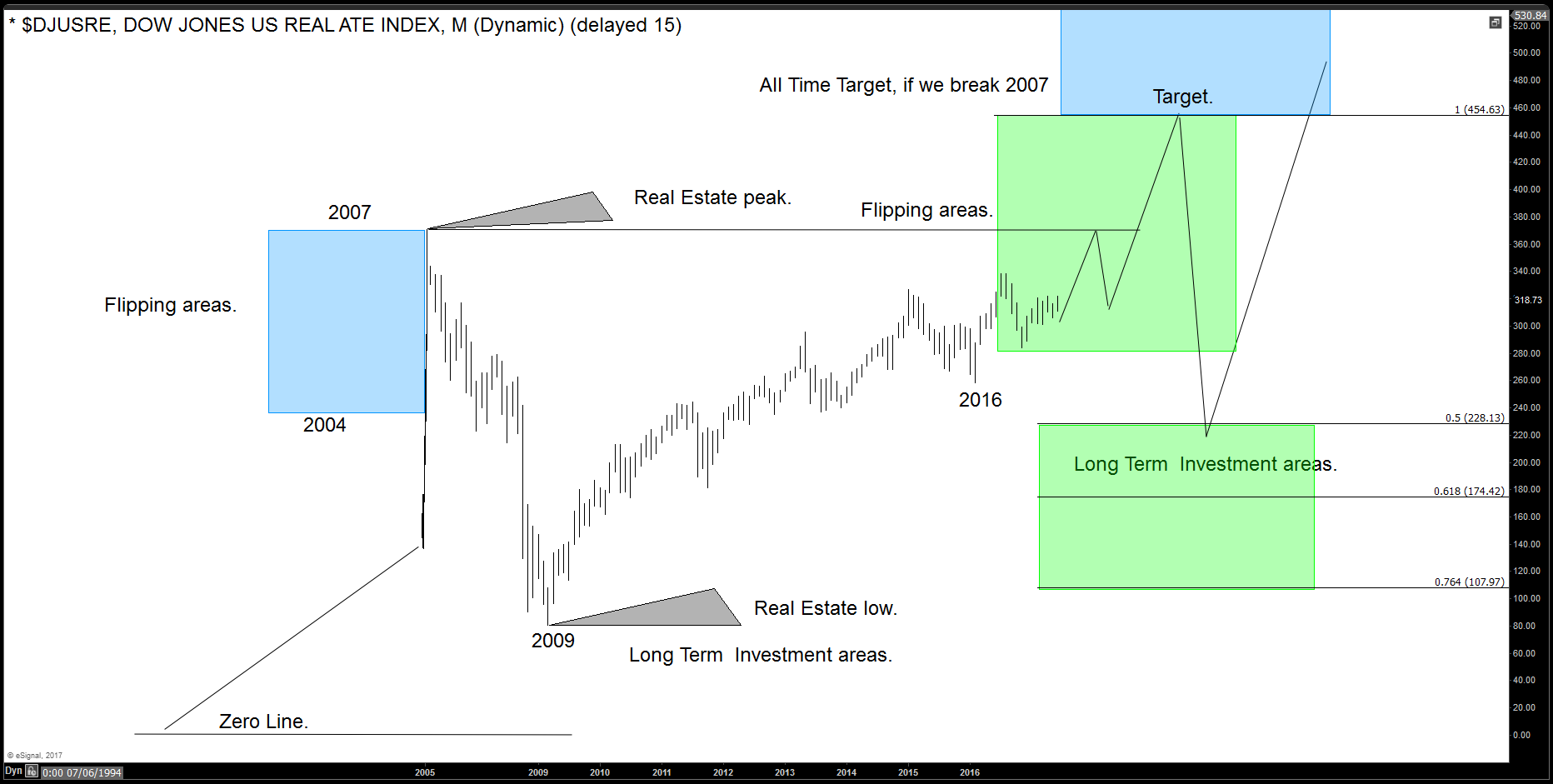

Real Estate (DJUSRE): Buy now or Wait?

