-

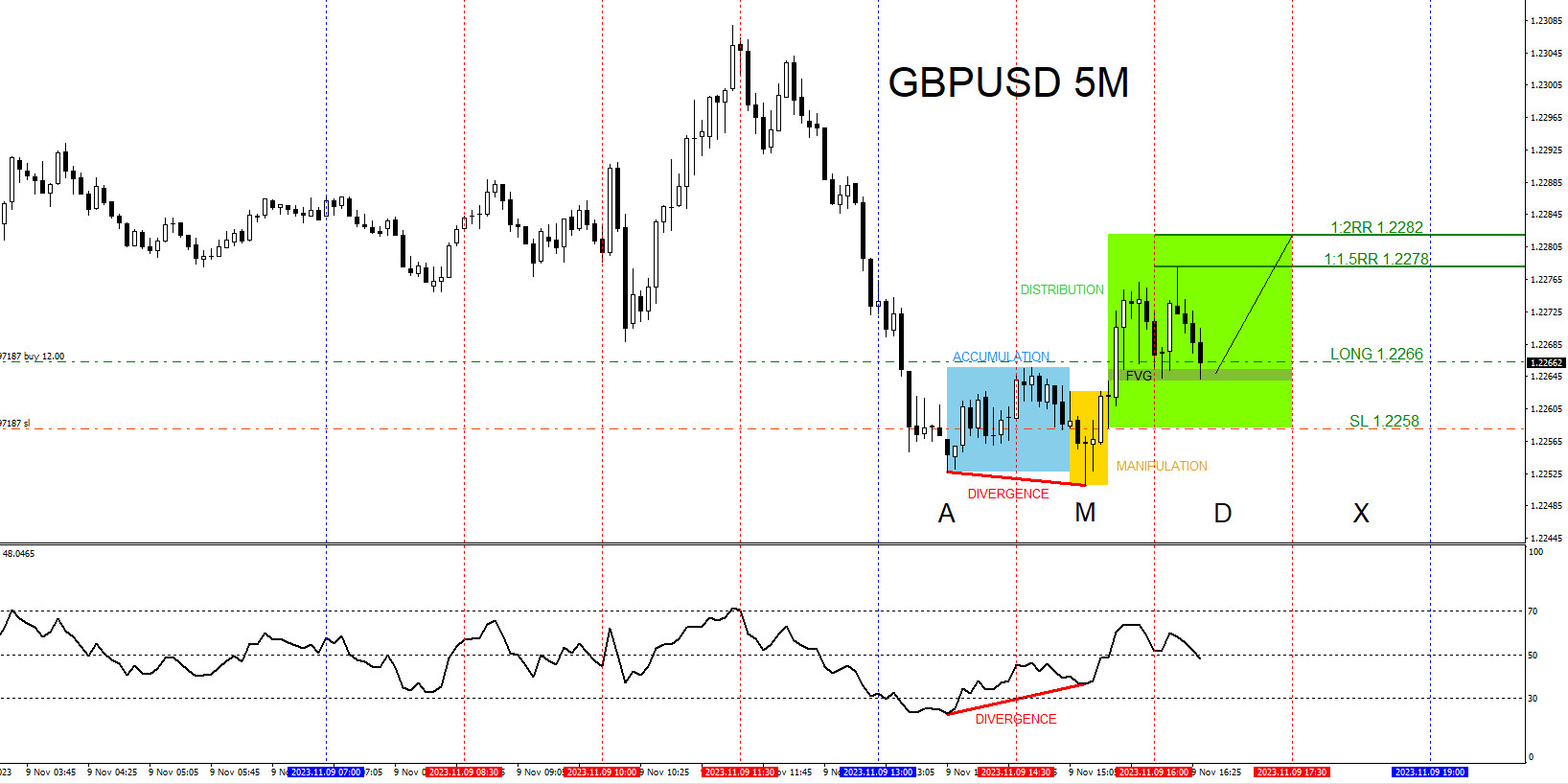

GBPUSD : Buy Trade Hits Targets

Read MoreThe accumulation, manipulation, distribution market pattern happens everyday in the markets. On November 9 2023 this pattern was visible on the GBPUSD pair during the New York session hours. The manipulation phase followed by the distribution phase usually occurs during the 1:30am to 4:30am EST hours during the London session and the 7:30am to 10:30am […]

