The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Silver Miners ETF (SIL) Maybe Ready to Resume Higher

Read MoreSilver Miners ETF (SIL) Ended Correction and maybe ready to resume higher. This article and video look at the Elliott Wave path.

-

Consumer Staples ETF $XLP Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Consumer Staples ETF ($XLP) through the lens of Elliott Wave Theory. We’ll review how the rally from the October 06, 2023, low unfolded as a 5-wave impulse and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 5 Wave Impulse Structure […]

-

Robinhood (NASDAQ: HOOD) Extension in Wave III Above $50

Read MoreSince our previous blog about Robinhood stock HOOD, the price tripled during a strong bullish upside move. Therefore, we’ll be looking at the daily Elliott Wave Structure and explain the current structure within the cycle. The recent daily rally started in August 2024, HOOD established an impulsive 5 waves structure to the upside within wave III. In addition, it exceeded […]

-

Tesla Inc. $TSLA Blue Box Area Offers A Buying Opportunity and Can Reach $515

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Tesla Inc. ($TSLA) through the lens of Elliott Wave Theory. We’ll review how the rally from the November 27, 2024, low unfolded as a 5-wave impulse and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 5 Wave Impulse Structure + […]

-

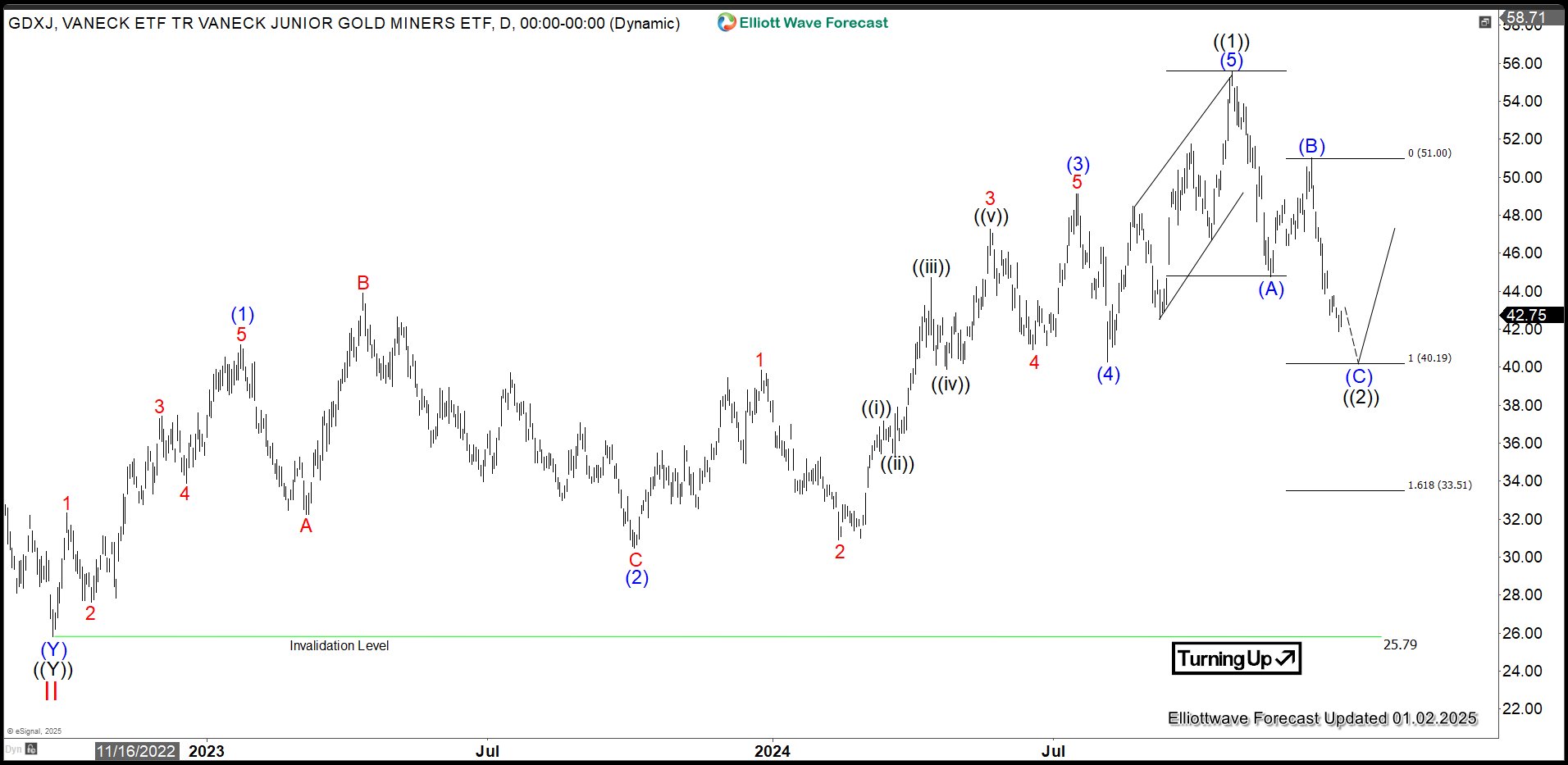

Gold Miners Junior (GDXJ) Zigzag Correction in Progress

Read MoreGold Miners Junior (GDXJ) is an exchange-traded fund (ETF) managed by VanEck. This ETF primarily invests in small-cap companies in the gold and silver mining sector. The ETF has higher potential for growth or risk compared to larger, established mining companies. These junior miners can offer significant leverage to gold price movements. It makes GDXJ […]

-

SUI Expecting The Final Bullish Wave To Break Above $5

Read MoreSince our previous Video blog about SUI, the coin rallied more than 900%. Therefore, we’ll be looking at the daily Elliott Wave Structure and explain the current structure within the cycle. The recent daily rally started in August 2024, SUI established an impulsive 5 waves structure to the upside within wave ((3)). In addition, it reached […]