Palantir Technologies Inc. (PLTR) continues to dominate the AI-driven data analytics space, recently surging over 130% year-to-date to trade near $184.63. Investors have responded enthusiastically to its expanding government contracts, including a $10 billion U.S. Army deal and a £1.5 billion defense partnership with the U.K. These wins have propelled Palantir’s Q2 earnings past expectations, with $1 billion in revenue and 16 cents EPS. As a result, the company raised its full-year guidance. However, its valuation raises concerns: with a forward P/E ratio above 200, Palantir must deliver sustained earnings growth to justify its premium. Analysts remain divided, issuing a consensus “Hold” rating and setting price targets that range widely from $45 to $215—highlighting both upside potential and valuation risk.

Meanwhile, Palantir continues to expand its commercial reach. It recently partnered with Snowflake to enhance enterprise AI capabilities, further embedding its platforms Foundry, Gotham, Apollo, and AIP into public and private sector operations. This strategic move strengthens its scalability and adoption. Nevertheless, some analysts caution that the stock may be overheated, trading at 277 times forward earnings. If growth expectations falter, Palantir could face downward pressure. Competitors like AMD and ASML are closing in on its market cap and may attract investor attention if Palantir’s valuation proves unsustainable. Ultimately, PLTR offers long-term exposure to the booming AI and big data sectors, but investors should remain vigilant as the market recalibrates.