-

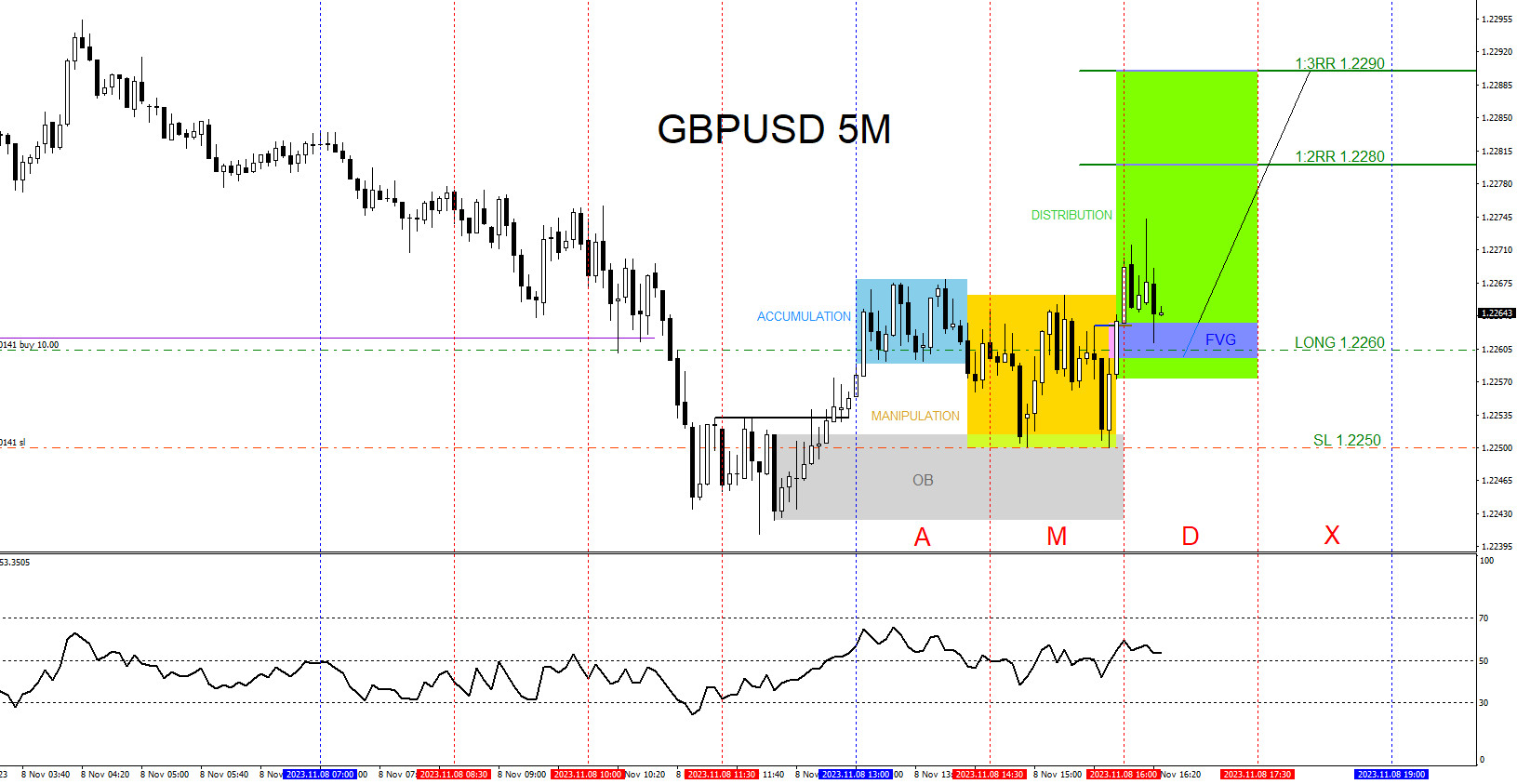

GBPUSD : Accumulation, Manipulation, Distribution 11.8.2023

Read MoreThe accumulation, manipulation, distribution market pattern happens everyday in the markets. On November 8 2023 this pattern was visible on the GBPUSD pair during the New York session hours. The manipulation phase followed by the distribution phase usually occurs during the 1:30am to 4:30am EST hours during the London session and the 7:30am to 10:30am […]

-

NASDAQ100 : Accumulation, Manipulation, Distribution

Read MoreThe accumulation, manipulation, distribution market pattern happens everyday in the markets. On October 31 2023 this pattern was visible on the NASDAQ100 index. Before any move upwards or downwards, the market needs to take out stop losses and manipulate traders to enter buy or sell orders to form liquidity for the market. This market pattern […]

