Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

Traders Identity, The Key to Succeed in Trading

Read MoreTrading is a profession that many enter with big dreams, we all have been guilty one way or the other of the illusion of making a living out of trading.

-

DAX Forecasting The Rally And Buying The Dips In Blue Box

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of DAX, published in members area of the website. As our members know, the Index has incomplete bullish sequence in the cycle from December’s low. The Elliott wave structure has been calling for further strength. Consequently, […]

-

SPX Elliott Wave: Calling The Rally From Blue Box

Read MoreSPX pulled back in 3 waves last week and put in a strong rally which has already resulted in new highs. In this blog, we are going to take a look at structure of this 3 wave pull back and the subsequent reaction from the blue box. We share one chart from members area every […]

-

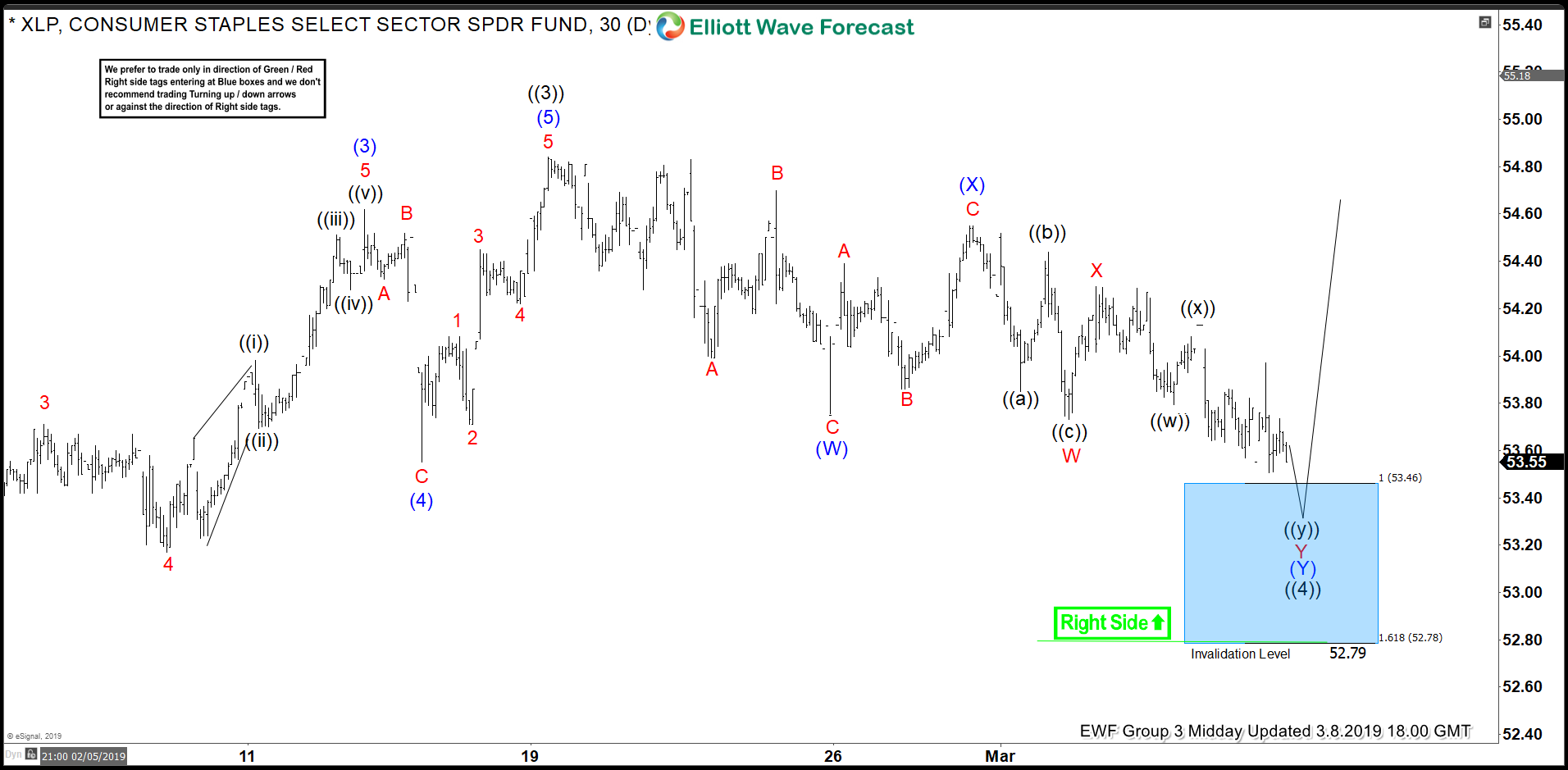

Patience is Paying Off for XLP Longs

Read MorePatience is Paying Off for Traders that are Long XLP After consolidating sideways for over two weeks XLP appears to be rewarding longs for their patience. Since 12/26/2018, XLP has risen from a low of $48.33 to its most recent high of $54.84 on 2/19/2019. This represents a 13.47% gain trough to peak. During that […]

