Many traders often face the dilemma of whether Forex Trading is right for them or Stocks Trading. For traditional buy-and-hold, “long only” investors, Stocks Trading remains an obvious choice for a number of reasons. Stocks have a long-term record of positive returns; investors can receive regular income from dividends; dividends and capital gains have favourable taxation, and so on. But real decisions need to be made when it comes to Trading and you will hear arguments in favour of both of them. In this article, we would like to highlight the advantages and disadvantages of both of them.

Liquidity Factor:

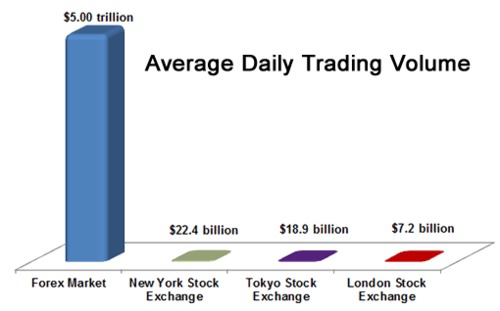

Forex market is considered as the most liquid market with a trading volume crossing over $ 5.3 trillion per day back in 2013. This is a massive figure and way more than the combined figure of all stock markets. Back in 2013, average daily trading volume for New York Stock Exchange was $22.4 billion, Tokyo Stock Exchange was $18.9 billion and London Stock Exchange was $7.2 billion. Whereas, average daily trading volume for the Forex Market was $5.00 trillion.

Leverage: Forex is another world when it comes to leverage and offers very high leverage as compared to what’s on offer in stocks trading. For example, you could get a leverage of 200:1 or more in Forex Trading as compared to only 2:1 for Stocks Trading. More leverage allows traders to open bigger position by setting aside a small amount of money and hence can magnify the returns when trades are working out but it could also wipe out one’s trading capital in minutes if not used properly. Therefore, leverage must always be used with strict Money / Risk Management or else it could prove to be very dangerous.

Trading spreads: Forex trading spreads tend to be tighter than those of stocks because of the Forex market’s depth. The abundant liquidity and tight spreads makes it easy to get in and out of Forex trades quickly. Compare that to stock trades, where liquidity may be a constraint and bid-ask spreads are wider.

Trading window: Is your primary trading window during the day or evening? For those who have a day job, trading during regular business hours isn’t feasible. So if you really have a desire to trade, Forex trading is an appealing alternative because it’s open virtually 24 hours a day.

Ease of Trading: New York Stock Exchange has over 4500 stocks listed and NASDAQ has close 3500 stocks. Apart from them, we have Tokyo, London and other stock exchange as well. If we combine the US, European and Asian stock markets we have close to 40 industries. In Currency trading we have handful of pairs out of which most smart traders monitor 3 to 4 pairs and trade them frequently. I believe it is much easier to track a couple instead of going through thousands of stocks. Even in bull market, your stock may go down if it is not the right and best stock in its peer group. You could even see some stocks trading down with the sector trading higher. So, one needs to be make their stock picks very carefully. The currency market has fewer options and the bulk of trading revolves around US Dollar and Euro. (up to 70 percent of the total combined daily traded volume). However, there are still a number of Forex pairs available for trading.

Commission: Most stock brokers charge commission. Commission is the payment that you pay to your broker for placing an order. Currency market brokers has the option of no to low commission. They compensate their services through the bid/ask spread.

Market Hours: The major stock markets are open for merely 8-9 hours a day and close trading at 4:30 – 5:00 PM local time. Forex market never sleeps at least during the week and traders have the ability to place trades anytime during the day. Forex Trading remains open from Sunday at 2 PM EST until Friday 5 PM EST.

Short Selling: Another major advantage of Forex Trading is that traders can place traders in both directions without any restrictions whereas there are usually some restrictions on short selling at least in the US. For example when the market price of a Stock declines 10 percent in one day, trading halts!

Trading Window: Forex markets have no centralized exchange location so trades are placed directly from the institutions. quotes are often placed instantly and usually vary from different currency dealers. This allows us to get the best deals and pick the best one as per our trading style. On the other hand, Stock markets have a centralised exchange location and with most online stock trades the price that you think you’re getting is not what usually ends up on your order. Thus stock markets have a much more limited trading window and have a higher chance for delays in execution, slippage and price manipulation.

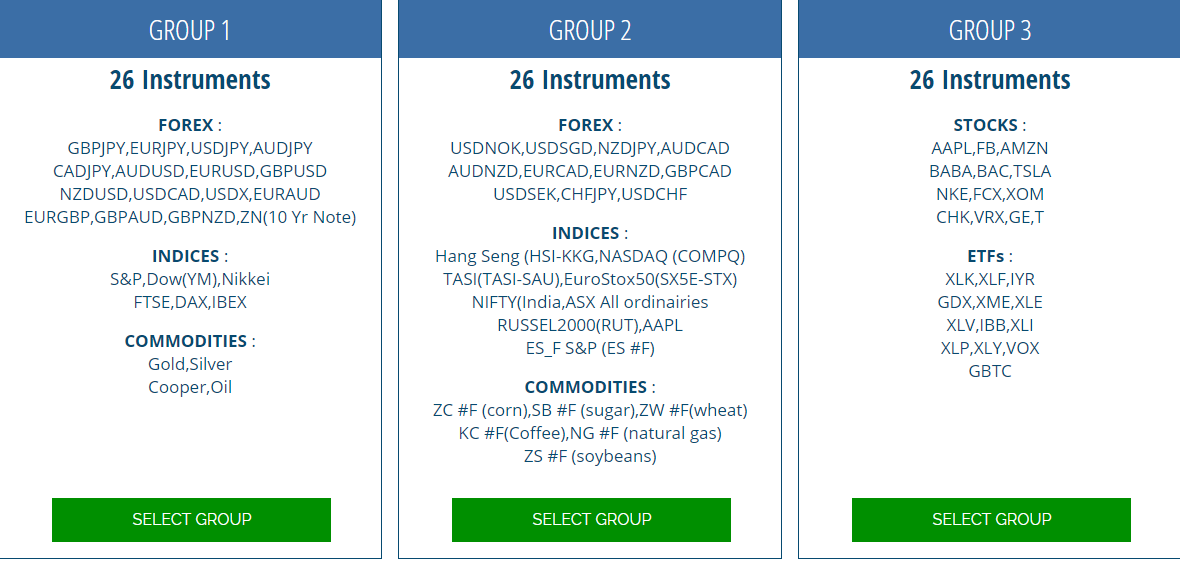

Regardless of whether you are a Forex Trader or a Stock Trader, you will feel at home with Elliottwave-Forecast.Com as we cover 78 Instruments including Forex, Commodities, Indices, Stocks and ETFs. See below the list of all the instruments we cover:

We have decided the instruments in three groups so traders can pick the group which best meets their needs based on what instruments they like to trade the most.

You may also like reading:

- Head and Shoulders Pattern – Trading Guide with Rules & Examples

- Bonds vs Stocks – Where to Invest in 2021

- Fibonacci Retracement, Extension & Trading Strategies

- Best Trading and Forex Signal Providers