Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

Bitcoin Elliott Wave View: Buying The Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of Bitcoin In which our members took advantage of the blue box areas.

-

EURUSD Forecasting The Rally And Buying The Dips In The Blue Box Area

Read MoreEURUSD is another forex pair that we have been trading lately . In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURUSD, published in members area of the website. As our members know, EURUSD is showing higher high sequences in the cycle from the 10/01 low, calling […]

-

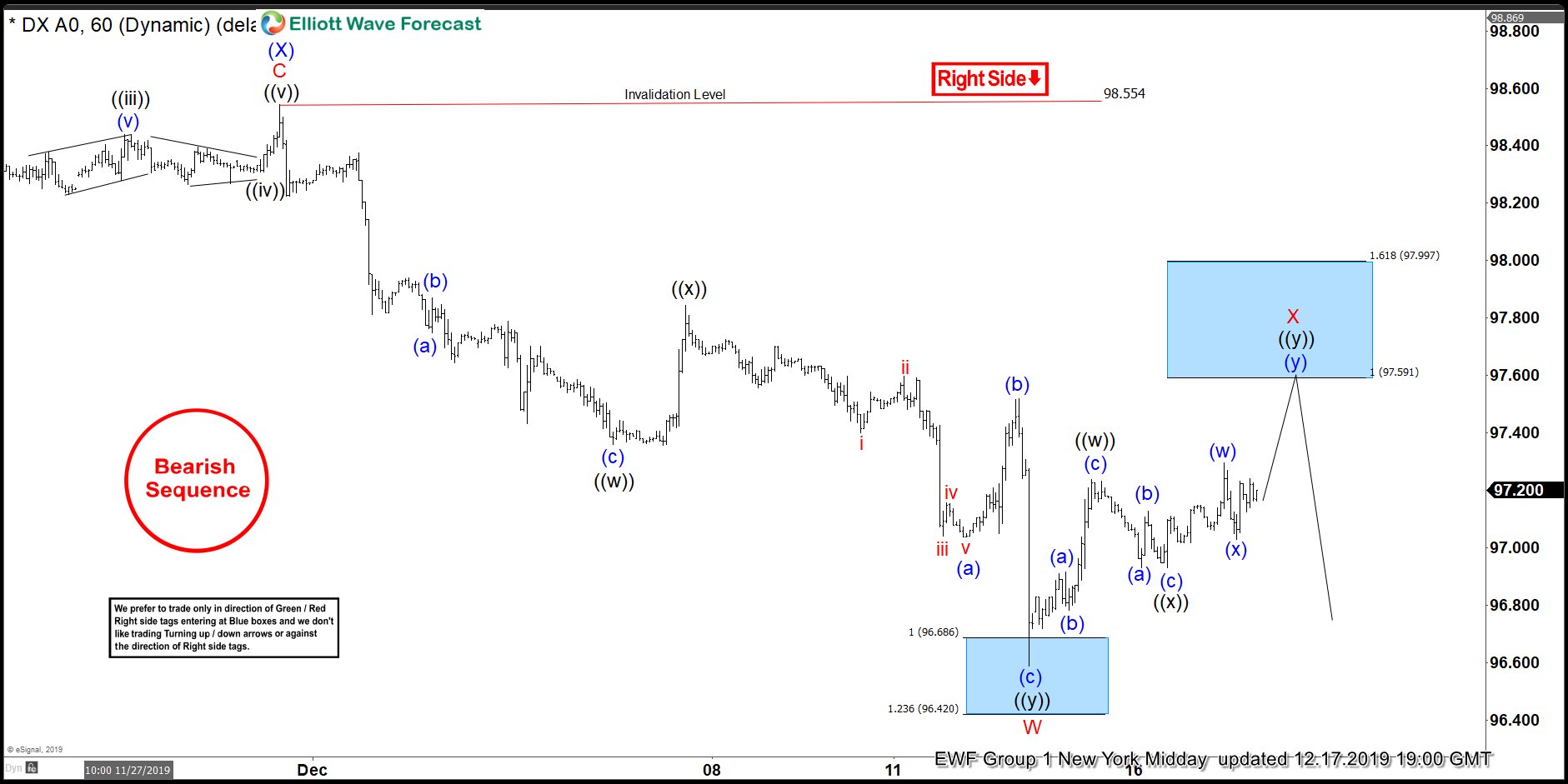

USDX Selling The Rallies In The Blue Box

Read MoreHello fellow traders. Another instrument that we have been trading lately is USDX. In this technical blog we’re going to take a quick look at the Elliott Wave charts of USDX, published in members area of the website. As our members know, USDX has incomplete bearish sequences in the cycle from the 10/01 peak, targeting […]