Read MoreWe at Elliottwave–forecast.com track a lot of Indices around the World. One of the Indices we track is DJUSRE (Dow Jones US Real Estate Index) which provides a guideline for housing properties in the U.S. Buying real estate is always a good way to invest and make money. For years, investors use the real estate […]

-

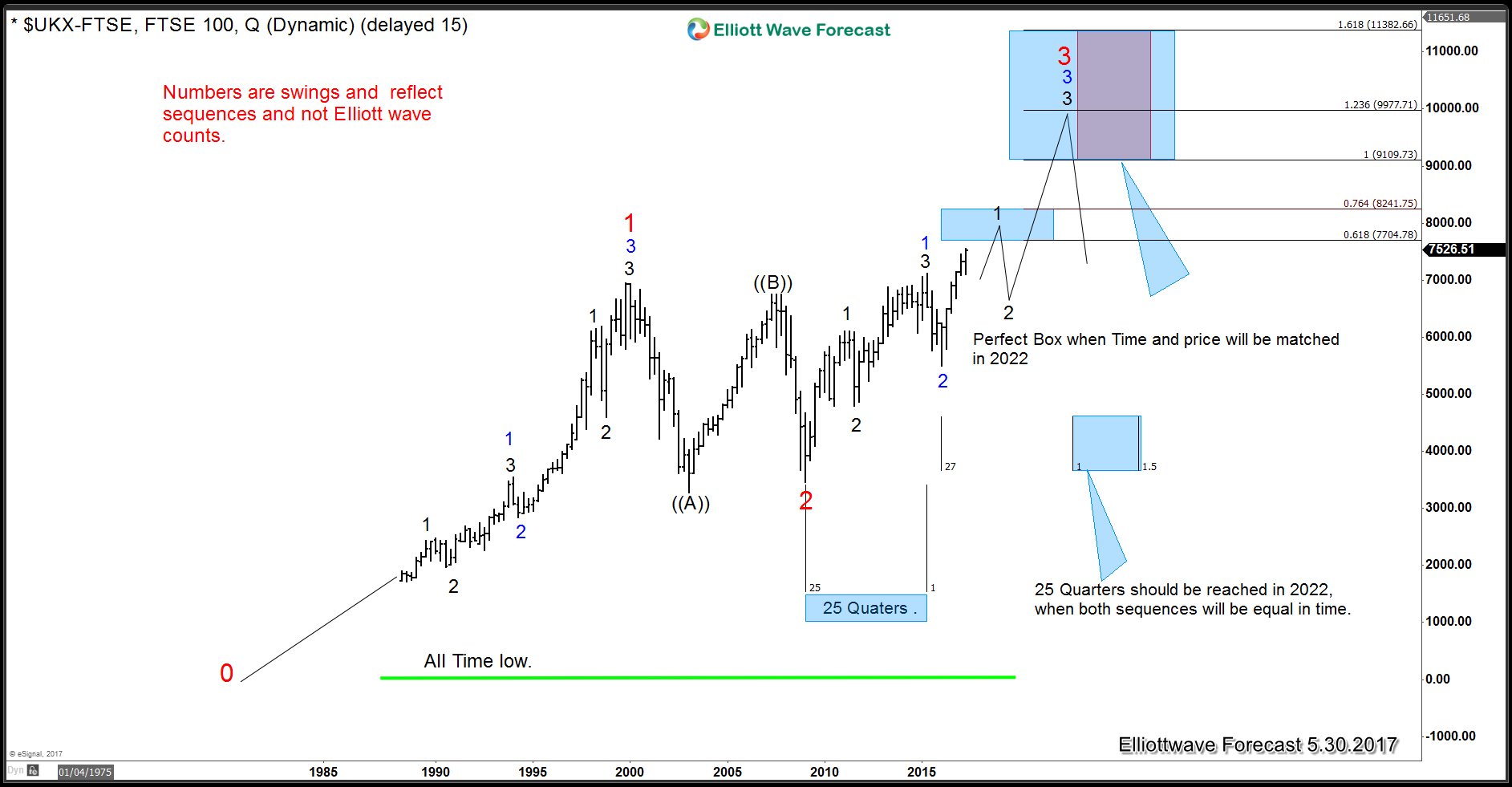

Are the World Indexes close to a Huge peak?

