Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

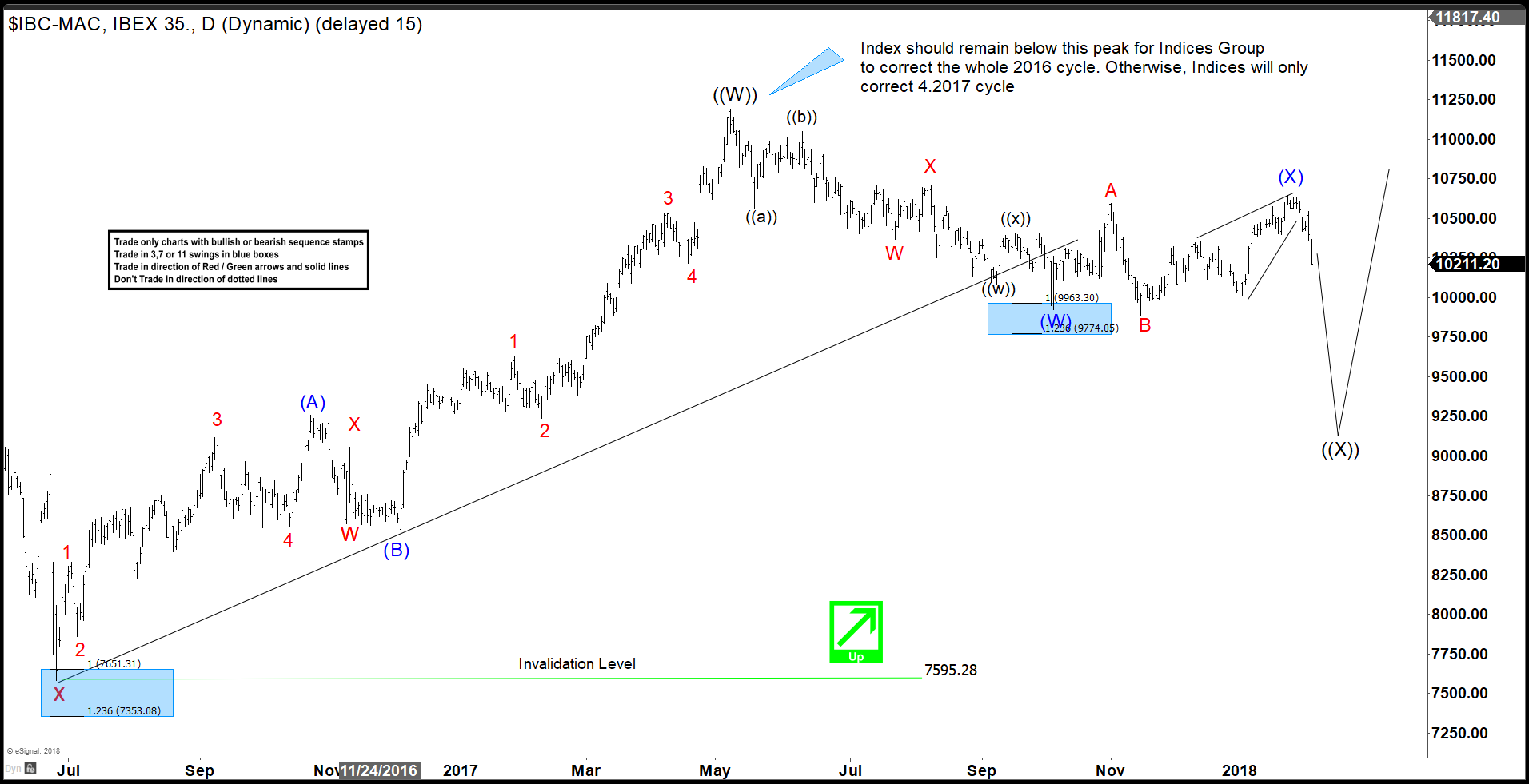

Elliott wave Theory and Market Timing

Read MoreIn this blog, we will talk about the concept of Market Timing. Market is a wild animal which always, is in full control. Many traders want to trade every day and always getting in and out of the market which ends up more like gambling than trading. We at Elliottwave-Forecast.Com have practiced the Elliott wave […]

