Unpacking IBEX’s Rally: A Technical Analysis Using 1-Hour Elliott Wave Charts

In this blog post, we’ll dive into the recent performance of the IBEX index, focusing on its 1-Hour Elliott Wave Charts. Since the April 7, 2025, low, the rally has unfolded as an impulse structure. Showcasing a sequence of higher highs that suggests further upside potential.

Given this momentum, our advice to members has been to avoid selling the index. Instead buy the dips in 3, 7, or 11 swings within the blue box areas. Below, we’ll break down the structure and provide insights into our forecast.

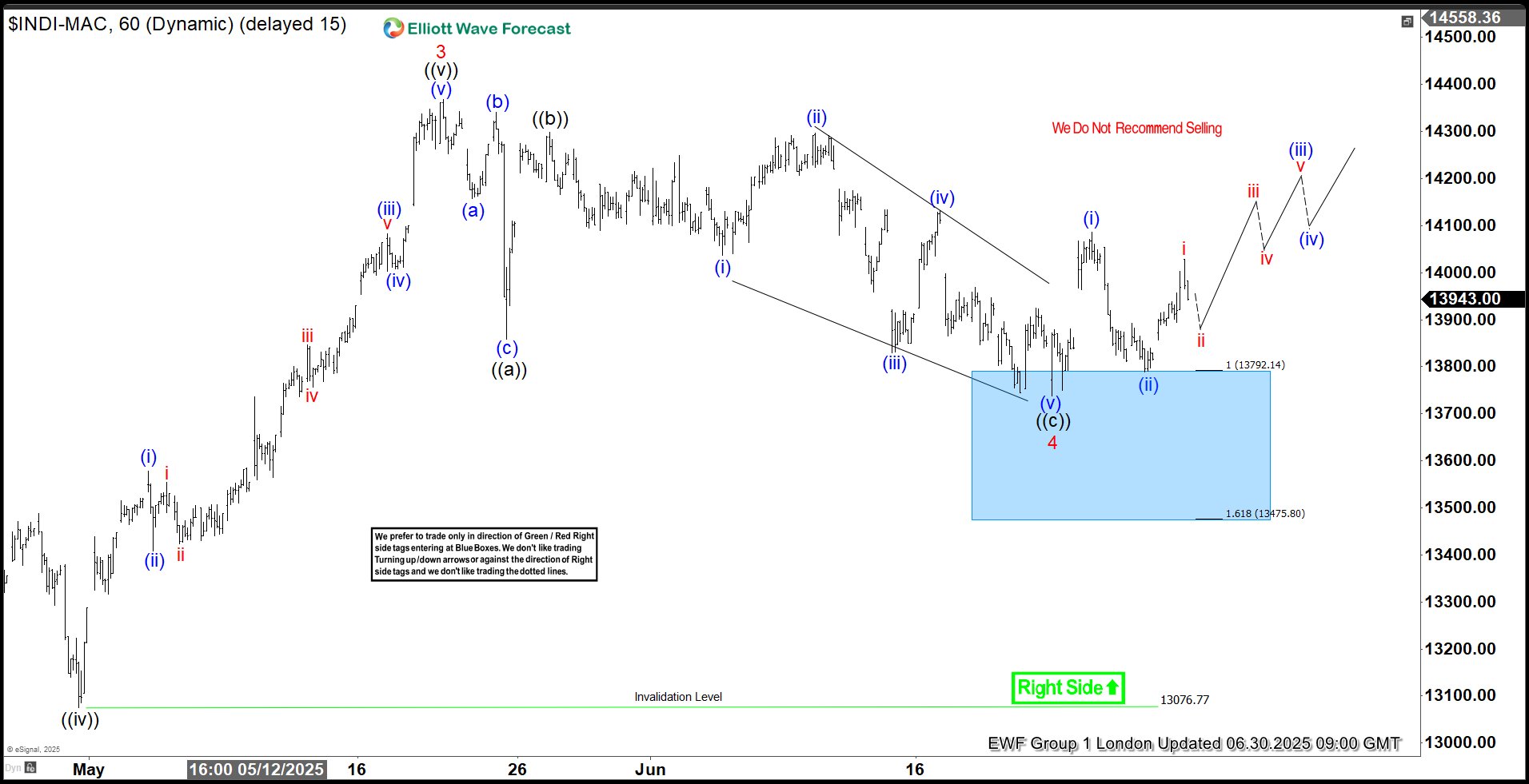

IBEX 1-Hour Elliott Wave Chart From 6.19.2025 update

IBEX’s Wave Structure Update: A Closer Look at the 1-Hour Elliott Wave Chart

As of our June 19, 2025, NY Midday update, the IBEX index had completed wave 3 at the 14368 high. The subsequent decline unfolded as wave 4, which corrected the preceding cycle. This pullback followed a double three structure, with wave ((w)) ending at 13858 and wave ((x)) bouncing to 14298. Wave ((y)) then extended to the blue box area (13784-13468), a zone anticipated for buyer interest, potentially triggering a 3-wave bounce or the next significant leg higher.

Let’s examine the latest 1-Hour Elliott Wave Chart update as of June 30, 2025, to see how the structure has evolved.

IBEX’s Reaction from the Blue Box Area: A Promising Turnaround

Our latest 1-Hour Elliott Wave Chart update from June 30, 2025, shows the index reacting higher after completing its correction within the blue box area. This favorable move enabled members to secure risk-free positions shortly after entering long at the blue box zone. However, a decisive break above the 14368 high is crucial to confirm further upside potential and prevent a deeper pullback.

Stay ahead of the market with real-time IBEX analysis and updates on other key indices. Join our 14-Day Trial to access the latest insights and price action.

To succeed in trading, mastering risk and money management, Elliott Wave theory, cycle analysis, and market correlations is essential. Our trading strategy excels in pinpointing entry, stop-loss, and take-profit levels with high accuracy, empowering you to protect your investments and lock in risk-free positions. Ready to elevate your trading skills? Take the first step with our Trial and unlock the secrets to professional trading.