Hello traders and welcome to a new blog post highlighting how our proprietary blue box support system helps traders found opportunities in the financial markets. In this post, the spotlight will be on Ethereum – a cryptocurrency.

Ethereum is a decentralized, open-source blockchain platform that enables smart contracts and decentralized applications (dApps). Launched in 2015, it extends beyond digital payments, allowing developers to build financial services, games, and more on its network. Its native currency, Ether (ETH), powers transactions and secures the system.

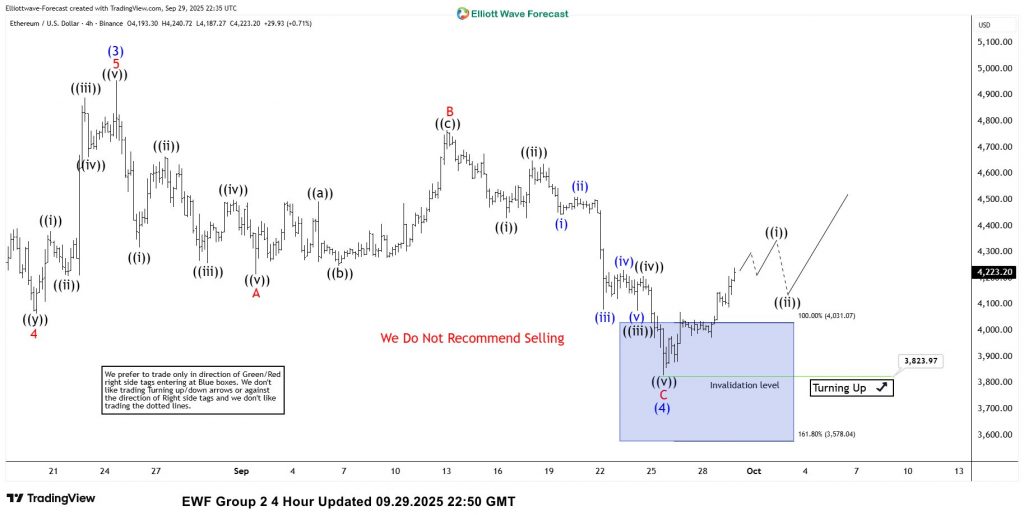

Ethereum remains in an all-time bullish trend. Bullish cycles comprise sequences of higher-highs and higher-lows. The last corrective bearish cycle started in March 2024 and ended in April 2025 after the preceding bullish cycle from June 2022 couldn’t breach the 4784 precious all-time high. Meanwhile, what’s most important is the sort of rally that followed the April pivot – a clear impulse wave sequence. The momentum of the April 2025 cycle took the bears out completely. Thus the crypto reached a new record high of 4957 on 24th August 2025. From the August high, a pullback started as expected. Prior to the pullback, we mentioned in the live sessions to members, to buy the pullbacks that follow from our proprietary blue box. What happened afterwards?

Ethereum Elliott Wave Trade Setup – 09.28.2025

The pullback from August high extended lower into a familiar structure – a zigzag structure. We identified a 3-swing zigzag structure and shared the chart above with Elliottwave-Forecast members who went Long at 4031 and set stop at 3578 anticipating at least a 3-swing bounce to risk free area. However, the ultimate expectation is to see another 5-wave sequence develop from the lows of September to a fresh record high.

Ethereum Elliott Wave Trade Setup – 09.29.2025

The price left the blue box zone as expected for wave ((i)) of 1 of (5) according to the latest H4 chart update we shared with members. Soon, the price will hit the first target at 4297. At that price, our members will take partial profit and adjust the stop to a risk free position. It’s the just a day after the blue box. The coming days will be interesting, to see how big and fast this recovery would go. As for us, we will continue to provide updates 24 hours daily to our members who are already on the Long side.

About Elliott Wave Forecast

At www.elliottwave-forecast.com, we update one-hour charts four times daily and four-hour charts once daily for all 78 instruments. We also conduct daily live sessions to guide clients on the right side of the market. Additionally, we have a chat room where moderators answer market-related questions. Experience our service with a 14-day trial for only $9.99. Cancel anytime by contacting us at support@elliottwave-forecast.com.