-

Eurostoxx Buying Dips in Blue Boxes and Forecasting The Rally

Read MoreBack in September 2019, we said Eurostoxx break above July 25 2019 created an incomplete bullish sequence from December 27, 2018 low. This called for extension higher toward 3849 – 3993 area to complete the sequence from December 27, 2018 low. Let’s take a look at the chart we shared in our public social media […]

-

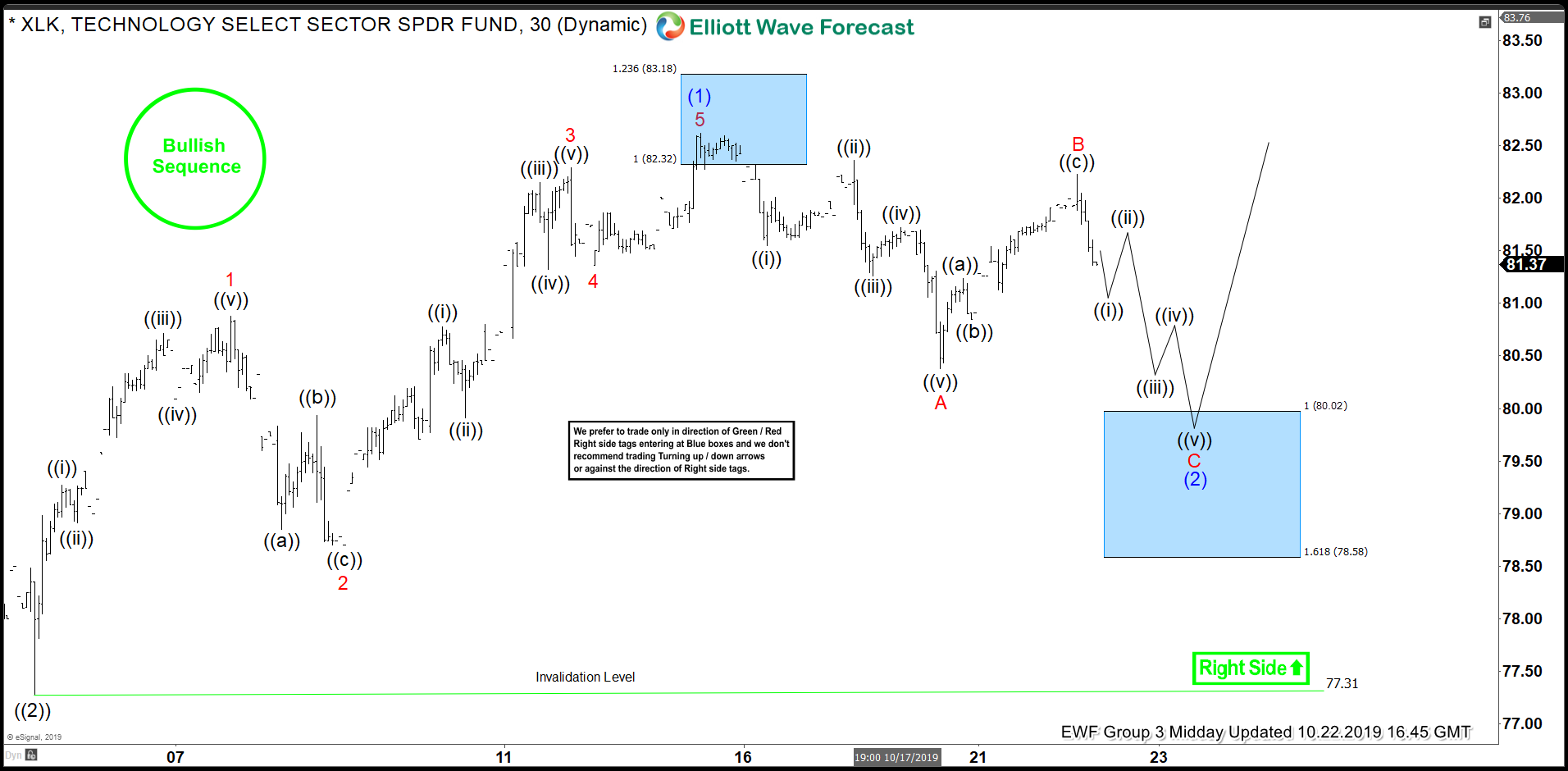

XLK Forecasting The Path & Buying The Dips In The Blue Box

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of XLK – Technology Select Sector , published at elliottwave-forecast. As our members know XLK has been showing incomplete bullish sequences in the cycle from the August 5th low. Break of the September 12th peak made […]

