-

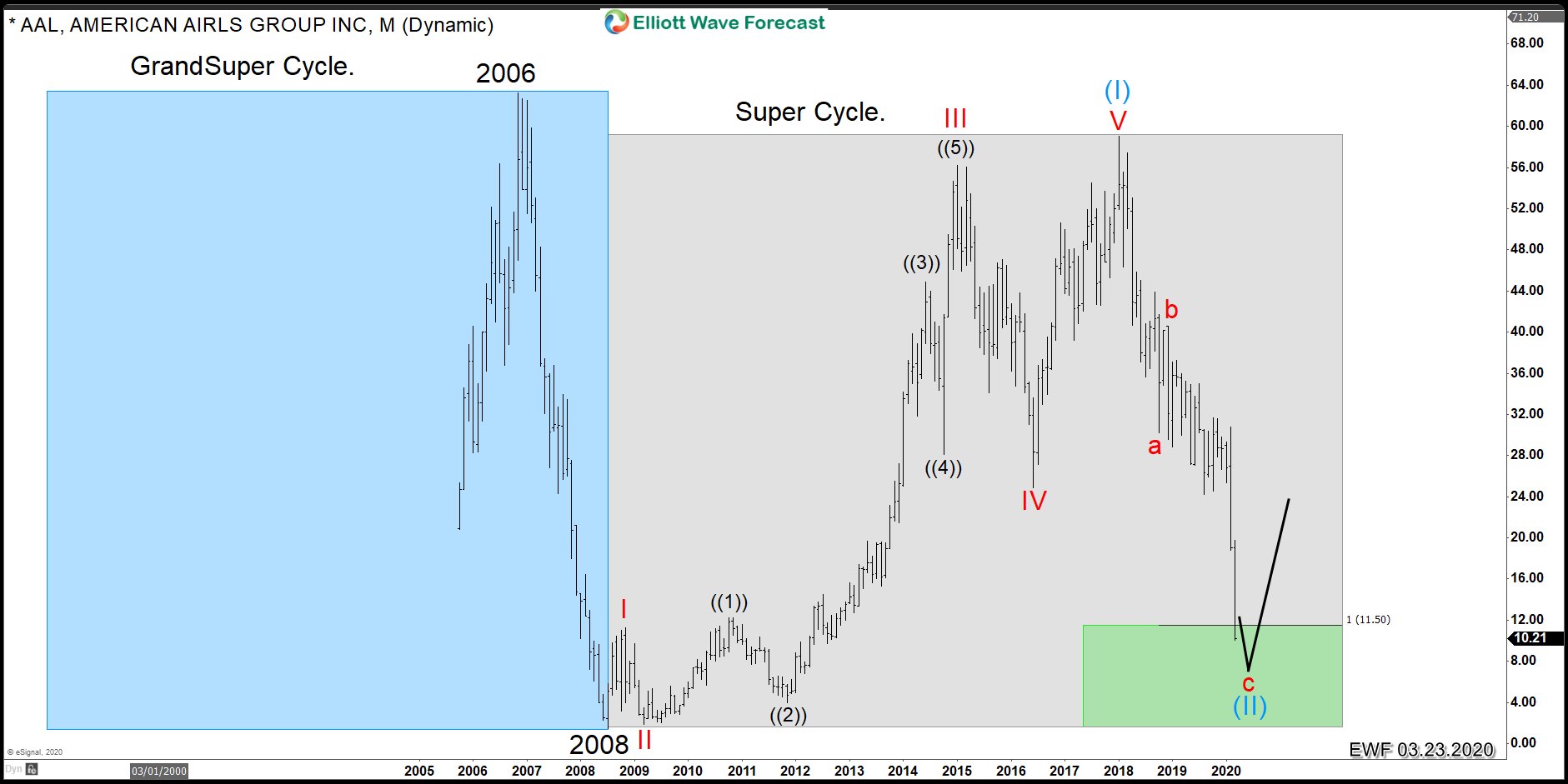

American Airlines (AAL): Another Buying Opportunity

Read MoreIn this article, we will look at the American Airlines (AAL) to make sense of the recent huge volatility in the stock market. The world faces a tremendous crisis due to the pandemic created by the Corona virus. The financial markets consequently have entered a tremendous selling pressure. As it always happens, some sectors always […]

-

Home Depot (HD) Ending 2008 Cycle, $267 Remains Target

Read MoreThe 2009 cycle is ending across the World Indices. Many Indices show five waves already since the lows, but some have been weak since the previous peak sometimes around 2018. Indices like $FTSE, among others, are reaching the Blue Box area since 2018. The following chart shows the extreme area in $FTSE: FTSE Reaching Extreme […]

-

$INTC (Intel) Still Remains Supported Until $88.00 Area

Read MoreIn this article, we will look at the Elliott Wave technical path for Intel (ticker: INTC). Most world indices is still trading within the 2009 cycle and should see more upside until the cycle ends. The 2009 cycle is ending because index like $SPY shows a clear five waves advance since 2009. This is a […]