-

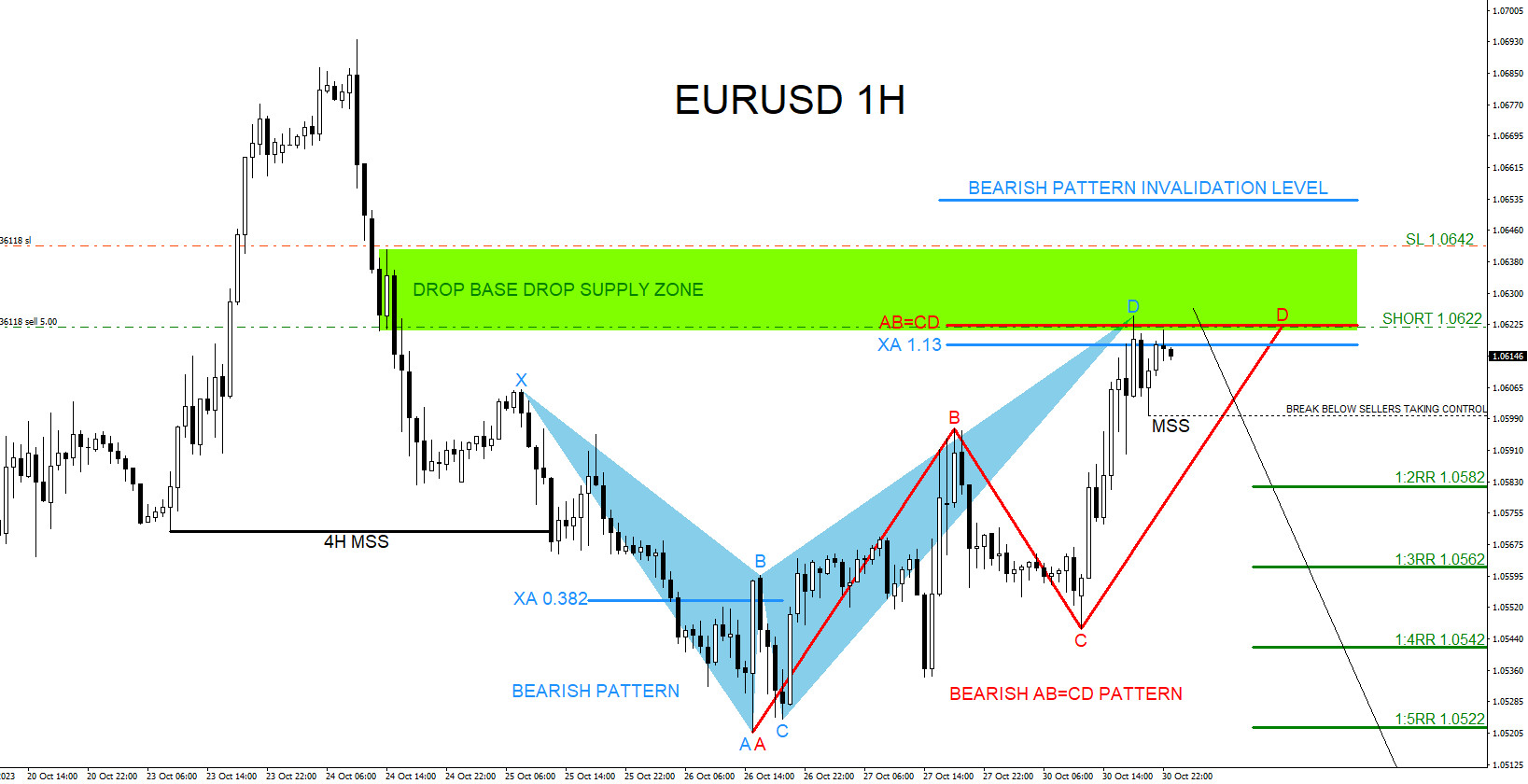

EURUSD : Bearish Patterns Calling for a Move Lower?

