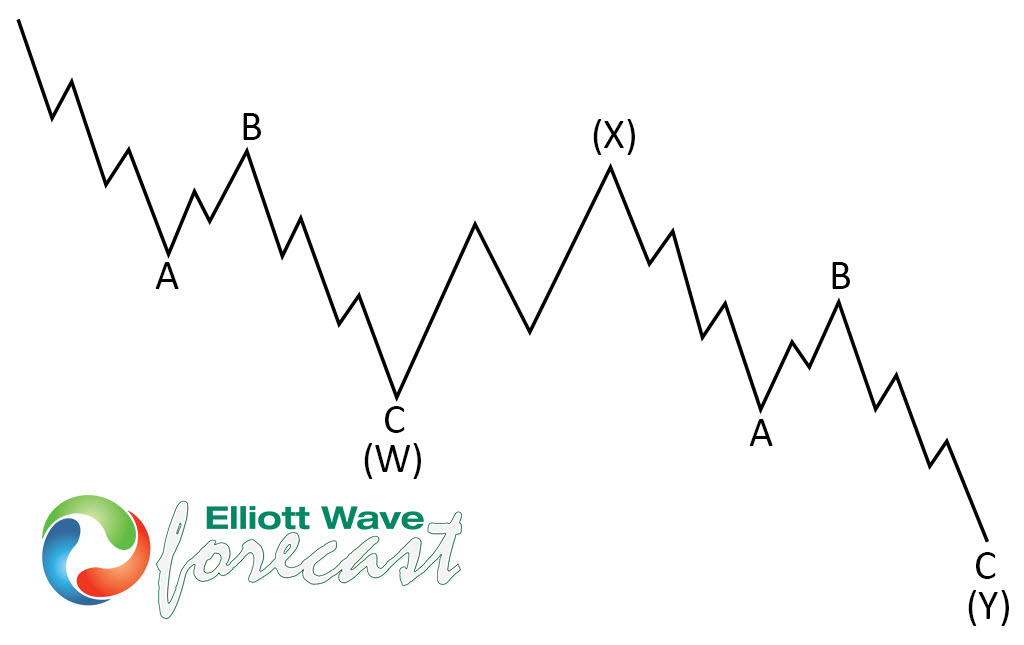

Short-term Elliott Wave view in Copper (HG_F) suggests that the metal is rallying as a 5 waves Elliott wave impulsive structure from November 15, 2019 low. Up from there, wave ((i)) ended at 2.69, and wave ((ii) pullback ended at 2.619. Subdivision of wave ((ii)) unfolded as a double zigzag. Wave (w) of ((ii)) ended at 2.653, wave (x) of ((ii)) ended at 2.679, and wave (y) of ((ii)) ended at 2.619. The metal has resumed higher in a powerful wave ((iii)) with more than 161.8% extension of wave ((i)). Up from 2.619, wave (i) of ((iii)) ended at 2.676, wave (ii) of ((iii)) ended at 2.676 and wave (iii) of ((iii)) is proposed complete at 2.77.

Expect the metal to continue to extend higher to end wave ((iii)) as 5 waves up from 2.619 low. Afterwards, it should correct the cycle from December 4, 2019 low (2.619) before the rally resumes again. We don’t like selling Copper. We expect dips to continue to find support in the sequence of 3, 7, or 11 swing for further upside. This view is valid as far as pivot at 2.619 low stays intact.