-

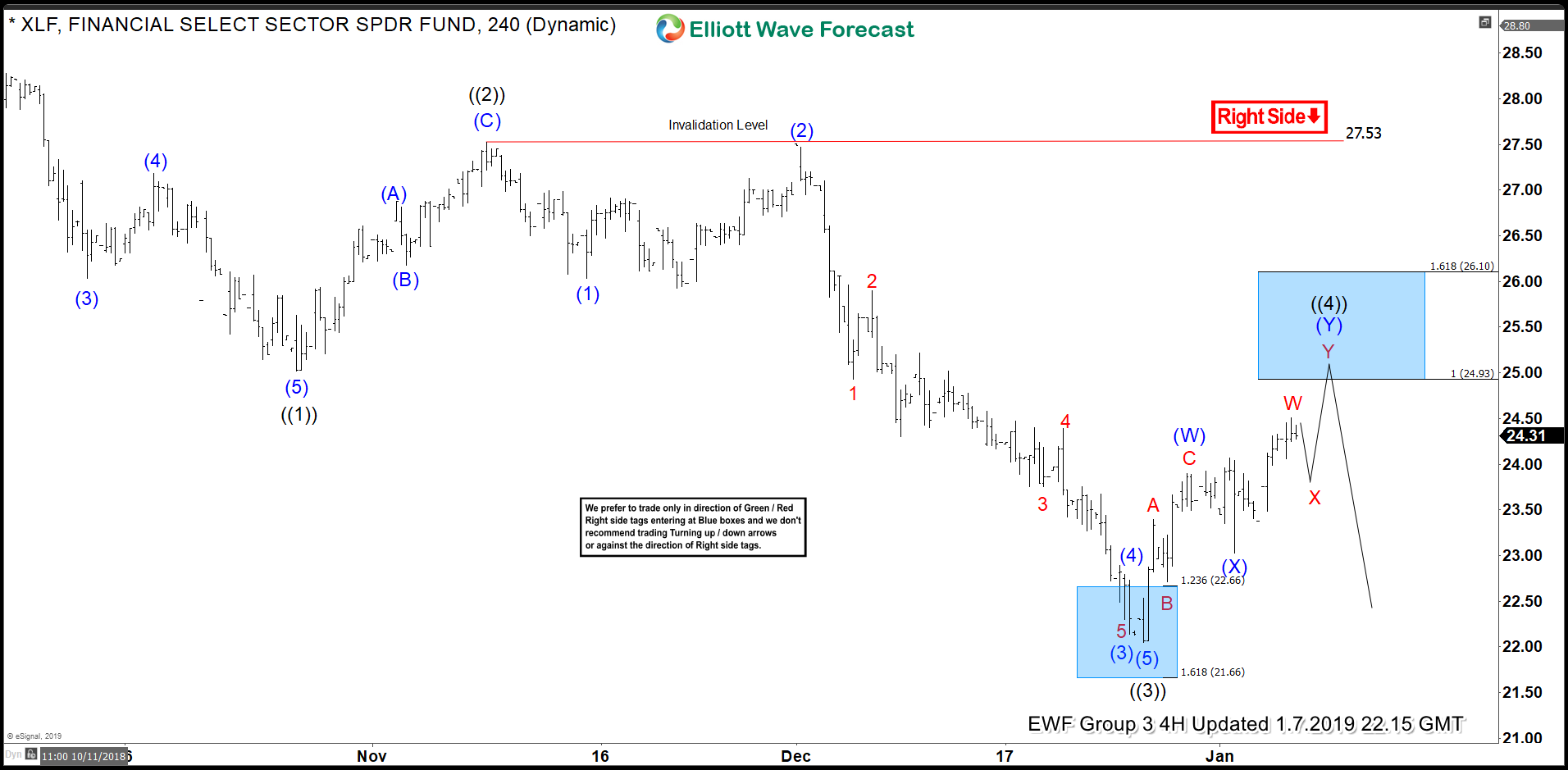

XLF Bearish Into Banking Stocks Earnings Releases

Read MoreThe major component stocks of XLF begin to report earnings for Q4 2018 the week of January 14th. This includes banking stocks such as C (reporting on 1/14/2019) and JPM (reporting on 1/15/2019). January 16th will see more banking stocks such as WFC, BAC, GS, and USB report. This brief explores the near-term price structure […]