Read More***OCTOBER 31 2023 : EURUSD SELL Trade was stopped out for -20 pips*** EURUSD Sell trade entered at 1.0622 with a 20 pip Stop Loss at 1.0642. Targets at 1.0582 (1:2RR minimum target) and 1.0522 (1:5RR maximum target). The pair can still make a small push higher to grab buyside liquidity from today’s high but […]

-

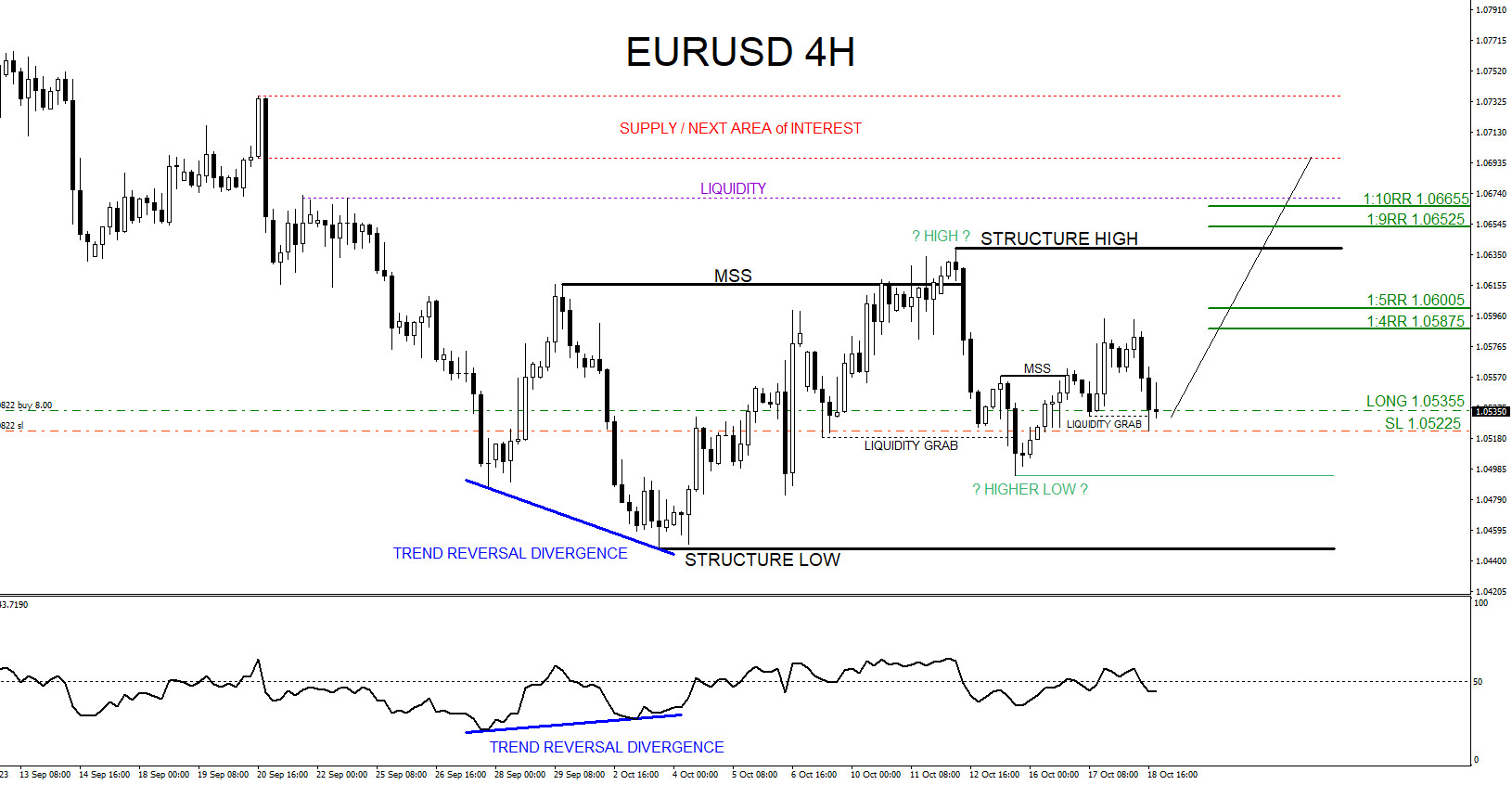

EURUSD : Catching the 130 Pip 1:10 Risk/Reward Move Higher

Read MoreOn October 17 and 18 2023 I posted on social media, @AidanFX , “EURUSD: Expecting for bulls/buyers to attack the weak structure high and break above to the liquidity level and to the supply/next area of interest zone. Let’s see what it does in the rest of the trading week.” and “EURUSD: Will be looking to […]