-

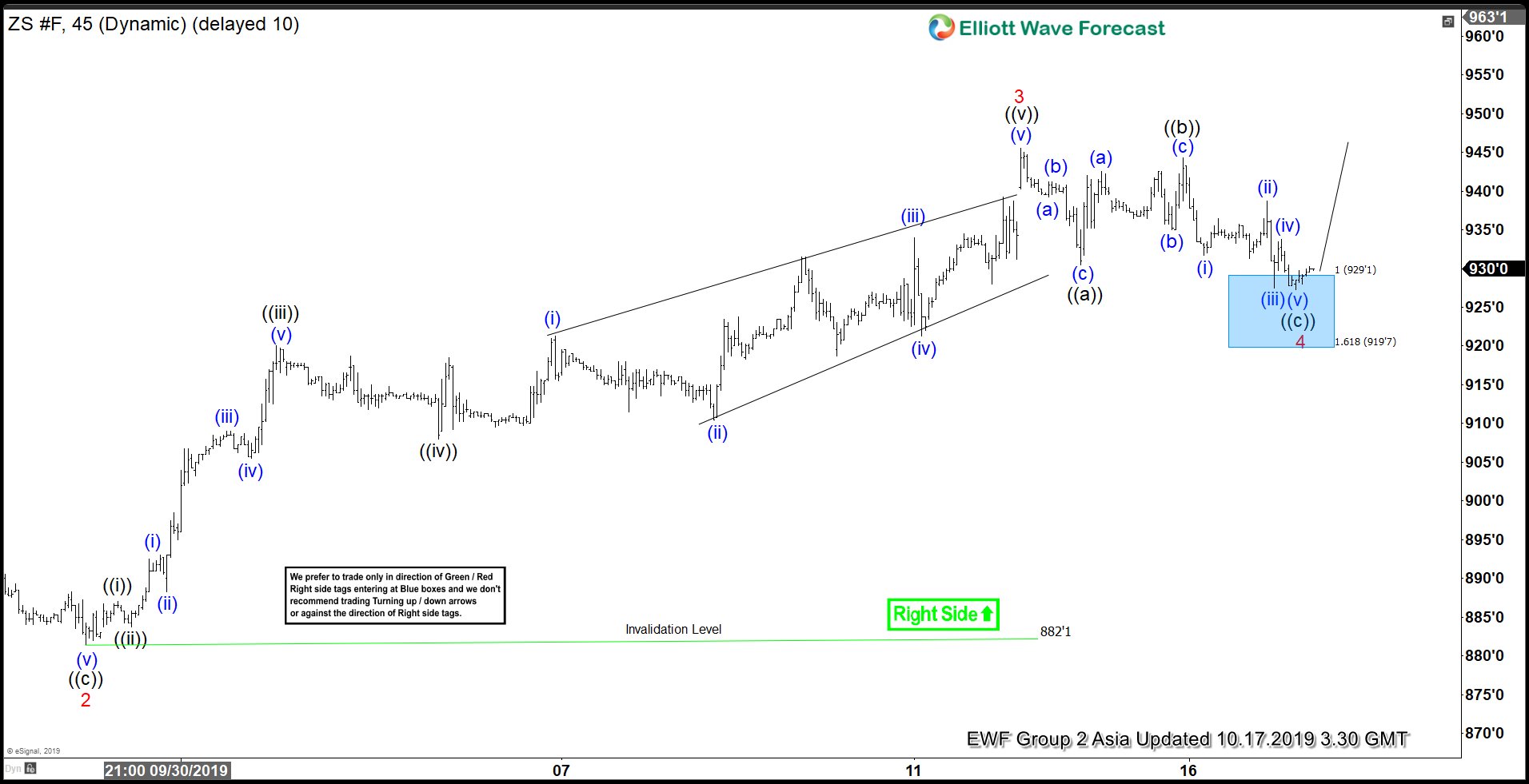

Soybean Futures ( $ZS_F ) Buying The Intraday Dips At The Blue Box

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Soybean Futures ( $ZS_F ). As our members know we are favoring the long side in the commodity. We advised members to avoid selling Soybean Futures and keep buying the dips in the sequences of […]