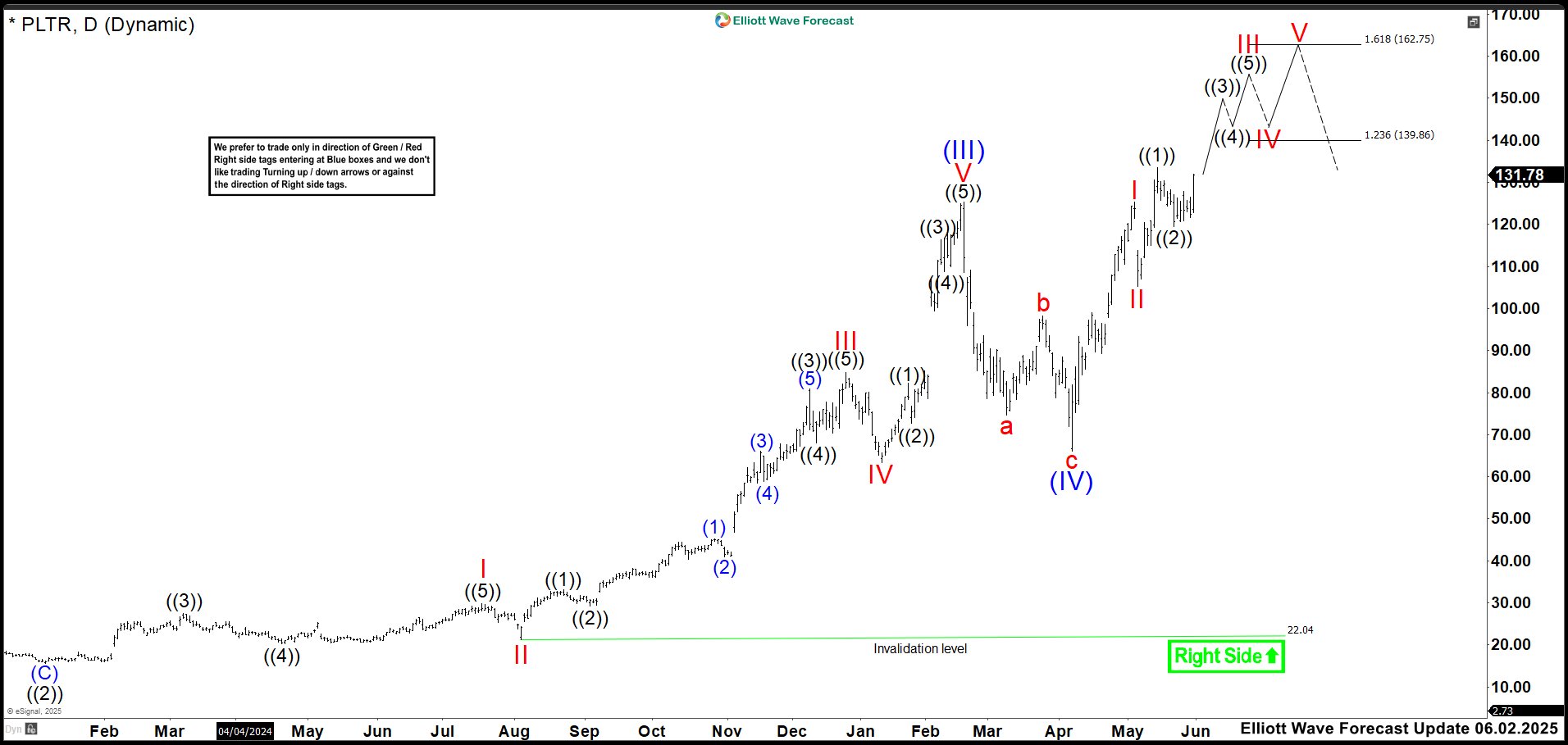

Elliott Wave Outlook: PLTR Daily Chart Analysis June 02, 2025

In June, Palantir’s stock plunged to $80.00 and then corrected in a clear three-wave pattern. This decline aligned with the 50% Fibonacci retracement of wave (III), effectively retesting the previous wave IV price zone. From that level, the stock rallied decisively, breaking above the wave (III) high and confirming the completion of wave (IV). Elliott Wave analysis at the time indicated the formation of a new impulse structure—likely wave (V). Wave I of (V) peaked at $125.26, followed by a wave II pullback to $105.32. This setup suggested that Palantir had entered wave ((3)) of III, with bullish momentum building.

As the impulse continued to unfold, we projected further upside toward the $139.86–$162.75 range, where wave III might conclude. If the price failed to show a downward reaction at those levels, wave III would room to extend even higher. This technical structure pointed to a strong bullish cycle, reinforcing Palantir’s positioning for continued gains in the evolving AI and data analytics landscape. Given the setup, the recommended strategy was to buy dips and ride the momentum.

Elliott Wave Outlook: PLTR Daily Chart Analysis October 26, 2025

In this latest update, we can see that the market extends in wave (V), showing continued bullish momentum. Wave III pushes up to $190.00 before sharply pulling back to $142.34, marking wave IV. Although the price rallies from that low, it does not break above the wave III high. Therefore, we anticipate more upside to complete wave V of (V). This structure suggests that wave V is likely to extend, and we expect the price to move higher as the impulse unfolds.

Currently, the market is targeting the $201.49–$219.79 zone, where a bearish reaction could signal the completion of wave V. If no reaction occurs, prices may continue climbing to even higher levels. Should a correction begin, it would likely revisit the $142.34 level at minimum, with a possible retracement toward $100 per share. However, this remains speculative. For now, the best approach is to wait for price action to reach the proposed zone and monitor the reaction closely.

Transform Your Trading with Elliott Wave Forecast!

Ready to take control of your trading journey? At Elliott Wave Forecast, we provide the tools you need to stay ahead in the market:

✅ Blue Boxes: Stay ahead in the market with fresh 1-hour charts updated four times daily, daily 4-hour charts on 78 instruments, and precise Blue Box zones that highlight high-probability trade setups based on sequences and cycles.

✅ Live Sessions: Join our daily live discussions and stay on the right side of the market.

✅ Real-Time Guidance: Get your questions answered in our interactive chat room with expert moderators.

🔥 Special Offer: Start your journey with a 14-day trial for only $0.99. Gain access to exclusive forecasts and Blue Box trade setups. No risks, cancel anytime by reaching out to us at support@elliottwave-forecast.com.

💡 Don’t wait and get a DISCOUNT for any plan!

Click in the next link, go to Home Chat and ask for a flat discount code saying that you saw this in Luis’ Blog: 🌐