Iren Ltd, a vertically integrated data center business, is powering the future of Bitcoin and AI with renewable energy. Strategically located across renewable-rich US and Canadian regions, the company has also powered an 850% stock surge since April. This rally decisively shattered previous all-time highs in September, confirming a powerful bullish regime.

Today, we dissect the Elliott Wave pattern fueling this extraordinary move. In addition, our analysis provides a clear technical roadmap with specific targets for its continued ascent. The convergence of strong technical and a clear wave structure creates a compelling opportunity.

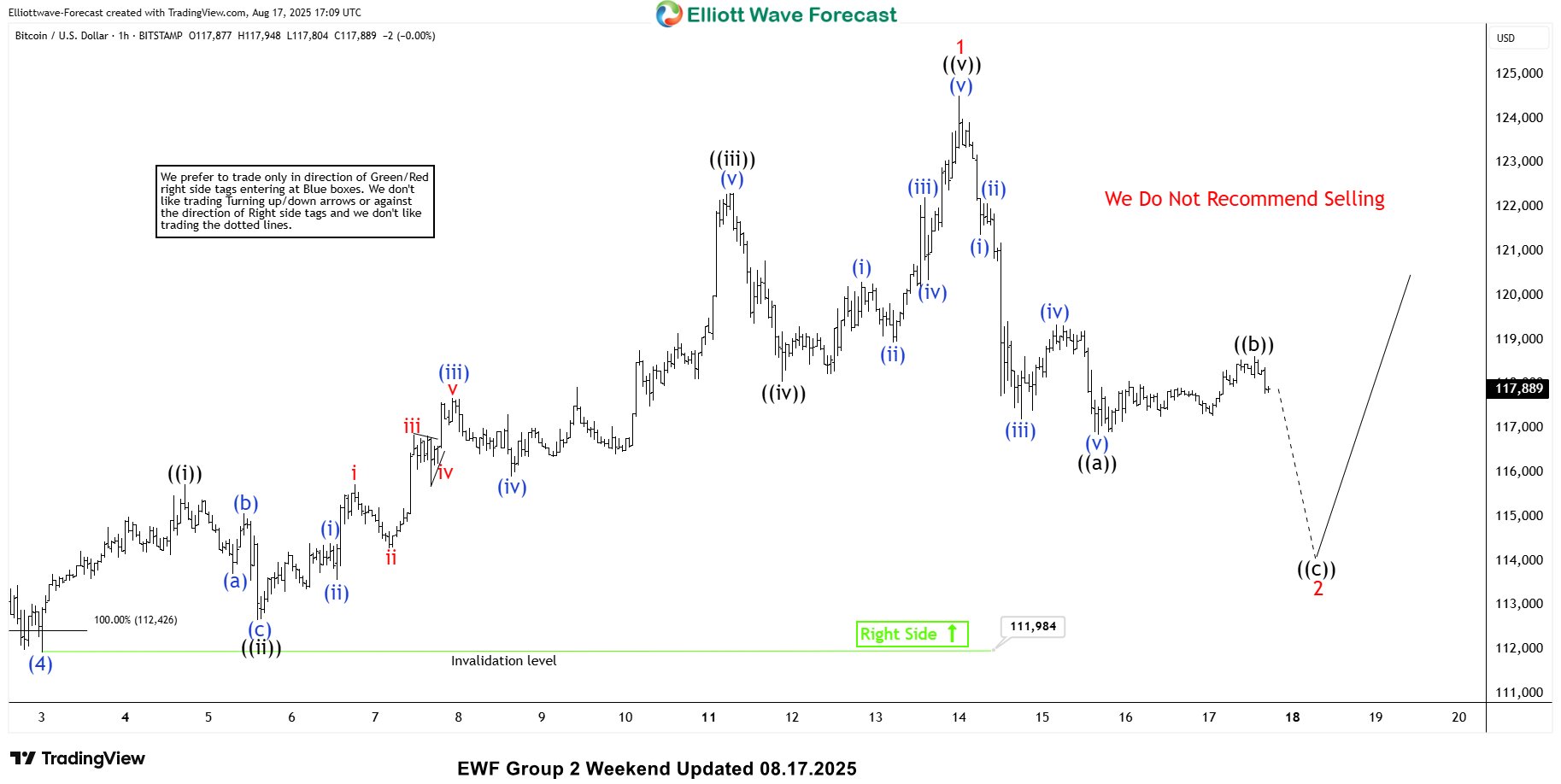

Elliott Wave Analysis

IREN’s explosive rally from its April 2025 low of $5.13 shows a clear 3-wave advance. This structure confirms an incomplete bullish daily cycle. The stock completed Wave ((1)) at $21.54, then corrected to $14.72 in Wave ((2)). Now, Wave ((3)) extends higher through a series of internal waves.

Currently, wave 5 of (3) targets the $51.86 – $55.64 zone. Following this peak, a Wave (4) pullback should hold above critical support at $39.63. This support level is essential for maintaining the bullish structure and setting up the next rally phase.

IREN Daily Chart 09.30.2025

Conclusion

IREN’s robust bullish structure will support the stock through all upcoming pullbacks. Consequently, traders gain strategic opportunities to buy daily and weekly dips. Use our Elliott Wave strategy for optimal timing. Ideally, enter positions after the stock completes a 3, 7, or 11-swing corrective sequence. Furthermore, our extreme Blue Box system pinpoints these entries with high precision. Ultimately, this methodology provides clarity and confidence for capturing the next leg higher.

Explore our system to gain deeper insights into this methodology.