-

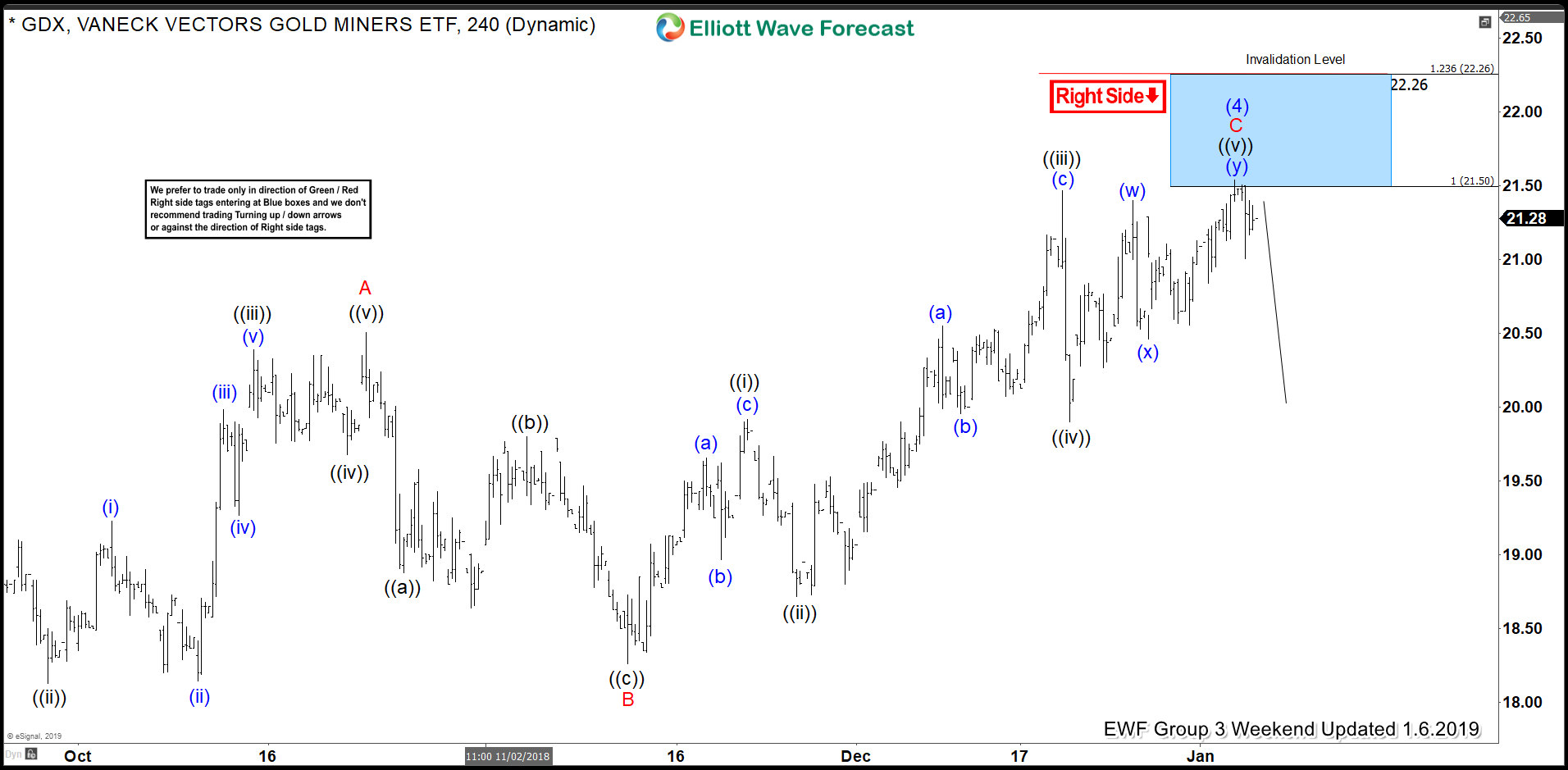

Near Term Projected Top in XAU/USD Confirms Short Setup for GDX

Read MoreNear Term Top XAU/USD Correlated to Short in GDX Subscribers of our Group 3 offerings at EWF know that we are intensively tracking the Elliott wave structure and cycle in GDX anticipating a top in the Vaneck Vectors Gold Miners ETF. Likewise our Group 1 Subscribers are aware we are simultaneously charting for a near […]