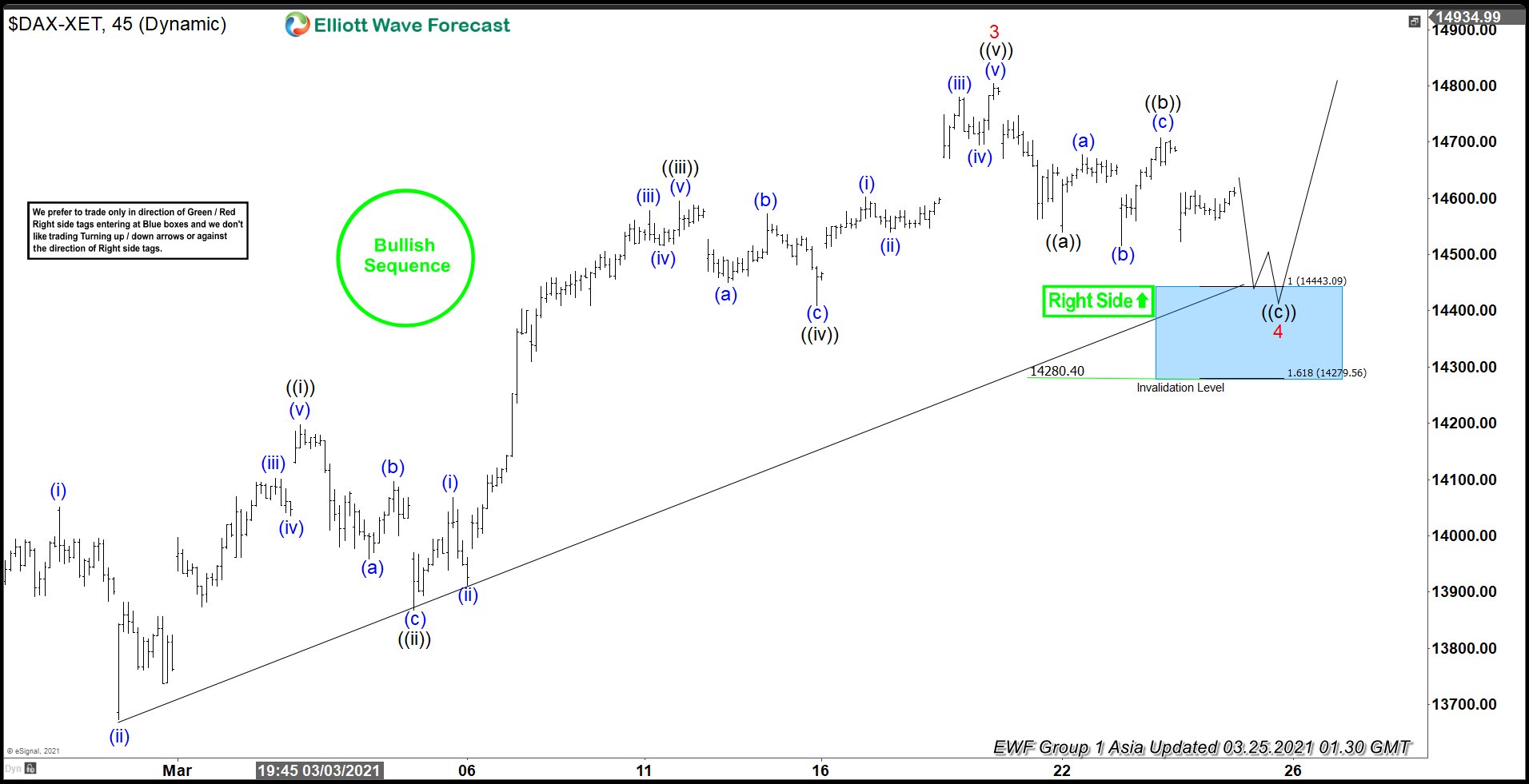

DAX Short term Elliott Wave View suggests that the rally from January 28, 2021 low is unfolding as a 5 waves impulsive Elliott Wave structure. The Index ended wave 3 of this impulsive rally at 14804.01. Internal of wave 1 unfolded as an impulse in lesser degree. Wave ((i)) of 3 ended at 14197.49, and pullback in wave ((ii)) of 3 ended at 13868.20. Index then resumed higher in wave ((iii)) of 3 at 14595.02, and pullback in wave ((iv)) of 3 ended at 14409.35. Final leg wave ((v)) of 3 ended at 14804.01

Wave 4 pullback is currently in progress as a zigzag Elliott Wave structure. Down from wave 3, wave ((a)) ended at 14539.27, and bounce in wave ((b)) ended at 14707.37. Final leg lower wave ((c)) is expected to complete at the blue box area of 14280 – 14443. This is a 100% – 161.8% Fibonacci extension of wave ((a))-((b)). From this area, we expect the Index to extend higher in wave 5 or bounce in 3 waves at least. Potential target for wave 5 at minimum is 123.6 – 161.8% external retracement of wave 4 which is around 14887 – 150225.