-

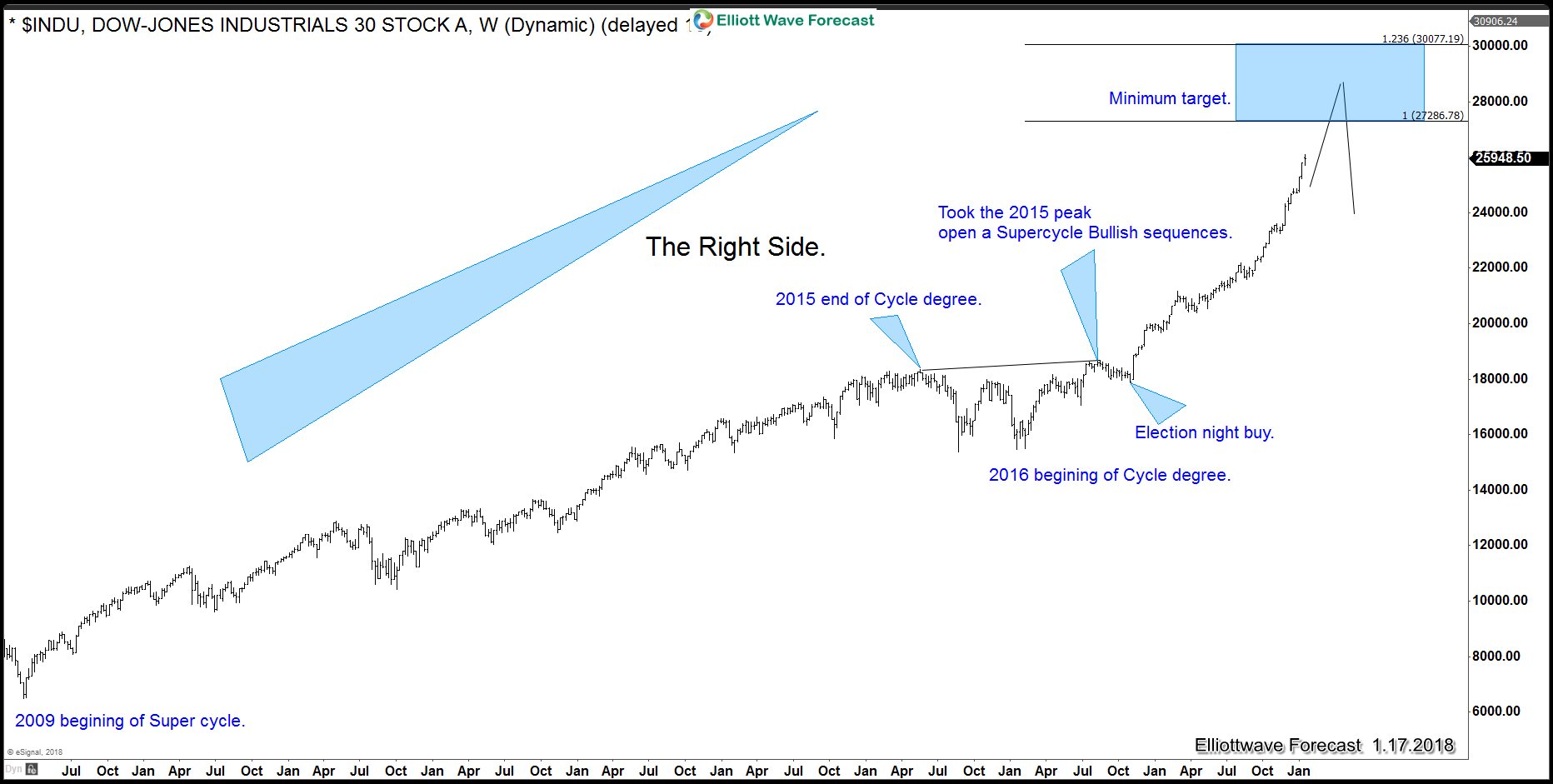

The Right side: The Only Way To Survive In Trading

Read MoreThe Reality of Market Participation The Market, as everyone knows, is a combination of buyers and sellers, when every second there are orders being executed on both sides. Many traders, when join this profession, come under the idea of trading every day, every hour and every swing in the market. There is a truth in […]

-

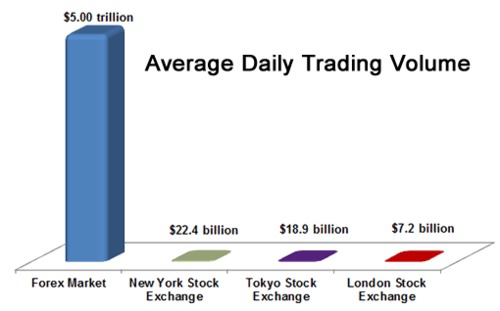

Forex Trading vs Stocks Trading – Elliott Wave Forecast

Read MoreMany traders often face the dilemma of whether Forex Trading is right for them or Stocks Trading. For traditional buy-and-hold, “long only” investors, Stocks Trading remains an obvious choice for a number of reasons. Stocks have a long-term record of positive returns; investors can receive regular income from dividends; dividends and capital gains have favourable […]