-

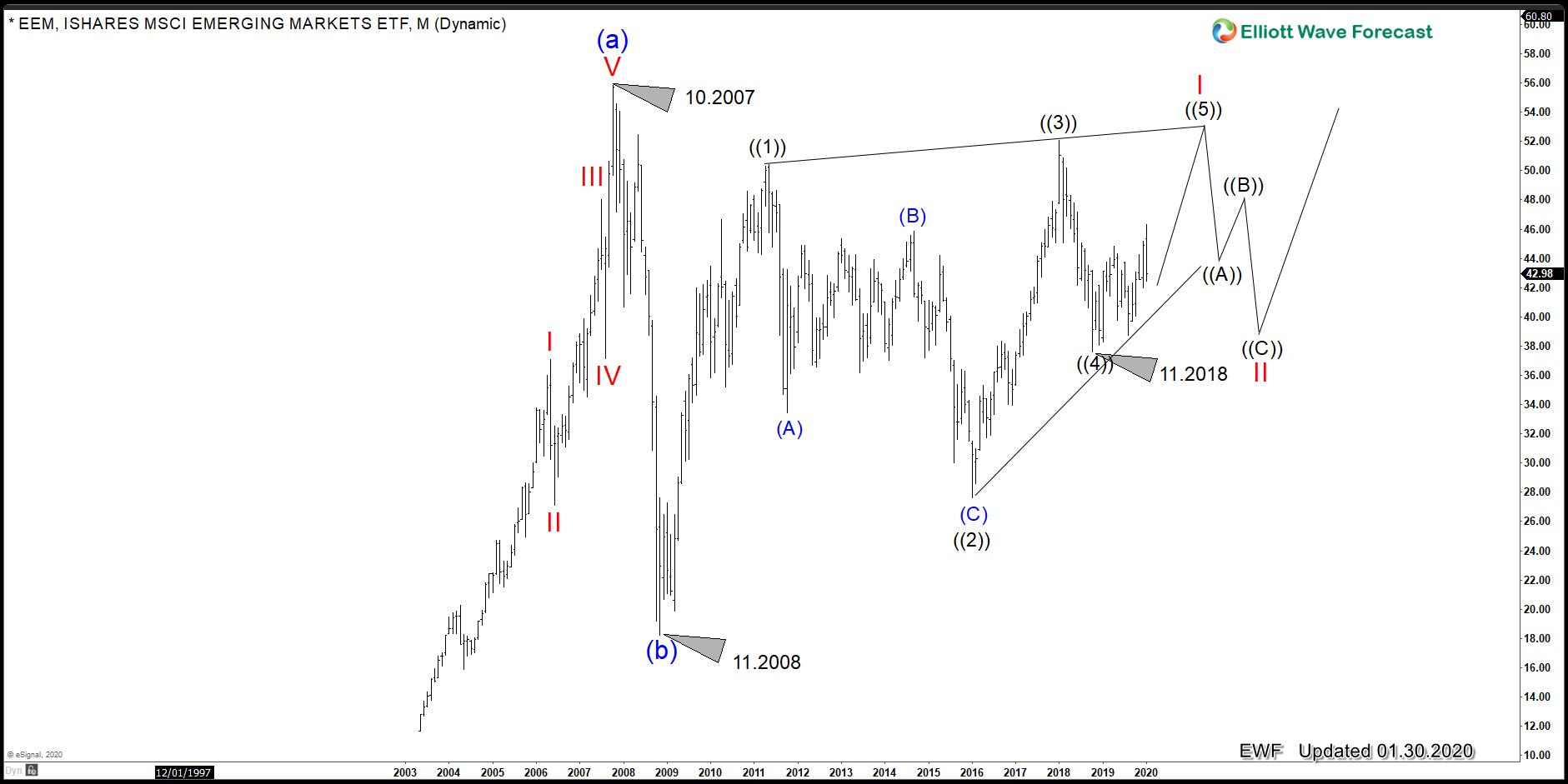

Emerging Market (EEM) Likely Will See New Highs

Read MoreThe Emerging Market (EEM) trade within the same cycles as World Indices. However, when comparing it to Indices like $SPY and $SPX, EEM lag behind after it bottomed in 11.2008. Looking at the Grand Super Cycle price action, EEM peaked in 10.2007 then dropped hard along with other Indices. It bottomed in 11.2008 and since […]

-

Nvidia Corp (NVDA) Within Powerful Wave ((III))

Read MoreNvidia is one of those instrument across the market which has ended the Grand super cycle since the all-time low. The advance since the all-time low appears impulse or five waves advance which ended on 10.01.2018. As the Elliott Wave Theory explains, after five waves, there will be three waves pullback. The Instrument turned lower […]

-

Best Buy (BBY): The Instrument is ending wave III of (III)

Read MoreBest Buy ( $BBY) is showing an incomplete cycle in the Grand Supercycle degree. This article explains the Elliott wave path.