Read MoreAre the World Indexes close to a huge peak? Since the correction between the year 2000 and 2009, many traders around the world have developed an idea of bearish World Indexes with more downside to come. With Fed driving Market, everyone is under the idea that Global Indexes are inflated and will crash again resulting in another […]

-

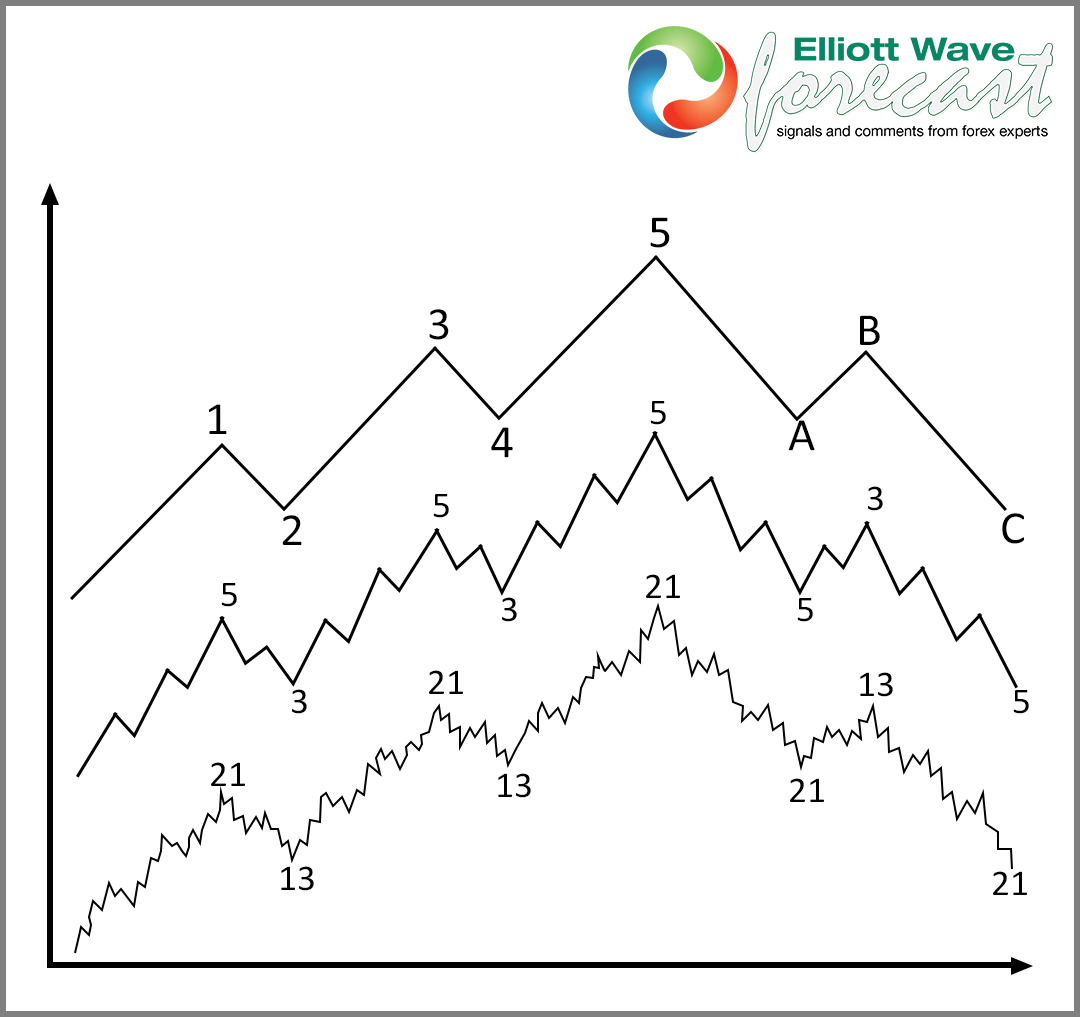

How to map the Market using Elliott wave Theory

Read MoreThe Importance of Trend Trading As many traders know, one of the most important aspects of the Trading profession is understanding the trend and how to develop a trend trading system. Many traders wants to trade every single line or move in the Market and that is the major reason why 95%-97% of the traders […]

-

INDU: Elliott Wave Structure showing more upside

Read MoreIn the Elliott wave Theory, the main idea is an advance in 5 waves followed by 3 waves back, this is seen most of the times in Indexes and right now INDU (Dow) is showing a possible 5 waves advance since the low at 1.19.2017. As of right now, we should be ending the wave ((iii)) in […]