-

Trading Elliott Wave Forecast Charts

Read MoreElliott Wave Forecast is a technique to forecast the market based on Elliott Wave Principle which was develop around 1930’s and since then many traders have been following the theory and applying it in their everyday trading. We all know life is not perfect and nothing is 100% accurate, same applies to the Elliott wave Theory. We have […]

-

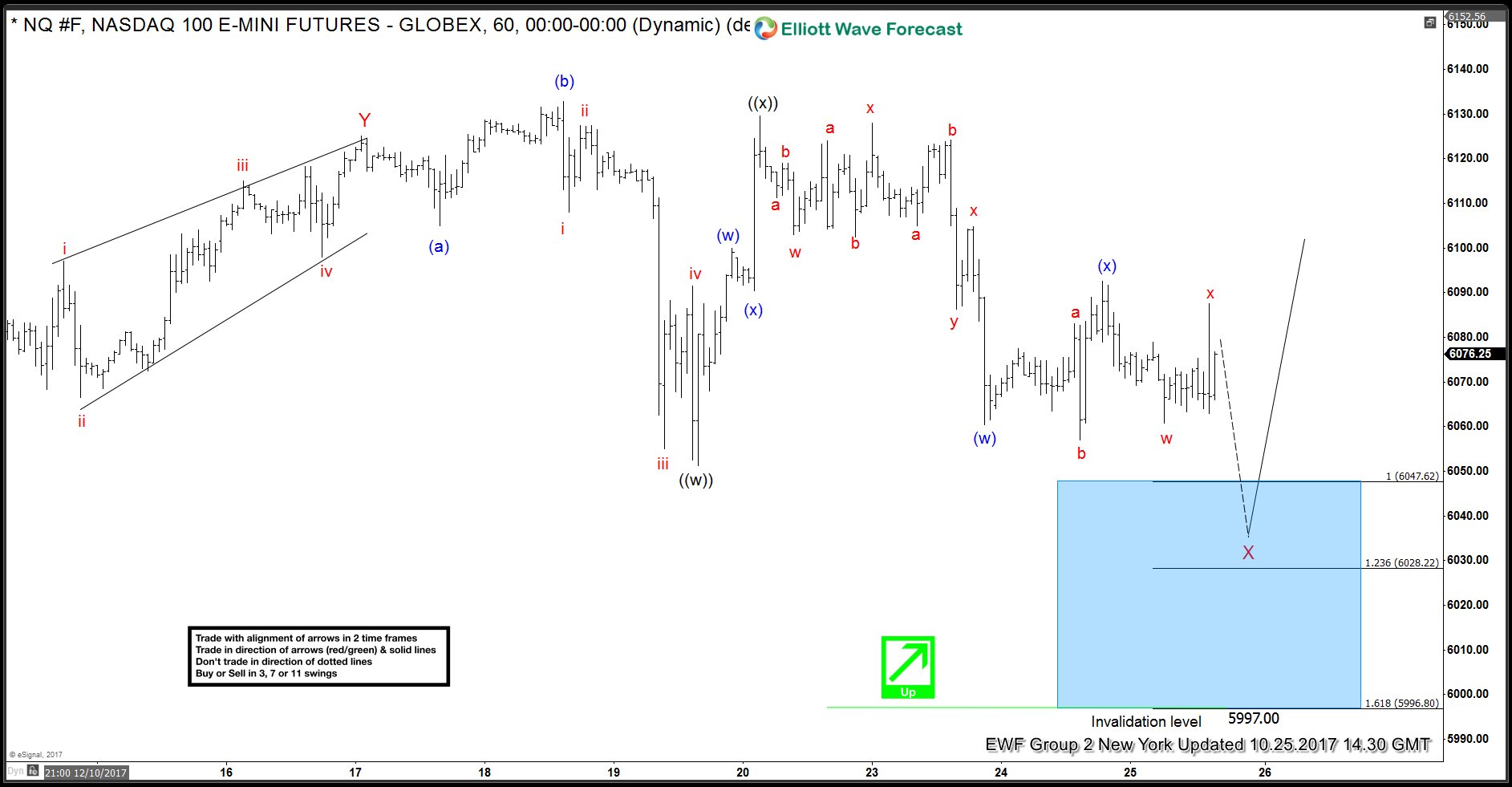

Nasdaq Forecasting The Rally After 7 Swings

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of Nasdaq index published in members area of www.elliottwave-forecast.com. We’re going to take a look at the price structures of the index and get through Elliott Wave forecast. As our members know , we were pointing […]

-

High Frequency Trading and Elliott wave Theory

Read MoreThe development of computer technology and the Internet is perhaps the most important progress that shape and characterize the 21st century. The proliferation of computer-based and algorithmic trading breed a new category of traders who trade purely based on technicals, probabilities, and statistics without the human emotional aspect. In addition, these machines trade ultra fast […]