Ford Motor Company (F) has recently demonstrated strong operational momentum, beating Q3 earnings expectations with $0.45 EPS versus the anticipated $0.35. This performance stemmed from robust demand in its truck and hybrid segments, which helped offset ongoing losses in its electric vehicle division. Moreover, Ford’s revenue surged to $50.5 billion, surpassing analyst forecasts. However, despite this upside surprise, management revised its full-year EBIT guidance downward due to a fire at a key Novelis supplier plant, which is expected to cost the company up to $2 billion in lost earnings.

Nevertheless, Ford continues to adapt strategically. The company is shifting EV production to Europe to reduce costs and improve margins, while also benefiting from relaxed U.S. emissions regulations that could lower compliance costs. At the same time, analysts remain cautious. Although the stock trades near its 52-week high, the average price target sits below current levels, signaling limited upside. As a result, investors should weigh Ford’s attractive 6.3% dividend yield and operational resilience against macroeconomic headwinds and execution risks.

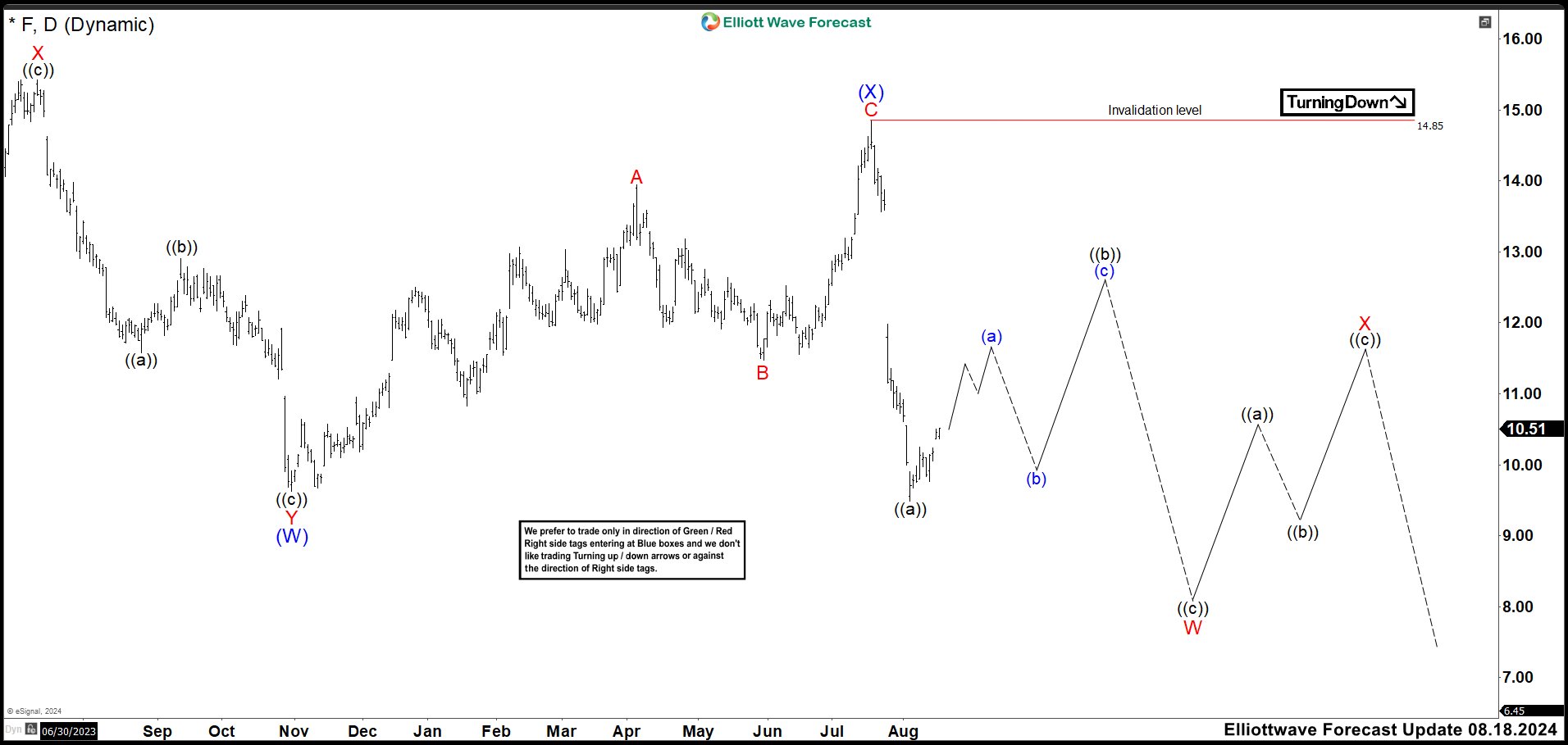

Elliott Wave Outlook: Ford (F) Weekly Chart May 2025

Last time we reviewed F ’s wave count in May, we identified it as being in wave (Y). Since then, we’ve been anticipating a rebound resembling wave B before continuing downward into wave C, which would complete the correction. This scenario remains valid as long as the price stays above 4.02; or alternatively, as long as the market holds below the wave (X) high.

Elliott Wave Outlook: Ford (F) Weekly Chart Nov 2025

The current wave has climbed significantly, forming a double correction and still showing potential to break above 13.97. As momentum builds, sellers defend the 14.88 high, which acts as a critical price. For the bearish scenario to remain intact, price must stay below this level and continue toward the 7.79–6.05 zone. However, if the market breaks above 14.88, it would suggest that wave II already ended at the 8.36 low, shifting the structure toward a bullish bias.

Meanwhile, buyers currently hold ground in the 11.86–10.52 area, which serves as a key zone. As long as price remains above this range, the market can attempt to push higher. Nevertheless, if price breaks below this, the probability of revisiting and potentially breaking the 8.36 low increases. This zone becomes the battleground where bulls must defend to sustain upward momentum.

Transform Your Trading with Elliott Wave Forecast!

Ready to take control of your trading journey? At Elliott Wave Forecast, we provide the tools you need to stay ahead in the market:

✅ Blue Boxes: Stay ahead in the market with fresh 1-hour charts updated four times daily, daily 4-hour charts on 78 instruments, and precise Blue Box zones that highlight high-probability trade setups based on sequences and cycles.

✅ Live Sessions: Join our daily live discussions and stay on the right side of the market.

✅ Real-Time Guidance: Get your questions answered in our interactive chat room with expert moderators.

🔥 Special Offer: Start your journey with a 14-day trial for only $0.99. Gain access to exclusive forecasts and Blue Box trade setups. No risks, cancel anytime by reaching out to us at support@elliottwave-forecast.com.

💡 Don’t wait and get a DISCOUNT for any plan!

Click in the next link, go to Home Chat and ask for a flat discount code saying that you saw this in Luis’ Blog: 🌐