-

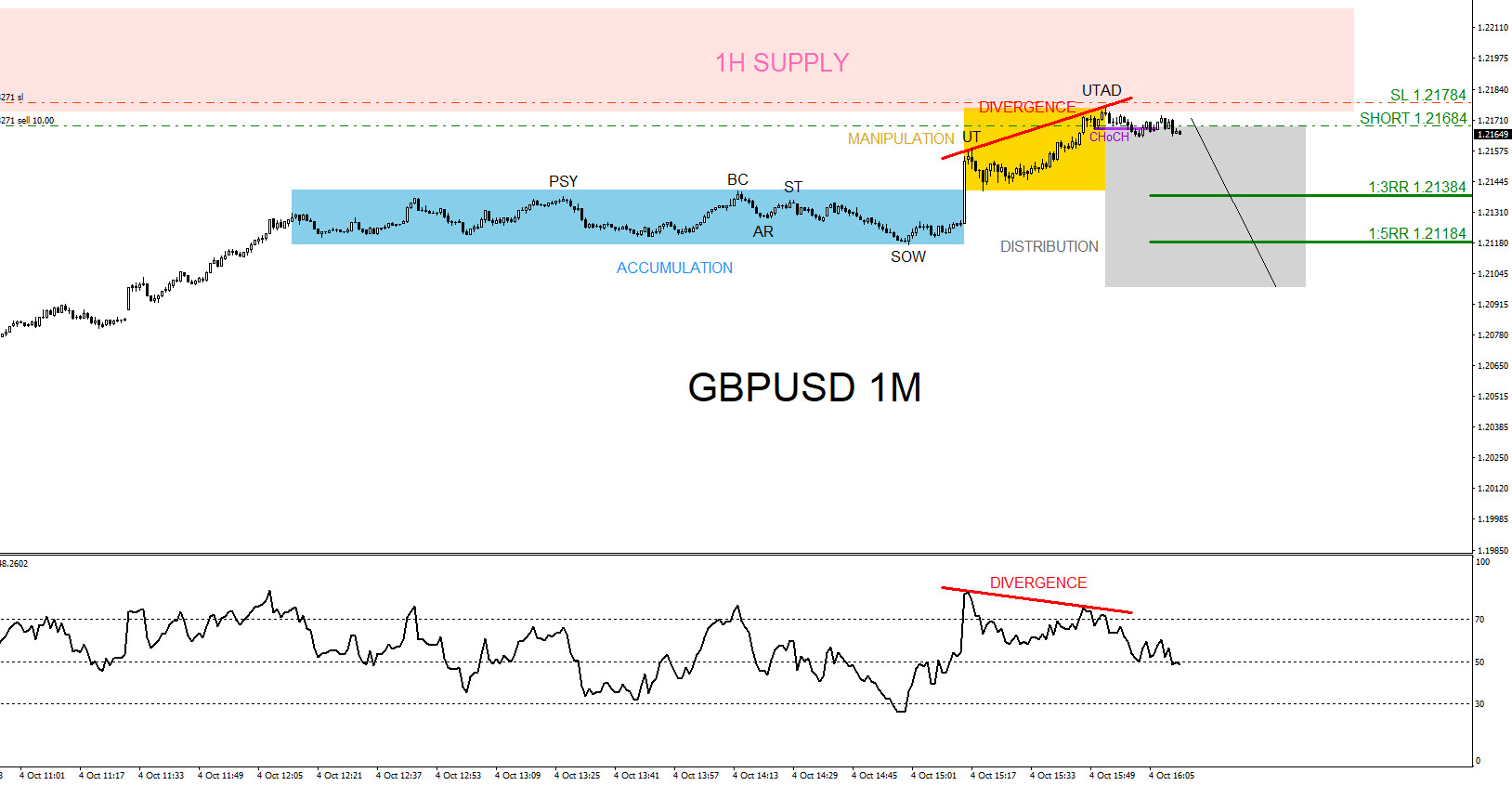

GBPUSD : Sell Trade Hits Targets

Read MoreOn October 4 2023 I posted on social media @AidanFX ” Sold GBPUSD at 1.21684 Stop Loss at 1.21784 Target at 1.21384.” SELL Trade Setup 1. Price entered the 1 Hour supply zone area signalling a reversal move lower. (Pink) 2. Bearish Wyckoff distribution schematic pattern (Black Labels) terminating in the supply zone signalling a […]